How Do I Find The Best Mortgage Rate

Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done. The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you keep your home loan will impact your decision.

If you plan on keeping your home loan long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages. Locking in a low rate is a smart choice. But you can get lower mortgage rates with some adjustable-rate loans too. If you plan on only keeping your home for a short period of time, then you may be able to pay less interest with an ARM.

Interfirst Mortgage Company: Best Non

Interfirst Mortgage Company is a combo-direct mortgage lender, wholesale lender and correspondent lender.

Strengths: Interfirst has an A- rating from the Better Business Bureau and high marks from borrowers on Bankrate and elsewhere. Plus, with its multiple business channels, the lender can offer several loan options for many types of borrowers.

Weaknesses: Interfirst isnt licensed in every state, and if youre trying to compare mortgage rates, you might have a harder time, since this lender doesnt showcase rates publicly on its website.

> > Read Bankrate’s full Interfirst Mortgage Company review

How Do I Find Current 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start start the process of getting approved for your home loan. Its that easy

A 30-year fixed-rate mortgage is the most common term of mortgage. It provides the security of a fixed principal and interest payment, and the flexibility to afford a larger mortgage loan because the payments are more affordable theyre spread out over three decades.

Recommended Reading: 70000 Mortgage Over 30 Years

How Are Mortgage Rates Impacting Home Sales

The total number of mortgage applications inched lower during the week ending December 17, 2021. The 0.6% decline was driven by a decrease in the number of purchase loan applications, according to the Mortgage Bankers Association.

- The total number of purchase loan applications decreased by 6% week-over-week, breaking a five-week run of increases. Compared to the same week last year, there were 9% fewer applications.

- Refinance applications, on the other hand, increased by 2% from the week prior but were 42% lower year-over-year. Refis made up a little over 65% of all applications.

Home Buyers With A Lot Of Monthly Income

If you have plenty of cash left over every month, you may be able to afford the higher payments that come with a shorterterm mortgage.

Opting for a shorter term could save you a bundle, because it means you pay less interest.

Instead of borrowing over 30 years, youd be borrowing for 20, 15, 10 or even fewer. And the less time you pay interest, the more you save.

The same benefits apply when refinancing to a 15year term instead of a new 30year term.

Intrigued? Run your figures through The Mortgage Reports mortgage calculator.

Youll notice the payments for a 15year loan are much higher. But you may be shocked by how much interest youd save.

Also Check: Rocket Mortgage Requirements

Mortgage Rates By State

Real Estate Economist and Associate Dean in Florida Atlantic University’s College of Business

With mortgage rates near historic lows, what can homebuyers do right now to ensure theyre getting the best deal when purchasing a home?

Individuals should begin their mortgage search before they begin their home search. This will put them at the price point they can best afford and allow them to potentially prioritize their offer with sellers over other buyers, since they will be ready to close quickly.

What causes mortgage rates to rise or fall?

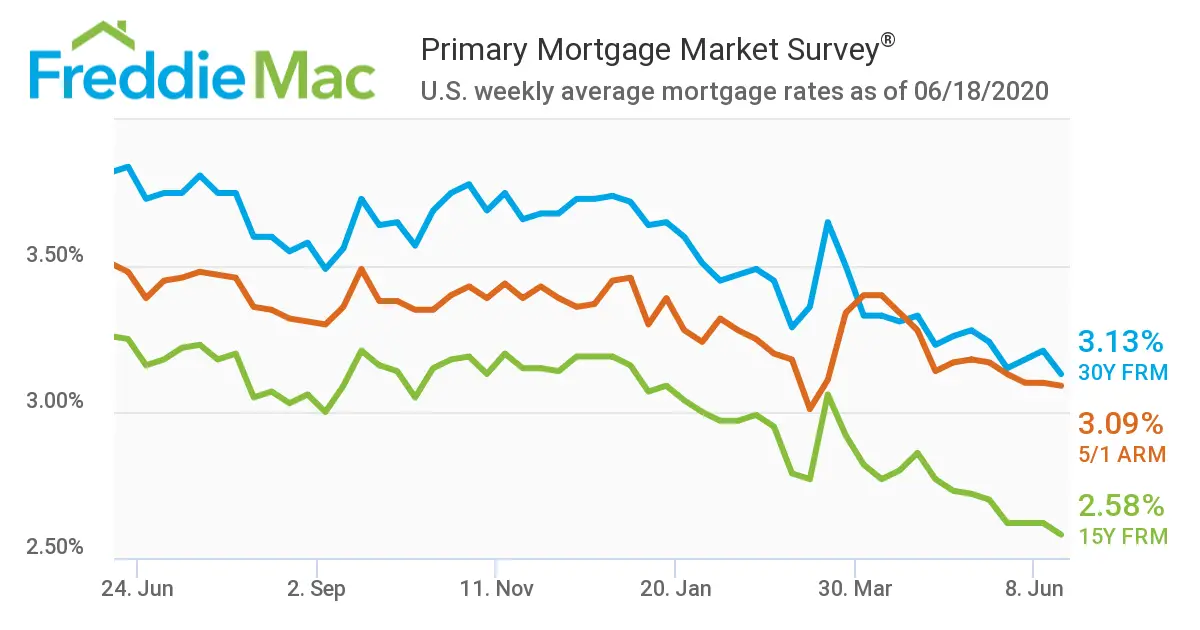

Increases or decreases in 10-year Treasury yields directly influence 30- and 15-year mortgage rates. Currently, the Federal Reserve is actively buying 10-year Treasury notes, which increases the demand for these securities and drives their price up and yields down. So, our near record low mortgage rates are directly tied to the Federal Reserve Board’s response to COVID-19 in efforts to keep financial markets open. When it begins to taper significantly, mortgage rates will rise.

Should current homeowners consider refinancing with rates that are this low?

Does The Federal Reserve Decide Mortgage Rates

The Federal Reserve doesnt directly decide mortgage rates. Instead, it influences the rate by keeping inflation under control. Their goal is to help guide the economy, encouraging its growth. Raising or lowering short-term interest ratesa decision made by the Federal Open Market Committeemay encourage lenders to raise or lower their mortgage rates also.

Read Also: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How Do 5/1 Arm Rates Compare

The initial interest rates on ARMs are generally lower than those for fixed-rate loans. Often, adjustable rates are about 0.5% lower.

For example, if you were in line for a 3.0% fixed-rate mortgage, you could likely get a 2.5% adjustable rate. That lower rate might mean you could afford a bigger mortgage and a better, more costly home.

But the relationship between fixed rates and adjustable rates is not an iron rule. Sometimes, the gap is a bit wider. And sometimes its a little narrower. There are also periods when ARM rates are actually higher than fixed rates.

So its up to you to check where ARM rates stand in comparison to FRMs at the time when you are deciding which to choose.

You also need to shop around between different lenders for your best possible rate.

The ARM rate lenders can offer you depends on your credit score, credit report, down payment, and home value, among other factors. And you wont know which mortgage lender can offer the lowest rate until youve compared personalized rates from a few of them.

Compare todays 5/1 ARM rates

| Program | |

|---|---|

| 4.968% | Unchanged |

| Rates are provided by our partner network, and may not reflect the market. Your rate might be different. . See our rate assumptions . |

Whether You Buy Points

Lenders sometimes offer borrowers a lower interest rate if they buy “points” or “mortgage discount points.” Points are prepaid interest. A point usually costs you 1% of your mortgage amount and lowers your rate by one-eighth to one-quarter percent . Whether points are worth buying depends on how long you intend to live in the house — for them to be cost-effective, you need to own the home long enough to save more in interest than you pay up front. The longer you keep the house, the more likely you are to save money by purchasing points.

Also Check: Reverse Mortgage For Condominiums

Someone Moving In Less Than 10 Years

A 30year term with a fixed rate buys you security and predictability over three decades. But suppose you dont need all that time, because you know youll be moving on in ten years or fewer.

In this case, you might be better off with an adjustablerate mortgage .

Adjustablerate mortgages typically come in 3 forms: the 5/1, 7/1, and 10/1 ARM. All have 30year terms, but the first number refers to the amount of time your interest rate is fixed.

If youre certain youll be moving before that fixedrate period ends, you could opt for an ARM and enjoy the introductory rate it offers which is usually significantly lower than 30year mortgage rates.

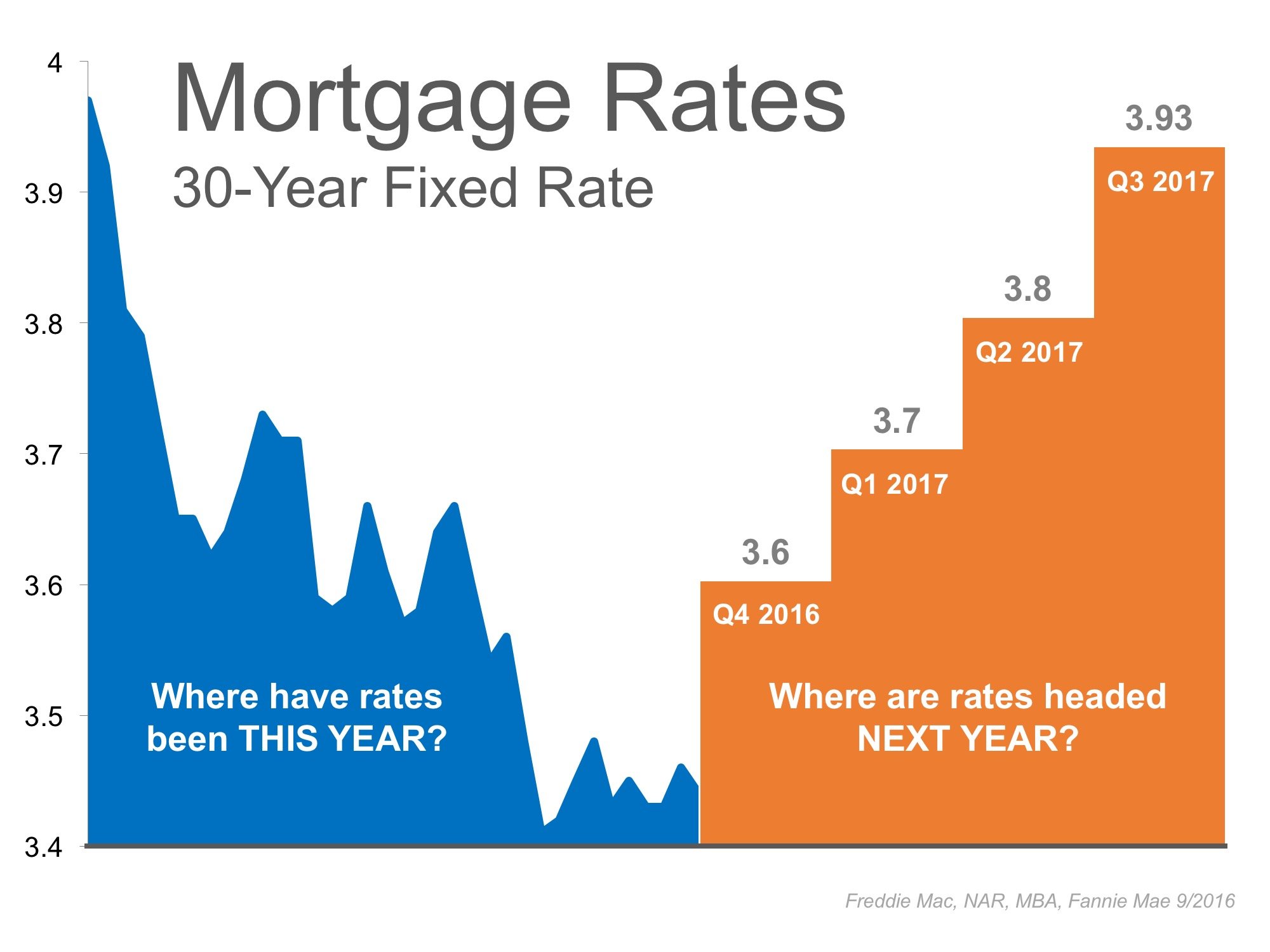

What Are The Mortgage Rate Trends For 2021

This year, rates have fluctuated but overall they have been low compared to rate history. But, many experts believe rates will rise in 2021.

As the economy recovers and the Federal Reserve announced its plan to scale back its low-rate policies the likely outcome will be rising mortgage rates. However, the expectation among experts isnt for skyrocketing rates overnight, but rather a gradual rise over time.

Recently, though, rates have been volatile. News of the Omicron COVID-19 variant has created fresh economic uncertainty and is putting upward pressure on rates. At the same time, rates are getting downward pressure due to the highest inflation in nearly 40 years.

Long term, experts still expect rates to slowly increase as the economy recovers. The recent volatility could continue through the end of the year and into 2022.

Also Check: Rocket Mortgage Payment Options

What Is A Good 30

A 30-year fixed-rate mortgage is a home loan that maintains the same interest rate and monthly principal-and-interest payment over the 30-year loan period. With a rate that lasts the length of the loan, youll want the best rate you can get. Since your rate is most directly impacted by your credit score and down payment, youll want to make sure your credit file is accurate and make a down payment thats as much as you can easily afford.

Getting a good deal on a mortgage is like getting a good deal on a car. You do online research, you talk with friends and family, and then you comparison-shop. That last step, which involves applying with multiple lenders, is the most important step.

When you compare loan offers using the Loan Estimates, youll feel confident when you identify the offer that has the best combination of rate and fees.

A Freddie Mac report concluded that a typical borrower can expect to save $400 in interest in just the first year by comparison-shopping five lenders instead of applying with just one lender. Over several years, comparison-shopping for a mortgage can save thousands of dollars. Thatll give you something you can brag about.

The 30-year fixed isnt your only option. The 15-year fixed loan is common among refinancers. Adjustable-rate mortgages have low monthly payments during the first few years of the loan, making them popular for high-dollar loans.

Federal Housing Administration Loans

The FHA provides housing programs suitable for first-time homebuyers. It allows borrowers to qualify even if they have low credit scores. With FHA loans, you can make a smaller downpayment to obtain a 30-year fixed-rate mortgage. This makes it a popular financing option for buyers with tight finances. FHA loans come in 15 and 30-year fixed terms, as well as 20-year terms.

Qualifying for FHA Loans

Under the FHA program, if your credit score is 500, your downpayment should be 10% of the loan amount. But if your credit score is at least 580, your downpayment can be as low as 3.5 percent.As for DTI ratio requirements, your front-end DTI should not be lower than 31 percent. Your back-end DTI should not exceed 43 percent, though some borrowers qualify at 50 percent with compensating factors.

In the beginning, FHA loans are affordable for homeowners because of low rates. But after several years of payments, it gets costly because of mortgage insurance premium . In an annual basis, the MIP cost is around 0.45 percent to 1.05 percent of the loan amount. The rates increase as you gain more home equity.

How to Remove Mortgage Insurance Premium

Also Check: Recasting Mortgage Chase

When To Lock Your Mortgage Rate

Keep an eye on daily rate changes. But if you get a good mortgage rate quote today, dont hesitate to lock it in.

Remember, if you can secure a 30year mortgage rate below 3% or 4%, youre paying less than half as much as most American homebuyers in recent history. Thats not a bad deal.

*Average rates are for sample purposes only. Your own interest rate will be different. See our mortgage rate assumption here.

Va 30 Year Fixed Mortgage Rates

Since VA loans are guaranteed by the government, VA loans provide access to special benefits, including:

Also Check: Rocket Mortgage Qualifications

Types Of 5 Year Arm Rates

Most loan programs offer ARMs as well as FRMs. The main exception is USDA loans, which are available only as 30-year, fixed-rate mortgages .

Although fixed-rate loans are more popular by far, ARM versions are also available for these major loan options:

- Conventional loans Home loans not guaranteed by the federal government

- Conforming loans Mortgages that conform to rules created by Fannie Mae and Freddie Mac, as well as those actually owned by Fannie and Freddie

- Jumbo loans Mortgages above the conforming loan limit, which can have loan amounts in the millions

- FHA loans Low-down-payment and low-credit loans backed by the Federal Housing Administration

- VA loans Zero-down-payment loans for veterans and service members, backed by the Department of Veterans Affairs

- Shorter-term loans You might choose a 10- or 15-year mortgage instead of the usual 30-year one. ARMs are often available for those

Not all lenders offer all flavors of mortgages. And some may decide not to provide ARM versions of all the loans they offer.

But, as long as you qualify for the mortgage you want, you should be able to find it as an ARM. You just might have to shop around a little more than someone looking for a fixed-rate home loan.

What Is The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing the money, and it is advertised as a percentage of the loan. , and it includes the interest rate plus other fees associated with the mortgage. So the APR will provide you with a better idea of the total cost of financing the loan. You may find lenders offering the same interest rate and monthly payments, but if one is charging higher upfront fees, then the APR will be higher.

The Federal Truth in Lending Act requires lenders to disclose the APR, but the fees can vary. When comparing APRs between lenders, ask which fees are not included for better comparison.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

Interesting Facts About Fixed Mortgage Rates In Canada

Current fixed mortgage rates are encouraging many people to buy homes in Canada, but there are some trends that suggest people are preferring shorter loan terms. For example, about 40 percent of all Canadian homeowners in 2012 held a loan with a 5-year term. Today, only about a third of all homeowners would consider a loan of up to 10 years. This is a change from past decades in which the 10-year loan was the most popular fixed-rate mortgage option. Clearly, many people believe that they can get the best fixed mortgage rates on loans that have terms of 10 years or less.

What You Should Know About Adjustable

Adjustable-rate mortgage loans are inherently riskier than fixed-rate mortgages. Although your introductory rate may be ultra-low, theres a good chance rates could rise at some point in your loan term.

A higher interest rate means a bigger monthly mortgage payment. And if rates rise enough, a homeowner could get priced out of their home which is a dangerous position to be in.

The risk of rising rates is the main reason most home buyers choose a fixed-rate mortgage over an ARM. However, if you know youll move or refinance before the introductory period ends, an ARM may offer a lower interest rate and savings on your mortgage payment.

If youre considering an ARM for its money-saving benefits, here are a few things you should know about this type of mortgage before opting in.

ARM rate caps make these loans less risky than you think

Today, most adjustable-rate mortgages come with rate caps. These reduce your exposure to risk by limiting the amount your rate can rise in any given year and over the life of the loan.

Rate caps are usually expressed like this: 2/2/5.

Following is the meaning for each, in order:

Still, caps are there to protect you.

Recommended Reading: Bofa Home Loan Navigator

Interest Rates And Apr Vary By Loan Type

30year mortgage rates also vary by loan program.

If you look at interest rate alone, VA loans typically have the lowest rates, followed by USDA loans.

FHA mortgages also have belowmarket rates. But they charge expensive mortgage insurance premiums which push up the overall cost of the loan.

Similarly, conventional loans with less than 20% down can have expensive private mortgage insurance . Thats especially true for borrowers with lower credit.

But for borrowers with great credit, PMI is less expensive and wont have as big of an impact on monthly mortgage payments.