The Va Interest Rate Reduction Refinance Loan

The is another refinance program which waives traditional home loan DebttoIncome requirements. Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W2s and pay stubs.

The VA Streamline Refinance is available to military borrowers who can show that theres a benefit to the refinance either in the form of a lower monthly payment or a change from an ARM to a fixedrate loan.

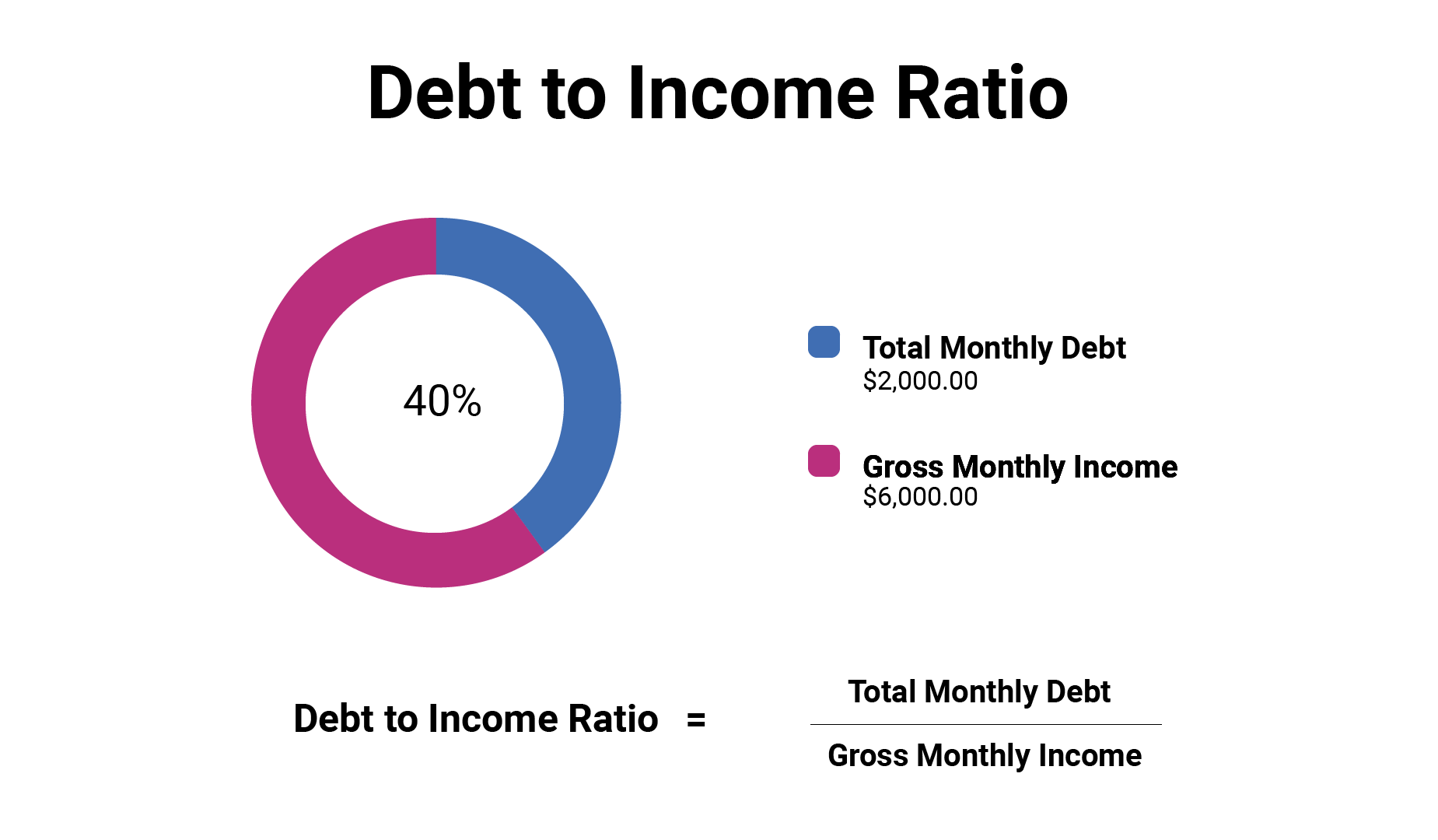

Calculate Your Dti Ratio

Divide your total monthly debt payments by your monthly net income. To convert this into a percentage, multiply it by 100 this number is your DTI ratio.

For example:

The DTI ratio youll need to qualify for a loan will depend on the type of loan you get as well as the lender. For example, if you want to take out a personal loan, your DTI ratio should be no higher than 40% though some lenders might require lower ratios than this.

If your DTI ratio seems to be in good shape and you want to apply for a personal loan, be sure to consider as many lenders as possible to find the right loan for you. Credible makes this easy you can compare your prequalified rates from multiple lenders in two minutes.

Ready to find your personal loan? Credible makes it easy to find the right loan for you.

- Free to use, no hidden fees

- One simple form, easy to fill out and your info is protected

- More options, pick the loan option that best fits your personal needs

- Here for you. Our team is here to help you reach your financial goals

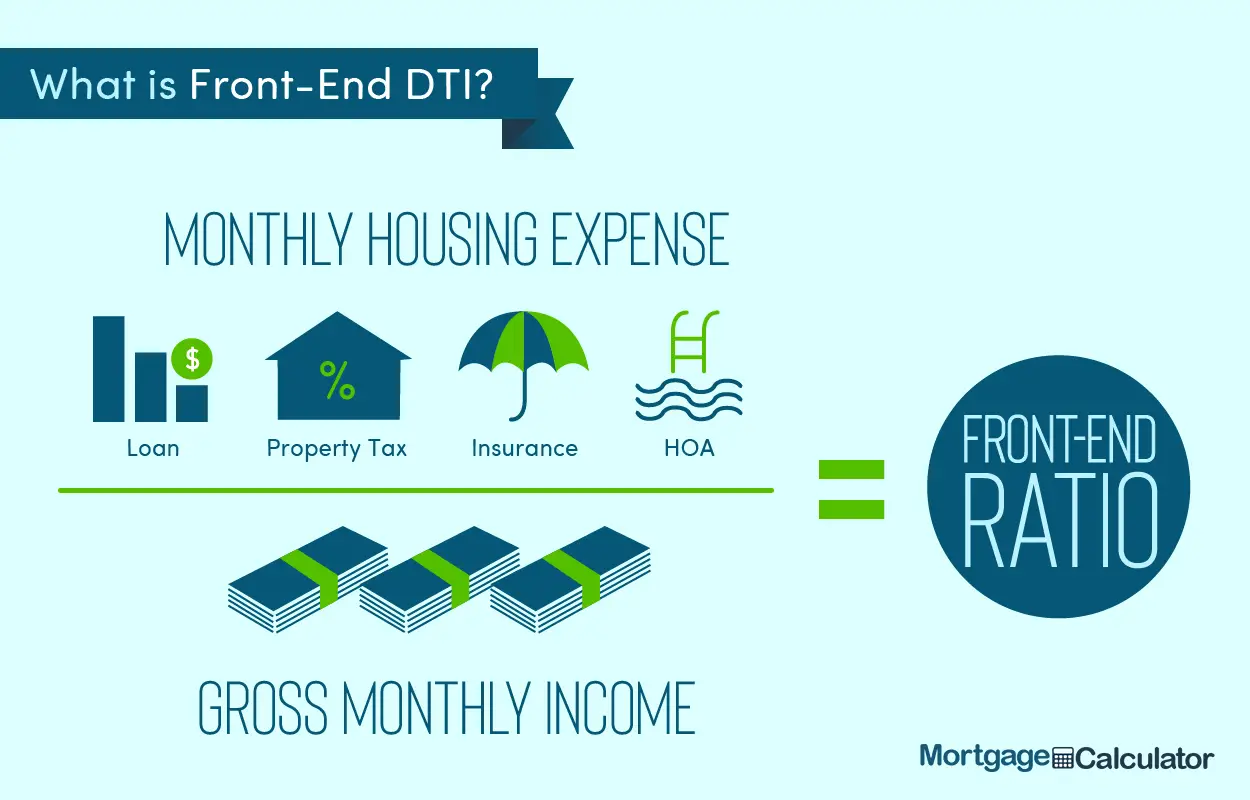

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Also Check: Bofa Home Loan Navigator

How To Calculate Your Income

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don’t Forget Your Spouse!

Your spouse’s income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.

Dti Limits For Key Loan Types

Here are the acceptable DTI ratios for conventional, FHA, VA, and USDA loans.

| Loan type |

| 44% or less |

Although the table above shows the maximum acceptable DTI ratios for different mortgages, keep in mind that different lenders have different standards for each loan program they offer. Also, some lenders may require a higher or lower DTI ratio, based on its underwriting guidelines, your credit score, down payment amount, and income.

You May Like: Rocket Mortgage Launchpad

How Can I Reduce My Debt

There are a number of ways that you can lower your debt-to-income ratio, including:

- Avoiding taking on more debt

- Paying off as much as you can on high-interest credit cards and consumer debt

- Closing unused credit card and loan accounts

- Not making any big purchases on credit prior to buying a home

- Increasing your income. Overtime, commission, bonus payments and wages from a second job or money earnt from freelance work can all reduce your debt-to-income ratio

These are merely a handful of the ways you could potentially reduce your debt-to-income ratio before applying for a mortgage. Make an enquiry to speak with an expert broker who can offer bespoke advice on the best course of action.

How Is The Debt

The debt-to-income ratio can be calculated using these two formulas:

Gross debt service ratio

This corresponds to the percentage of your gross income that goes towards housing fees for the home youâre looking to buy. Generally speaking, you need a GDS between 32% and 39% to get a loan, but your bank may require a lower ratio.

To calculate it:

1. Add up your monthly occupancy expenses: Mortgage payments + municipal taxes + school taxes + heating and electricity + 50% of the condo fees . 2. Multiply the total by 100. 3. Divide the new total by your gross monthly income.

Total debt service ratio

This is the percentage of your gross monthly income that goes towards housing fees for the home youâre looking to buy, in addition to your other debts. Your TDS shouldnât exceed 44%, but a lender may require a lower ratio. Usually, a TDS under 40% is good enough to get a loan.

To calculate TDS:

1. Add up your monthly occupancy expenses: Mortgage payments + municipal taxes + school taxes + heating and electricity + 50% of the condo fees . 2. Add your other monthly financial commitments to this total: Loans, typically 3% of the limit on each of your credit cards and lines of credit , child support and alimony, as well as any other debt payments. 3. Multiply the total by 100. 4. Divide the new total by your gross monthly income.

To calculate these ratios, you can use the Canada Mortgage and Housing Corporationâs debt service calculator.

Recommended Reading: Rocket Mortgage Vs Bank

What Is The Debt

Its a pretty simple concept.

Your debt-to-income ratio compares what you owe against what you earn. In mathematical terms, its the quotient of your monthly obligations divided by your monthly gross income: R = D/I, where D is your total debt, I is your total income, and R is your debt-to-income ratio.

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required, and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay.For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI.Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Your homeowners insurance premium

- Student loan minimum payment: $125

- $100

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

You May Like: Reverse Mortgage Mobile Home

The Debt Ratio Isnt The Only Issue

Dont focus solely on your debt ratio, though. Yes, its a big deal, but not the only one. The lender looks at the big picture. Think of your credit score and your employment history. You could have the best debt ratio but the worst credit score. You wouldnt qualify in this case. You could also have the best debt ratio but not have consistent employment. Each of these factors plays a role in your ability to secure a loan.

Lenders want to know that you can afford the loan, but also that you have good habits. A low credit score shows that you dont pay your bills on time. It could also mean you overextend yourself. There are many variables that play into your credit score. The key is not focusing on one factor, but looking at the big picture.

Knowing how lenders calculate the debt to income ratio can help you get a head start. If you know your debt ratio is high, you can work it down. Start paying debts off or figure out how to increase your income. Maybe you need a 2nd job for a while. Youll need it for at least 6 months before a lender can use the income. But it might be just enough to help push you into the approval zone.

How To Calculate Debt

Just like physical health, financial health turns on a slew of different factors, some more important than others. Its tough for nonexperts to keep track of them all.

While you dont need encyclopedic knowledge of all the components of a good credit score or the considerations involved in loan underwriting decisions, it doesnt hurt to know what pleases lenders and what turns them off.

Besides your credit score itself, the one metric worthy of further investigation is your debt-to-income ratio.

Its hard to overstate debt-to-incomes centrality to the underwriting process. If your ratio is too high, youll find it very difficult to secure personal loans and other types of credit at reasonable rates. That can have serious ramifications for your lifestyle and personal financial health, some of which well discuss in greater detail below.

average return of 618%

Heres what you need to know about the debt-to-income ratio: how its calculated, why it matters, its limitations as an indicator of financial health, and what you can do to improve your personal or household ratio.

Read Also: Rocket Mortgage Loan Types

Dti And Your Mortgage

Lenders must evaluate your financial health before deciding to give you a loan to make sure you will be able to repay it. When your DTI is evaluated, lenders typically dont want to see anything too much higher than 43%, though there are exceptions. You can sometimes still get a loan with a high DTI, but you will likely need to have other factors working in your favor to balance out the larger amount of debt, such as a significant amount of savings or a high credit score.

If your DTI is low enough to qualify you for a loan but still on the higher end, keep in mind that you might qualify for higher interest rates than someone with less debt. The lower your score, typically, the better loan you will qualify for.

If Your Dti Is Between 36% And 50%

A DTI between 36% and 50% is still considered OK for the most part you can likely still qualify for a loan fairly easily with a DTI ratio in this range. If your DTI is closer to 50%, however, it may require taking action to reduce debt if you plan on applying for a mortgage soon and hope to get a favorable rate.

If you can afford to do so, you should practice strategies like the snowball method to attempt to pay down some of your debts before applying. While you may have no issues getting a loan, getting rid of some of your debts might help you achieve a lower interest rate going forward.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

Personal Loans And Auto Loans

With personal loans and car loans, you might be able to qualify for financing with a DTI ratio higher than the typical 43% cap for a qualified mortgage. But you should pay close attention to your interest rate and monthly payment to make sure its affordable for you.

Wells Fargo, for example, says that if you have a DTI of 35% or less, youre probably in pretty good shape.

How To Lower Your Debt

To improve yourDTI ratio, the best thing you can do is either pay down existing debt or increase your income.

While paying down debt, avoid taking on any additional debt or applying for new credit cards. If planning to make a large purchase, consider waiting until after you’ve bought a home. Try putting as much as you can intosaving for a down payment. A larger down payment means you’ll need to borrow less on a mortgage. Use aDTI calculator to monitor your progress each month, and consider speaking with a lender toget pre-qualifiedfor a mortgage.

Recommended Reading: How Much Is Mortgage On 1 Million

What Percentage Of Your Income Should Your Mortgage Be

Calculating the percentage of income for your mortgage payments will help you understand exactly how much you can afford to spend. Buying real estate via a mortgage is the largest personal investment that most people make in their lifetime.

For this reason, working out how much you can comfortably borrow depends on several factors. Its not just a question of how much the bank is willing to lend you. Factors such as the mortgage percent of your net income , finances, priorities, and preferences are all part of the equation.

As a general rule, most prospective homeowners can finance a property that costs anywhere between two and two-and-a-half times their gross annual income . Now, lets imagine that you earn $100,000 per year. This would mean that you can afford a mortgage between $200,000 and $250,000. However, this calculation is only a general guideline.

Ultimately, when you consider buying a property, there are several essential factors to consider. Primarily, you need to have a good idea of the amount your lender thinks you can afford . Next, it helps to take a personal inventory and think about the type of home where you would like to live. If you plan to live in your new home for many years, what sort of things will you be willing to trade-offor notto afford your dream home?

Dti Formula And Calculation

The debt-to-income ratio is a personal finance measure that compares an individuals monthly debt payment to their monthly gross income. Your gross income is your pay before taxes and other deductions are taken out. The debt-to-income ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments.

The DTI ratio is one of the metrics that lenders, including mortgage lenders, use to measure an individuals ability to manage monthly payments and repay debts.

Total of Monthly Debt Payments Gross Monthly Income \begin & \text = \frac } } \\ \end DTI=Gross Monthly IncomeTotal of Monthly Debt Payments

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences.

The debt-to-limit ratio, which is also called the , is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

Speak To A Mortgage Expert About Debt

If you have questions and want to speak to an expert for the right advice, make an enquiry.

The expert brokers we work with are whole-of-market, meaning that they can find the best deals for you from a wide selection of mortgage lenders.

We dont charge a fee, theres no obligation to invest, and there are no marks made against your credit rating.

Ask a quick question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

Maximise your chances of approval, whatever your situation. Find your perfect mortgage broker

How Do You Calculate Your Debt

Now that you know what a debt-to-income ratio is, how do you go about calculating it? Thankfully, it is a fairly simple process and shouldnt take you that long at all to figure out. It is calculated by dividing the debt payments you make each month by how much money you make each month, the number is normally presented as a percentage.

For example, if you make $4,000 a month and have debt that includes a $1,000 mortgage payment and a $500 car loan payment, you will have a debt-to-income ratio of 37.5%. So, the calculation we made for that was $1,500 divided by $4,000 . We got .375, and then we turn that number into a percentage and get 37.5%!

But the question you are probably asking is what does that number mean? If you have a low DTI ratio, you have a good balance between debt and income and are in no real danger of not being able to keep up with your debt, even if an emergency comes up. However, if you have one that is high, it can sometimes signal that you are carrying too much debt for how much money you are making. Also, having a high DTI ratio can simply make it hard for you to pay bills every month with so much of your income going to your debt payments.

Is your car loan payment worth more than your car? Heres what to do.

What is a Good Debt-to-Income Ratio?

Interested in getting serious about paying down your debt? Check out this infographic.

Recommended Reading: Can You Refinance A Mortgage Without A Job