What Happens At The End Of A Term

At the end of each term, you have the option to renew or refinance your mortgage.

- Renewing your mortgageinvolves signing for another term with your existing lender. Your monthly payment and mortgage interest rate may change.

- Refinancing your mortgageinvolves signing a new term agreement, possibly with a different rate or lender. Refinancing allows you to take advantage of lower mortgage rates or better options not offered by your current lender. You can also borrow more money by using your home equity and receiving it in cash.

Your mortgage lender might not reassess your credit score or debt service ratios if youre renewing at the same lender. If youre switching to a new lender, youll need to be reassessed and you may need to pass the mortgage stress test.

Why Can’t Canadians Get 30 Year Mortgages

The typical Canadian mortgage matures in 5 years or less. Why can’t Canadians get 30 year mortgages? I used to think that the answer was “inflation”, or “inflation uncertainty”. Now I don’t. Now I think the answer is “Section 10 of the Canada Interest Act“. Which we should abolish.

Why can Americans get 30 year mortgages? I used to think the answer was “some sort of implicit subsidy by Fanny and Freddy”. Now I’m not so sure.

This post is mostly about Canada. But it has implications for Americans. On reading US and responses to my previous post, I get the impression that there’s a general assumption that the US 30 year mortgage only exists because of government support. I’m not sure that’s right. Or rather, it may depend on what sort of 30 year mortgage we are talking about.

We really need to distinguish “closed” from “open” mortgages.

A 5-year “closed” mortgage means the interest rate is fixed for 5 years. That’s the typical Canadian mortgage. If you want to pay it off earlier, you have to compensate the lender by paying the difference between the old and new interest rates over the remaining term of the mortgage. That means you never have any incentive to renew a mortgage if interest rates fall.

There is a market in open mortgages in Canada, but nearly all are for very short terms, like 6 months or 1 year.

In Canada: open mortgages for longer than 1 year fail the test of the market and the market for closed mortgages for longer than 5 years is effectively banned.

Comparing Mortgage Payment Frequency

| $134,166 | $134,009 |

There are slight interest savings to be had from increasing your mortgage payment frequency. This keeps your mortgage amortization the same, which is why you wont realize as much interest savings.

Many mortgage lenders offer accelerated payment frequencies, such as accelerated bi-weekly and accelerated weekly mortgage payments. With accelerated payments, you will be paying the equivalent monthly payments, which means that you will be making an extra payment per year. In the above table, a monthly payment would have been $2,117.

To calculate the accelerated bi-weekly payment amount, you would divide $2,117 in half to get $1,058.50. Your accelerated bi-weekly payments will be $1,058, higher than the regular bi-weekly amount of $977. This increased amount allows you to pay off your mortgage faster, which shortens your amortization and saves you interest.

Recommended Reading: Mortgage Recast Calculator Chase

Needing To Be Physically Present In Canada To Purchase Property

If you want to buy property in Canada, you are expected to be present in Canada at least twice during this process. However, depending on where you are located or where you are looking to buy you might not need to be physically present in Canada in order to purchase a property. If you have any questions about this requirement, you should speak with a real estate agent, broker or attorney since they can advise you on how to proceed if you are unable to travel from your home country or wherever you are residing to Canada in order to be physically present to carry out this process. Depending on where you are buying, you might be able to appoint someone to be your power of attorney to be at your closing

You might need to be physically present in Canada to buy property in Canada, at least twice. However, depending on where you are located and where you are looking to buy, you might not need to be physically present in Canada, you might be able to appoint someone to be your power of attorney or legal representative to sign off on all relevant documents at closing. If you are unsure about whether or not you need to be physically present to carry out this process, you will need to speak with a real estate agent or broker or professional who can advise you about this.

Cons Of A 30 Year Mortgage:

Higher Rate: A 30 year mortgage can definitely have its benefits but these will come at a cost. Usually, the lowest rate 30 year mortgage in Canada will be approximately 0.25% higher in rate than the comparable 25 year amortization mortgage. In other words for every $100,000 in the mortgage, the cost will be about $250 more per year on a 30 year amortization vs a 25 year amortization mortgage.

Smaller Payments, More Interest: In addition to a higher rate, the effect of a smaller monthly or bi-weekly payment means it takes that much longer to pay down the mortgage and it means youll be paying interest for that much longer. An additional 5 years of mortgage term could easily mean $10,000 $20,000 of more interest even if the rates were exactly the same as a 25 year amortization mortgage.

May not be necessary: You may not require a 30-year mortgage to buy in the home price range that you are considering. Sometimes a Banker or Broker will incline their client to think this is the only way, when a 25 year lower rate may be possible. Also, the payments are not too much lower with 30 year. For example, on a $300,000 mortgage, and a constant rate of 2.19% the patent on a 30 year mortgage is $1136.07. The payment on the 25 year version of the mortgage would be $1298.03 or a 161.96 per month difference. If we then consider a lower rate on the 25 year amortization and a savings of $50 per month due to the lower rate, the monthly savings is really only about $100 in this example.

Also Check: Can You Do A Reverse Mortgage On A Mobile Home

How Do I Pay For Cmhc Insurance

Your lender is actually the party responsible for payingCMHC insurancecosts. In the majority of cases, your lender will pass these costs down to you by adding the CMHC insurance premium to your mortgage loan amount. This will slightly increase your monthly or bi-weekly payment.

In some cases, your lender may allow you to pay CMHC insurance costs as a lump-sum, or not pass down the cost to you at all. Contact your lender for more details.

What Is A Low

When applying for a mortgage in Canada, you must have a down payment of at least 5%, but many people choose larger down payments. If your down payment is 20% of the purchase price or less, your mortgage is considered high ratio, and youâll have to buy CMHC insurance. CMHC insurance protects your lender if you default on your mortgage. If you have a high-ratio mortgage, the maximum amortization period in Canada is 25 years.

For mortgages with a 20% or larger down payment , you donât need mortgage default insurance, and you can choose a more extended amortization period.

Recommended Reading: Who Is Rocket Mortgage Owned By

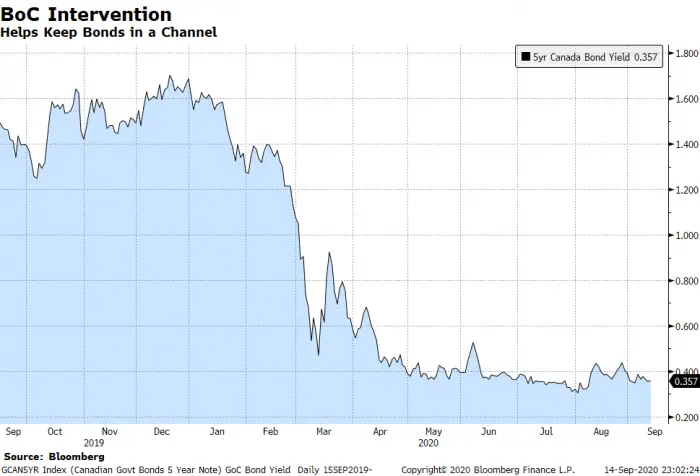

The Bank Of Canada Influences Interest Rates

The Bank of Canada also affects interest rates, mainly through changes in our policy interest rate.

The Bank of Canada doesnt set mortgage rates. But it does have some impact on them.

When the economy is strong, we may raise this rate to keep inflation from rising above our target. Likewise, when the economy is weak, we may lower our policy rate to keep inflation from falling below target. Changes in the policy interest rate lead to similar changes in short-term interest rates. These include the prime rate, which is used by the banks as a basis for pricing variable-rate mortgages. A policy-rate change can also affect long-term interest rates, especially if people expect that change to be long-lasting.

In the past, high and variable inflation eroded the value of money. In response, investors demanded higher interest rates to offset those effects. This increased funding costs for mortgage lenders. But since the Bank of Canada began targeting inflation in the 1990s, interest rates and uncertainty about future inflation have declined. As a result, funding costs are now much lower.

Higher Interest Rates From Smaller Payments

A 30 yr mortgage allows for lower monthly or bi-weekly payments since the amortization period is longer. However, you would also keep paying interest through the extra 5 years. These years could result in you paying an extra $10,000 to $20,000 in interest. Whats even more interesting is that you could incur this extra payment even if your 30 yr mortgage rate in Canada is the same rate as a 25-year amortization mortgage.

You May Like: Rocket Mortgage Conventional Loan

So Could 30 Be The New 25 For Canadian Mortgages

The short answer is no, at least not mortgages covered by default insurance. If you have less than a 20% down payment the longest amortization still sits at 25 years, but, once you get past the 20% mark there are many options with longer amortization periods most lenders will offer 30 years, with a couple even allowing up to 35.

While many Canadians feel extending the amount of time given to pay a mortgage isnt a wise practice, many need to go with the stretched option especially since the introduction of the stress test a couple of years ago.

Are The Lowest Mortgage Rates Usually Online

For the last few years, the best rates in Canada have usually been found online. Thats because internet-based lenders have been more competitive and often accept smaller profit margins. Even big banks are now joining the bandwagon with special pricing for online mortgage shoppers. RATESDOTCA tracks dozens of lenders and aggregates the best deals all in one place.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

Closed And Open Mortgages

Besides fixed and variable, you also need to choose between closed and open mortgages. Most homeowners will go with a closed-term mortgage since it gets them access to lower interest rates. The trade-off is that you will pay a penalty if you want to renegotiate your mortgage or pay off the balance before your term ends. That said, closed-rate mortgages can come with prepayment privileges that allow you to make additional payments without penalty.

Open rate mortgages are a good choice if you think youll be able to repay your mortgage in the near future. You can repay either part or all of your mortgage without having to worry about any fees. Converting your mortgage to another term without any penalties is another option. This added flexibility comes at a cost in the form of higher interest rates.

Federal Housing Administration Loans

The FHA provides housing programs suitable for first-time homebuyers. It allows borrowers to qualify even if they have low credit scores. With FHA loans, you can make a smaller downpayment to obtain a 30-year fixed-rate mortgage. This makes it a popular financing option for buyers with tight finances. FHA loans come in 15 and 30-year fixed terms, as well as 20-year terms.

Qualifying for FHA Loans

Under the FHA program, if your credit score is 500, your downpayment should be 10% of the loan amount. But if your credit score is at least 580, your downpayment can be as low as 3.5 percent.As for DTI ratio requirements, your front-end DTI should not be lower than 31 percent. Your back-end DTI should not exceed 43 percent, though some borrowers qualify at 50 percent with compensating factors.

In the beginning, FHA loans are affordable for homeowners because of low rates. But after several years of payments, it gets costly because of mortgage insurance premium . In an annual basis, the MIP cost is around 0.45 percent to 1.05 percent of the loan amount. The rates increase as you gain more home equity.

How to Remove Mortgage Insurance Premium

Recommended Reading: Chase Recast

Its Also Important To Consider Pre

Many prudent clients will opt for a longer amortization period to prepare for circumstances in which cash flow becomes tight but will continue to pay their mortgage like it has a borrowing period of 20 or 25 years. This pro-active move negates the added interest associated with the longer amortization period.

If youd like to explore whether or not it makes sense to look at a longer amortization, like a 30-year mortgage, please reach out. Were here to help and go full out for you®.

While the information contained in this site has been presented with all due care, Faris Team assumes no responsibility or liability for any errorsor omissions.

How Are Mortgage Rates Calculated

If you have a variable rate mortgage, compounding varies and its much harder to calculate since your interest payments will fluctuate based on the market. One month your interest rate might be 2.5% and the next it could be 2.6%, which will ultimately affect how much you pay in interest.

When you first start out paying your mortgage, youll be paying more toward interest and less toward your principal balance. But as each month passes, your principal would be less, meaning youll pay less toward interest and more toward your principal balance.

Did you know

You dont have to settle for a monthly payment on your mortgage. You can pay weekly or bi-weekly and pay down your mortgage faster and cheaper. Paying your mortgage off weekly or bi-weekly allows you to pay about a months worth extra of your mortgage each year.

Interest rates vs. APR

When youre looking to take out a mortgage or refinance your existing mortgage, you might see both APR and interest rates and theyre not the same thing. The interest rate, expressed as a percentage, is the amount that youll pay to the lender to borrow money. The which is the annual percentage rate, is usually higher than the interest rate, because it includes interest as well as additional fees that youll pay like origination fees and closing costs.

About our promoted products

Recommended Reading: Chase Recast Mortgage

How To Get A 30

Here are the steps youâll need to take to get a 30-year mortgage in Canada.

Save for your down payment: Youâll need enough cash for a 20% down payment, plus the closing costs of buying your new home. Depending on location, closing costs can be between 1% and 5% of the total purchase price.

Find a home in your price range: Once youâve saved diligently, youâll need to figure out how much you can afford. Use our mortgage affordability calculator to work out how much you can afford to buy with your current savings making up at least a 20% deposit.

Find a mortgage provider: While most mortgage providers will offer non-insured, 30-year mortgages, youâll still need to find the best product for you. With a longer amortization period, your mortgage rate will be especially important, so be sure to compare mortgage rates between lenders.

Fixed Rates Above 4% Are On The Way

Other mortgage observers increasingly expect 5-year fixed rates to hit 4% in the coming weeks if current economic and geopolitical conditions persist.

Five-year fixed-rate mortgages with 30-year amortizations were available at about 2.50% in January and are now offered at rates about 1% higher, mortgage broker Dave Larock of Integrated Mortgage Planners wrote in his latest blog post. If they continue to rise at their current pace, 5-year fixed rates could easily exceed 4% by Easter.

Ron Butler of Butler Mortgage said he currently expects 5-year rates to settle in the low 4% range.

He added that the current hikes have already led to a general slowdown in mortgage activity.

Typically in times of extreme volatility, like this, those with a pre-approval lock in to try to act quickly, but those who dont have a pre-approval just pause, he told CMT.

Rising rates are currently only impacting new homebuyers, as those with mortgage renewals coming up still have rate offers on the table that were received prior to the latest hikes. But that will soon change, Butler notes.

Those who are renewing are still getting six-week-old rates, so they are happy, he said. Ask again in six weeks .

Having said that, Butler added that the current trend is pure variable, very little fixed. Larock confirmed the trend, saying hes seeing more clients lean towards variable rates right now.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Is A Variable Rate Better

If youre comparing a variable rate and a fixed rate at the same point in time, a variable rate will almost always be lower than a fixed rate. Just as how a longer term mortgage will have a higher rate when compared to a shorter term mortgage, borrowers will pay a premium for locking-in a fixed rate.

Historically, variable rates have performed better than fixed rates, as found in a 2001 study by theIndividual Finance and Insurance Decisions Centre. Thats because interest rates have generally fallen over the past few decades, meaning that borrowers with a variable mortgage rate would have benefited from falling interest rates.

In todays low interest rate environment, its not certain if interest rates can continue to decrease further. While the focus can be on the direction of the change, you should also pay attention to how large the interest rate changes can be.

Since variable rates are often already priced at a discount to fixed rates, variable rates would be a better choice if interest rates dont move at all. Variable rates might still be a better choice if interest rates only increase slightly and later on in your mortgage term.

A fixed mortgage rate would be better if you think interest rates will significantly rise in the near future. Many borrowers also place value on the peace of mind that a fixed mortgage rate gives. The slightly higher mortgage rate might be worthwhile in exchange for not having to worry about interest rate fluctuations.