Mortgage Interest Rate Faq

What are current mortgage rates?

Current mortgage rates are averaging 5.51% for a 30year fixedrate loan, 4.67% for a 15year fixedrate loan, and 4.35% for a 5/1 adjustablerate mortgage, according to Freddie Macs latest weekly rate survey. Your individual rate could be higher or lower than the average depending on your credit score, down payment, and the lender you choose to work with, among other factors.

Will mortgage rates go down next week?

Mortgage rates could decrease next week if the mortgage market takes a cautious approach to a possible recession on the horizon. However, rates could rise if the high inflation of 2022 keeps up and needs to be reigned in.

Will mortgage interest rates go down in 2022?

Its unlikely mortgage rates will go down in 2022. Inflation has been climbing at a record rate over the last few months. And the Fed is planning to raise interest rates after each of its scheduled FOMC meetings. Both these factors should lead to significantly higher mortgage rates in 2022.

Will mortgage interest rates go up in 2022?

Yes, its very likely mortgage rates will increase in 2022. High inflation, a strong housing market, and policy changes by the Federal Reserve should all push rates higher in 2022. The only thing likely to push rates down would be a major resurgence in serious Covid cases and further economic shutdowns. But, while it could help mortgage rates, no one is hoping for that outcome.

What is the lowest mortgage rate right now?

What Is A Good Loan Term

When picking a mortgage, it’s important to consider the loan term, or payment schedule. The most common loan terms are 15 years and 30 years, although 10-, 20- and 40-year mortgages also exist. Mortgages are further divided into fixed-rate and adjustable-rate mortgages. For fixed-rate mortgages, interest rates are the same for the life of the loan. Unlike a fixed-rate mortgage, the interest rates for an adjustable-rate mortgage are only the same for a certain amount of time . After that, the rate adjusts annually based on the market rate.

One important factor to take into consideration when choosing between a fixed-rate and adjustable-rate mortgage is the length of time you plan on staying in your home. For people who plan on living long-term in a new house, fixed-rate mortgages may be the better option. Fixed-rate mortgages offer greater stability over time in comparison to adjustable-rate mortgages, but adjustable-rate mortgages can sometimes offer lower interest rates upfront. However you could get a better deal with an adjustable-rate mortgage if you only have plans to to keep your home for a couple years. The best loan term is entirely dependent on your situation and goals, so make sure to consider what’s important to you when choosing a mortgage.

Find the Best Refinance Rates with the CNET Rate Alert

Inflation Is Behind Rising Rates

Higher interest rates tend to accompany high inflation, and prices have been rising at above an 8% annual rate for three consecutive months. The Consumer Price Index stood at 8.6% in May .

The price of money goes up at times of high inflation, just as the prices of bacon and eggs do. The higher price of money shows up in the form of higher interest rates. To earn a profit, lenders raise rates on all types of loans, including mortgages.

As long as inflation remains elevated, mortgage rates are likely to rise. Look for that to be the case in July.

Read Also: What Is A Modified Mortgage

Bank Of Canada Historical Mortgage Rates: 1975 2020

The following mortgage rate history chart is from the Bank of Canada, dating back to 1975. The central bank sources its data from the weekly posted interest rates from Canadas Big Six banks: Bank of Nova Scotia , Toronto-Dominion Bank , Bank of Montreal , Royal Bank of Canada , Canadian Imperial Bank of Commerce , and the National Bank of Canada.

Heres a look at what conventional five-year fixed mortgage rates have been up to throughout the last 50 years:

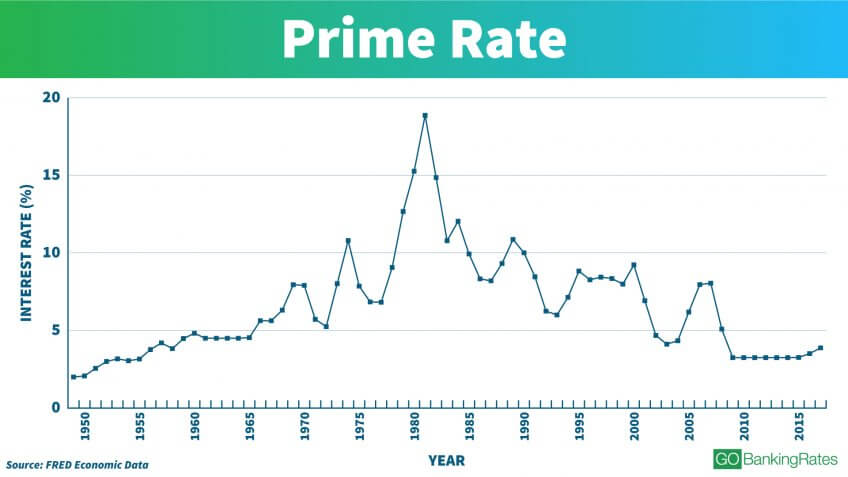

Interest rates dont exist in a vacuum, and are a reflection of the state of moving parts in Canadas economy and abroad, including a wide number of economic growth indicators and global geopolitical risks.

For example, interest rates for conventional five-year, fixed-rate mortgages peaked in 1981 when the Bank of Canada raised its benchmark overnight lending rate to 21% amidst the global recession of the early 1980s. The recession followed a chain of events, including the Iranian Revolution, which resulted in a drop in oil production. As oil prices shot up, so did inflation in Canada and other G7 countries.

How Do I Find The Best Mortgage Rate

Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done. The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you keep your home loan will impact your decision.

If you plan on keeping your home loan long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages. Locking in a low rate is a smart choice. But you can get lower mortgage rates with some adjustable-rate loans too. If you plan on only keeping your home for a short period of time, then you may be able to pay less interest with an ARM.

Read Also: How To Get A Mortgage After Chapter 7

Historical Mortgage Rates: Averages And Trends From The 1970s To 2022

See Mortgage Rate Quotes for Your Home

Since 1971, historical mortgage rates for 30-year fixed-rate loans have hit historic highs and lows due to various factors. Well use data from Freddie Macs Primary Mortgage Market Survey to do a deep dive into whats driven historical mortgage rate movements over time, and how rate fluctuations affect buying or refinancing a home.

How Are Mortgage Rates Impacting Home Sales

Home sales continue to slow. The number of mortgage applications decreased by 1.7% for the week ending July 8, according to the Mortgage Bankers Association.

- The total number of purchase applications edged 4% lower week-over-week and was 18% lower compared to this time last year.

- Refinance applications saw a bit of a rebound, increasing by 2% from the previous week. Compared to this time last year, however, applications were down 80%.

You May Like: Can You Use A Mortgage To Buy Land

How Do You Qualify For The Best Mortgage Rates

Getting the best mortgage rates requires five main things:

How Does Your Credit Score Affect Your Rate

Your credit score measures your likelihood of making continuous, on-time mortgage payments. Homebuyers with higher credit scores seem less risky to lenders. So, in general, the higher your credit score, the lower your mortgage rate. But other factors such as your personal debt, down payment size, and loan program also influence your rate.

Also Check: How Much Mortgage 200k Salary

How Can I Calculate How Much My Ontario Mortgage Payments Would Be

Our Ontario Mortgage Payment Calculator will help you figure out how much youll pay with any rate you find on the site. It only takes a few minutes to use, so give it a try. You can modify the mortgage amount, mortgage term and type, amortization and payment type to see how your mortgage options and payment amount are impacted.

What Do High Rates Mean For The Housing Market

When mortgage rates go up, home shoppers’ buying power decreases, as more of their anticipated housing budget has to go toward paying interest. If rates get high enough, buyers can get priced out of the market completely, which cools demand and puts downward pressure on home price growth.

However, that doesn’t mean home prices will fall in fact, they’re expected to rise even more this year, just at a slower pace than what we’ve seen in the past couple of years.

Read Also: Which Credit Score Do Mortgage Companies Use

How To Find Personalized Mortgage Rates

When you are ready to apply for a loan, you can reach out to a local mortgage broker or search online. Make sure to think about your current finances and your goals when looking for a mortgage. Specific mortgage interest rates will vary based on factors including credit score, down payment, debt-to-income ratio and loan-to-value ratio. Having a higher credit score, a higher down payment, a low DTI, a low LTV, or any combination of those factors can help you get a lower interest rate. The interest rate isn’t the only factor that affects the cost of your home â be sure to also consider other costs such as fees, closing costs, taxes and discount points. Make sure you speak with several different lenders — for example, local and national banks, credit unions and online lenders — and comparison shop to find the best mortgage for you.

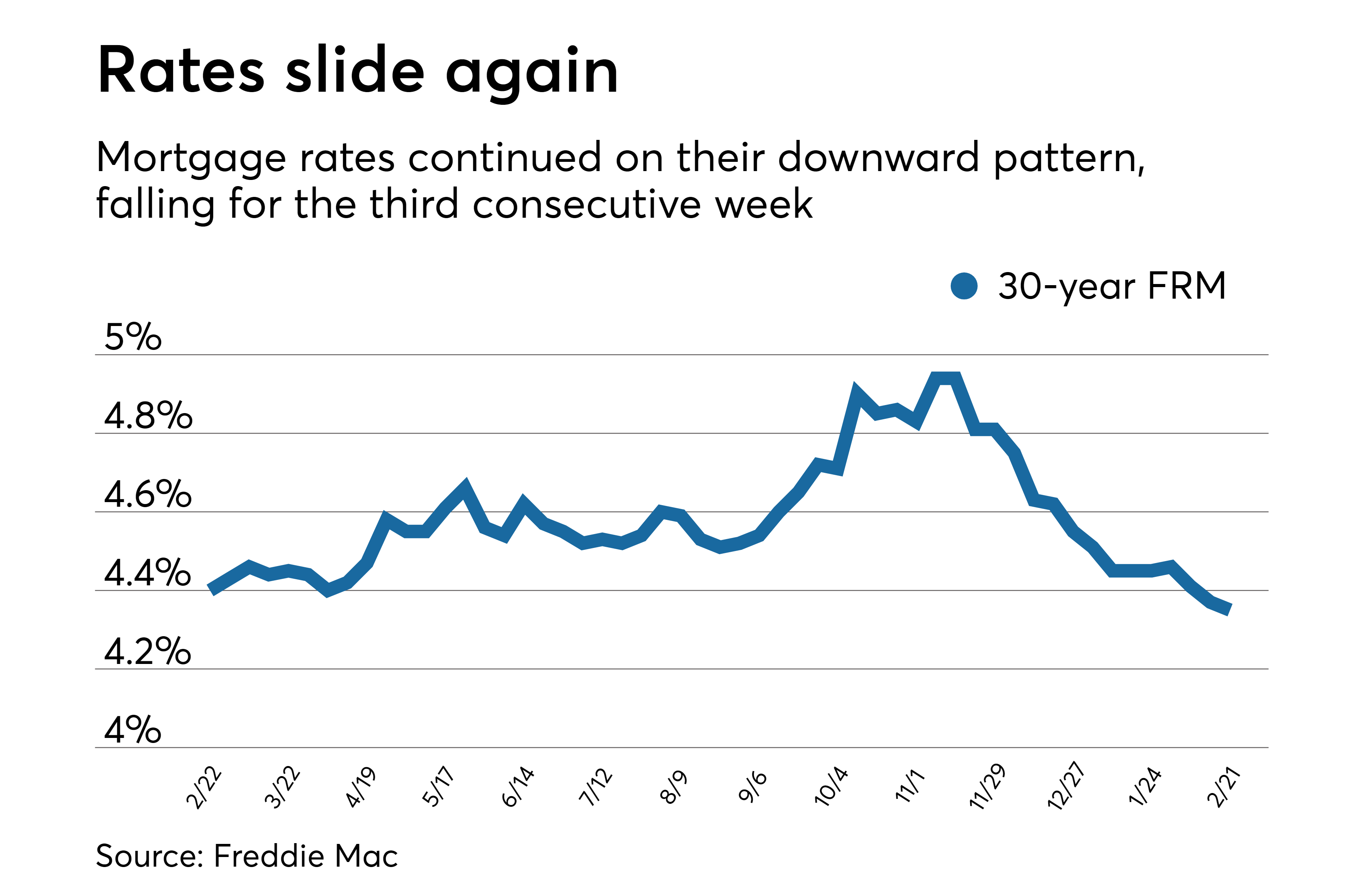

Mortgage Rates Beat A Retreat

The average rate offered for a 30-year mortgage fell back significantly from its recent peak, continuing a series of big up-and-down swings, while the 15-year dropped slightly.

The average rate offered to homebuyers using a conventional 30-year fixed mortgage fell to 5.83% from 6.09% the previous business day. A few days ago it had vaulted to 6.19%, its highest point since at least 2019. The average for a 15-year mortgage inched down to 5.20% from 5.22% the previous business day. Last week the 15-year was at 5.26%, also the highest since at least 2019.

Fixed mortgage rates tend to track the direction of 10-year Treasury yields, which usually rise with heightened inflation fears . Yields have generally spiked over the past monthalbeit with some big intraday swingsas inflation and the Federal Reserves effort to cool it with higher interest rates have intensified.

You May Like: Could I Qualify For A Mortgage

Closing Costs & Loan Fees

Anytime you take out a home loan, youll want to be aware of the closing costs. Closing costs can be anywhere between 3-6% of the loan amount, and include fees such as loan origination charges, prepaid interest and property taxes. Choosing a higher interest rate in exchange for lender credit can reduce your upfront costs. There is a possibility that you will be selling your home or refinancing in five to eight years, so this strategy could save you money in the short-term.

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

Read Also: What Is The Amortization Schedule For A 30 Year Mortgage

Number Of Eligible Refinance Candidates Based On Interest Rates

| Interest rate |

|---|

| 0.47 |

| : Black Knight |

While refinancing options can lead to a lower monthly payment, not all of the options yield less interest over the life of the loan. For example, refinancing from a 5% mortgage with 26 years left on it to a 4% rate, but for 30 years, will cause you to pay more than $13,000 in interest.

Before you start shopping around for a lender, you can find out how much you could save by using a mortgage refinancing calculator.

Youll also want to consider how long you plan on staying in your home as the closing costs can eat up your savings if you sell shortly after refinancing. The closing costs to refinance run between 2% to 5% of the loan amount, depending on the lender. So you should plan on keeping your home long enough to cover those costs and realize the savings from refinancing at a lower rate.

Keep in mind, the rate you qualify for also depends on other factors such as your credit score, debt-to-income ratio, loan-to-value ratio and proof of steady income.

Are Low Frills Mortgages Worth It

Restricted mortgages have boomed in popularity the last five years. Lenders realize that consumers want the lowest rate, so theyve tried to strip out features from their mortgages to get the pricing lower. For some borrowers who plan no financing changes for five years, low-frills mortgages may make sense. For most Canadians, the small rate savings isnt worth the much higher potential costs after closing. Those costs can bite you if you break, port, increase or otherwise refinance before your mortgage maturity date. Hence, for the majority of homeowners, its worth the small premium for a full-featured mortgage

You May Like: What Determines The Interest Rate On A Mortgage

Will Mortgage Rates Go Down In July

Mortgage rates surged in the first half of 2022, with the average 30-year fixed rate growing by 248 basis points from Jan. 6 to June 30, according to Freddie Mac.

Rates mostly fluctuated through the second quarter until the Federal Reserves June hike to combat inflation. The day after, mortgage interest rates experienced the largest week-over-week jump 55 basis points, or 0.55% since 1987.

With the pandemics declining economic impact, inflation running at 40-year highs, and the Fed planning four more aggressive hikes, interest rates could continue trending upward this year.

However, concerns over an impending recession have caused rate drops and could cause more on any given week.

Experts from Fannie Mae, First American and other industry leaders are split on whether 30-year mortgage rates will keep climbing in July or level off.

The market should expect rate volatility in a tight range, similar to the energy and momentum of a yo-yo as it unwinds and rewinds.

Paul Buege, president and CEO of Inlanta Mortgage

Paul Buege, president and CEO of Inlanta Mortgage

Prediction: Rates will rise

The markets have already factored in an increase of no less than 50 basis points and a larger increase will produce mortgage rates over 6.5 percent. The Fed will be looking for multiple signals that inflation is beginning to ease. Key economic indicators to watch will be the gross domestic product , employment figures, consumer spending and inflation.

Prediction: Rates will rise

What Is The Best Mortgage Loan Type

The best mortgage is the one that helps you meet your housing needs for as little financing costs as possible. There are a few factors to consider when it comes to getting the right mortgage.

Some experts recommend getting a 15-year mortgage because youll pay far less interest and be debt-free in half the time compared to a 30-year loan. With a 30-year loan, your monthly payments can be significantly lower, but youll pay much more in interest over the loans life. So its a tradeoff.

There are also tradeoffs in choosing a government-backed versus a conventional loan. For example, FHA mortgages can have lower requirements than conventional loans. But unlike conventional loans, FHA loans require mortgage insurance even if your loan-to-value ratio drops below 80%.

If you want a set interest rate for the life of the loan and more stable monthly payments, then a fixed-rate mortgage is ideal. The interest rate on a fixed-rate mortgage never changes.

Regardless of what loan type you go with, remember, its not the loan you have to keep forever. Even if you stay in the same home for the rest of your life, you can refinance your mortgage to take advantage of better terms or rates.

Recommended Reading: How To Find Mortgage Payment

Mortgage Rate Trends In The 1990s

The 1990s saw a dramatic shift in the 30-year rates movement, as it plunged to an average of 6.91 percent in 1998, according to Bankrate data. This was spurred by the dot-com bubble, an era when investors rushed to buy stocks from technology companies that were overvalued. When these stocks plummeted, investors turned their focus to fixed-income investments, such as bonds. As bond prices rose and yields fell, mortgage rates, which follow the 10-year Treasury yield, also declined.