Real Estate On Zillow

In 2018, Kori McClinton started looking for a home in New Orleans, but then halted the search and continued to rent after having no luck finding the right one.Years later, her grandmother urged her to try again, advising the 26-year-old disability analyst to take advantage of low interest rates before its too late.My grandmother actually called me and was telling me how she saw the news about the Federal Reserve saying that the interest rates were going to go up fast, and how I needed to hurry up and get a home, McClinton said.

McClinton was able to secure a $220,000 loan this year with an interest rate of 2.9% a number she thought was extraordinarily low.

I was shocked, she said. I asked the lender multiple times, Are you sure this is for the entire loan? Seriously?’

The US has been experiencing all-time low mortgage rates for almost two years. But all of that is changing.

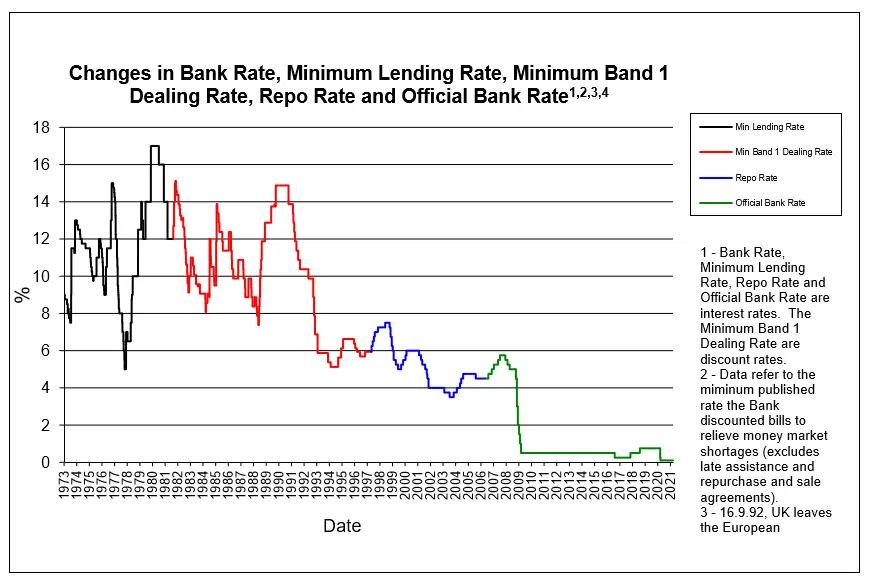

Low mortgage rates are usually reflective of a struggling economy. Rates plummeted in 2020 when the coronavirus pandemic began, people lost jobs, businesses closed, and the Fed lowered the federal funds rate to 0% to 0.25%. They stayed at record lows throughout 2020 and 2021.

Mortgage rates have started rising in the beginning of 2022, though. Yes, the US economy is still working its way back from the damage caused by the pandemic. But its also successfully added more jobs, more people are joining the workforce, and inflation has soared.

Constant Maturity Treasury Rates

Constant Maturity Treasury rates, or CMT rates, refer to a yield thats calculated by taking the average yield of different types of Treasury securities with varying maturity periods, and using it to adjust for a number of time periods.

Some lenders will use this rate to determine interest for adjustable-rate mortgages . If the CMT goes up, you can expect any loans tied to it to increase their interest rates as well.

Will Current Mortgage Rates Last

As the new Omicron variant causes a new surge of the virus, uncertainty around the economic recovery is putting downward pressure on rates. With a little over a week left in the year, expect mortgage rates to remain near historic lows. Looking into next year, however, all signs are pointing to increasing rates.

Next year, the Federal Reserve expects to tighten monetary policy sooner than previously thought. Last week, the central bank announced that it expects to end its bond purchasing program by spring 2022 and raise the federal funds rate three times next year. Both of these moves will put upward pressure on mortgage rates.

On Thursday, the yield on the 10-year Treasury note opened at 1.457%, just 0.001 percentage points lower than Wednesday’s close of 1.458%. There tends to be a spread of about 1.8 percentage points between the 10-year Treasury and average mortgage rates.

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

How Do I Get The Best Mortgage Rate

To get the best mortgage interest rate for your situation, its best to shop around with multiple lenders. According to research from the Consumer Financial Protection Bureau , almost half of consumers do not compare quotes when shopping for a home loan, which means losing out on substantial savings. Interest rates help determine your monthly mortgage payment as well as the total amount of interest youll pay over the life of the loan. While it may not seem like much, even a half of a percentage point decrease can amount to a significant amount of money.

Comparing quotes from three to four lenders ensures that youre getting the most competitive mortgage rate for you. And, if lenders know youre shopping around, they may even be more willing to waive certain fees or offer better terms for some buyers. Either way, you reap the benefits.

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes, and heating expenses should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Gross Debt Service Ratio

Read Also: Who Is Rocket Mortgage Owned By

Hybrid Or Combination Mortgages

You could choose to opt for a hybrid or combination mortgage. In these mortgages, part of your interest rate is fixed and the other is variable.

The fixed portion gives you partial protection in case interest rates go up. The variable portion provides partial benefits if rates fall.

Each portion may have different terms. This means hybrid mortgages may be harder to transfer to another lender.

The Global Economy Matters

Many Canadian banks borrow money in other countries, particularly the United States. And keep in mind that the worlds financial markets are interconnected. Interest rates in Canada respond to what happens elsewhere. For example, foreign interest rates fell during 2019. Interest rates for Canadian five-year fixed mortgages dropped in response.

Read Also: 10 Year Treasury Yield And Mortgage Rates

Comprehending The Bond Market And Its Influence On A Fixed

The biggest influence on a fixed-rate mortgage is the bond market, which the chartered banks use to determine their mortgage rates. A mortgage and a Government of Canada bond are two investments that banks use to generate profits. But there are many differences between these two types of investments, and banks use bonds as a security against losses in their mortgage departments. Bonds are:

- A no-risk financial endeavour for banks

- Guaranteed to yield at least a minimal profit

- A no-cost investment

On the other hand, when a bank lends money for a mortgage, they are:

- Carrying a much higher risk

- Incurring costs associated with approval and set up

- Not guaranteed profit, and at risk of loosing money if the borrower defaults

Banks, therefore, calculate the interest rates on the money they lend based on the interest rates they are getting on the money they have invested , and use their forecasted earnings from bond investments to cover the costs and possible losses incurred through a mortgage. Consequently, the more lucrative the bond market and the higher the bond rates, the lower your fixed-rate mortgage will be.

Health Of The Economy

Mortgage rates vary based on how the economy is doing today and its outlook. When the economy is doing well meaning unemployment rates are low and spending is high mortgage rates increase. When the economy isn’t doing as well , including high unemployment rates and a lower demand for oil, mortgage rates fall.

Read Also: Chase Recast Mortgage

What Is A Mortgage Principal

A principal is the original amount of a loan or investment. Interest is then charged on the principal for a loan, while an investor might earn money based on the principal that they invested. When looking at mortgages, the mortgage principal is the amount of money that you owe and will need to pay back. For example, perhaps you bought a home for $500,000 afterclosing costsand made a down payment of $100,000. You will only need to borrow $400,000 from a bank or mortgage lender in order to finance the purchase of the home. This means that when you get a mortgage and borrow $400,000, your mortgage principal will be $400,000.

Your mortgage principal balance is the amount that you still owe and will need to pay back. As you make mortgage payments, your principal balance will decrease. The amount of interest that you pay will depend on your principal balance. A higher principal balance means that youll be paying more mortgage interest compared to a lower principal balance, assuming the mortgage interest rate is the same.

How To Save Interest On Your Mortgage

Now that you know a bit more about how interest is calculated lets look at the ways you can actually pay less of it.

- Get the best rate. Shopping around for a better interest rate can save you thousands of dollars. If you already own a home, you may want to consider refinancing with your current lender or switching to a new lender.

- Make frequent payments. Because there are a little over four weeks in a month, if you make biweekly instead of monthly mortgage repayments, youll end up making two extra payments a year.

- Make extra payments. The quicker you pay down your loan amount, the less interest youll need to pay on your smaller outstanding loan amount. If you have a variable interest rate, you can save even more by making extra payments when interest rates are low.

- Choose a shorter loan term. The longer you take to pay off your loan, the more interest youll end up paying. Remember, banks calculate interest on your loan amount daily, so choosing a 25-year loan term instead of 30 years can make a big difference.

You May Like: Recasting Mortgage Chase

How Banks Regulate And Determine Mortgage Rates

Depending on the type of loan you have, lenders regulate mortgage rates based on different factors. Some of these are unique to your history, while others depend on external factors. Among the external influences of how mortgage rates are determined are as follows.

Economic Factors That Help Determine Mortgage Rates

Ultimately, several factors, including the rate of inflation, the price of U.S. treasuries and the Federal Reserve, affect mortgage rates. That’s because all these things and more affect how much investors are willing to pay to invest in the mortgage-backed securities we discussed on the previous page.

Let’s start with inflation, which is the phenomenon where the prices of common goods and services rise across the board. Consistent and moderate inflation is actually a sign of a healthy economy, and should ideally result in a proportional rise in wages for workers as well. For lenders, inflation poses an inherent problem — it means that the money people borrow now will be worth less when they come to pay it back. If economists predict a rise in inflation, investors will insist on higher mortgage rates to make up for this loss.

Because investors have many choices of where to invest their money, competition among other investments also determines mortgage rates. Like with bonds and other financial instruments, investors often compare MBSs against U.S. treasuries. You might assume a 30-year fixed mortgage would compare to a 30-year treasury. But in reality, borrowers in 30-year fixed mortgages are likely to refinance or move after only 10 years. So investors compare such mortgage investments to 10-year treasuries.

We’ve just skimmed the surface of a complex system of factors that affect mortgage rates. For more on similar financial topics, explore the links on the next page.

Also Check: 70000 Mortgage Over 30 Years

Are Mortgage Rates And Refinance Rates The Same

Normally, mortgage and refinance rates are similar. So a 30year fixedrate loan to buy a house should have a similar rate to a 30year fixedrate refinance.

But sometimes mortgage and refinance rates drift apart. And its usually for one of two reasons:

How Much Interest Can Cost

Your interest rate and how its calculated affects your regular mortgage payments. A mortgage is usually a large amount of money. Therefore, small differences in the interest rate can have a significant impact on your costs.

Figure 1: Example of monthly mortgage payment for a mortgage of $300,000.00 with an amortization of 25 years at various interest rates

| Interest cost over 5 years | Interest cost over 25 years |

|---|---|

| 2.50% | |

| $73,097.91 | $233,738.23 |

Make sure your home is within your budget. Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, you may be overextending yourself.

Also Check: Does Rocket Mortgage Sell Their Loans

Home Price And Loan Amount

Homebuyers can pay higher interest rates on loans that are particularly small or large. The amount youll need to borrow for your mortgage loan is the homeprice plus closing costs minus your down payment. Depending on your circumstances or mortgage loan type, your closing costs and mortgage insurance may be included in the amount of your mortgage loan, too.

If youve already started shopping for homes, you may have an idea of the price range of the home you hope to buy. If youre just getting started, real estate websites can help you get a sense of typical prices in the neighborhoods youre interested in.

Enter different home prices and down payment information into the Explore Interest Rates tool to see how it affects interest rates in your area.

Mortgage Points And Credits

You may have an opportunity to nab a lower interest rate by buying mortgage points, also called discount points. Each point costs about 1% of the loan amount, and the interest rate reduction can depend on the specific loan offer. Conversely, lenders may pay you lender credits that can offset your closing costs but increase your interest rate.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

How The Bond Market Affects Mortgage Rates

We dont tend to think of it this way because home is so personal for everyone, but at the end of the day, mortgages are just a big financial instrument. Like a lot of finance products, mortgages can be traded among investors. The particular mechanism for trading home loans is the mortgage bond.

Also called mortgage-backed securities , mortgage bonds are collections of loans with similar characteristics such as down payment amount, credit score and the original investor in the loan .

Based on your personal characteristics, you get bucketed into an MBS. Investors who are choosing bonds make decisions about which bonds to buy based on their risk tolerance and desire for a certain rate of return.

If you fall into a category with better financial characteristics, youre more likely to be able to make your payment than someone who has a riskier profile. The trade-off is that the interest rate is lower for you than it would be for the other borrower.

However, it goes beyond personal factors. One of the key things to understand is that the bond market in general is considered to be a safer place to put your money than the stock market. Although the stock market may offer a higher rate of return, its subject to a lot more volatility and could suffer more in a downturn. Bonds offer a guaranteed yield.

Should I Lock My Mortgage Rate

Since your mortgage rate isnt guaranteed, it might be a good idea to lock it as soon as possible so youre not caught off guard. Make sure youve compared multiple quotes before doing so. Other scenarios in which it might be a good idea to lock your mortgage rate would be if youre closing on a home soon, you have enough assets and income to proceed with the closing process and youve already sold your current home.

You May Like: Rocket Mortgage Qualifications

How Do I Find My Best Mortgage Rate

Getting quotes from multiple lenders is a good way to find the most competitive mortgage rate based on your financial situation. When you do, make sure to look at the loan estimate document carefully to see exactly youll be paying. If youre a first-time homebuyer, most states have programs that offer below market rates to accelerate your path to homeownership.

Work On Factors You Can Control

You can’t control whether the economy is struggling or flourishing. Of the factors that you can technically control, not all will be within your reach. For example, maybe you aren’t willing to get a shorter mortgage term with a lower rate, because the resulting monthly payments would be too high for your budget.

But maybe you can pay down some credit card debt. This would both lower your debt-to-income ratio and probably increase your credit score, both of which would help you land a lower rate.

Read Also: Can You Do A Reverse Mortgage On A Mobile Home