What Will Sellers Do

When sellers have bought a home at a low rate, and rates are rising, a phenomenon known as rate lock can take effect sellers have a disincentive to move.

When rates move dramatically in a short period of time, its the existing-home market that slows down, said Smoke.

Weve had effectively a 30-year tailwind run of declining mortgage rates, noted Fleming. At this point in time, maybe they go up or down a little bit, but the long-term trend over the past 30 years has been lower and lower and lower mortgage rates, Fleming noted.

Think about how the housing market is composed: 5.5 million to 5.6 million homes sell per year, with an additional million new, so were talking somewhere on average of 6 to 6.5 million home sales a year. The vast majority of those home sales come out of the existing market, and what defines the existing market? Existing homeowners. They have to make the decision to supply that home for sale.

This becomes a problem when rates are rising upward from historic lows.

McLaughlin confirmed: If there are homeowners who bought their homes in the last three to five years and they were able to get a rate of 3 to 3.5 percent, buying a new home means a new mortgage at a higher mortgage rate, so many may decide to stay put and renovate their existing home, which is what many of them have been doing anyways.

The Beginnings Of Canada’s Central Bank In 1935

The Bank of Canada was created as part of the Bank of Canada Act in 1935. It was recommended by the Royal Commission in response to the economic conditions of the Great Depression. In March 1935, the Bank of Canada was opened to the public as a private institution with shares sold to public investors. It was quickly nationalized as a public institution by an amendment to the Bank of Canada Act in 1938.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Mortgage Rates In 2020 And 2021

2020 saw new lows for mortgage rates, with the 30-year fixed rate diving to just under 3 percent, according to Bankrate data, and averaging 3.38 percent for the year. Amid the pandemic, fearful investors were attracted to safer products such as Treasury and mortgage bonds, pushing yields and rates lower, explains McBride.

The onset of the COVID-19 pandemic in 2020 spurred mortgage rates to new record lows, as the economy was faced initially with a rapid contraction that was the worst since the Great Depression and followed up by unprecedented accommodation by the Federal Reserve, McBride says.

While rates ticked up slightly in 2021, that trend has since reversed, and the 30-year fixed rate continues to hover at a low point: 3.2 percent as of early August 2021. You can view current 30-year mortgage rates on Bankrate.

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

You May Like: Can You Refinance A Mortgage Without A Job

What Will The Fed Do

The Fed pushing short-term rates up doesnt necessarily automatically translate to higher mortgage rates, but it does put upward pressure on them, explained Fleming. At last years December meeting, the Federal Reserve raised short-term rates for the first time in years and its meeting again next week, so its anyones guess what will happen to rates afterward.

The stars are now truly aligned to see what the Fed anticipated happening a year or so ago, said Cook. Its a combination of the continual, gradual improvement of the economy, the cooling down of the international financial problems that were causing delays, and the election, too.

We had a surprise post-election, not only by the results of the election but the response of bond markets and consequently mortgages, said Fleming. What I like to say is that Trump in this case Trumped Yellen we all expected Janet Yellen and the Fed to finally do another Fed funds rate increase in December, which may or may not have had a relatively large effect on mortgage rates.

Well see rates drift down a little bit through the end of the year, predicted Smoke. The Fed having their meeting and making a policy change would be a reason for the market to back off, assuming they arent raising short-term rates aggressively and early next year.

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

According to FICO, only people with credit scores above 660 will truly see interest rates around the national average.

You May Like: Mortgage Rates Based On 10 Year Treasury

Historical Home Loan Variable Rates Fixed Rates And Discount Rates

The data set includes the historical discount interest rates back to 2004. Discount rates are the special interest rates that apply to the different packages that the banks offer . In most cases the annual fees range from $350-$395 which gets you a range of loan features and entitles you to the additional discount which in most cases ranges between 0.9% and 1.65%. The variable rates above will typically be circa 1.0%-1.50% lower than above.

Historical Home Loan Variable Rates Compared To Fixed Rates

The data set includes 3 year fixed rates back to 1990. We have plotted this data against historical Australian interest rates for the period.

We consider 3 year interest rates to be relevant because in Australia the average home loan runs for between 3 and 4 years before it is refinanced, paid out or the property/properties the subject of the loan are sold .

Clearly, you will have been worse off if you selected a 3 year fixed rate loan at any time up until about November 2001. This is because if you fixed a rate until then, the trend was for rates to be reducing and so a fixed rate loan would have missed out on the trend downwards.

If you fixed rates up until 3 years before the peak you would have been fine .

If you fixed at any time between these dates you will have been locked into that interest rate and you would have been likely to miss the period of lower interest rates between about October 2008 and July 2010.

If you fixed interest rates at about July 2007 , the variable rates that applied when your loan came out of its fixed rate period would have been about the same .

It is also interesting to compare how often the fixed rate exceeds or is exceeded by the variable rate. Since September 2010, 3 year fixed rates have been less than variable rates. With the recent COVID QE response from the RBA by reducing the 3 years official rate to be the same as the cash rate, fixed rates will be low for some time.

Don’t Miss: Rocket Mortgage Loan Types

Historical Mortgage Rates And Refinancing

Refinancing is the process of swapping your old loan for a new loan. Homeowners can take advantage of lower rates to decrease their monthly payment. This extra money could go toward the principal, paying other debts or building up your savings.

A cash-out refinance is a refinancing option if you have enough equity in your home. The way a cash-out refinance works is you take out a loan for more than you owe on the home. You can use the extra to pay off other debts or make home renovations. If rates are lower than when you took out your first mortgage, your payment may not change much.

How Do I Get A Mortgage

To get a mortgage, you need to start by getting your finances in order. Having a strong financial profile will a) increase your chances of being approved for a loan, and b) help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford. The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need. Each type of mortgage requires a different credit score, and requirements can vary by lender. You’ll probably need a score of at least 620 for a conventional mortgage. You can increase your score by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment. Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.

Then, it’s time to shop around and get quotes from multiple lenders before deciding which one to use.

Read Also: Rocket Mortgage Payment Options

The Lowest 30year Mortgage Rates Ever

Rates plummeted in 2020 and 2021 in response to the Coronavirus pandemic.

- At 2.65% the monthly cost for a $200,000 home loan is $806 a month not counting taxes and insurance

- Youd save $662 a month, or $7,900 a year compared to the 8% longterm average

Due to the Federal Reserves promise of low interest rates postCOVID, mortgage rates are expected to stay low for years.

But as weve seen in the past, predictions about mortgage rates are often wrong.

Thats why when rates are good, experts recommend locking one in instead of waiting for potentially lower rates in weeks or months.

What Is A Mortgage

A mortgage is a type of secured loan provided by a financial institution to cover the cost of buying a home should you not have enough cash to pay for it upfront. You pay back the lender over an agreed-upon amount of time, including an additional interest payment, which you can consider the price of borrowing money.

Because a mortgage is a secured loan, it means you put your property up as collateral. Should you fail to make your payments over time, the lender can foreclose on, or repossess, your property. Learn more about how a mortgage works here.

Don’t Miss: Reverse Mortgage For Condominiums

Bank Of Canada Keeps Policy Rate Unchanged Against Expectations

The Bank of Canada announced on January 26th, 2022 that they will be holding their policy interest rate at 0.25%. Other highlights include:

- There is no change to prime rates at Canadas major banks

- CPI inflation is expected to average 4.2% for 2022 before decreasing to an average of 2.3% for 2023

- The Bank of Canada made it clear that interest rates will rise in the future

There is no change to the Bank of Canadas policy interest rate in spite of high inflation and strong GDP growth. This means that there will be no change to the prime rates at Canadas major banks. Instead, the Bank of Canada has now made it clear that rate hikes are in the cards for the rest of 2022.Scotiabank’s latest interest rate forecastpredicts that the Bank of Canada’s policy rate will end off the year at 2.00%, a significant increase from the current policy rate of 0.25%. The next interest rate announcement will be on March 2, 2022.

Historical Mortgage Rates: 1971 To 2020

In 1971, the same year when Freddie Mac started surveying lenders, 30-year fixed-rate mortgages hovered between 7.29% to 7.73%. The annual average rate of inflation began rising in 1974 and continued through 1981 to a rate of 9.5%. As a result, lenders increased rates to keep up with unchecked inflation, leading to mortgage rate volatility for borrowers.

The Federal Reserve combated inflation by increasing the federal funds rate, an overnight benchmark rate that banks charge each other. Continued hikes in the fed funds rate pushed 30-year fixed mortgage rates to an all-time high of 18.63% in 1981. Eventually, the Feds strategy paid off, and inflation fell back to normal historical levels by October 1982. Home mortgage rates remained in the single-digits for much of the next two decades.

The mortgage rates trend continued to decline until rates dropped to 3.31% in November 2012 the lowest level in the history of mortgage rates. To put it into perspective, the monthly payment for a $100,000 loan at the historical peak rate of 18.63% in 1981 was $1,558.58, compared to $438.51 at the historical low rate of 3.31% in 2012.

This year, interest rates are expected to stay around 3.8%, according to Freddie Mac. This is good news for consumers as home prices continue to rise.

| Year |

|---|

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

This Months Economic Calendar

The next thirty days hold no shortage of market-moving news that will change the current mortgage rates trend. Notably, watch for the Fed meeting adjournment on September 20. Rates could swing wildly on an unexpected outcome.

- Thursday, August 31: Personal Income and Outlays

- Friday, September 1: Jobs Report, unemployment rate, wages

- Thursday, September 14: Consumer Price Index

- Tuesday, September 26: New Home Sales

- Tuesday, September 26: Fed Chair Janet Yellen speaks

- Friday, September 29: Personal Income and Outlays

Now could be the time to lock in a rate in case inflation ticks up this month.

Historical Basic Interest Rates

We have include the historical basic interest rate history in Australia since Sep-1998 because of the increased popularity. Basic products usually dont come with an offset account or linked credit cards but they also in many cases come with any ongoing fees. First Home Buyers are increasingly choosing basic products as its fits well with their requirements of low fees. Over a 30 years loan, the difference in fees between a basic product versus the full featured packaged product can total over $11,000.

Note the RBA stopped publishing the basic rates since Feb-2020.

Don’t Miss: Chase Recast Calculator

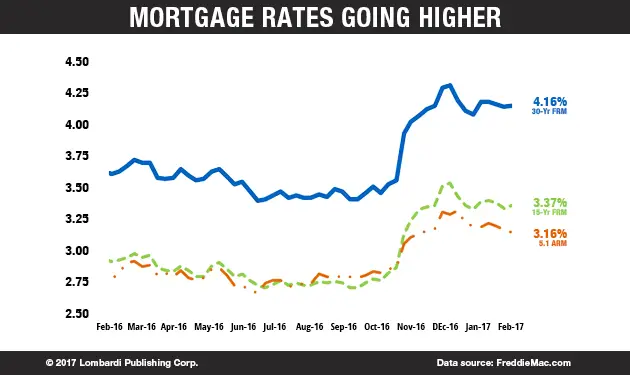

Which Way For Mortgage Rates In 2017

Following an avalanche of rate cuts, the mortgage industry should brace itself for a possible upward turn as lender costs and inflation rise, experts advise

The trend for mortgage rate cuts is coming to an end and both brokers and clients should prepare for hikes this year, according to industry experts.

Meanwhile, lending giants including HSBC, Nationwide Building Society and Yorkshire Building Society have taken the axe to rates and announced best-buy contenders in recent weeks, largely driven by strong competition. At the start of this month, Tesco Bank even launched what some have labelled the lowest-ever five-year fix, at 1.78 per cent with a £995 fee, for borrowers with at least a 40 per cent deposit or equity.

So just whats next for mortgage rates? And what will it mean for brokers and borrowers?

Base rateOn the base-rate front, although last autumn there was talk of further cuts to the historic-low rate of 0.25 per cent, in fact opinion has since swung the other way, with sentiment now suggesting the next change will be upwards. Depending on whom you believe, however, this could happen any time between now and 2019.

This market shift has led to a rise in swap rates which influence fixed-rate mortgages putting lenders under pressure through inflated funding costs.

As a result, Andy Knee, chief executive of conveyancing specialist LMS, thinks this yearwe could see the back of record-low rates.

How Historical Mortgage Rates Affect Refinancing

When mortgage interest rates slide, refinancing becomes more attractive to homeowners. A refinance replaces your current loan with a new loan, typically at a lower rate. The extra monthly savings could give you wiggle room in your budget to pay down other debt or boost your savings.

If the equity in your home has grown, you can tap it with a cash-out refinance and make home improvements. With this type of refinance, youll take on a loan for more than you owe. You can use the extra as cash to make home improvements or pay off other debt. Lower rates may help minimize the larger monthly payment.

When rates go up, theres less financial benefit to refinancing. Another caveat to refinancing, in general, is ensuring that you stay in your home long enough to recoup closing costs. To do this, divide the total loan costs by your monthly savings. The result tells you how many months it takes to recoup refinance costs, called the breakeven. The quicker you reach your breakeven, typically, the more cost-effective the refinance becomes.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Read Also: How Much Is Mortgage On 1 Million