Getting A Mortgage In Georgia

If youre considering a move to Georgia, there are several different cost factors you need to weigh before making your move. First, the median home price in the state is just under $40,000 lower than the current national average. Mortgage rates are also slightly below the national average, meaning that mortgage costs should be lower for the life of the loan.

The median monthly homeownership cost for people with mortgages is about $200 lower than the current national average, which could amount to several thousands of dollars in savings throughout the year, and according to a study posted by Housing Wire in 2019, Georgia ranked 20th in the country for the lowest average mortgage rates.

- Median home price: $166,800

- Average 30-year fixed rate: 3.52%

- Median monthly ownership cost: $1,383

- Homeownership rate: 63.1%

*Rates and data as of May 5, 2020. Assuming 3.72% APR national average on a 30-year fixed-rate mortgage.

Mortgage Payments By City

Especially in coastal cities where space is at a premium, a monthly home payment can be much higher than the national average or median payment. According to US Census Bureau data from the 2018 American Community Survey, the median monthly home payment was more than $2,500 per month in Los Angeles, and over $2,700 per month in the New York City area.

But, not all metro areas are as expensive in Phoenix, Arizona, the median home payment is about $1,500 per month, and about $1,700 per month in Dallas. Here’s how the most populated metro areas stack up in monthly living costs according to Census Bureau data. Cities are listed by size.

| City |

| $253,300 |

Salt Lake County Utah

- Median monthly mortgage payment in 2021: $1,705

- Median monthly mortgage payment in 2019: $1,298

- Median home value in 2021: $449,365

- Median home value in 2019: $304,300

- 2020 county population: 1,185,238

Salt Lake Countyhome to Salt Lake City, South Salt Lake, and other citiesis the most populous county in the state. Its also grown by leaps and bounds%2C%20one,occupied%20by%20Millcreek%20in%202010. “external” over the last few years.

As the thriving economy draws in more new residents to Salt Lake City, housing has been at a premium, and the 2021 median home value reflects that. Some prospective buyers in the area have even taken to sending cover letters and even love letters to stand out from competing bidders.

Recommended Reading: Mortgage Rates Based On 10 Year Treasury

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Total Interest Paid On A $150000 Mortgage

Longer-term loans will always come with more interest costs than loans with shorter lifespans. For example, a 15-year, $150,000 mortgage with a 4% fixed rate would mean spending $49,715 over the course of the loan. A 30-year mortgage with the same terms, however, would cost $107,804 in interest nearly $60,000 more once all is said and done.

Enter your loan information to calculate how much you could pay

Learn: How to Buy a House: Step-by-Step Guide

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

Historical Mortgage Rates In Georgia

Georgia Mortgage Rates Quick Facts

- Median Home Value: $202,500

- Loan Funding Rate: 53.68%

- Homeownership Rate: 67.3%

- Median Monthly Homeownership Costs: $1,417

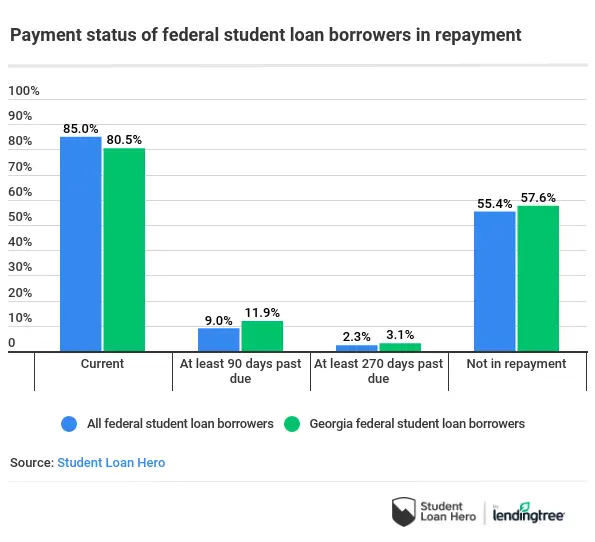

Georgia rates have historically followed closely to national averages. Homeownership costs are also fairly low on a national scale, as Georgia’s median is roughly $200 below the U.S. mark.

A financial advisor in Georgia can help you plan for the homebuying process. Financial advisors can also help with investing and financial plans, including tax, retirement and estate planning, to make sure you are preparing for the future.

What’s The Average Mortgage Payment Per Month

4.2/5average monthly mortgage paymentpaymenttypicalmonthly income

Keeping this in consideration, what is the average mortgage payment on a 300 000 House?

Based on their mortgage calculator it seems reasonable to look at houses up to about $300,000. Their calculator estimates the monthly payments to be about $1500 a month for this price. We will be making about $50,000 a year plus about $20,000ish for a down payment.

Subsequently, question is, how much house can I buy for 1500 a month? Formula for Income to Afford a Home Mortgage Payment

| Mortgage Principal |

|---|

| $1,491 |

Also Know, what is a reasonable mortgage payment?

One rule of thumb says that most homeowners can afford a property that’s between 2 and 2 ½ times their annual gross income. Some experts take the position that you should spend no more than 28 percent of your gross income on your mortgage payment, including principal, interest, taxes and insurance.

How much do I need to make for a 250k mortgage?

To afford a house that costs $250,000 with a down payment of $50,000, you’d need to earn $43,430 per year before tax. The monthly mortgage payment would be $1,013. Salary needed for 250,000 dollar mortgage.

| Month |

|---|

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

Average Mortgage Payments In The Us

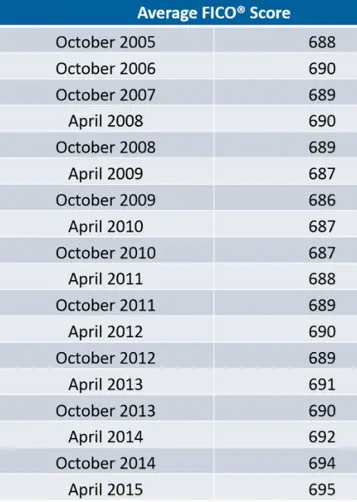

Monthly mortgage payments are largely determined by the size of a loan. In general, high-income consumers who take out bigger mortgages will pay more in lifetime interest than lower-income consumers. Still, smaller loans generally have the higher interest rates, as do loans drawn by borrowers with poor credit scores. As expected, higher interest rates also lead to larger monthly payments as a whole.

Interfirst Mortgage Company Best For Refinancing

This Chicago-based lender can issue a preapproval in one day and help you close your loan in 45 days. While its a good option for new purchase loans, we think its an especially good pick for refinancing due to its lack of lender fees. Youll still have to pay standard closing costs, but the no-fee policy means youll be a bit closer to the break-even point.

Strengths: No lender fees all-online process

Weaknesses: Must have at least a 620 credit score to qualify doesnt advertise refinance rates online

Read Bankrate’s Interfirst Mortgage Company review

Read Also: Rocket Mortgage Payment Options

How Much Money Does A Mortgage Payment Processing Clerk Make In Georgia

Average Monthly Salary3,990

A person working as a Mortgage Payment Processing Clerk in Georgia typically earns around 2,590 GEL per month. Salaries range from 1,320 GEL to 3,990 GEL .

This is the average monthly salary including housing, transport, and other benefits. Mortgage Payment Processing Clerk salaries vary drastically based on experience, skills, gender, or location. Below you will find a detailed breakdown based on many different criteria.

Haakon County South Dakota

- Median monthly mortgage payment in 2021: $444

- Median monthly mortgage payment in 2019: $319

- Median home value in 2021: $117,138

- Median home value in 2019: $74,700

- 2020 county population: 1,872

Home values in Haakon Countya county with a population of less than 2,000have historically been well below the national average. While prices have rapidly increased over the last two years, that still holds true.

Over the last two years, buyers, enticed by extremely low mortgage rates during the pandemic, caused a nearly 60% uptick in home prices in this county. Haakon County homeowners are now paying a lot more, on average, for their mortgage payments every month with the median monthly mortgage payment up by about 40% compared to 2019.

Also Check: Bofa Home Loan Navigator

Breakdown Of The Average Mortgage Payment

In 2015, the average American homeowner spent about $1,800 on paying down the principal on their loans and nearly $8,000 on mortgage interest and related charges, a combined monthly average of about $820. The bulk of each payment is split between paying interest and paying principal. As time goes by, the portion of money going towards interest decreases while the amount put towards reducing principal increasesa process called amortization.

Counties Where Mortgage Payments Have Jumped The Most In The Past Two Years

From tiny coastal towns in Maine to massive California metros, the national housing market has been roaring since the start of the pandemic. What started with an uptick in buying after mortgage rates fell to record lows quickly became a home-buying frenzy as the shift to remote work took hold. Buyers, suddenly free to work from any location, began snatching up homes in nearly every market and leaving housing shortages and vastly increased home prices in their wake.

Were now nearly two years into the global pandemic, but thus far, the frantic home-buying trends we saw at the start of the public health crisis have persisted. Most markets are still experiencing severe housing shortagesand while there have been bids to build more housing, the ongoing supply chain issues have made it nearly impossible to meet the increased demand.

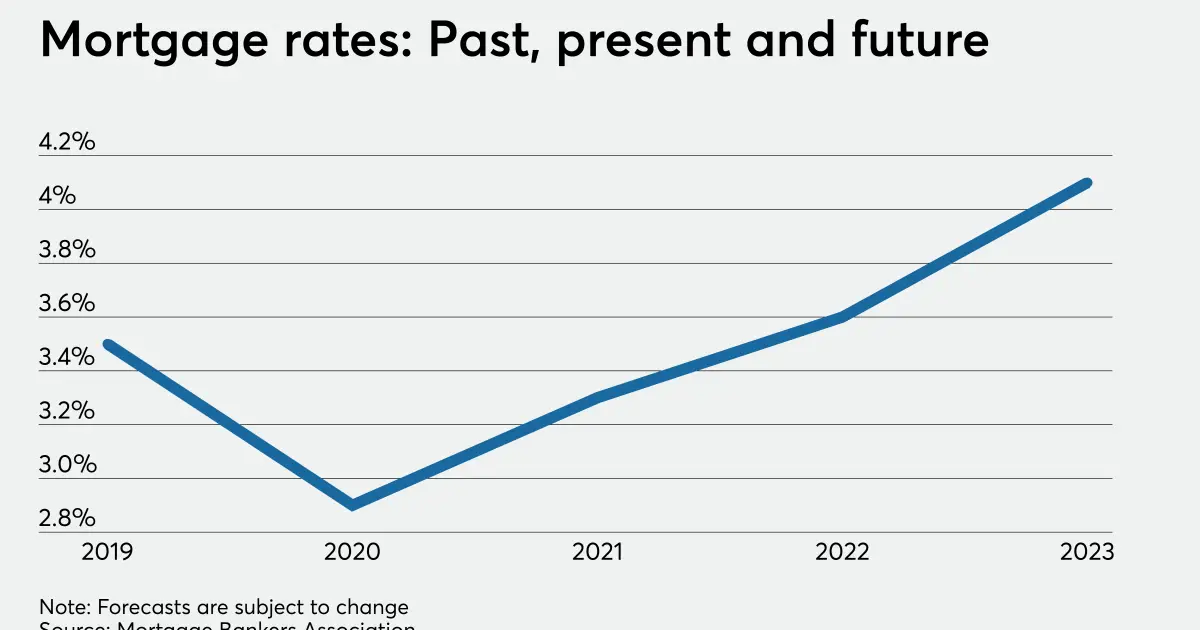

That said, there are signs that some of the frenzied home buying has started to slow. But while things may cool off a bit more over the next few months, the slower housing market pace may not translate to cheaper home prices. In fact, future homebuyers could be in for a surprise as home prices are expected to stay high until well into 2022. Purchasing a home will become even more expensive if predictions of rising interest and mortgage rates from inflation materialize.

Recommended Reading: Rocket Mortgage Loan Requirements

Buying A Home In Georgia

If youre tempted to save on your home inspection fee when youre buying a home in Georgia, you probably shouldnt. The law over what the seller must disclose to you is a bit confused.

In theory, Georgia subscribes to the caveat emptor principle when it comes to real estate transactions. In other words, the buyer purchases the place as-is and the seller is not obliged to say a word about any defects or issues.

Thats the position of Georgia statute law. But some Georgia courts have found sellers do have duties to disclose material defects. And its standard practice for sellers to provide such disclosures on a special form drawn up by the Georgia Association of Realtors.

Even in states with clear statutory obligations to disclose, its often a good idea to have a home inspection. After all, owners may not know of some defects , which relieves them of their legal duty to disclose.

A couple of insurance issues when youre buying a home in Georgia:

That could add up to a lot of money.

Whats The Average Mortgage Payment

We dont want to waste your time, so lets get down to business. The median monthly mortgage payment is just over $1,600, according to the U.S. Census Bureau.1 That can vary of course, based on the size of the house and where you live, but thats the ballpark number.

If youre the kind of person who doesnt need to know how we came up with the number $1,600, feel free to skip to the next section. But if you want more detailsincluding how to calculate your own average paymentread on!

You May Like: Chase Mortgage Recast

Fairway Independent Mortgage Corporation Best For Va Loans

While many lenders have shifted to an all-online approach, Fairway Independent Mortgage Corporation continues to maintain a nationwide network of more than 400 branch locations to offer in-person assistance to borrowers. This lender is one of the main names in lending to military servicemembers, veterans and their spouses: In 2020, it funded more than 17,000 VA loans for a total of more than $5.6 billion.

Strengths: 40-plus locations across Georgia mobile app offers easy application tracking and document uploading A+ rating from the Better Business Bureau

Weaknesses: Doesnt advertise mortgage rates or list borrower requirements online

Read Bankrate’s Fairway Independent Mortgage Corporation review

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Recommended Reading: Recasting Mortgage Chase

Georgia / All Professions

The term ‘Annual Salary Increase’ usually refers to the increase in 12 calendar month period, but because it is rarely that people get their salaries reviewed exactly on the one year mark, it is more meaningful to know the frequency and the rate at the time of the increase.

How to calculate the salary increment percentage?

The annual salary Increase in a calendar year can be easily calculated as follows: Annual Salary Increase = Increase Rate x 12 ÷ Increase Frequency

2%

Mortgage Payments By Income

Just like the average mortgage payment in Utah is different from payments elsewhere, this segment varies by income, as well. According to the data provided by the US Census Bureau, Americans making the most money have the highest average house payments per month. People from this income group, interestingly, dont have the highest median interest rate.

The highest mortgage interest rates are reserved for Americans making between $10,000 and $39,999. Those from the $10,000-19,999 income group are among the consumers paying the highest interest rate. Yet, they boast the lowest typical mortgage payment per month.

As you can see in the table above, households making $120,000 or more pay the highest median mortgage of about $1,600. Those making $10,000-19,999 meanwhile pay the lowest median mortgage payment per month of $607.

The difference between the highest and lowest median payments is an impressive $993. The first group gets better median rates of 4%, while the latters median mortgage rate is 5%.

You May Like: Can You Refinance A Mortgage Without A Job

Georgia State Mortgage Resources And Intricacies

Buyers looking to get into Georgia may want to check out the HUD website for Georgia or the states website on government assistance for homebuyers. Realtors or mortgage brokers licensed in the state can also help you understand everything you need to know about buying, refinancing or applying for a mortgage.

Property taxes in the state of Georgia came in ranked 27th most expensive, with a tax rate of 0.94%, according to a study published in 2019 by USA Today. Be aware that property taxes may vary by county and city, so take time to understand what you may be paying if you purchase a home in certain parts of Georgia.

Average Monthly Mortgage Payment Affordability

On average, homeowners earn far more than the median household in the United States. The median homeowners with a mortgage earns $83,219 annually, compared with the national median income of $59,039. Plus, many homeowners also have the advantage of having locked in a monthly mortgage payment years ago. That means that homeowners with a mortgage put a mere 15% of their household income toward their monthly mortgage payment.

Of course, not all homeowners can so easily afford their monthly mortgage payment. New homeowners in particular face more challenging borrowing conditions. For example, current renters may have lower incomes and lower credit scores than current homeowners. Combining that with rising mortgage interest rates and rising home prices makes homeownership seem out of reach for many.

However, housing affordability analysis from the Urban Institute shows that renters who earn the median income put an average of 28% of their income toward their monthly rental payment. By contrast, buying a median-priced home with a 3.5% down payment would mean that current renters could cut their monthly payments down to 25.3% of their income. This doesnt mean homebuying makes sense for all current renters. Nationally, more than two-thirds of all renters earn $60,000 or below per year. Unless most current renters live in areas with lower than average home prices, monthly mortgage payments may prove to be too expensive.

Also Check: 10 Year Treasury Yield Mortgage Rates

Average House Payment By Balance Owed

Average house payments vary by balance owed, and even the monthly payments for the same amount can differ. The mortgage term and the interest rate are the most decisive factor. Lets analyze the average mortgage payment on 100k under different terms.

While the table focuses on 100k mortgages, the same variations apply to the average mortgage payment on 500k. The takeaway, in any case, is that the average payment can vary remarkably. For instance, the difference between a 15-year mortgage with an interest of 3% and one with a 5.50% rate is $126.5 a month.

Most Expensive Places To Live In Georgia

1. Marietta, GA Both utility and grocery costs in Marietta are 6% above the national average, and housing costs are only 9% below the national average. Expect to see median home prices of $314,035 and a monthly median rent of $983.74.

2. Roswell, GA Groceries in Roswell are 3% more expensive than the national average. Expect to pay about $3.42 for a loaf of bread and $1.99 for a gallon of milk. The median cost of a home in the area is $297,142, and the median rent is $930.82. The average cost of gas in the area is $2.48 a gallon.

3. Atlanta, GA The overall cost of living in Atlanta is about 1% below the national average. Housing costs are only 6% below the national average, with median home prices of $327,568 and median rent prices of $1,026. Transportation costs in the city are 1% above the national average, with a gallon gas costing $2.64.

4. Berkeley Lake, GA As one of the wealthiest cities in Georgia, Berkeley Lake may be a more expensive place for you to live. Grocery costs are 3% over the national average in the city. Expect to pay $1.86 for a carton of eggs and $3.42 for a loaf of bread. Transportation is about 5% below the national average, which should provide some breaks. Gas in the city is around $2.48 a gallon.

*Data source: PayScale

Recommended Reading: Chase Mortgage Recast Fee