A Note On Discount Points

Heres an insider tip when comparing mortgage rates: lenders often advertise rates based on the assumption youre going to buy discount points.

Those discount points are an extra sum you can choose to pay at closing to shave a little off your mortgage rate.

Often, you pay 1% of the loan amount to reduce your interest rate by about 0.25%. So, on a $200,000 loan, you might pay $2,000 to reduce your 3% rate offer to 2.75%.

Theres nothing wrong with these points , and theyre often a good idea. But comparing an advertised rate that assumes youll buy discount points with ones that dont make the same assumption is like comparing apples with oranges. You wont get a fair answer.

Is 375% A Good Rate For Near Perfect Credit

I got a 3.75% quote from Citibank with no points. They gave me a copy of my credit check and I have a Equifax Beacon 5.0 score of 814 out of 818. No debt and have over 20% down saved up. Seems like a good rate but I’m wondering if anyone has seen lower for a 30 year fixed? First time home buyer new to all this. I was hoping for below 3.5%.

What Is A Good Loan Term

When picking a mortgage, remember to consider the loan term, or payment schedule. The loan terms most commonly offered are 15 years and 30 years, although you can also find 10-, 20- and 40-year mortgages. Mortgages are further divided into fixed-rate and adjustable-rate mortgages. The interest rates in a fixed-rate mortgage are stable for the duration of the loan. For adjustable-rate mortgages, interest rates are set for a certain number of years , then the rate adjusts annually based on the market interest rate.

When choosing between a fixed-rate and adjustable-rate mortgage, you should consider the length of time you plan to stay in your house. Fixed-rate mortgages might be a better fit if you plan on staying in a home for quite some time. Fixed-rate mortgages offer greater stability over time in comparison to adjustable-rate mortgages, but adjustable-rate mortgages may offer lower interest rates upfront. However you could get a better deal with an adjustable-rate mortgage if you only plan to keep your house for a couple years. The best loan term is entirely dependent on your personal situation and goals, so make sure to take into consideration what’s important to you when choosing a mortgage.

Find the Best Refinance Rates with the CNET Rate Alert

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

Consider A Shorter Loan Term

When you take out a 15-year fixed-rate mortgage instead of a 30-year fixed-rate mortgage, the interest rate will normally be lower. In mid-September 2020, for example, the 30-year rate was 2.87%, and the 15-year rate was 2.35%.

You also could consider an adjustable-rate mortgage. Its introductory rate may be lower than what you could get on a fixed-rate mortgage. It depends on the market, though: In mid-September, a 5/1 ARM had an interest rate of 2.96%.

Even if you can get a lower rate on an ARM, youre taking a risk. It might be cheaper in the short term, but it could be more expensive in the long term. Why?

- No one knows what interest rates will look like when the ARMs introductory period ends.

- Theres no guarantee youll be able to refinance or sell when the ARMs introductory period ends.

Check Your Credit Scores And Reports

Any effort to secure the best interest rate for your mortgage should begin with checking your credit scores and reports with Equifax, Experian and TransUnion, the three major credit bureaus. Heres an example of how to do this and what to look for.

At Experian.com, you can sign up for a free account that will provide your FICO Score 8 and broad insights on what aspects of your credit need improvement.

For $4.95, you can access your FICO Score 2, which Experian says is the credit score most mortgage lenders use.

Experian also offers a tool called Experian Boost that can improve your credit score slightly by including your utility and mobile phone bill payment history.

Review your credit reports and check for inaccuracies on any item thats dragging down your score. You can open a dispute online, by phone or by mail if you see any problems.

AnnualCreditReport.com lets you get free copies of your reports from all three credit bureaus. You can get a free report as often as once a week through April 2021.

Learn more about how your credit score affects your mortgage rate and whether it makes sense to pay for a special version of your credit score.

You May Like: Rocket Mortgage Loan Requirements

When You Apply For A Mortgage Theres One Factor That Could Save You Tens Of Thousands Of Dollars If You Play It Right: Your Interest Rate

Your interest rate impacts how much youll pay your lender over time. Fortunately, you may be able to influence the interest rate you get by taking steps to build your credit, saving for a big down payment and researching your options.

Mortgage experts predict that interest rates will jump by a half percentage point this year, which may seem trivial. But take a closer look: A 30-year, $250,000 mortgage with a 4.25 percent fixed interest rate will cost about $21,400 less over the life of the loan than the same mortgage with a 4.75 percent rate.

Whether youre planning on refinancing your current abode or purchasing a new home, heres what you can do to better your chances of scoring a great mortgage rate:

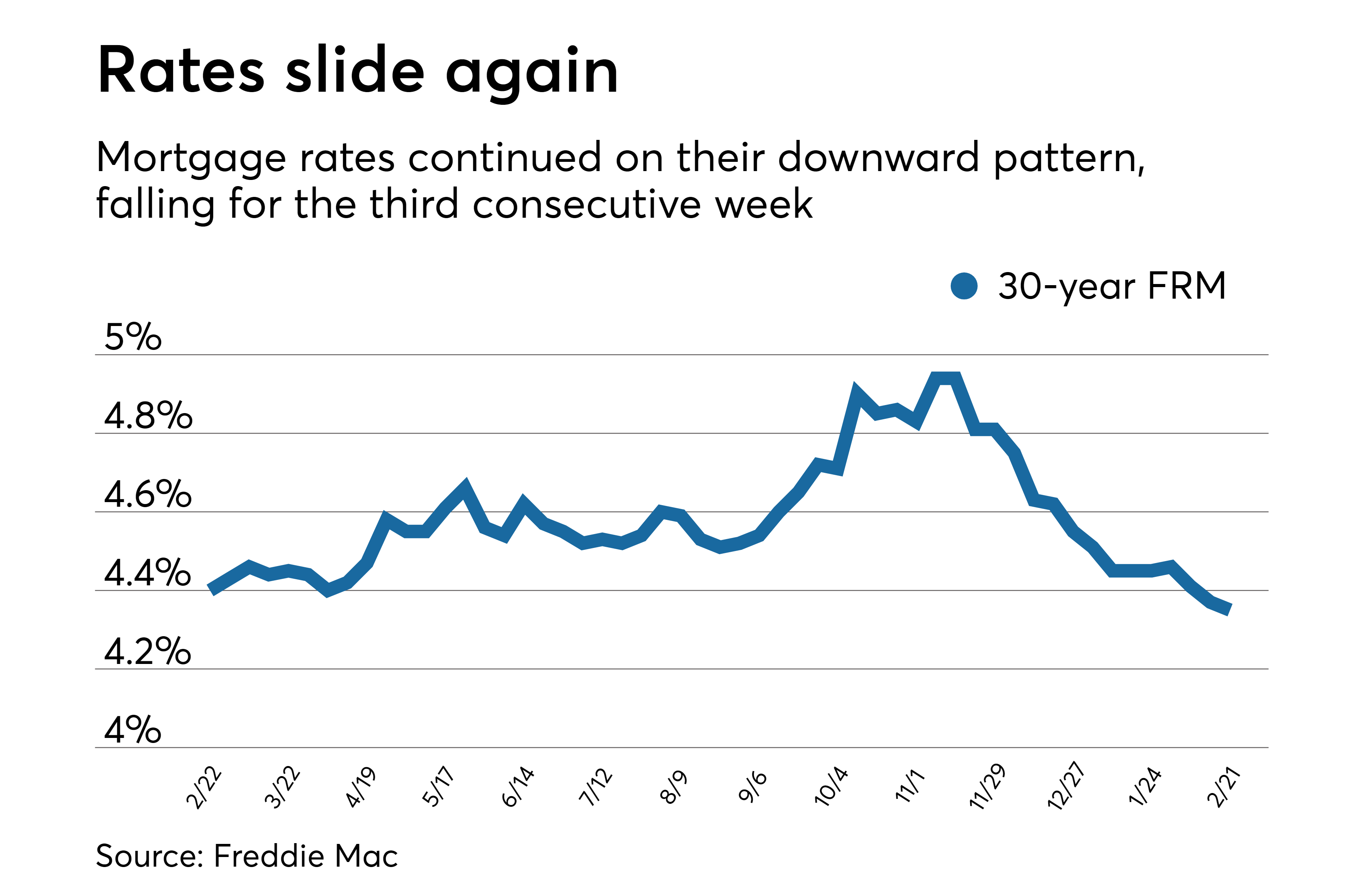

Heres What To Expect With Mortgage Rates And The Housing Market This January 2022

Many experts predicted mortgage rates would reach this level in 2022. However, most experts did not predict it to happen this quickly.

Realtor.com chief economist Daniele Hale and Fairweather both recently told us they predicted mortgage rates would reach 3.6% by the end of 2022, not in the first month of the year.

Mortgage Bankers Associations economist Joel Kan forecasted the average 30-year fixed mortgage rate to hit 4% by the end of 2022, citing economic growth as one of the biggest reasons behind his prediction. If rates continue to increase like they have been lately, his prediction will come true much earlier than anticipated, as well.

New COVID variants and surges in cases havent had as much of a negative impact on the economy as the initial wave, so even while the pandemic continues, rates will likely continue increasing, said Mohtashami.

On a possible plus side for homebuyers, rising rates could cool down the housing market somewhat. If you have to wait until later in the year when mortgage rates are higher, I think youll have the benefit of a lot more selection, Fairweather says. At the end of the day, buying a home should be a long-term decision. You cant really lose as long as youre staying in the house for a long time, she says: In the long run home values will go up.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Save Up For A Bigger Down Payment

When you make a small down payment on a home, the lender considers you a higher-risk borrower than someone who makes a larger down payment.

One place where youll see lenders account for this risk is with private mortgage insurance . If you put down less than 20% on a conventional loan, youll usually have to pay PMI premiums. Until you have enough equity to cancel it, PMI will affect you the same way a higher interest rate would: by increasing your monthly payment and your total borrowing costs.

Saving up for a bigger down payment can help you avoid PMI altogether. Even if you cant put 20% down, you can pay less for PMI with a larger down payment. On top of that, a larger down payment can actually get you a lower interest rate.

The more of your own money youre willing to invest in the property, the less risky youll be for the lender, and they may be able to offer you a lower interest rate.

Having trouble saving up? Check Down Payment Resource to see if youre eligible for any down payment assistance programs in your area.

What if youre refinancing? This strategy still works. You can bring cash to closing to increase your equity.

Heres What This Means For Existing Homeowners:

Rising mortgage rates might make it seem like refinancing is no longer a good option, but thats not necessarily true. Mortgage rates at current levels are still considered favorable compared to the 4%+ rage they were prepandemic. A good rule of thumb is if you can score a new mortgage rate that is close to 0.75% lower than your current rate, it could be a good move to refinance.

Homeowners who are on the fence about refinancing may want to consider it. Mortgage rates are expected to continue their upward trajectory in the long term, so it may be worth crunching the numbers with a few lenders to see if you can benefit.

A rate and term refinance could go a long way in reducing not only your monthly payments but also the amount of interest paid over the life of the loan. With home values across the country having increased over the past year, you could also take advantage of the increased equity in your home by doing a cash-out refinance, home equity loan, or HELOC. These can be a useful tool to help pay off high-interest debt, pay for college expenses, or fund a home improvement project.

Also Check: Rocket Mortgage Qualifications

Shop At A Mix Of Financial Institutions

Your finances are in order, and you know what type of loan you want. Now its time to shop around for a mortgage.

This is likely going to be the biggest purchase of your life its not a bad idea to go to two or three financial institutions, Morse says. Rates can fluctuate daily and even from hour to hour, he adds, so take that into account while shopping. You might want to shop on different days to get a mix of options.

Start with your bank or credit union, as they may offer you a better rate simply for having an existing banking relationship with them. Make sure youre also checking other credit unions, national banks, and local or regional banks.

From one lender to the next, you may see different promotional rates, fees, interest rates and offers for discount points. For example, Morse says his credit union doesnt charge an application fee, which saves about $500. Fortunately, lenders must provide you with a standard Loan Estimate, which makes it easier for you to compare loans.

Heads up: Shopping for a mortgage will add a hard inquiry to your credit reports, which may temporarily lower your scores. Try to limit your shopping to a 45-day window, as multiple credit inquiries from mortgage lenders within this time frame may be treated as just one.

Figure Out What Loan Works Best For You

Mortgage loans typically come in two forms:

- Conventional loans are not insured or guaranteed by a government agency.

- Government-insured loans are backed by a government agency such as the Federal Housing Administration or Veterans Administration .

Generally, people with lower credit and smaller down payments can qualify for an FHA loan, but they tend to be more expensive than conventional loans. Your loan officer can help determine what type of loan you qualify for and whats best for your situation.

Rates also typically come in two types:

- Fixed-rate loans lock in your interest rate for the entire loan term, which often range from 10 to 30 years.

- Adjustable-rate loans typically have a fixed interest rate for five, seven or 10 years and then adjust annually after that .

Although you may qualify for a low adjustable rate theyre typically lower than fixed rates by about 1 percentage point it may increase over time.

The most popular type of adjustable-rate mortgage is the 5/1, where your rate is fixed for five years and then adjusts every year after that. But if you know youll be in the home more than five years, it may make more sense to get the fixed rate, which starts a bit higher than the ARM but wont increase.

Read Also: Bofa Home Loan Navigator

Whats That In Dollars

Say youre getting a 30year, fixedrate mortgage of $300,000 with 5% down.

Someone with the lowest of those APRs would pay around $128,000 in interest over the life of the loan.

But someone whose score is in the 620639 range would pay closer to $218,900 in total interest payments for the same home price. So over time, what might look like a relatively small rate difference can add up to huge savings.

Ebs New Business Variable Rates

A variable rate can go up and down. Have a look at EBS new home loan variable rates below.

For information on the EBS Variable Rate Policy Statement please click here

Owner Occupier mortgage customers may be able to move to a lower Loan to Value interest rate where the LTV changes sufficiently throughout the mortgage. There is more information on this option here

Cost per ‘000

Recommended Reading: Rocket Mortgage Loan Types

Pay Attention To Mortgage Insurance

If your down payment is less than 20% of the purchase price, youll typically have to pay private mortgage insurance . And those premiums can add significantly to your monthly payments.

The cost of mortgage insurance will be reflected in your APR but not in your interest rate. The same goes for the mortgage insurance premiums on an FHA loan.

So make sure you learn about the cost and benefits of mortgage insurance before you commit to a loan.

What Is The Difference Between Apr And Interest Rate

The mortgage APR is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

How To Know When To Refinance Your Mortgage

Here are some key points you should consider when deciding whether to refinance your mortgage:

- Your credit score. With most mortgage lenders, youll need a credit score of at least 620 to qualify for a mortgage refinance. To get the lowest mortgage rate, youll need a 740. Also keep in mind that, if your credit is lower than it was when you took out your current mortgage, you may not qualify for as favorable a rate as you did before.

- Yourdebt-to-income ratio . For conventional loans, some lenders will work with a DTI as high as 43%. FHA loans will go a little higher, usually accepting DTIs of 50%. Lower, however, is generally better.

- How long youre staying. When you refinance, youll need to pay closing costs. If you plan to move out in the near future, you may not break even.

- How much equity you have in your home. In order to qualify for a mortgage refinance you generally need at least 20% equity in your home.

Dont try to time the market. Waiting on rate swings is as troublesome as timing the stock market. Dont wait to see what happens with mortgage rates tomorrow if you can save money or move closer to your financial goals by refinancing today.

What Are The Disadvantages Of 30

The biggest disadvantage of a 30-year fixed rate mortgage is that it’s more expensive over time than a shorter term loan. Let’s compare it to a 15-year fixed rate mortgage as an example. The 30-year fixed mortgage is more expensive not only because the interest rate on a 30-year fixed loan is higher than a 15-year fixed loan, but also because you’ll pay more interest over time since you’re borrowing the money for twice as long. Additionally, spreading the principal payments over 30 years means you’ll build equity at a slower pace than with a shorter term loan.

Also Check: 10 Year Treasury Vs Mortgage Rates

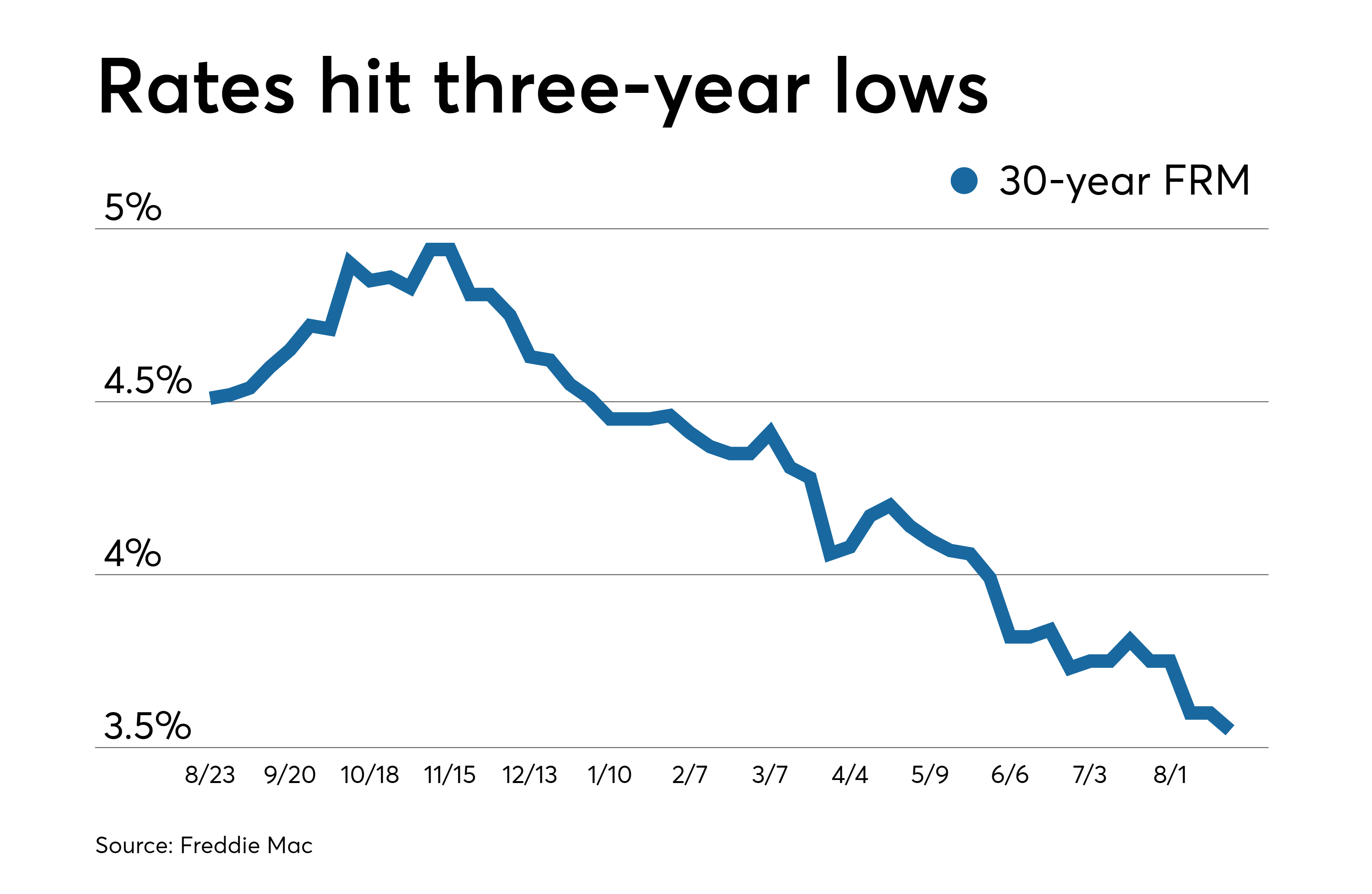

My New Expanded Mortgage Rate Chart

- I created a fresh mortgage rate chart that factors in the new record low rates

- And the possibility of them drifting even lower over coming months and years

- The chart is also more granular because rates are broken down by eighths as opposed to quarters

- Also available in 50k increments if your loan amount is closer to that

These charts can make it quick and easy to compare rate quotes from mortgage lenders, or to see the impact of a daily rate change in no time at all.

After all, mortgage rate updates can happen frequently, both daily and intraday. And rates are especially erratic at the moment.

So if you were quoted a rate of 3.5% on your 30-year fixed mortgage two weeks ago, but have now been told your home loan rate is closer to 4%, you can see what the difference in monthly payment might be, depending on your loan amount.

Today, that scenario might be the opposite. A quote of 3.5% a month ago might now be 3%, or even below 3%.

That has forced me to create a new expanded mortgage rate chart that contains 30-year fixed interest rates all the way down to 2%. Whether they get anywhere close to that remains to be seen, but never say never.

I just hope I dont have to make another chart

Anyway, this is all pretty important when purchasing real estate or seeking out a mortgage refinance, as a significant jump in monthly mortgage payment could mean the difference between a loan approval and a flat out denial.