Open Mortgages Vs Closed Mortgages

With an open mortgage, youre able to prepay any amount of your mortgage at any time without facing a prepayment penalty. The compromise for having an open mortgage is that interest rates are higher to make up for the flexibility of being able to pay it off at any time.

With a closed mortgage, on the other hand, the interest rate is more attractive than a closed mortgage because youre limited by how much extra you can pay towards your mortgage each year. So, the compromise here is that youll face a prepayment limit. This means that youre only permitted to pay a certain percentage of your original or current balance per year often 15%, on average, but this varies between lenders. If you have the choice, be sure to always opt for the original balance prepayment option as it will enable you to pay off more in a year. And if you choose to pay more than your annual limit, youll receive a prepayment penalty. Its important, therefore, to be aware of your limits and stay within them.

What’s The Best Loan Term

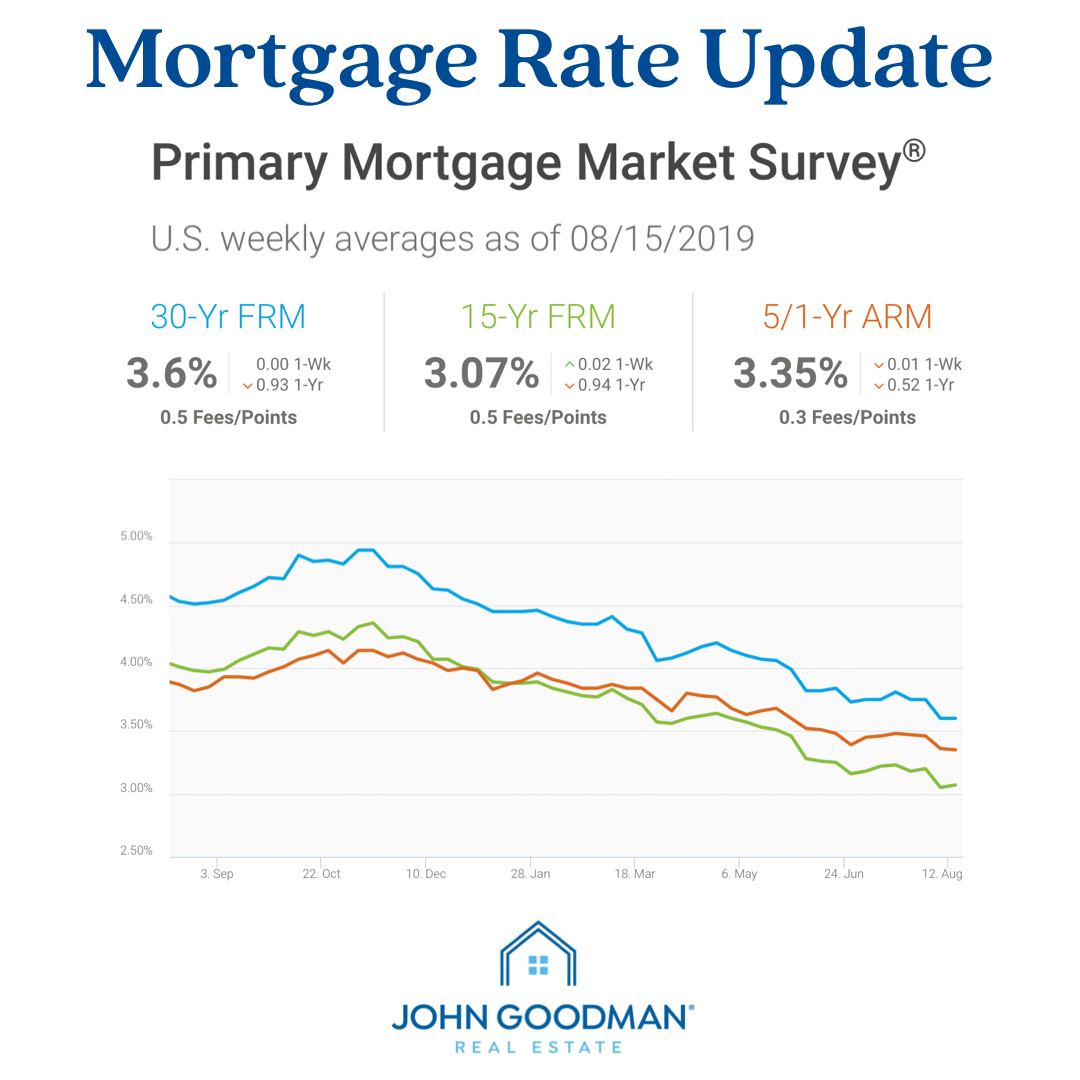

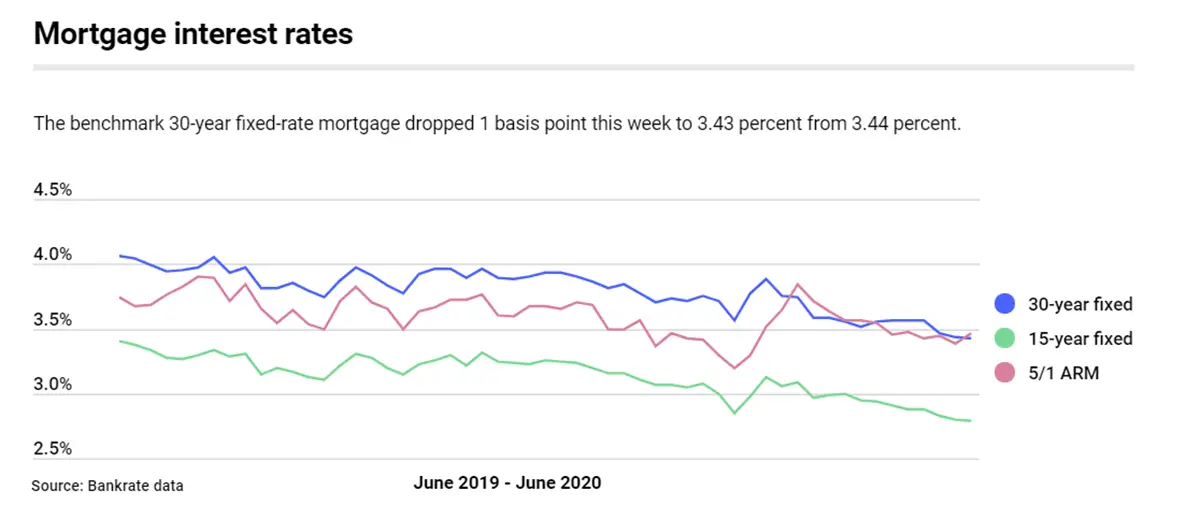

One important thing to consider when choosing a mortgage is the loan term, or payment schedule. The mortgage terms most commonly offered are 15 years and 30 years, although you can also find 10-, 20- and 40-year mortgages. Another important distinction is between fixed-rate and adjustable-rate mortgages. For fixed-rate mortgages, interest rates are stable for the life of the loan. For adjustable-rate mortgages, interest rates are set for a certain number of years , then the rate changes annually based on the market rate.

One important factor to consider when choosing between a fixed-rate and adjustable-rate mortgage is how long you plan on staying in your house. For those who plan on living long-term in a new house, fixed-rate mortgages may be the better option. While adjustable-rate mortgages may offer lower interest rates upfront, fixed-rate mortgages are more stable in the long term. If you don’t have plans to keep your new home for more than three to 10 years, however, an adjustable-rate mortgage might give you a better deal. There is no best loan term as a general rule it all depends on your goals and your current financial situation. Make sure to do your research and know what’s most important to you when choosing a mortgage.

Find the Best Refinance Rates with the CNET Rate Alert

Bank Of Canada Keeps Policy Rate Unchanged Against Expectations

The Bank of Canada announced on January 26th, 2022 that they will be holding their policy interest rate at 0.25%. Other highlights include:

- There is no change to prime rates at Canadas major banks

- CPI inflation is expected to average 4.2% for 2022 before decreasing to an average of 2.3% for 2023

- The Bank of Canada made it clear that interest rates will rise in the future

There is no change to the Bank of Canadas policy interest rate in spite of high inflation and strong GDP growth. This means that there will be no change to the prime rates at Canadas major banks. Instead, the Bank of Canada has now made it clear that rate hikes are in the cards for the rest of 2022.Scotiabank’s latest interest rate forecastpredicts that the Bank of Canada’s policy rate will end off the year at 2.00%, a significant increase from the current policy rate of 0.25%. The next interest rate announcement will be on March 2, 2022.

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

Best Mortgage Rates In Canada

- home equity line of credit

| Rate |

|---|

-

Answer a few quick questions and see the lowest rates you can qualify for.

-

Apply online

Apply for your mortgage instantly and easily using our secure online application.

-

Connect with our mortgage advisors

Questions or comments? Book a call and one of our mortgage advisors will walk you through all the details

The Beginnings Of Canada’s Central Bank In 1935

The Bank of Canada was created as part of the Bank of Canada Act in 1935. It was recommended by the Royal Commission in response to the economic conditions of the Great Depression. In March 1935, the Bank of Canada was opened to the public as a private institution with shares sold to public investors. It was quickly nationalized as a public institution by an amendment to the Bank of Canada Act in 1938.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

What Are The Types Of Mortgages: Fixed Vs Variable

A variable mortgage rate fluctuates based on the so-called prime rate, a benchmark lenders usually adjust based on movements in the Bank of Canadas trendsetting overnight rate. When rates rise, homeowners pay more in interest. However, not everyone will see their monthly payments increase when rates climb. Some variable-rate mortgages keep payments steady up to a certain threshold even as the interest rate moves up. Instead, these borrowers will see their amortization period extended in response to higher rates, meaning it will take longer to pay off the mortgage. You can also lock into a fixed interest rate at any time, without breaking the mortgage contract and if you break the contract with a variable rate, the penalty is often much lower.

A fixed interest rate mortgage typically locks in payments for a set term of two to five years. Fixed rates are often higher than variable, but offers peace of mind to homeowners their mortgage payments will be consistent for the years to come. It is not possible to switch from a fixed to variable rate without breaking the mortgage contract .

Mortgage Rate Predictions For Late 2021

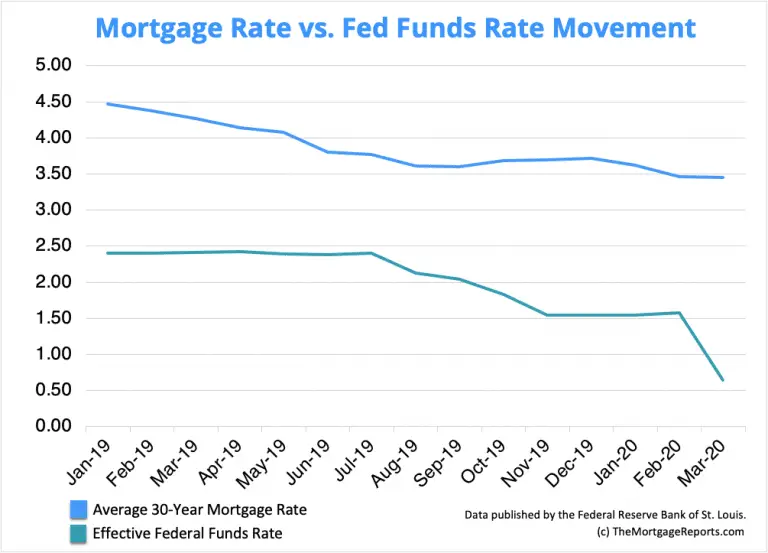

Most industry pros expect mortgage rates to rise modestly through December 2021 and into 2022.

Fannie Mae, NAR, and the Mortgage Bankers Association all agree 30-year fixed mortgage rates should average around 3.10% in the fourth quarter of 2021.

Others, like Freddie Mac and the National Association of Home Builders, think mortgage rates will continue to rise, hitting averages of 3.20% or higher by the end of December.

| Housing Authority |

Mortgage rates are moving away from the record-low territory seen in 2020 and 2021.

But keep in mind that rates are still ultra-low from a historical perspective.

Just three years ago, in November 2018, 30-year rates were at nearly 5 percent . And in November of 2019 they were averaging between 3.5 and 4.0%.

So if you havent locked a rate yet, dont lose too much sleep over it. There are still great deals to be had especially for borrowers with strong credit.

Just make sure you shop around to find the best lender and lowest rate for your unique situation.

Don’t Miss: Rocket Mortgage Vs Bank

What Else Can Canadians Expect In The 2022 Mortgage Market

Robert McLister offered some insights for the year ahead. In addition to rate increases, he suggested there will be new restraints on lending, such as increasing the minimum down payment for investors from 20 per cent to between 25 and 35 per cent. New restrictions, combined with other factors, could lead to a growth in housing inventory and a slowdown in the rate of mortgage growth.

With reports from Erica Alini, Rob Carrick, Jessie Willms and Robert McLister.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. .

Selecting A Mortgage Term

Choosing between a short-term mortgage or a long-term mortgage can also affect your interest rate. A short-term mortgage generally offers a lower rate, and, as it requires more frequent renewal, you can benefit from lower interest rates when you renew, if rates stay low at your renewal. Long-term mortgages, on the other hand, offer stability, as you wonât need to renew it often. However, long-term mortgage holders may not be able to take advantage of lower interest rates if the market fluctuates.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

How Do I Compare Mortgage Rates In Canada

When comparing mortgage rates in Canada, its important to look at similar terms and mortgage types to ensure youre measuring similar products and not looking solely at rates. Mortgage rates and features vary by lender so, in order to gain an accurate comparison, you have to look at similar offerings.

Know Your Adjustment Period

In order to determine whether an ARM is a good fit, borrowers have to understand some basics about these loans. In essence, the adjustment period is the period between interest rate changes. Take, for instance, an adjustable-rate mortgage that has an adjustment period of one year. The mortgage product would be called a 1-year ARM, and the interest rateand thus the monthly mortgage paymentwould change once every year. If the adjustment period is three years, it is called a 3-year ARM, and the rate would change every three years.

There are also some hybrid products like the 5/1 year ARM, which gives you a fixed rate for the first five years, after which the interest rate adjusts once every year.

Also Check: Requirements For Mortgage Approval

Year Mortgage Rate Forecast For 2021 2022 2023 2024 And 2025

| Month |

| 31.1% |

30 Year Mortgage Rate forecast for .Maximum interest rate 3.14%, minimum 2.96%. The average for the month 3.05%. The 30 Year Mortgage Rate forecast at the end of the month 3.05%.

Mortgage Interest Rate forecast for .Maximum interest rate 3.07%, minimum 2.89%. The average for the month 3.00%. The 30 Year Mortgage Rate forecast at the end of the month 2.98%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.02%, minimum 2.84%. The average for the month 2.94%. The 30 Year Mortgage Rate forecast at the end of the month 2.93%.

Mortgage Interest Rate forecast for .Maximum interest rate 2.98%, minimum 2.80%. The average for the month 2.90%. The 30 Year Mortgage Rate forecast at the end of the month 2.89%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.10%, minimum 2.89%. The average for the month 2.97%. The 30 Year Mortgage Rate forecast at the end of the month 3.01%.

Mortgage Interest Rate forecast for May 2022.Maximum interest rate 3.25%, minimum 3.01%. The average for the month 3.11%. The 30 Year Mortgage Rate forecast at the end of the month 3.16%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.37%, minimum 3.16%. The average for the month 3.24%. The 30 Year Mortgage Rate forecast at the end of the month 3.27%.

Mortgage Interest Rate forecast for .Maximum interest rate 3.42%, minimum 3.22%. The average for the month 3.31%. The 30 Year Mortgage Rate forecast at the end of the month 3.32%.

How Often Does A Prime Rate Change

Related Articles

The prime rate is a key interest rate that is published daily in the pages of the “Wall Street Journal,” an authoritative source for financial news, stock market prices and economic statistics. Banks, credit-card companies and other lending institutions use the prime rate as a benchmark for the interest rates they charge customers. As a result, the prime rate is one of the most important indicators of the cost of borrowed money.

You May Like: Who Is Rocket Mortgage Owned By

Take A Look At Our Mortgage Payment Calculator And Learn How Much Home You Can Afford

With a 30 year fixed mortgage, borrowers have the advantage of knowing the mortgage payments they make each month will never increase, allowing them to budget accordingly.

Each monthly payment goes towards paying off the interest and principal, to be paid in 30 years, thus these monthly mortgage payments are quite lower than a shorter-term loan. You will, however, end up paying considerably more in interest this way.

Save More By Shopping Around

Mortgage lenders are still offering historically low rates to good borrowers. But theres a catch.

You cant just look for the lowest rate advertised online. Because the rates lenders advertise arent available to everyone.

Those offers typically represent borrowers with perfect credit, 20% down or more, and a sterling credit history.

Those criteria wont apply to everyone. The rate youre actually offered depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment

- Your home equity

- Your loan-to-value ratio

- Your debt-to-income ratio

To figure out what rate a lender can offer you based on those factors, you have to fill out a loan application. Lenders will check your credit and verify your income and debts, then give you a real rate quote based on your financial situation.

You should get 3-5 of these quotes at minimum. Then compare them to find the best offer.

Look for the lowest rate, but also pay attention to your annual percentage rate , estimated closing costs, and discount points extra fees charged upfront to lower your rate.

This might sound like a lot of work. But you can shop for mortgage rates in under a day if you put your mind to it. And shaving just a few basis points off your rate can save you thousands.

Don’t Miss: Chase Recast Mortgage

Today’s Average Rates For Jumbo Loans

| Program | |

|---|---|

| 3.17% | -0.15% |

A 30-Year Fixed Jumbo loan of $600,000 at 3.84% APR with a $150,000 down payment will have a monthly payment of $2,809. A 20-Year Fixed Jumbo loan of $600,000 at 3.93% APR with a $150,000 down payment will have a monthly payment of $3,613. A 15-Year Fixed Jumbo loan of $600,000 at 3.46% APR with a $150,000 down payment will have a monthly payment of $4,277. A 10-Year Fixed Jumbo loan of $600,000 at 3.56% APR with a $150,000 down payment will have a monthly payment of $5,950. A 7/1 ARM Jumbo loan of $600,000 at 3.31% APR with a $150,000 down payment will have a monthly payment of $2,630. A 5/1 ARM Jumbo loan of $600,000 at 3.22% APR with a $150,000 down payment will have a monthly payment of $2,599. A 3/1 ARM Jumbo loan of $600,000 at 3.31% APR with a $150,000 down payment will have a monthly payment of $2,631. All monthly payments displayed assume a maximum Loan to Value of 80% and 740 credit score, and do not include amount for taxes and insurance. The actual monthly payment may be greater.

What Mortgage Can You Afford

Getting a mortgage is one thing being able to carry monthly payments without being house rich but cash poor is another. Big monthly expenses like daycare, car loans, emergency funds and saving for retirement or your childrens education dont disappear when youre a homeowner, so plan for those expenses while looking for a loan. Use Rob Carricks Real Life Ratio calculator to see how much in monthly payments you can comfortably afford.

Read Also: 10 Year Treasury Yield Mortgage Rates

Will House Prices Go Down In 2022

The current housing boom will flatten in 2022or possibly early 2023when mortgage interest rates rise. There is no bubble to burst, though prices may retreat from panic-buying highs. But this has not been a bubble. A bubble is not simply rising prices, but demand not justified by fundamental economic factors.

How Does Your Credit Score Affect Your Rate

Aside from macroeconomic factors that are out of your control, your personal situation will also influence the interest rate youre eligible for. Your down payment and credit score can have a big impact on your mortgage rate.

Lenders set mortgage rates based on how risky they determine a loan to be. So having a lower credit score, or smaller down payment will increase the rate youre likely to qualify for. On the other hand, improving your credit score and having a bigger down payment can have the opposite effect and reduce your interest rate. While each lender has different standards, having a down payment of at least 20% and a credit score of 700 to 740 will typically get you the lowest mortgage rate.

If youre having trouble qualifying for a mortgage or getting a decent interest rate, you may have better luck with a government-secured loan. Certain mortgages are backed by the different departments of the federal government and are considered less risky by lenders. There are loans guaranteed by the Federal Housing Administration , Department of Veterans Affairs , and the Department of Agriculture .

Also Check: 70000 Mortgage Over 30 Years

What Affects Mortgage Interest Rates

Mortgage ratesFactorsaffectinterest rateAlthough every situation is different, I would recommend refinancing your mortgage if:

Here’s how to get the best mortgage rate:

Interfirst Mortgage Company: Best Non

Interfirst Mortgage Company is a combo-direct mortgage lender, wholesale lender and correspondent lender.

Strengths: Interfirst has an A- rating from the Better Business Bureau and high marks from borrowers on Bankrate and elsewhere. Plus, with its multiple business channels, the lender can offer several loan options for many types of borrowers.

Weaknesses: Interfirst isnt licensed in every state, and if youre trying to compare mortgage rates, you might have a harder time, since this lender doesnt showcase rates publicly on its website.

> > Read Bankrate’s full Interfirst Mortgage Company review

Recommended Reading: Chase Mortgage Recast

Can I Change My Mortgage Rate After Locking

Yes, you can change lenders after locking a rate. But youll have to start the application process over with your new lender. That means getting pre-approved, submitting all your documents, and waiting for underwriting twice. All in all, closing a mortgage or refinance usually takes more than a month.