Apply For The Mortgage Loan

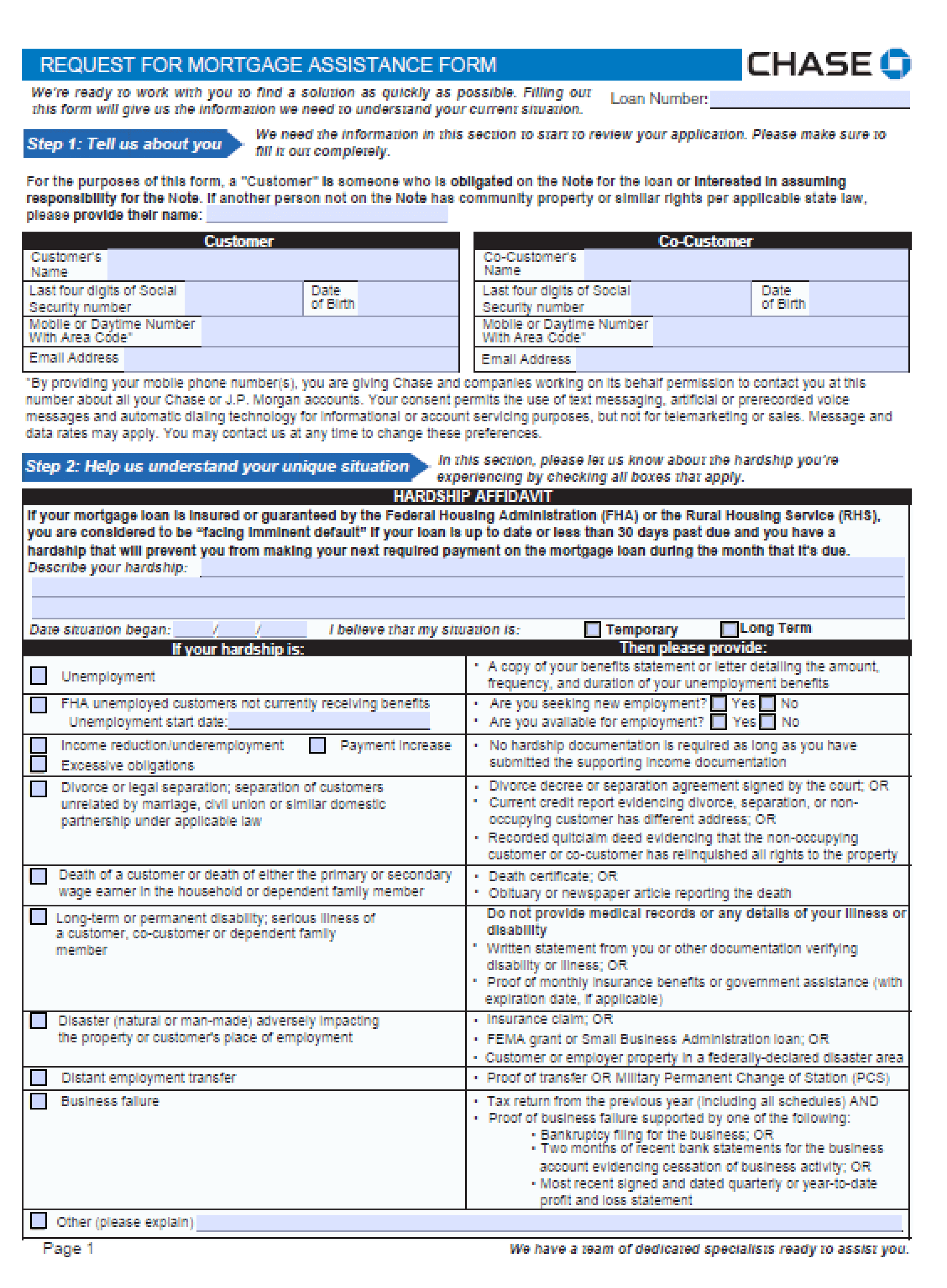

Once youve weighed your loan/lender options, apply for a loan with your first choice. As you can guess, it mainly involves providing a lot of paperwork that demonstrates your ability to pay the mortgage. The basics include pay stubs, your federal tax return, and recent bank statements.

For a comprehensive checklist of the documents your lender might need, see our mortgage application checklist.

Find The Perfect Loan For Your Unique Needs

Every home buyers financial situation is different, so your mortgage should be tailored to fit. But with so many types of mortgages, how do you know which one is best for you?

Conventional mortgages are popular options for those with good credit. They generally have fewer restrictions than government-backed loans, but theyre not the only option. Federal Housing Administration loans offer lower credit and down payment requirements for qualified home buyers. If youre a Service member, Veteran or eligible surviving spouse, a Veterans Affairs loan could be good option for you.

There are plenty of other options, including Adjustable Rate Mortgages and Jumbo loans. Compare mortgage options to learn more on your own, or contact a mortgage loan officer to help you determine the best loan to meet your specific needs.

Gathering Your Loan Documents

Before you submit a mortgage loan application, you will need to gather certain documents for the lender’s review. The lender should give you a specific list of items they require. These documents will probably include the following:

- Purchase agreement for the property you wish to buy.

- Tax returns for the last couple of years.

- W-2 statements for the last couple years.

- Pay stubs showing year-to-date information for the last several pay periods.

- Your checking account statements for the last three months.

- Savings account statements for the last 2 to 3 months.

- Any statements relating to other assets, such as a 401 plan.

- A complete list of debts you currently owe.

Your lender may request additional items that are not discussed above. But there’s a 99% chance you will need at least all of the items on this list. If you can start rounding them up now, you’ll have an easier time down the road when you’re ready to submit your mortgage loan application.

You should also ask what portion of your tax return paperwork the lender requires. They might only need the summary page. So before you start burning copies of multipage documents, find out exactly what they want.

Also Check: Rocket Mortgage Conventional Loan

Speak With A Mortgage Broker

To discover your eligibility for a home loan, the best place to start is to speak with a mortgage broker.

There are many benefits to using a mortgage broker:

- In most cases, the services of a broker are free.

- They have access to a wide range of major banks and lenders, and specialist lenders, which can be helpful if you do not quite fit into standard policies.

- You will get a fast and easy approval compared to going to the bank directly because the broker will handle the application process from start to finish.

- Mortgage brokers have strong negotiating power to get tough loans approved and to negotiate sharp interest rate discounts on your behalf.

and then call us on 1300 889 743 or fill in our to get started on the home loan application process today.

Why Do I Need A Home Inspection

A home inspection is an added expense that some first-time homebuyers dont expect and might feel safe declining, but professional inspectors often notice things most of us dont. This step is especially important if youre buying an existing home as opposed to a newly constructed home, which might come with a builders warranty. If the home needs big repairs you cant see, an inspection helps you negotiate with the current homeowner to have the issues fixed before closing or adjust the price accordingly so you have extra funds to address the repairs once you own the home.During the inspection, be sure to ask questions and bring a checklist of things you want information on. Note that a comprehensive inspection should not only bring defects and problem areas to your attention, it should also highlight the positive aspects of a home as well. When you receive the final report, prioritize the issues and decide whether you want to negotiate those items with the sellers. Remember: Every deal is different and negotiable.

You May Like: Rocket Mortgage Vs Bank

How Long Does A Loan Application Take

as some borrowers will have more complex applications than others.

Lenders who offer a lower interest rate are often slower as they receive more applications.

Other lenders are completely incompetent!

Well warn you if any of the lenders were recommending are known to have poor service levels.

To give you some idea, it usually takes a customer 48 hours to send their documents to us.

It will then take 24 hours for us to confirm our recommendation.

When the lender receives the loan, it can take anywhere from four hours to two weeks for them to complete conditional approval.

The valuation can take from two days to one week.

Formal approval can take from one day to one week.

The best way to find out is to call us to confirm the time required.

As a general rule, if youre buying a property allow a two-week cooling off period or finance clause to give us ample time to obtain an approval.

Wait For Your Formal Mortgage Offer

If a lender is happy with your application, it will make you a formal mortgage offer. Mortgage offers are usually valid for six months, whereas remortgage offers are typically only valid for three months .

Generally, you should expect to receive your mortgage offer within four weeks of applying.

The process could take longer if there’s an issue with the valuation, the lender’s processing centre is busier than usual, additional information or documents are needed, or if your application is particularly complicated.

Once you have a formal mortgage offer, your conveyancer will arrange for the mortgage funds to be transferred from your mortgage lender to the person you are buying the property from on the day of completion.

- Find out more: mortgage lender reviews

Don’t Miss: How Does The 10 Year Treasury Affect Mortgage Rates

How Long From Clear To Close Is Closing

Once your loan is approved and cleared to close, the mortgage team will have 3 days to finalize all of your closing documents so youre ready to complete the transaction. So, barring any unforeseen complications, youll be sitting at the closing table and signing the property deed on your new home a mere 72 hours from the time you receive your CD.

Underwriting Your Mortgage Application

Once we have your initial approvals, our underwriters will examine your application. Loan criteria varies based on the loan type and whether you are buying or refinancing a house. These will determine credit, debt, income, asset, and loan-to-value requirements. We will also calculate a debt-to-income ratio based on your monthly expenses and income. We use DTI to help us estimate your ability to make your mortgage payments in addition to your other monthly expenses.

When you are buying a house, we will most likely send an appraiser to estimate the home’s value and ensure the sale price is consistent with the market value of other homes in the neighborhood. For a refinance, an appraisal will be dependent on the requirements of the loan type.

During our review, we may request additional documents from you. It’s important that you respond to these requests quickly so we can keep your loan moving and close as early as possible. Learn more about mortgage underwriting.

You May Like: Chase Mortgage Recast

If Youre Applying For A Mortgage Its A Good Idea To Start Prepping Your Financial Documents

Lenders will request paperwork for your mortgage application that proves things like how much money you make and your debts. The exact forms you need for a home loan depend on your situation. For example, someone who is self-employed will likely have to provide different forms than someone who is employed by a company.

Although the exact forms might vary, Todd Huettner, owner of Huettner Capital, a residential and commercial real estate lender, says a lender can get a good sense of your approval odds by checking out your recent pay stubs, bank statements, W-2 forms and tax returns.

Huettner says that with these documents, hes able to make a good assessment of the borrower. These documents allow me to tell what they can and cannot do with a very high level of certainty, he says.

Depending on your unique financial situation, here are seven mortgage documents you might need when applying for a home loan.

Submit For Clear To Close

Your Processor will submit the file back underwriting for the final loan approval once all conditions have been procured. The Underwriter typically reviews conditions within 24 to 48 hours.

Assuming the submitted paperwork satisfies all the conditions the Underwriter will issue the Clear to Clear or CTC.

Please note: there is a small chance that more paperwork may be required from you if the submitted conditions raise additional questions.

Also Check: Rocket Mortgage Qualifications

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

The Lender Begins Final Loan Processing

With the purchase agreement in place, you now contact your lender so they can start processing the loan.

Your lender is required to give you aloan estimate within three business days of receiving your complete application for a mortgage. The application you submitted in step 2 isnt complete until it includes the property address. The LE is a standardized form that makes it easier to understand the terms of your loan.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

How Do I Know If I Will Get Approved For A Mortgage

Your credit score is determined based on your past payment history and borrowing behavior. When you apply for a mortgage, checking your credit score is one of the first things most lenders do. The higher your score, the more likely it is youll be approved for a mortgage and the better your interest rate will be.

Whats Important To Know About The Loan Estimate

- A Loan Estimate isnt an indication that your loan application has been approved or denied.

- You dont need to have a signed contract for the property that youre receiving a Loan Estimate for.

- Youre not obligated to pay an application fee other than a reasonable fee for the lender to run a credit report.

- If your interest rate or loan details change, you may receive a revised Loan Estimate.

- An interest rate on your Loan Estimate is not a guarantee. Some lenders may lock your rate as part of issuing a Loan Estimate but others may not.

- If you choose to move forward with the loan and lender, you must convey your intent to proceed.

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

Prepare Documents For Your Mortgage Application

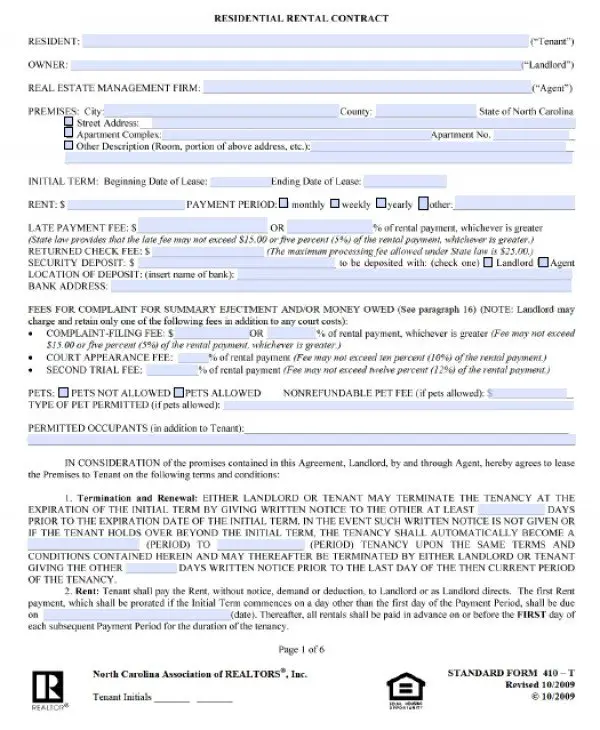

In order to apply for a mortgage, you’ll need to provide:

- Proof of ID

- Details of your employment

- Up to six months of bank statements

Only certain documents will be accepted, and you’ll usually need originals rather than scanned or printed versions .

For proof of identity, you’re required to show either your passport or photo driving licence.

Note that having an old address on your driving licence can lead to complications, and you may have to provide much more documentation to prove your address. To avoid this, try to make sure all documentation is up to date.

Proof of address

You’ll need two documents as proof of address. These can be a bank statement, utility bill, council tax bill or credit card statement. All of these documents must be dated within the last three months – older documents will not be accepted.

You should check that any documentation you provide has your name spelt correctly and consistently. Anything addressed to ‘Steven’ rather than ‘Stephen’, for instance, is unlikely to be accepted as evidence. The same applies if you changed your surname after getting married.

Bank and credit card statements

You’ll also need to provide details of your outgoings, with bank and credit card statements from the last three to six months, any car finance or hire purchase agreements, details of any loans, plus a list of other regular payments and expenditure like travel or childcare.

- Find out more:mortgages for self-employed buyers

Conditional Approval Or Pre

, also know as conditional approval or in-principle approval, is not a full approval.

At this stage, you have met most of the banks lending policies subject to a few conditions.

Typically, it means that you are yet to find a property which means your home loan is approved subject to a property valuation.

As long as the property meets the lenders guidelines, they are likely to approve your home loan application. You can read more about that are acceptable to lenders and others that can be difficult to get approved.

The good news is that a pre-approval lasts about 3 months, which is usually enough time to find a suitable property.

Usually, you can extend your pre-approval if needed by providing a new set of payslips.

We often receive enquiries from customers who sign the Contract of Sale and pay their deposit before getting pre-approved.

This can be risky! If you cant get formal approval, you risk losing your deposit.

Read Also: Rocket Mortgage Loan Requirements

Check Your Credit Score

Before you get a mortgage, check your credit scores to see where you stand. If your score isnt as high as you think it should be, remember that there are low-credit mortgages out there, such as FHA loans, that could be a fit for your situation.

There are several ways you can boost your credit score if needed, such as paying down your credit cards, bringing any past-due accounts current and reviewing your credit reports for errors. If you spot a discrepancy, now is the time to contact the credit bureaus to correct it.

What You Need To Apply For A Mortgage

Your lender will ask you numerous questions on the mortgage application, so youll need to know things like contact information, specific dates, numbers and more. Here are the main documents and information youll need to answer them:

- Employment information

- Income information

- Additional income information from the past two years

- Bank statements from the past three months or other retirement accounts)

- Form 4506-T or 4506T-EZ from your loan officer authorizing the lender to access your tax returns

- Signed purchase contract

If youre self-employed, own a business or get paid through commissions, youll likely also need to provide additional information such as:

- Federal tax returns from the past two years, including business tax returns

- Business records from the past several years

Note your lender may request more documents during the underwriting process. This is common and expected sometimes, a lender just needs more information so that they can clearly understand your risk level and determine your ability to repay.

Recommended Reading: Does Getting Pre Approved Hurt Your Credit

How Long Does Clear To Close Take

Waiting on clear to close can be agonizing for a homebuyer, which is why we speed up this process as much as possible to get you to the closing table without delay. Our goal is to have you clear to close in as little as 10 days and the clock starts running as soon as we receive your loan application.

Clear To Close Timeline

How many days before closing do you receive mortgage approval? Clear to close timelines vary by lender and even underwriting team. There are also unique conditions that could extend the clear to close timeline, like irregularities in a loan application or spikes in mortgage team workloads. When lending activity is high in other words, when a lot of people are applying for mortgages and refis it may take underwriters more time to process loans.

Also Check: 10 Year Treasury Vs Mortgage Rates

Cfpb Answers Faq On The Tila

On August 26, 2014, the CFPB staff and Federal Reserve Board co-hosted a webinar and addressed questions about the final TILA-RESPA Integrated Disclosures Rule that will be effective for applications received by creditors or mortgage brokers on or after August 1, 2015. The webinar is the second in a planned series intended to address the new rule. In the initial webinar the CFPB staff provided a basic overview of the final rule and new disclosures that we have previously covered.

According to the CFPB staff, this webinar and the ones that will follow will be in the format of a spoken Q& A to answer questions that have been posed to the CFPB. Although the CFPB staff does not plan to issue written Q& A, the staff believes this approach will help facilitate clear guidance on the new rules in an accessible way. Industry members, however, would prefer written guidance. Note that the American Bankers Association has released a transcript of the CFPBs webinar that is available to ABA members.

During the remarks, the CFPB staff announced that the CFPB will soon release additional guidance material on its website, including a timing calendar to illustrate the various timing requirements under the new rule. In addition, the next webinar in the series is tentatively scheduled for October 1, 2014, and will cover Loan Estimate and Closing Disclosure content questions.

The Receipt of an Application

Assumptions

Record Retention