What Is Mortgage Pre

Pre-qualification is how lenders determine if you fit the basic financial criteria for a home loan.

To get pre-qualified, you tell a lender some basic information about your credit, debt, income, and assets, and it tells you how much you may be able to borrow. Tell is the key word here. The information used for pre-qualification is self-reported, which means the lender typically doesnt verify it or look at your credit report.

How Much Down Payment Should You Save

Before buying a house, be sure to give yourself enough time to save for a down payment. While the amount depends on your budget, the homes price, and the type of loan you have, most financial advisers recommend saving for a 20% down payment. This is a sizeable amount, which is more expensive if your homes value is higher.

In September 2020, the median sales price for new homes sold was $326,800 based on data from the U.S. Census Bureau. If this is the value of your home, you must save a down payment worth $65,360. Paying 20% down lowers risk for lenders. Its a sign that you can consistently save funds and reliably pay back your debts.

Down Payments Vary

Down payment requirements are different per type of loan. However, many conventional mortgage lenders require at least 5% down. For government-backed loans such as an FHA loan, a borrower with a credit score of 580 can make a down payment as low as 3.5% on their loan. Take note: A smaller down payment subjects you to a higher interest rate.

Nonetheless, its still worth making a larger down payment on your mortgage. Heres why paying 20% down is more beneficial for homebuyers.

How Much Can I Afford

How much you can afford to spend on a home in Canada is primarily determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow based on your current situation.

Read Also: Does It Make Sense To Pay Points On A Mortgage

Purchase A Cheaper Home

If you have low interest student loans which will take many years to extinguish it may make sense to start your housing journey with a cheaper home that is a bit smaller or a bit further from work in order to get started on the housing ladder.

Some people view renting as throwing money away, but even if you put 20% down on a home you are 5X leveraged into a single illiquid investment. Getting laid off during a recession can lead to forclosure.

Over the long run other financial assets typically dramatically outperform real estate. Buying a home for most people is more about investing in emotional stability instead of seeking financial returns.

Real Estate Price Appreciation

Real estate can see sharp moves in short periods of time, though generally tends to keep up with broader rates of inflation across the economy over long periods of time. In 2006 near the peak of the American housing bubble the New York Times published an article titled This Very, Very Old House about a house on the outskirts of Amsterdam which was built in 1625. They traced changes in property values in the subsequent nearly 400 years to determine it roughly tracked inflation.

Longterm Stock Market Returns

How Much Do I Need To Make For A $750000 House

![Home Loan Extra Repayment Calculator [Cut years from your mortgage!] Home Loan Extra Repayment Calculator [Cut years from your mortgage!]](https://www.mortgageinfoguide.com/wp-content/uploads/home-loan-extra-repayment-calculator-cut-years-from-your-mortgage.png)

A $750,000 house, with a 5% interest rate for 30 years and $35,000 down will require an annual income of $183,694.

We’re not including additional liabilities in estimating the income you need for a $750,000 home. Use our required income calculator above to personalize your unique financial situation.

Also Check: When To Get Prequalified For A Mortgage

Documentation Required To Get Pre

To get a full pre-approval, youll need to be prepared to provide the following documentation:

- Pay stubs Youll need to provide your most recent pay stub, which must show your year-to-date earnings. Youll need a pay stub for each job you have, and for each person applying for the pre-approval.

- W2s Many mortgage lenders will require your W-2 for at least the most recent calendar year. However, some lenders may require them for the past two years.

- Completed, signed income tax returns Youll need to provide these if youre self-employed, or have substantial real estate, investment, or partnership income. They should include all pages of IRS Form 1040, including schedules.

- Asset statements For bank accounts or taxable investment accounts, youll need to provide statements covering the most recent two months, or the most recent quarter. For retirement accounts, youll need to provide something similar.

- Gift information If some or all your down payment will come from a gift, youll need to provide the amount of the gift, when it will be available, who the donor will be, and what their source of funds for the gift will be. The lender will likely request that the donor complete a formal mortgage gift letter, that will request specific details.

- This can usually be satisfied by providing your drivers license. In some cases, the lender may request a copy of your Social Security card. These documents will be requested to verify your identity for federal compliance purposes.

How Much Can I Get Pre

The amount a lender can pre-approve you for depends on multiple factors such as your income, your current DTI ratio, loan term, and interest rate. In addition to that, a lender will consider your pre-approval only in the case if:

- Your credit score is above 620,

- You have money for the down payment,

- You have proof of stable employment history,

- You have not declared bankruptcy or foreclosed on your home within the last 4 and 7 years respectively.

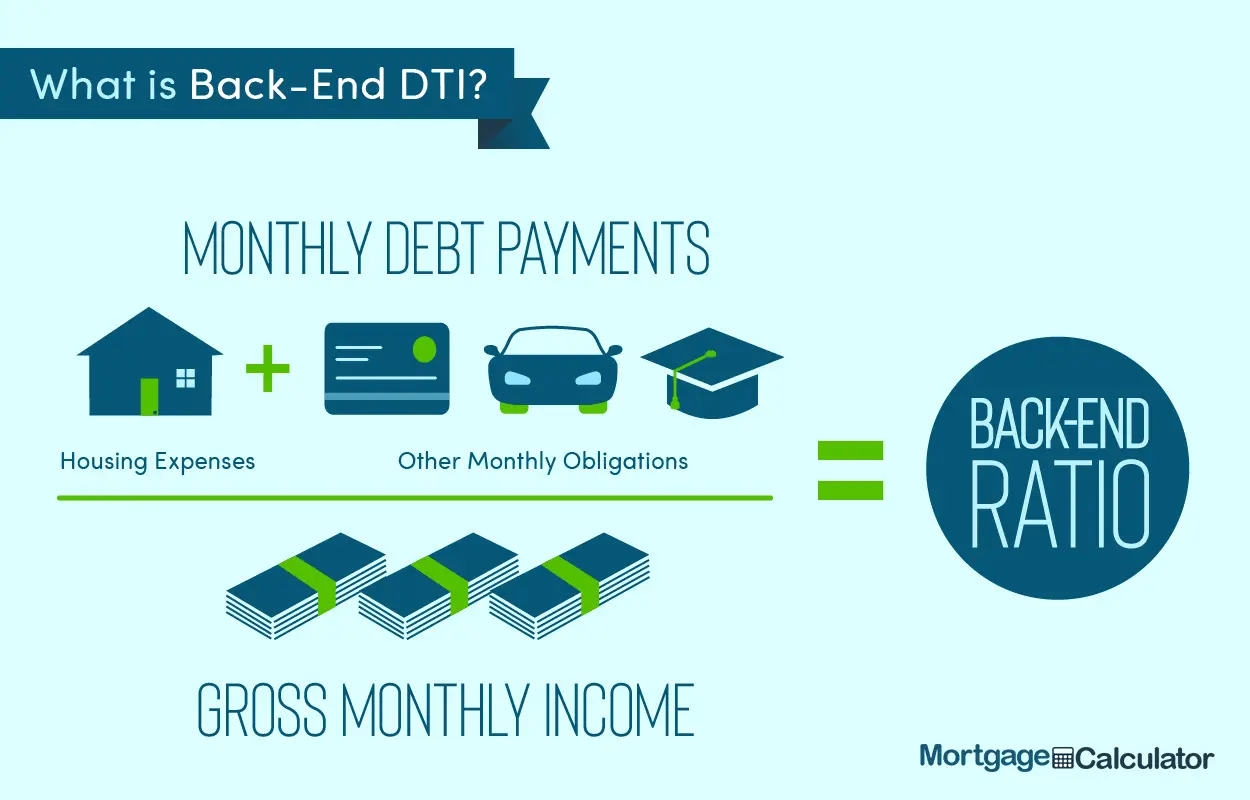

Another condition that should be satisfied is that your monthly debt payments should not exceed 43% of your monthly gross income. If all the mentioned requirements are met, the lender can do the following calculations to determine how much they can pre-approve you.

First, they need to calculate how much you can add to your monthly debt payments to keep your DTI ratio under 43%. Your DTI equals monthly debt payments divided by monthly gross income. Using this simple formula, the lender can calculate your maximum monthly debt payments as follows:

When the lender knows the maximum monthly debt payments you can make while keeping your DTI at 43%, the lender needs to subtract your current monthly debt payments to find your monthly mortgage payments.

The monthly mortgage payments found are the maximum fixed monthly payments on a loan a lender can pre-approve you for. Based on this number, the lender can calculate the loan value they can provide using the following formula.

Recommended Reading: What’s A Good Ltv For Mortgage

Calculate Your Loan Prequalification And More

When figuring out how to qualify for a home loan, it helps to determine your ability to qualify. Thats why we put together this loan prequalification calculator. So, whether youre trying to qualify for a home loan or an auto loan, make sure you even qualify. Just bear in mind that this loan prequalification calculator is in no way a guarantee. It is, however, a good starting point in figuring out if you can get pre-approval for a home loan.

Estimate How Much House You Can Afford

To help you get started, you can use our calculator on top to estimate the home price, closing costs, and monthly mortgage payments you can afford based on your annual income. For our example, lets suppose you have an annual income of $68,000. Youre looking to get a 30-year fixed-rate loan at 3.25% APR. For your down payment and closing costs, youve saved $55,000. See the results below.

- Annual income: $68,000

| Total Monthly Mortgage Payment | $1,587 |

Based on the table, if you have an annual income of $68,000, you can purchase a house worth $305,193. You may qualify for a loan amount of $252,720, and your total monthly mortgage payment will be $1,587. Since your cash on hand is $55,000, thats less than 20% of the homes price. This means you have to pay for private mortgage insurance . Take note: This is just a rough estimate. The actual loan amount you may qualify for may be lower or higher, depending on your lenders evaluation.

The following table breaks down your total monthly mortgage payments:

| Monthly Payment Breakdown | |

|---|---|

| Total Monthly Mortgage Payment | $1,587 |

According to the table, your principal and interest payment is $1,099.85. When we add property taxes and home insurance, your total monthly mortgage payment will be $1,481.34. But because you must pay PMI, it adds $105.30 to your monthly payment, which results in a total of $1,587 every month.

Read Also: How Much Is A Habitat For Humanity Mortgage

What Down Payment Should I Input In The Mortgage Pre

If you aren’t sure about how much mortgage you qualify for, then just choose 5%. Once you see the result, then you can change the amount and the resulting purchase price will change.

The calculator will first calculate how much mortgage you qualify for. Then based on this number and your down payment chosen, you will see how much purchase price you can make that won’t exceed the mortgage approved.

As you review the results on the right side, you can see that the Default Insurance Premium is also included. When your down payment increases from 5% to 10%, the default insurance premium goes down. Therefore with a bigger down payment and lower mortgage insurance premium, your purchase price goes up.

The Length Of A Home Loan Term

The loan term refers to how long you have to pay off a loan. Shorter terms mean higher monthly payments with less interest. Longer terms flip this scenario, meaning more interest is paid, but the monthly payment is lower.

When youre looking at monthly payments, its important to balance dueling goals of affordability while at the same time trying to pay as little interest as possible.

One strategy that might be helpful is to put extra money toward the monthly principal payment when you can. This will result in paying less total interest over time than if you just made your regular monthly payment.

You can also take a look at recasting your mortgage to lower your payment permanently. When you recast, your term and interest rate stays the same, but the loan balance is lowered to reflect the payments youve already made. Your payment is lower because the interest rate and term remain.

One thing to know about recasting is that sometimes theres a fee, and some lenders limit how often you do it or if they let you do it at all. However, it can be an option worth looking into, because it might be cheaper than the closing costs on a refinance.

Read Also: Can You Get A Mortgage Loan With No Credit

What Else Is Included In Dti

Your debt-to-income ratio also considers auto loans, minimum credit card payments, installment loans, student loans, alimony, child support, and any other expenses you must make each month. It doesn’t typically include recurring monthly charges for utilities, internet service, cable or satellite TV, mobile phone subscription or other charges for ongoing services or other things where the cost is newly incurred each month.

To calculate if you have the required income for a mortgage, the lender takes your projected monthly mortgage payment, adds your expenses for credit cards and any other loans, plus legal obligations like child support or alimony, and compares it to your monthly income. If your debt payments are less than 36 percent of your pre-tax income, you’re typically in good shape.

What if your income varies from month to month? In that case, your lender will likely use your average monthly income over the past two years. But if you earned significantly more in one year than the other, the lender may opt for the year’s average with lower earnings.

Note: Your required income doesn’t just depend on the size of the loan and the debts you have but will vary depending on your mortgage rate and the length of your loan. Those affect your monthly mortgage payment, so the mortgage income calculator allows you to take those into account as well.

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross household income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Don’t Miss: Can You Refinance Your Mortgage With Bad Credit

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

How Much House Can I Afford On My Salary

Lets say you earn $70,000 each year. By using the 28 percent rule, your mortgage payments should add up to no more than $19,600 for the year, which equals a monthly payment of $1,633. With that magic number in mind, you can afford a $305,000 home at a 5.35 percent interest rate over 30 years. But youd need to make a down payment of 20 percent.

Recommended Reading: How To Get Assistance With Mortgage Payments

How Do I Pre

You will need to gather some important basic financial information before you can complete the mortgage affordability and pre-qualification calculator. This includes your total monthly income before taxes plus your total monthly debt payments .

Once you have your most current information gathered, enter your income and debt totals in our mortgage affordability and pre-qualification calculator. You will also need to have a basic idea of what type of mortgage financing you would like to have. Start by choosing your preferred mortgage loan term and the associated interest rate that you expect to obtain. Then enter the state in which you are looking to purchase. Finally, you will need to enter the percentage that you plan to put as a down payment. Remember, the down payment is an up-front payment, so you need to have that cash readily available.

How Much Can I Borrow

One of the most common questions asked by buyers when starting the home buying process is “How much of a mortgage can I afford?” Obviously, the answer to this question will directly impact the price range of homes that you can consider when searching the market. The answer to this question is not set in stone, though, as it only takes into account your current circumstances. Interest rates or house prices could fall, or you could get a promotion and a pay rise, which could vastly increase the amount you are able to borrow. However, there are guidelines that you can follow in order to figure out how much of a mortgage you can afford and qualify for, which is where the Maximum Mortgage Calculator comes in. There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. These are your monthly income and your monthly obligations .

Total monthly income from all sources. All income should be entered before taxes.

Recommended Reading: What Can You Include In A Mortgage

Shop Around Among Different Lenders

While these factors are considered by all mortgage lenders, different lenders do have different rules for who exactly can qualify for financing.

Be sure to explore all of your options for different kinds of loans and to shop around among mortgage lenders so you can find a loan you can qualify for at the best rate possible given your financial situation.

What Are The Current Home Loan Interest Rates

HDFC is currently offering home loan interest rates starting from 6.70%* p.a. Customers can avail these home loan interest rates along with benefits like a longer loan tenure of up to 30 years, end to end digital solutions, customized repayment options and much more! To calculate your EMI visit To apply now for a home loan visit

Recommended Reading: How To Check My Mortgage Balance