Commercial Property Mortgage Calculator Terms

Following are the terms for the commercial real estate loan calculator.Mortgage Amount – The amount of the loan that you want to apply for.Loan Terms – The terms in a number of years for the loan.Interest Rate – The annual interest rate that you need to pay for the loan.Balloon Payment Due – In how many years will the balloon payment be due.First Payment Date – You can set the date for the first payment date in the past, present, or some date in the future.Amortization schedule – Show the amortization schedule of each payment or on a yearly basis.

If you are working with a realtor whether you are looking to buy or sell a commercial property, you can use the commercial realtor commission calculator to calculate the cost of hiring a real estate agent.

Commercial Mortgage Vs Residential Mortgage

Commercial mortgages have some similarities with residentialmortgages. But instead of obtaining a loan to own a home, you are borrowingmoney to secure property for business use.

The table below highlights differences between a residential mortgage and commercial mortgage:

| Loan Details | |

|---|---|

|

Conventional loans, 30-45 business days FHA loan, 10-60 business days USDA loan, 30-45 business days VA loans, 40-50 business days |

Can take 3-4 months |

Navigating Commercial Mortgage Costs

After youve played around with the commercial mortgage calculator and examined the numbers, you might be worried about the costs of financing your commercial real estate purchase. While a lenders fees can be preset and impossible to work around, there are some ways you can lower how much youll pay in interest.

Don’t Miss: Can You Get A Reverse Mortgage On A Condo

How To Qualify For Commercial Real Estate Loans

Commercial loan approval depends on your creditworthiness as a business owner. When a lender grants a loan, they trust that your company will produce enough profits to pay back the mortgage. That said, a commercial lender can only approve your loan after carefully reviewing your financial status.

Main Qualifications for Commercial Lending

Lenders refer to three main types of requirements before approving a commercial mortgage. These qualifications include your business finances, personal finances, and the propertys characteristics. They also check your personal and business credit score. Commercial lenders review your accounting books to verify if you have enough cash flow to repay the mortgage.

Apart from your finances, commercial underwriters also evaluate your company profile and your business associates. They will even assess your business plan and check the companys projected earnings based on your goals. Due to this strict underwriting process, many new companies have a hard time getting their loan approved.

Make sure to meet the following requirements when you apply for a commercial loan:

Prepare The Required Documents

Processing paperwork for a commercial mortgage application is often a slow and taxing process. Lenders require many legal documents that contain extensive financial information.

Get ready with the following documents when you apply for a commercial mortgage:

- Income tax returns up to 5 years

- Third-party appraisal on the property

- Proof of citizenship

- Your business credit report

- State certification as a limited liability entity

- Books accounting the last 5 years of your business, or since it started

- Business plan states how the property will be used, details the strengths of the business, etc.

How Long Does the Processing Take?

It typically takes around 93 days or 3 months from application to closing. This is the median time for most commercial loan applications. For construction loans, the processing time can even take up to 6 months. And compared to residential mortgages, commercial loans take a lot longer to close.

Recommended Reading: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

The Best Office Productivity Tools

Kutools for Excel Solves Most of Your Problems, and Increases Your Productivity by 80%

- Reuse: Quickly insert complex formulas, charts and anything that you have used before Encrypt Cells with password Create Mailing List and send emails…

- Super Formula Bar Reading Layout Paste to Filtered Range…

- Merge Cells/Rows/Columns without losing Data Split Cells Content Combine Duplicate Rows/Columns… Prevent Duplicate Cells Compare Ranges…

- Select Duplicate or Unique Rows Select Blank Rows Super Find and Fuzzy Find in Many Workbooks Random Select…

- Exact Copy Multiple Cells without changing formula reference Auto Create References to Multiple Sheets Insert Bullets, Check Boxes and more…

- Extract Text, Add Text, Remove by Position, Remove Space Create and Print Paging Subtotals Convert Between Cells Content and Comments…

- Super Filter Advanced Sort by month/week/day, frequency and more Special Filter by bold, italic…

- Combine Workbooks and WorkSheets Merge Tables based on key columns Split Data into Multiple Sheets Batch Convert xls, xlsx and PDF…

- More than 300 powerful features. Supports Office/Excel 2007-2019 and 365. Supports all languages. Easy deploying in your enterprise or organization. Full features 30-day free trial. 60-day money back guarantee.

Office Tab Brings Tabbed interface to Office, and Make Your Work Much Easier

Figuring Out The Monthly Payments On A Commercial Real Estate Loan Has Never Been More Simple

Undertaking a commercial mortgage is a serious investment. The experts at Commercial Real Estate Loans. understand very well that there’s no shortcut to getting commercial real estate financing. With that in mind, we strongly believe that having the right tools and know-how gives you an incredible advantage towards acquiring the financing you deserve.

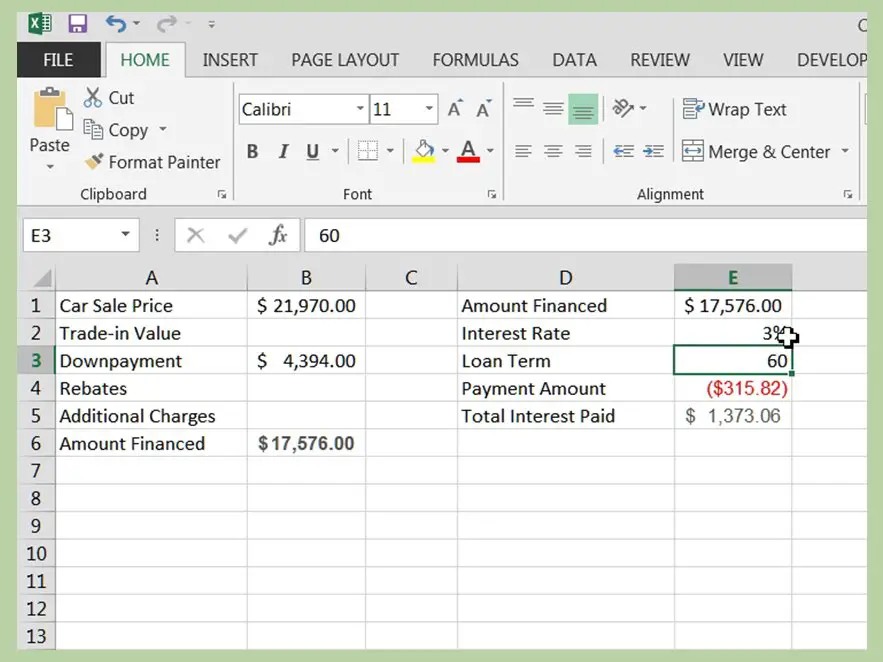

The most useful tool, in our humble opinion, is our commercial mortgage calculator, which determines estimated monthly payments for a commercial mortgage at any given rate. Start off by inputting the loan amount and interest rate. Once those are entered, set the amortization and term length to see the monthly payment figure over time.

Its important to keep in mind that the commercial mortgage calculator only shows the principal and interest portion of your monthly payment. Some lenders may require additional fees that could be worked into the monthly payment. These figures should also be considered when viewing the calculator’s results to get a more accurate estimation of the monthly payment. The calculator comes equipped with an amortization schedule that details the amortization over the length of the loan term.

You May Like: Mortgage Rates Based On 10 Year Treasury

Understanding The Application Process

Before applying for a commercial real estate loan, ask aboutall the required documents. Commercial lenders usually ask for your companysfinancial statements and tax returns within the last 3 to 5 years to assessyour business stability. Other documents you need to prepare include:

- Corporate financial records

- Financial history, including profiles ofbusiness partners

- Your personal financial records

- Leases

Depending on the lender, they may require more documentsother than the ones mentioned above. And the more documentation needed, thelonger the approval process. This is because all the required documents must beverified.

How To Lower Your Mortgage Payments

There are a few ways to lower your monthly mortgage payments. You can reduce the purchase price, make a bigger down payment, extend the amortization period, or find a lower mortgage rate. Use the calculator to see what your payment would be in different scenarios.

Keep in mind that if your down payment is less than 20%, your maximum amortization period is 25 years. As for finding a lower mortgage rate, its a good idea to speak to a mortgage broker for assistance.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

How Much Interest Will I Pay On A Commercial Loan

The interest paid on a commercial real estate loan will depend on the interest rate charged, the length of the term, and the amortization schedule. To see the total interest charged over time for any type of commercial loan, visit our calculator on this page and look at the “Total Interest” under the Payment Summary chart after inputting your loan amount, interest rate, and amortization.

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

Also Check: Monthly Mortgage On 1 Million

Conventional Commercial Mortgage Rates

Uninsured commercial mortgages are not backed by the CMHC, which means that they are based solely on the borrower. This makes commercial mortgage rates tied to corporate bond yields. Due to commercial mortgages being less liquid than corporate bonds, commercial mortgage rates are higher than corporate bond yields.

The five-year commercial mortgage premium over BBB corporate bonds was just under 1% as of April 2021. This is higher than the average spread of 0.5% over the past five years. To learn more aboutcommercial mortgages ratesyou can view our article.

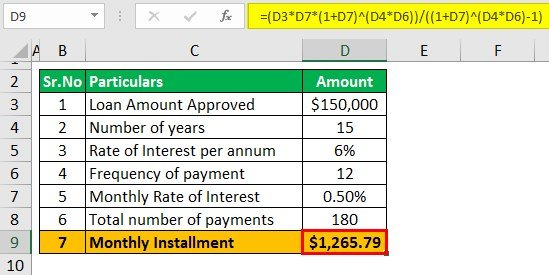

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

Recommended Reading: Reverse Mortgage For Condominiums

Commercial Real Estate Calculator

The Commercial real estate calculator is to be used for commercial loans only. It is a perfect calculator for real estate investors who are looking to buy commercial properties as an investment. If you are looking for a conventional mortgage calculator with taxes and insurance, please use the mortgage calculator with taxes and insurance with more options.

For commercial loans, lenders expect the borrowers to repay the loan in advance before the due date. They do this by including a balloon payment which is a lump sum of money to be paid at the end of the balloon payment due year. For example, if the balloon due year is 5 years, you will make regular monthly payments to the lender. At the end of the 5th year, you are required to pay off everything in a lump sum payment. This commercial mortgage loan calculator with balloon payment will calculate the mortgage balloon payment for you after certain years.The commercial mortgage calculator with amortization has a commercial amortization schedule that has all the details about each payment including payment date, payment number, interest paid, principal paid, total payment, and remaining balance.The commercial mortgage amortization schedule is printable and downloadable for your convenience.

If you live in the UK, you can use the Commercial Mortgage Calculator UK.

How Do Commercial Loans Work

To apply and get approval for a commercial loan, companies need to provide financial statements, such as their income statement and balance sheet to the bank. This is necessary because this is the only way that the bank knows that the business can repay the loan. In the case of default, the bank wants to take control of a company’s assets to cover their loss.Commercial loans are usually short-term, but they can be renewed and extended for a longer period.Many commercial lenders require collateral for commercial loans, whereas some lenders require a down payment. It really depends on the particular lender that you work with. Shop around and see which commercial lender suits your needs.

Recommended Reading: Chase Mortgage Recast Fee

How Is Interest Calculated On A Commercial Loan

This depends heavily on whether or not the loan is interest-only or amortizing. If it is interest only, the monthly interest is the rate divided by the number of periods in a year , then multiplied by the loan amount. If it is an amortizing loan, the calculations are slightly trickier, and we recommend using a calculator like the one provided on this page.

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Understanding The Commercial Mortgage Calculator

Our Calculator will help to determine the estimated principal, interest, and amortization for any given loan amount and rate. The principal is the amount of money you are borrowing from the lender. The principal amount you can borrow depends on what your current finances and future business prospects can handle, as determined by the lender. Some factors lenders use to determine how much they can lend a borrower are the projected revenue the property will yield and how much your total assets cover in relation to your total debt .

The industry median interest rate for commercial real estate loans is approximately 3% above the federal rate. The amount of interest that you will be required to pay for the life of the loan term is typically determined by your credit score. The loan term is the duration of time that you have to pay off the principal and interest of the loan. Loan terms for commercial properties are usually about 15-30 years. The length of the loan term affects the size of your monthly installments, as well as how much you would have paid off at the end of the loan .

Through Commercial Real Estate Loans.,& nbsp you can be confident that we will provide you access to the industrys best loan rates no matter the property type, location or size!

My Mortgage Payment Plan

This line graph shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.

Find out how much you can save by changing your payment frequency.

This table shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.| Amortization |

|---|

* These calculations are based on the information you provide they are approximate and for information purposes only. Actual payment amounts may differ and will be determined at the time of your application. Please do not rely on this calculator results when making financial decisions please visit your branch or speak to a mortgage specialist. Calculation assumes a fixed mortgage rate. Actual mortgage rates may fluctuate and are subject to change at any time without notice. The maximum amortization for a default insured mortgage is 25 years.

** Creditor Insurance for CIBC Mortgage Loans, underwritten by The Canada Life Assurance Company , can help pay off, reduce your balance or cover your payments, should the unexpected occur. Choose insurance that meets your needs for your CIBC Mortgage Loan to help financially protect against disability, job loss or in the event of your death.

You May Like: Rocket Mortgage Vs Bank

Compute Your Costs With The Commercial Loan Calculator

Navigating the costs associated with a small business loan can be tough.

But by using our commercial loan calculator and plugging in multiple scenarios to account for higher or lower interest rates and repayment lengths, you can gain insight into the costs of financing.

If you dont think you can afford it, try building your credit or save up some funds to commit a larger down payment. Remember, you can circumvent interest costs with principal-only payments over the life of your loan.

Once you feel the time is right, you can apply to get the funding your small business needs.

Commercial Loan Terms And Payment Structure

Commercial mortgages come in short terms of 3, 5, and 10 years. Others stretch as long as 25 years. But in general, commercial mortgage terms are not as long as most residential loans, which is usually 30 years.

When it comes to the payment structure, expect commercial loans to vary from the traditional amortizing schedule. A lender asks a borrower to pay the full loan after several years with a lump sum payment. This is called a balloon payment, where you pay the total remaining balance by the end of the agreed term.

For instance, a commercial loan has a balloon payment due in 10 years. The payment is based on a traditional amortization schedule such as a 30-year loan. Basically, you pay the first 10 years of principal and interest payments based on the full amortization table. Once the term ends, you make the balloon payment, which pays off the remaining balance in the mortgage.

Furthermore, you have the option make interest-only payments in a commercial loan. This means you do not have to worry about making principal payments for the entire term. Likewise, once the loan term is through, you must settle any remaining balance with a balloon payment.

In some cases, commercial lenders offer fully amortized loans as long as 20 or 25 years. This is how certain Small Business Administration loans are structured. And depending on the commercial loan and lender, some large commercial mortgages may be given a term of 40 years.

Read Also: Recasting Mortgage Chase