Are Points Tax Deductible

Home mortgage points are tax-deductible in full in the year you pay them, or throughout the duration of your loan.

The IRS guidelines list the following requirements:

- Your main home secures your loan .

- Paying points is an established business practice in the area where the loan was made.

- The points paid weren’t more than the amount generally charged in that area.

- You use the cash method of accounting. This means you report income in the year you receive it and deduct expenses in the year you pay them.

- The points paid weren’t for items that are usually listed separately on the settlement sheet such as appraisal fees, inspection fees, title fees, attorney fees, and property taxes.

- The funds you provided at or before closing, including any points the seller paid, were at least as much as the points charged. You can’t have borrowed the funds from your lender or mortgage broker in order to pay the points.

- You use your loan to buy or build your main home.

- The points were computed as a percentage of the principal amount of the mortgage, and

- The amount shows clearly as points on your settlement statement.

Can You Negotiate Points On A Mortgage

You can decide whether or not to pay points on a mortgage based on whether this strategy makes sense for your specific situation. Once you get a quote from a lender, run the numbers to see if its worth paying points to lower the rate for the length of your loan.

Sometimes, origination points can also be negotiated. Homebuyers who put 20 percent down and have strong credit have the most negotiating power, says Boies.

A terrific credit score and excellent income will put you in the best position, Boies says, noting that lenders can reduce origination points to entice the most qualified borrowers.

Should You Use Points On Your Loan

One of the key factors in understanding if you should use points is to understand your overall goals inbuying ahome. For many, purchasing a loan means paying for a loan for a set amount of years and owning the homefreeand clear after that time. For others, it is just a stepping stone to a different home or perhaps evenfor aninvestment. If you are planning on living in your home for the long haul, then paying points at thebeginningof your loan term can be very important. In fact, it can save you a good amount over the life of yourloan.

On the other hand, if you plan to live in your home for less than four years, it may not make any senseto put extramoney into the interest of your home. The fact is that this is a payment towards the interest only onyourhome, not the principle and for that reason you should take serious consideration over putting yourmoney towardsthe interest through points.

Don’t Miss: Can You Pay More On Your Mortgage

About Mortgage Discount Points

Discount points are a common feature of mortgages, but they can be confusing for many borrowers. Just how do they work?

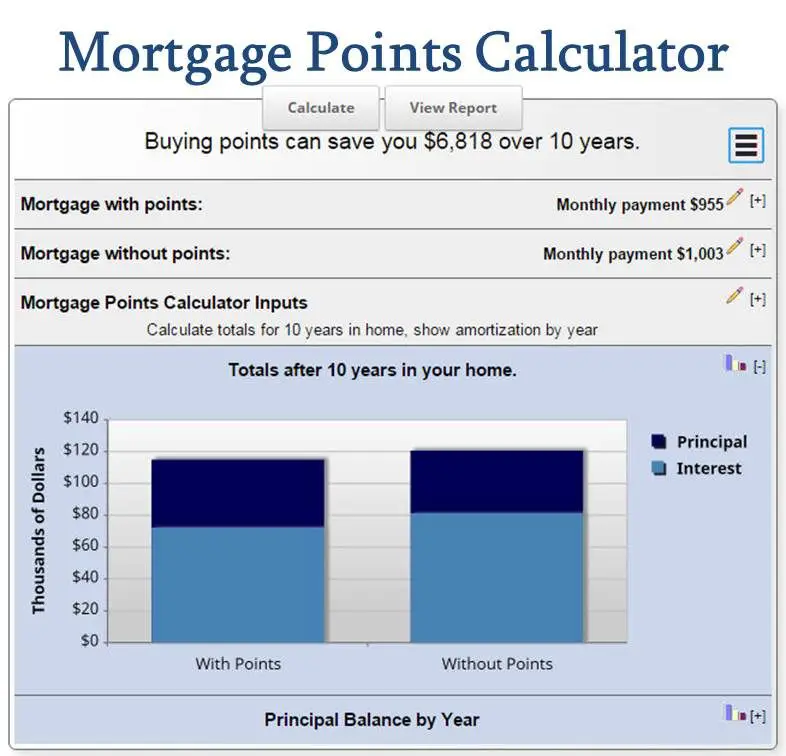

Discount points are a type of pre-paid interest. So by paying part of your interest up front, you can get a lower rate. And what you save in interest over the long haul can be a lot more than what you paid for the points up front. The question is, will you save enough to make it worth the initial cost?

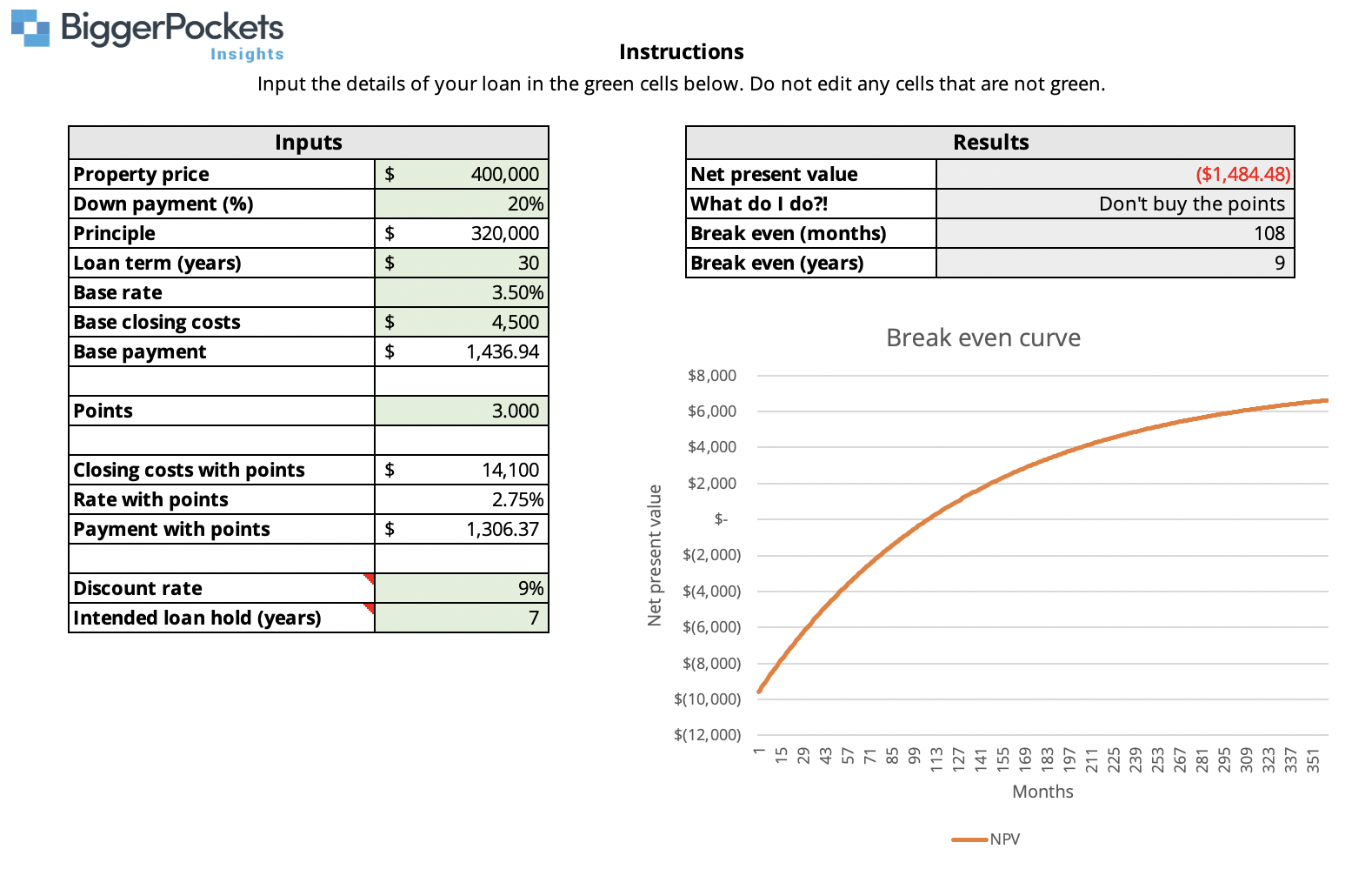

The key is to calculate the break-even point how long it will take for your interest savings from a lower mortgage rate to exceed what you paid for your discount points. If you can recoup your costs in five years or so, that’s often a good deal.

A big consideration is how long you expect to have the mortgage. If you sell the home or refinance the mortgage before reaching your break-even point, you’ll have lost money. Or if you do so only a year or two after reaching it, your savings might not be enough to make it worthwhile.

Discount points work best for someone who expects to stay in their home and not refinance for a long time. Over 20-30 years, the savings can be substantial in the tens of thousands of dollars. However, if it takes a long time to reach your break-even point, say 10-15 years, you have to ask yourself whether the small savings you’ll realize each month are worth the trouble, even if you expect to stay in the home longer than that.

Straight To The Point Valuations

There are two types of points you can pay on your mortgage loan:

- Discount points – a form of pre-paid interest which gives you a lower interest rate for the remainder of the loan

- Origination points – fees that are charged by a mortgage broker or lender for the origination of the loan

Determining whether you “should” pay points on your loan depends on what your financial goals are and how the points will affect the other terms of the loan, such as the interest rate or the other closing costs.

You May Like: How Do Commercial Mortgages Work

Should You Buy Mortgage Points

You should buy mortgage points if you have the resources to pay for them and plan to stay in your home long enough to recoup them. There are a few other situations where it may make sense to pay points for a mortgage:

The seller has agreed to pay your closing costs. Some loan programs allow a seller to pay a percentage of your sales price toward your closing costs, which is commonly called a seller concession. If youre able to negotiate this into your purchase agreement, it may be worth it to use the sellers money to buy a lower interest rate. The table below gives you a snapshot of the maximum percentage of your purchase price the seller is allowed to pay on your behalf:

| Loan program |

- You may be able to deduct the cost of mortgage points at tax time.

How Are Points Calculated On A Mortgage

Asked by: Audreanne Borer

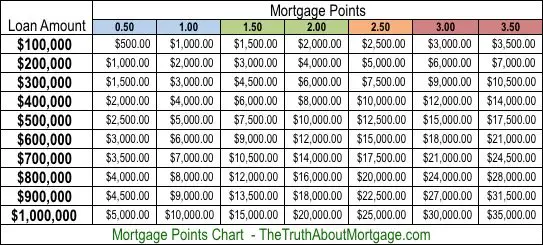

How do I calculate points on a loan? One mortgage point is equal to 1% of your loan amount. So, one point on a $200,000 loan would cost $2,000 upfront. One point will usually drop your interest rate by 0.25%, so you can compare the total costs of your loan by looking at interest and upfront costs.

You May Like: How Do You Buy Down A Mortgage Rate

The Bottom Line: Mortgage Points Can Save You Money

Though mortgage points and prepaid interest are right for some borrowers, they dont make financial sense for everyone. To determine whether you can save with discount points, you have to crunch the numbers.

Sit down and assess your budget, down payment, loan terms and future plans before you close. Determine your breakeven point and your likelihood of staying in the home to understand if discount points will save you money in the long run when refinancing or buying a home.

If youre ready to buy a new home or need to refinance your existing home loan, dont wait. Apply online with Rocket Mortgage®.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

When To Pay Points

Origination points typically arent charged on most loans and typically company specific. For example, traditional banks that happen to do mortgages often charge origination points on every loan. This is how they make additional money. In contrast, most mortgage bankers dont charge origination points.

Discount points are more specific to the loan and can be charged for a variety of reasons. The most common instances where discount points are charged are when escrow are waived, when credit scores are low, or when someone wants to buy down the interest rate.

Don’t Miss: Can You Refinance A Second Home Mortgage

Can Points Be Rolled Into Mortgage

Points can be added to a mortgage loan when you refinance. … One is discount points, which reduce the interest rate of your loan. The second type is origination points, which increase income for your lender and offset their expenses of making your mortgage loan. One point equals 1 percent of your mortgage loan amount.

What Is The Breakeven Point

To calculate the breakeven point at which this borrower will recover what was spent on prepaid interest, divide the cost of the mortgage points by the amount the reduced rate saves each month:

$4,000 / $56 = 71 months

This shows that the borrower would have to stay in the home 71 months, or almost six years, to recover the cost of the discount points.

The added cost of mortgage points to lower your interest rate makes sense if you plan to keep the home for a long period of time, says Jackie Boies, a senior director of Partner Relations for Money Management International, a nonprofit debt counseling organization based in Sugar Land, Texas. If not, the likelihood of recouping this cost is slim.

You can use Bankrates mortgage points calculator and amortization calculator to figure out whether buying mortgage points will save you money.

Also Check: What Are Essential For Completing An Initial Mortgage Loan Application

What Are Negative Mortgage Points

Just as paying points reduces your interest rate, increasing your interest rate will decrease the number of points.

Mortgage points can go negative. For example:

- 5% + 0 point

- 5.25% + -1%

Lenders often use the negative points to buy down the closing costs.

Based on the previous example, if the loan amount is $100,000 x 1% = $1,000. The lender uses that $1,000 toward the borrower’s closing costs.

Keep in mind that the interest rate was increased to obtain the lender subsidy.

Current Local Mortgage Rates

Compare your potential loan rates for loans with various points options.

The following table shows current local 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down

You May Like: What Is A Future Advance Mortgage

What Are Basis Points In Mortgage

A basis point in mortgage is a change equivalent to 0.01%. For example, if your mortgage was at 3.62%, and decreases by 15 basis points, it is now at 3.47%. An increase of a single basis point can be worth quite a lot. For example, your $500000 mortgage at 4.5% requires a monthly repayment of $2.406.76. An increase of 1 bps means you must now pay an additional $2.82 a month, which totals an additional $1016 in payment.

Rebates Can Be Good For Refinancing Too

Using rebates, a loans complete closing costs can be waived, allowing the homeowner to refinance without increasing their mortgage amount.

When mortgage rates are falling, zero-closing cost mortgages are an excellent way to lower your rate without paying fees over and over again.

You could potentially refinance three times in a year or more and never pay fees to the bank.

You May Like: Can You Sell A House With A Mortgage On It

You May Save On Taxes

Since mortgage interest is tax-deductible and points are considered prepaid mortgage interest, you may be able to deduct the cost of the points on your taxes. To understand the deductions you may be eligible for, check out the IRS rules on mortgage point benefits and speak with a qualified tax expert

Comparing Monthly Mortgage Principal & Interest Payments With Discount Points

A home-buyer can pay an upfront fee on their loan to obtain a lower rate. The following chart compares the point costs and monthly payments for a loan without points with loans using points on a $200,000 mortgage.

| Points | |

|---|---|

| $9,072.22 | $17,997.21 |

Some lenders advertise low rates without emphasizing the low rate comes with the associated fee of paying for multiple points.

A good rule of thumb when shopping for a mortgage is to compare like with like. Shop based on

- annual percentage rate of the loan, or

- a set number of points

Then compare what other lenders offer at that level.

For example you can compare the best rate offered by each lender at 1 point.

Find the most competitive offer at that rate or point level & then see what other lenders offer at the same rate or point level.

Don’t Miss: When Does A Reverse Mortgage Make Sense

Are There Any Tax Benefits Associated With Paying Mortgage Points

Mortgage points can generally be deducted as interest on your federal taxes, providing you meet certain criteria. In order to take the deduction, you must itemize your deductions on Schedule A of your tax return, and the points must have been paid in order to acquire the mortgage. Additionally, the mortgage must be used to purchase or improve your primary residence.

If you meet all of these criteria, you can deduct the full amount of mortgage points paid in the year they were paid. For example, if you paid $6,000 in points on a $600,000 loan in 2020, you could deduct the entire amount on your 2020 tax return. Paying mortgage points can provide valuable tax savings if you understand how the deduction works and if you meet all of the eligibility requirements.

How Mortgage Points Affect Apr

Banks will sometimes use a mortgage shopping tool known as APR to make a loan with discount points look more attractive than it really is.

APR, which stands for Annual Percentage Rate, is a calculation that shows the long-term cost of holding a mortgage.

But APR also assumes youll hold your loan for 30 years and pay off the total loan amount on schedule. Very often, you will not, which nullifies the APR math.

This is why its important to remember that your APR is not your mortgage rate.

Comparing loan estimates using the lowest APR method is rarely a good plan. It uses discount points against you.If youre not clear how much youll pay to borrow, ask your loan officer to walk you through your Loan Estimate or a truth-in-lending disclaimer.

Read Also: Can I Get A Mortgage With No Credit

Why Use Basis Points Versus Percentages

The advantage of using basis points over percentages has to do with the fact that its a distinct figure that remains constant as compared to a ratio. If I said that the price of a candy bar had increased 25%, that doesnt tell you everything you need to know. 25% relative to what? Is that a dollar or $10?

Basis points give you a form of absolute. No matter how much money is invested or the size of the loan, you can say the price or yield has gone up by 50 basis points and investors will know what that means.

How Do Mortgage Points Save You Money

To evaluate if mortgage points are smart for your home purchase, youll need an idea of how long youll stay in the home. In order for points to be worth their price, youll have to reach the breakeven point or the point at which you save more than you spent.

In the previous example, a point would cost about $3,000. At a savings of $33 per month, it would take around 91 months to break even on that $3,000. If you think youll move before that point, then its probably not a smart move to buy the points.

Find Out: How to Buy a House: Step-by-Step Guide

Also Check: What’s The Payment On A $250 000 Mortgage

What Are Todays Mortgage Rates

Todays mortgage rates are at historic lows. Mortgage points allow borrowers to buy down their interest rate even further, which can generate huge savings.

However, mortgage points arent always worth it. And if you opt not to pay for them, youre still likely to get a great deal in todays ultra-low rate environment.

How Are Mortgage Points Calculated

Did you know that mortgage points can lower your interest rate? It’s true!Here’s how mortgage points work: Lenders need to earn a certain amount of interest on a loan. Your lender could offer you a 5% interest rate on the loan amount of $100,000 for 30-years â which means you’d pay $93,256 in interest over the life of the loan. Ouch!

But if you’re willing to prepay some of the interest at the settlement, your lender can offer you a lower interest rate.

You May Like: How To Figure Out What Mortgage You Qualify For

How Many Mortgage Points Can You Buy

Theres no one set limit on how many mortgage points you can buy. However, youll rarely find a lender who will let you buy more than around 4 mortgage points.

The reason for this is that there are both federal and state limits regarding how much anyone can pay in closing cost on a mortgage. Because limits can change from state to state, the number of points you can buy may vary slightly.

According to a survey of lenders conducted weekly by Freddie Mac, for about the last 5 years, the average number of points reported on a 30-year fixed conventional loan was between 0.5 0.6 points.

Its important to note you dont have to pay for a full point to get a lower rate. Points are sold in increments all the way down to 0.125%.

What Are Mortgage Points And How Much Do They Cost

A mortgage point sometimes called a discount point is a fee you pay to lower your interest rate on your home purchase or refinance.

One discount point costs 1% of your home loan amount. For example, if you take out a mortgage for $100,000, one point will cost you $1,000. Purchasing a point means youre prepaying the interest to have a smaller monthly payment.

Points are paid at closing, so your lender will calculate the cost of any points you agree to purchase and add those charges to your other closing costs.

For each discount point you buy, your interest rate will be reduced by a set percentage point. The per-point discount youll receive varies by lender, but you can generally expect to get a .25% interest rate reduction for each point you buy. Most mortgage lenders cap the number of points you can buy. Generally, points can be purchased in increments down to eighths of a percent, or 0.125%.

For example, lets say you take out a $200,000 30-year fixed-rate mortgage at 5.125%. Your lender offers you an interest rate of 4.75% if you purchase 1.75 mortgage points. On a $200,000 loan, each point costs $2,000, which means that 1.75 points will cost $3,500.

If you choose not to buy mortgage points, your interest rate will remain at 5.125%. Over 30 years, without paying down the loan early, the cost of the loan, with interest, is $391,809.

Read Also: What Does Private Mortgage Insurance Cover