How To Remove An Ex From The Mortgage Without Refinancing

You dont need to remortgage to remove an ex from the mortgage as it is possible to do a Transfer of Equity on your existing product and many lenders also allow capital raising on an equity transfer.

As part of the process of transferring a mortgage into a sole name, a lender will carry out affordability and credit checks and there will be administration and legal fees to pay. For this reason, many people use buying out a mortgage from a partner as an opportunity to review their mortgage and often choose to refinance, particularly if there are Early Repayment Charges payable on their current deal.

Show about this topic

Should Both Spouses Be On House Title

Married couples buying a house or refinancing their current home do not have to include both spouses on the mortgage. In fact, sometimes having both spouses on a home loan application causes mortgage problems. For example, one spouses low credit score could make it harder to qualify or raise your interest rate.

Can you transfer a mortgage to a family member? You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable. If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But theyll still typically need to qualify for the loan with your lender.

Can a spouse be added to a mortgage? Yes, having both names on the houses title wont affect your mortgage or who is responsible for paying it. Whoevers name is on the mortgage will be solely responsible for the loan. To learn how to add a spouses name to the title after getting your mortgage, continue reading below.

Can I add my girlfriend to my mortgage? Fortunately, one person can take the title as sole owner and later add the other partners name to the deed. Officially adding the other partners name to the deed might allow your mortgage lender to call in the loan, and in some areas, you may have to pay transfer taxes and fees to add a name to the deed.

Can My Husband Refinance Our Home Without My Knowledge

It is not possible for one spouse to refinance a joint mortgage without the other borrower’s knowledge or consent that would be mortgage fraud. In addition, the spouse remaining on the mortgage needs to be able to qualify for the loan on their own. … And the person on the loan will have to pay closing costs, as well.

Recommended Reading: How Does Rocket Mortgage Work

Signing A Mortgage Loan

Most people who buy real estate do not have the cash necessary to pay for real estate without taking out a loan. In some cities, like San Francisco, the median house price is over a million dollars so borrowing is the norm. Almost every real estate loan is going to be guaranteed by the property itself. This means that the lender takes back a security interest in the property with a security instrument called a mortgage, but it’s common to use the term to refer to the loan it is securing as well.

Why won’t a lender be eager to remove your co-borrower or co-signer from the mortgage loan? Although the loan is secured by the property, all that means is that the lender can force a sale in case of default. But the lender can also look to the personal bank accounts and other assets of the co-borrowers if they don’t get their monthly principal and interest payments and seizing liquid assets like cash in an investment account is a lot easier than foreclosing on a house. Naturally, it’s better for the bank to have multiple co-borrowers to look to for missed payments.

Assuming A Mortgage Loan

If you don’t want to refinance, you can ask the bank about assumption, where you accept full responsibility for the debt yourself, keeping all loan terms the same, except for removing the name of the other co-borrower. Theoretically, this is easy. You tell the lender you want to take over the mortgage with a loan assumption. You sign the papers and pay a fee, often around 1 percent of the loan plus other fees, if this is permitted.

So what’s the issue? Most loans are not “assumable” and many banks and other private lenders say no to a loan assumption. You may have better luck if your loan is with the FHA or the Veteran’s Administration. In any event, it doesn’t cost anything to ask, but the odds are against you. Note that if you do find a lender who considers an assumption, you will still have to show good credit and sufficient income to support repayment on your own.

References

Don’t Miss: Rocket Mortgage Conventional Loan

File A Quitclaim Deed

Once you’re sure the applicant is able to refinance the loan in his or her own name, you’ll need to file a quitclaim deed. This deed is a legal document that releases you from any interest in the property. You can draw one up on your own, or use a complimentary template provided by such sites as Rocket Lawyer.

The deed will need to contain a description of the property and its address, the date of the transfer and the payment. In this instance, there is no exchange of money, but you’ll still need to state that on the deed. All parties must then sign the deed in front of a notary.

Risks Due To Deficiency

If there is a difference between the short sale amount and the balance that you owe, then your lender can sue you. For example, The bank can get a fraction of the house value when the borrower walks away from the mortgage. So, the borrower would sue.

The states that dont have anti-deficiency laws can even affect you. So you should always seek legal advice.

Read Also: How 10 Year Treasury Affect Mortgage Rates

Breaking Up Is Hard To Do

Youre parting ways with a spouse orco-mortgage borrower. Youve agreed who will keep the house and take overmortgage payments. But theres a problem.

In the eyes of yourmortgage lender, the ties that bind arent legally severed until you removeyour ex from the mortgage.

Even when a coupleagrees that one person is no longer responsible for the mortgage, the lenderdoesnt see it that way until the official records show it.

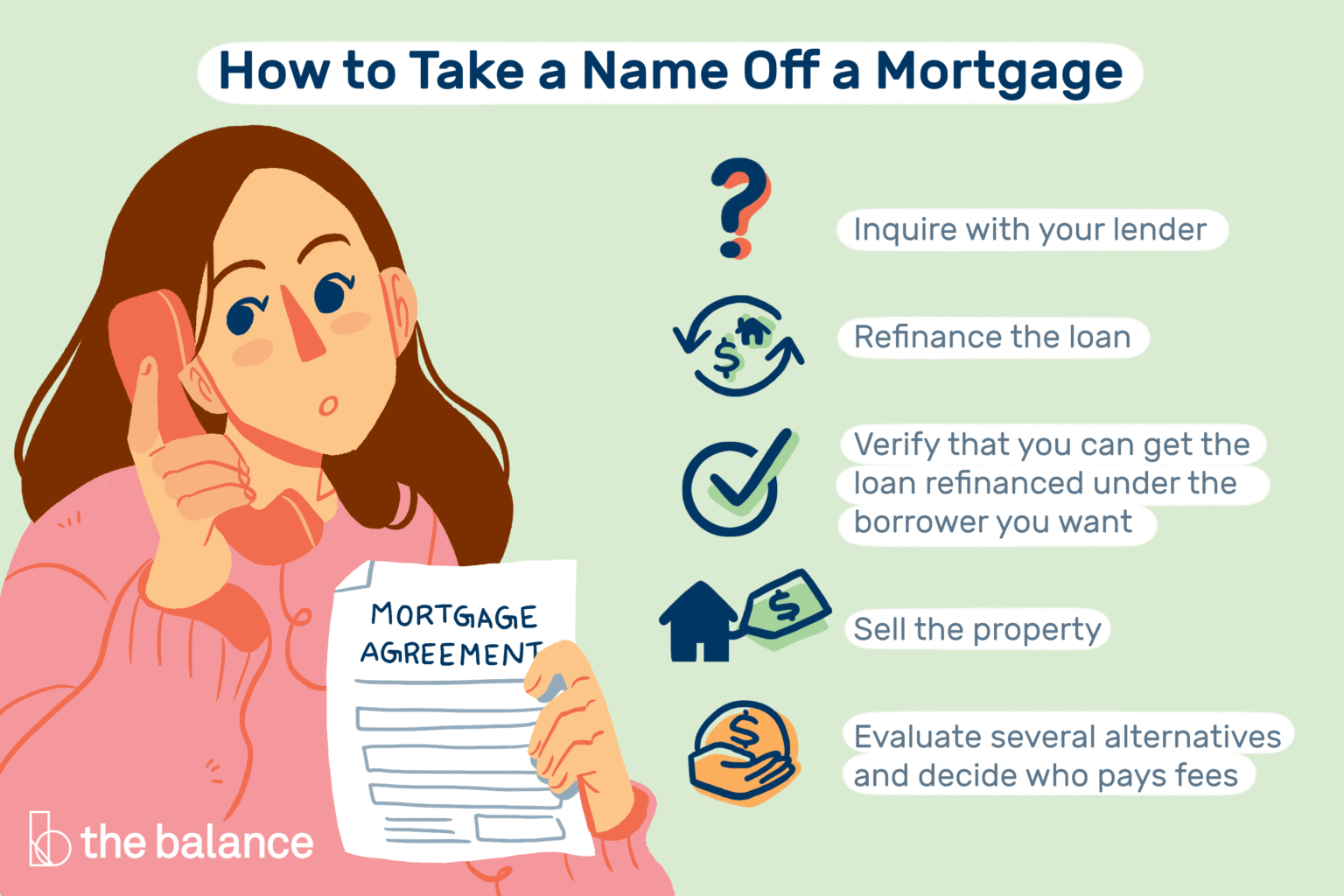

There are a few ways youcan take a name off a joint mortgage loan. The best way is usually torefinance, which may be less of a hassle than you think. Heres what you shouldknow.

What Happens To A Joint Mortgage After A Separation

If you are separating or divorcing the person you have a joint mortgage with, there are a few different options of what to do.

One option is to sell the home. That means you would no longer have any financial ties to each other. But it means both of you will need to find somewhere else to live.

If both of you want to leave the house, but dont want to give up ownership, then you could explore the option of renting it out. If you do this, either one or both of you can still own the home. If both of you want to still own the home, youll have to split the rent two ways, and youll still be on a joint mortgage with financial ties to each other. If just one of you wants to rent the property out, theyll have to buy out the other from the mortgage.

One of the most common choices is to have one partner buy the other out and transfer the joint mortgage to one person.

Use this guide to see your options for buying out your ex-partner: How can you buy a partner out after separation?

Read Also: Chase Recast Mortgage

How To Get My Name Off A Mortgage After Divorce

There are many decisions to be made when going through a divorce and one that should not be ignored or put off on the checklist is the decision of what to do with the house? Do you want to know how to get your name off a mortgage?

If youre wondering how to remove a spouse from a mortgage after a divorce then read on to see why this is so critical and how the process works.

Ask A Lawyer: Can I Get My Name Off Of The Mortgage

Question:

The house the children are living is still in my name. My spouse has remarried. How do I get my name off the mortgage? There was nothing in the divorce stating either of us got the house.

Answer:

As you advise that your name is on the mortgage for the house, it would follow that your name is also on the title to the house. As the divorce did not address the house, presumably you have not voluntarily signed over the house to your ex-wife and remain an owner of the house.

Unless you were divorced under circumstances where the divorce court did not have jurisdiction to address the house, such as one party did not participate in the divorce or the divorce was entered in a state different than the state in which the house is located, the divorce judgment should have addressed the house in some manner, either as marital property to be divided/awarded or as non-marital property of one of the parties. You should be able to re-open the divorce judgment to address the ownership or transfer of the house and assumption of the mortgage, or to require the sale of the house. You may wish to contact your attorney in the divorce to find out why the house was not addressed in the judgment or retain other qualified family law counsel to review your court documents to ascertain the next steps as to correcting the divorce judgment.

Also Check: Can You Do A Reverse Mortgage On A Mobile Home

Evaluate What Problems Are Impacting The Credit Score

Are there a lot of late pays on loans or credit cards? Are above 50% of the available credit limit? Does the person have recent run-ins with collections? Are there accounts that should be reported in good standing that show a late payment or went into collections for non-payment? If yes, these need to be rectified in order to improve the score.

The Solution: Release Or Refinance

When an ex-spouse is removed from the title to the property, he or she will usually also want to be removed from the loan. This protects the ex-spouse from responsibility if the former spouse does not make payments on time or if the mortgage is foreclosed. There are two ways to remove an ex-spouse from a loan: Release and refinance.

- A lender may release the ex-spouse from the loan. If presented with a divorce decree and a quitclaim deed, many lenders will remove the ex-spouse and leave the loan in the name of one spouse only. This is true even for loans underwritten by the Veterans Administration or other governmental organizations.

- Refinancing creates a fresh loan in the name of only one spouse. The prior loan is paid off as part of the refinancing. After the refinancing, the ex-spouse that is no longer listed on the property and is not responsible for past due mortgage payments, liens, or other property-related debt.

Issues sometimes arise when the release or refinancing is not done during the divorce. An uncooperative ex-spouse may try to require additional payment before cooperating in the transfer and/or release of the loan. Often, these unreasonable demands violate the divorce decree could create legal liability for the uncooperative spouse. In this scenario, the spouse seeking cooperation may seek to have the uncooperative spouse declared to be in contempt of court for ignoring the court order.

Read Also: Rocket Mortgage Launchpad

Furnish Proof Of Your Individual Income Demonstrate Your Sole Repayment Capacity

Prove your ability to repay the entire loan without the co-borrowers financial contribution. To convince your lender, you may have to show sufficient income by submitting your salary slips and providing copies of your bank statements. If you want to get another co-borrower on board, you may have to nominate a guarantor for the interim until you decide on a suitable candidate.

Why Would You Remove A Name From A Mortgage

Removing a name from a mortgage can be beneficial for a number of reasons. For instance, if you and your ex-spouse split up and only one person wants to keep the family home, you may have to remove the other persons name in a legal manner before moving forward. Another reason is because maybe you have refinanced your home often and dont want to go through that again. Lastly, another common scenario is that a co-signer may want to remove their name from a mortgage so they are no longer legally and financially responsible for the mortgage payments.

Recommended Reading: Bofa Home Loan Navigator

Take Spouse Off House Title In Order To Refinance

One of the most common ways of how to remove name from house title is to refinance. In fact, there are many lenders who offer this as the only option to remove name from property title Ontario. Refinancing your mortgage simply means trading your old mortgage for a new one which in most cases comes with a new balance. To qualify, you must show the lender that you have a proper income , you are in good credit standing , and your debt-to-income ratio is lower than 45%. However, these guidelines typically vary from lender to lender, so you might want to research the options available for you.

Unfortunately, many people may not be able to qualify for the mortgage on their own, which makes refinancing a difficult option of taking an ex off the mortgage after a separation. A good way of working around this is to submit to the lender details on any alimony or child support that youll be receiving after the separation. This may help increase your income and qualify for the refinance and way out on how to buy out your partner in a mortgage Canada.

What Kind Of Mortgage Are You Looking For

We’ll find the best rates for you

There are various reasons that lead people to apply for a joint mortgage. For example, most married couples prefer to apply for a joint mortgage for their new family home. Joint mortgages are easy to qualify when both parties meet all the necessary requirements needed to apply for a mortgage. However, sometimes things change and in the case of a marriage, a couple may decide to have a divorce which means one of the borrowers has to leave the house.

In such cases, most people ask whether its possible to remove a name from a mortgage without refinancing. One thing to note is that it is not easy to get your cosigners name off the mortgage loan but possible. Mortgage lenders in Montreal are ready to help in such situations and they help borrowers come to an agreement on how to go about with the transition smoothly. Just because one of the cosigners wants out does not mean that you automatically have to opt for refinancing. Both the primary borrower and the cosigners continue to be responsible for the loan until things get settled out.

Why removing a name may not be as easy as you think

How to get a name removed

The bottom line

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

What Is A Mortgage Payoff Letter

What Is A Payoff Statement? A payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your mortgage loan. The payoff statement is a vital document due to the interest on your loan balance, which is added daily.

Contact The Mortgage Lender

Call the lender who currently holds the mortgage and inquire about a refinance in the original applicant’s name only. The lender can re-evaluate the applicant’s income and credit score and review their payment history. If the applicant would now qualify for the mortgage on their own, the lender will provide a prequalification letter.

You May Like: Rocket Mortgage Vs Bank

Can I Buy My Ex Out Of The House

If you still share a mortgage, or if you own the property outright but you’re planning to mortgage one half to buy your ex out, you should speak to your lender as soon as possible. … To remove your ex-partner from the original mortgage agreement and the Title Deeds, you’ll need to complete a Transfer of Equity.

Use A Streamline Refinance To Reduce Time And Cost

If you have an FHA or VA home loan, you may be able to use a Streamline Refinance to remove your partners name form the mortgage.

Streamline Refinancing typicallydoesnt require income or credit approval, and you dont need a new home appraisal.These loans often close faster and cost a bit less than a traditional refinance.

However, if you want to remove aborrower from the mortgage using a Streamline Refi, credit re-approval might berequired. It depends on your situation.

- The FHAStreamline may allow you to remove a name without credit and incomeverification if the remaining borrower can prove theyve made the past 6 monthsmortgage payments or more on their own. If they cant prove theyve been makingpayments on their own or that they assumed the loan at least 6 months ago theyll have to re-qualify for the new mortgage

- The VA Streamline Refinance may allow you to remove a name without credit re-verification. Butthe person remaining on the loan must be the VA-eligible veteran not a non-VA-eligiblespouse

USDA loans also have a StreamlineRefinance option. However, if you use the USDA Streamline Refi to remove a namefrom the loan, the remaining borrower will need to re-qualify for the loanbased on credit and income.

Read Also: Chase Recast Calculator