Want To Make Irregular Payments Do You Need More Advanced Calculation Options

- Biweekly Payment Method: Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.

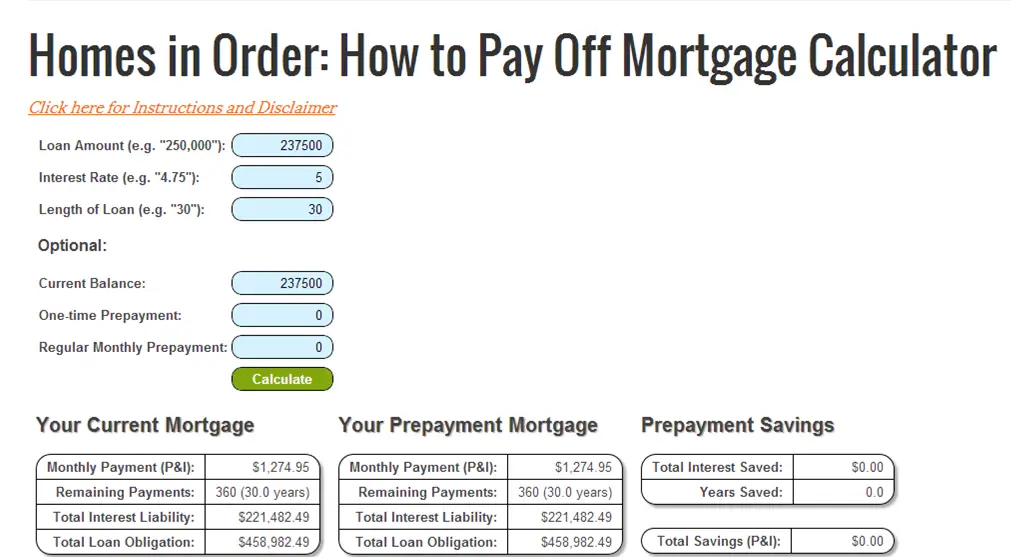

- Extra Payments In The Middle of The Loan Term: If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. For example, if you are 3.5 years into a 30-year home loan, you would set the loan term to 26.5 years and you would set the loan balance to whatever amount is shown on your statement. If you do not have a statement to see the current balance you can calculate the current balance so long as you know when the loan began, how much the loan was for & your rate of interest.

- Irregular Extra Payments: If you want to make irregular extra contributions or contributions which have a different periodicity than your regular payments try our advanced additional mortgage payments calculator which allows you to make multiple concurrent extra payments with varying frequencies along with other lump sum extra payments.

For your convenience current Los Angeles mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

Think About How Easily You Can Sell Your Investments

As property is an illiquid asset, this means it takes longer to access your money if you need cash for some reason quite quickly. Without a crystal ball itâs difficult to predict what youâll need, but the basic principle of investing is to make sure you have a rainy day fund and room to move in your cash flow if interest rates rise or other expenses arrive.

Investment Gains Vs Loan Interest Saved

If a homeowner decided to invest $100,000 versus paying down their mortgage in 10 years, they would earn $22,019 based on an average rate of return of 2%. In other words, there would be no material difference between investing the money versus paying off the 3.5% mortgage .

However, if the average rate of return was 5% for the 10 years, the homeowner would earn $62,889, which is more money than the interest saved in all three of the earlier loan scenarios, whether the loan rate was 3.5% , 4.5% , or 5.5% .

With a 10-year rate of return of 7% or 10%, the borrower would earn more than double the interest saved from paying the loan off early even with using the 5.5% loan rate.

Read Also: Rocket Mortgage Vs Bank

Will Other Investments Beat Paying Off A Mortgage Early

Is it better to pay off your mortgage or invest? Ultimately, its a personal decision, but investing could be more sensible.

Sadly, the math tells us its almost always better to invest in other places than in your mortgage, says Richard Bowen, CPA and owner of Bowen Accounting in Bakersfield, California.

Mortgage rates are lower than theyve been in recent years, so if paying off your mortgage early leads to a return equal to your interest rate, that return would likely be lackluster compared to the annualized return for the S& P 500 roughly 10 percent over the last 90 years.

A potentially better use of the funds might be to take the cash youd use to pay off your mortgage and leverage it into buying a cash flow-positive property like multi-family real estate or single-family homes that have the potential to offer higher long-term returns, Bowen points out.

Any choice poses a risk, however. Even after paying off your mortgage early, real estate prices could plunge, leaving you with a potential loss. Carefully consider which risks youre willing to take. Ultimately, you might be better off not paying your mortgage off early.

The thing is, no one can give you a guarantee on an investment, Bowen cautions. You can put your money in the stock market and lose it. You can put your money in real estate and it doesnt perform as well as you expected it to.

The Percentage We Recommend

At Rocket Mortgage®, the percentage of income-to-mortgage ratio we recommend is 28% of your pretax income. This percentage strikes a good balance between buying the home you want and keeping money in your budget for emergencies and other expenses. However, its important to remember that you dont need to spend up to your monthly limit. Think of 28% as the maximum amount you should spend monthly on your total mortgage payment. Remember to include your principal, interest, taxes, insurance and homeowners association dues in your total before you sign on a loan.

You May Like: Rocket Mortgage Requirements

Mistake #: Not Asking If Theres A Prepayment Penalty

Mortgage lenders are in business to make money and one of the ways they do that is by charging you interest on your loan. When you prepay your mortgage, youre essentially costing the lender money. Thats why some lenders try to make up for lost profits by charging a prepayment penalty.

Prepayment penalties can be equal to a percentage of a mortgage loan amount or the equivalent of a certain number of monthly interest payments. If youre paying off your home loan well in advance, those fees can add up quickly. For example, a 3% prepayment penalty on a $250,000 mortgage would cost you $7,500.

In the process of trying to save money by paying off your mortgage early, you could actually lose money if you have to pay a hefty penalty.

Adding Extra Each Month

Simply paying a little more towards the principal each month will allow the borrower to pay off the mortgage early. Just paying an additional $100 per month towards the principal of the mortgage reduces the number of months of the payments. A 30 year mortgage can be reduced to about 24 years this represents a savings of 6 years! There are several ways to find that extra $100 per month taking on a part time job, cutting back on eating out, giving up that extra cup of coffee each day, or perhaps some other unique plan. Consider the possibilities it may be surprising how easily this can be accomplished.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

Recasting Your Mortgage Might Not Be An Option

Before making a big one-off payment on your loan, ask your lender if they’re willing to recast your mortgage. The lender is not required to do this, and some loans arent eligible, so it might not be an option. Youll want to understand the process and whether this is possible before making any extra payments on your loan.

What Do I Need To Consider When Deciding To Pay Off Some Or All Of My Mortgage

- What is the interest rate on your mortgage, and how does it compare to the interest you can get on a savings account or by investing the money? There is also the potential you pay tax on those savings or capital gains.

- Are there any penalties for repaying the mortgage early? If you are on a fixed rate or discounted mortgage, there might be significant costs for paying it off early.

- Are you expecting any windfalls, such as selling a business, or inheritance? If you are expecting a large amount in the near future, there is probably less downside to paying off the mortgage.

- Do you have alternative investments that you want to make e.g. buying another property, or building up a business?

- How much money do you need for a rainy day fund? We suggest a minimum of three months outgoings, but six months is safer.

- What costs are you expecting? If you have years of school fees ahead of you, you might want to keep a large ring-fenced sum aside so you know you can to cover them, rather than paying off the mortgage. An offset mortgage might fit the bill in this instance.

- Are you expecting a decrease in income? In which case, you might want to keep extra savings to tide you over.

Want advice on whether to pay off your mortgage or invest your funds instead? Our partners at Unbiased will connect you with local independent financial advisors who can help you assess your options

Also Check: How Does 10 Year Treasury Affect Mortgage Rates

Overpaying Often Wins But Not For All

Get it right and overpaying your mortgage can be a huge cash boost, because…

- You’ll be eating into the debt you’ve built up from buying a home, meaning you pay it off quicker.

- You don’t pay interest on the amount you overpay.

- The money you’d save on interest often beats the returns possible by putting it in savings, given savings rates are currently so pitiful.

Overpaying means you make the same gain as saving at your mortgage rate. If you’ve a 2% mortgage, you’d need savings paying at least this. And, if you’ve used up your personal savings allowance, you need savings paying even more higher-rate taxpayers would need to earn 5% impossible to get on any savings account now.

Here’s a real-life example of someone who’s saved big by overpaying their mortgage:

Started making overpayments on my mortgage seven years ago. Saved £18,600 in interest and paid up eight years and three months early. So my ex-mortgage payment can now go towards a fantastic retirement pot. – Debbie

But before you chuck all your savings at your mortgage, you need to check the following…

What Is My Mortgage

If you have more debt, you might struggle to keep your DTI low while also paying off a mortgage. In this case, it can be useful to work backward before you decide on a percentage of income for your mortgage payment.

Multiply your monthly gross income by .43 to determine how much money you can spend each month to keep your DTI ratio at 43%. Youll then subtract all of your recurring, fixed monthly debt obligations and minimum payments on credit cards and other lines of credit. The dollar amount you have left after subtracting all of your debts lets you know how much you can afford to spend each month on your mortgage.

Lets take a look at an example. Imagine that your household brings in $5,000 in gross monthly income. Your recurring debts are as follows:

- Rent: $500

- Minimum student loan payment: $250

- Minimum credit card payment: $200

- Minimum auto loan payment: $200

- Homeowners association fees: $100

In this example, your total monthly debt obligation is $1,250.With quick math, we find that 43% of your gross income is $2,150, and your recurring debts take up 25% of your gross income. This means that if you want to keep your DTI ratio at 43%, you should spend no more than 18% of your gross income on your monthly payment. Use a mortgage calculator and your estimated monthly payment to calculate how much money you can borrow and stay on budget.

Recommended Reading: Monthly Mortgage On 1 Million

Make Extra Mortgage Payments

Another way you may be able to save money on interest, while reducing the term of your loan is to make extra mortgage payments. If your lender doesnt charge a penalty for paying off your mortgage early, consider the following early mortgage payoff strategies.

Just remember to inform your lender that your extra payments should be applied to principal, not interest. Otherwise, your lender might apply the payments toward future scheduled monthly payments, which wont save you any money.

Also, try to prepay in the beginning of the loan when interest is the highest. You may not realize it, but the majority of your monthly payment for the first few years goes toward interest, not principal. And interest is compounded, which means that each months interest is determined by the total amount owed .

Check : Can You Overpay Without Penalty Most Can Overpay 10% Per Year But Get It Wrong And You Risk 1000s In Fees

Most lenders allow you to pay 10% of your mortgage balance as an overpayment per year if you’re still in your introductory fixed or discount period.

If you’re on a tracker mortgage, or you’re beyond that intro deal and paying your lender’s standard variable rate , you can usually overpay by as much as you want. But many SVRs are expensive, so if on one it’s best to check if you can save by remortgaging, rather than only overpaying.

However, the 10% rule is not universal. Some lenders punish those who try to overpay by more .

Fees for paying too much are typically between 1% and 5% of the amount overpaid depending on your mortgage, though the fee you pay usually decreases the closer you are to the end of the fixed or discount period. The amount you pay as a penalty will vary between mortgage deals.

Say you’ve a five-year fix on a £100,000 mortgage and decide to overpay a lump sum two years into the deal. However, instead of sticking to the 10% limit free of penalty, you overpay £15,000 instead.

This means you must pay a 3% penalty on the extra £5,000 overpayment £150. However, this ‘percentage left on loan’ rule of thumb is very rough, so always double-check with your lender.

The reason for such harsh penalties is because lenders want you to stick with them once the cheap rate ends and because they’ve also budgeted to earn a certain amount of interest from you during the mortgage deal, and overpaying means they’ll get less.

Don’t Miss: What Does Gmfs Mortgage Stand For

Consider An Offset Account

An offset account is a savings or transaction account linked to your mortgage. Your offset account balance reduces the amount you owe on your mortgage. This reduces the amount of interest you pay and helps you pay off your mortgage faster.

For example, for a $500,000 mortgage, $20,000 in an offset account means you’re only charged interest on $480,000.

If your offset balance is always low , it may not be worth paying for this feature.

Are You Making An Emotional Decision

Some people are uncomfortable with the idea of heading into retirement with debt. Thats understandable. But it shouldnt necessarily be the driving force behind your financial planning. Its usually best to take an objective approach and see how your portfolio is doing. If your investments are earning strong gains, you may want to make them a priority for now. Let the math, and maybe a financial advisor, guide you and be confident in that decision.6

Theres no definitive right answer when it comes to how you prioritize your investments and your mortgage payments. Consider your finances, where you are in your retirement planning, and your tolerance for risk. Once armed with that information, youll be well equipped to make the best decision for you and your family.

Also Check: How Much Is Mortgage On 1 Million

Increase Your Mortgage Payment

Increase the size of your regular mortgage payment to take a large chunk off your mortgage principal. Choose a higher payment amount when you arrange your mortgage, or at any time during the term. This lets you pay down the principal faster.

Example: If you increase your monthly mortgage payment amount by $170 from $830 to $1,000, you’ll save almost $48,000 in interest over the amortization period. And you’ll own your home about 8 years sooner.1

Lump Sum Or Extra Payments

But the real key to paying off your mortgage debt faster is to get a mortgage that allows you to make extra payments. Most mortgages allow borrowers to make annual prepayments of 10% to 20% of principal, without extra fees. These extra payments go directly towards paying down the principal. If possible, try to avoid a mortgage that only allows you to make extra or lump sum payments on the mortgage anniversaryas this can reduce the likelihood of making the extra payment.

You May Like: Reverse Mortgage For Condominiums

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

What Are Todays Mortgage Rates

Todays mortgage rates are still at historic lows, even for borrowers with less than 20% down. In fact, borrowers with lowdownpayment government loans often get access to belowmarket rates.

So dont write off home buying because youre waiting to save 20% down. Many buyers can qualify today and dont even know it.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

Hit The Principal Early

Over the first few years of your mortgage, it may seem that you are only paying interest and the principal isnt reducing at all, says Nila Sweeney, managing editor or Property Market Insider. Unfortunately, youre probably right, as this is one of the unfortunate effects of compound interest. So you need to try everything you can to get some of the principal repaid early and youll notice the difference.

Every dollar you put into your mortgage above your repayment amount attacks the capital, which means down the track youll be paying interest on a smaller amount. Extra lump sums or regular additional repayments will help you cut many years off the term of your loan.