How Are Arm And Fixed

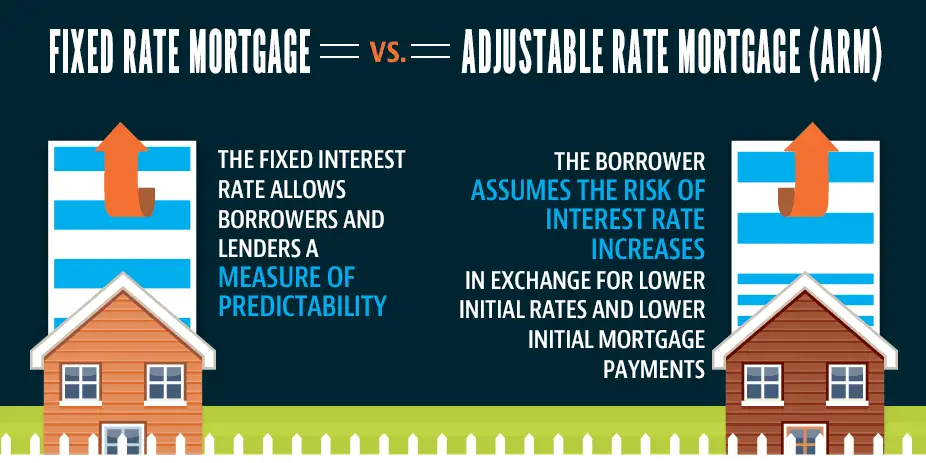

Both ARMs and fixed-rate mortgages have similar term length options and qualification requirements. Lenders will look at your credit score and your personal financial situation to determine the length of your loans term, your interest rate and your loan amount whether youre applying for a fixed-rate or an adjustable-rate mortgage.

Low Introductory Interest Rates

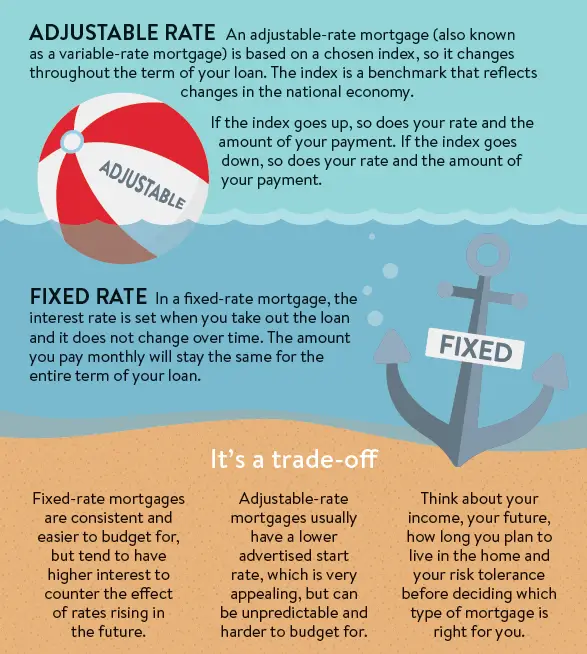

A big appeal of an adjustable-rate mortgage is its low introductory interest rate. ARM intro rates are typically lower than the rates for competing fixed-rate loans. The low rates can offer more manageable monthly payments that may appeal to younger borrowers early in their careers who expect their earnings to track with, or outpace, the rate increases to come once the ARM’s introductory period ends.

Low ARM introductory rates are also attractive to borrowers who don’t plan to keep their properties for more than a few years. Selling a home before an ARM’s introductory rate expires is a common tactic, and many ARM loan agreements discourage it by including stiff prepayment penalties. Of course, this strategy can also backfire if the local real estate market stalls or takes a downturn, making it difficult to sell the property.

How To Choose Between An Adjustable

Here are a few questions to ask yourself as you decide whether an adjustable-rate mortgage or fixed-rate mortgage makes the most sense for your home purchase.

- How long do you plan on living in your home? As mentioned, ARMs often work best for those who don’t plan to stay in the home for more than a few years, since you’ll get to spend some or all of the time paying the low introductory rate and avoiding the probable higher rate that will kick in later. If you plan to be in the home for the long term, a fixed-rate APR may be best since it will remain predictable.

- What do current interest rates look like? When mortgage rates are on the high side, getting locked in to a fixed-rate loan could be expensive . In that case, the risk of an ARM could be worth it since the introductory rate will be lower than fixed-rate loans. On the other hand, if mortgage rates are currently low, it could be a great time to lock down a fixed-rate loan since future market changes won’t impact you.

- Will you be able to afford payments if interest rates rise? The beauty of fixed-rate mortgages is the predictability of your monthly payments. If you’re on a tight budget, this certainty can help you stay on track. While ARMs start off with a lower rate, they can rise later, which would increase your monthly payment. Consider how flexible your budget is and whether you’d be able to afford a higher mortgage payment if interest rates go up.

Read Also: Which Bank Is Best For Mortgage

Which Is Better: Fixed Or Adjustable

It is a difficult decision to decide between a fixed and an adjustable-rate mortgage. Factors such as loan duration, the index used by the lender, the number and timing of rate adjustments, and your assumption about the increase/decrease of future interest rates all have an impact. Use this calculator to help compare the total cost of each alternative.

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Have Questions About Your Variable Rate Product

It’s important to know which type of variable product you have, or which one is the right choice for you. We have access to several lenders AND products, including those offered through our own lender, THINK Financial. Talk to us today if you have questions!

We’re always here to run the numbers for you and provide options if you’d like a change, or if you need more ideas on how to save on your mortgage.

At True North Mortgage, our highly trained brokers have the tools and experience to help you make the right choice for your budget. Give us a shout anywhere you are in Canada ââ¬â for 5-star mortgage advice.

Don’t Miss: What Happens With A Reverse Mortgage When Owner Dies

Why Would You Choose An Adjustable

Adjustable-rate mortgages may be the better option over fixed-rate mortgages for borrowers who expect to move out before the fixed-rate period of their ARM ends. ARMs are also often good in housing markets where interest rates are high, as your interest rate can adjust if rates drop. This is especially true for more expensive homes. The more expensive the home, the more the homeowner will save during the lower initial fixed-rate period. The difference can be in the 10s of thousands of dollars less in interest paid for ARMs compared to fixed-rate mortgages during the initial period of an ARM.

Benefits Of An Adjustable

Historically, ARMs have offered some major benefits. Heres why some borrowers consider getting an adjustable-rate mortgage:

- You can save during the introductory period. ARMs can be a wise choice if you plan to move a few years after buying your home. Youll save on interest payments by getting approved for a lower rate and be out of the house before the rate has a chance to increase.

- You may snag a lower rate when the mortgage adjusts. Even if you plan to be in your home for many years, you may save in the long run if rates decrease in the future. This is most likely to occur if you take out a mortgage when interest rates are high.

- You might qualify for financing to purchase a more expensive property. A lower intro rate may help you stretch your budget so you can buy a nicer home. Just remember the interest-rate risk youre taking on as you make your decision.

Don’t Miss: Are Home Mortgage Rates Going Down

Here’s How To Save Up To $700/year Off Your Car Insurance In Minutes

When was the last time you compared car insurance rates? Chances are youre seriously overpaying with your current policy.

Its true. You could be paying way less for the same coverage. All you need to do is look for it.

And if you look through an online marketplace called SmartFinancial you could be getting rates as low as $22 a month and saving yourself more than $700 a year.

It takes one minute to get quotes from multiple insurers, so you can see all the best rates side-by-side.

So if you havent checked car insurance rates in a while, see how much you can save with a new policy.

Choosing The Right Mortgage

If you are risk-adverse and seek simplicity, the fixed-rate mortgage is probably the best option. However, if youre willing to take a little more risk, then perhaps some type of ARM could work for you. Your personal circumstances and goals will also help dictate the right choice.

As you evaluate the risk spectrum with mortgage loans, its important to understand if the interest rate savings are significant enough to justify taking on the incremental risk of a hybrid or traditional ARM. The difference between locking in a rate that is 0.25 percentage points lower is far less meaningful than getting a rate that is a full percentage point lower.

Not everyone has the same level of comfort with risk. Consider which option really fits into your lifestyle before making a decision on the type of home loan you take out with a lender.

Read Also: How To Pay Off 100 000 Mortgage In 5 Years

The Bottom Line On Fixed

The biggest overall difference when youâre choosing between variable vs. fixed-rate mortgages is how much risk youâre willing to take on. Fixed-rate mortgages are safer, offering the full picture of how much your mortgage is going to cost. ARMs can help you snag a lower interest rate in the beginning, but you may end up with higher monthly payments and a greater total cost down the road. Before you make a final decision, be sure to weigh the benefits and drawbacks of each interest type.

Who Should Get Adjustable Rate Mortgages

This is the big question most people ask me how do I know if an ARM is right for me?

Under most circumstances, I would tell both first-time buyers and seasoned buyers to consider an ARM because it can lead to long-term savings overall, but, not everyone may be the right fit for an ARM.

ARMS are great for people who have some financial give and the ability to flow with the market. If you are liquid-heavy and have the ability to deal with the change in your rate after the established term, these loans can save you money on the front and back end, especially if you pay off part of the principal as you go.

Similarly, if you are a market-watching maniac and see that rates are high now with the potential to drop, you can pay less during your initial period, then when it is over, refinance and save on a new loan while keeping your established fixed rate.

On the other hand, ARM loans are not good for those who take on larger sums of debt that arent paid off quickly. For example, if youre already in debt with school loans or a business loan, starting an ARM wouldnt serve you well because if the rate jumps higher than before, you might not be able to pay the new rate after the initial term.

If you are considering an ARM loan ask yourself these two questions

Are you willing to navigate the ups and downs that come from the constant rate change?

What are you doing with the money that you are saving on this loan? Is it going to the principal?

Don’t Miss: What Are Basis Points In Mortgage

Choosing Between A Fixed

In personal finance, you rarely find clearly defined right or wrong answers. The better type of mortgage depends on what fits your circumstances.

A fixed-rate mortgage is more attractive if you might be in the home for a long time. You can feel assured that your mortgage rate will never go up and drive your payment higher.

An ARM is better if you might sell the house in five years, seven years however long you have before the loan starts adjusting. You can enjoy the low-interest rate at the start of the loan and get out before the mortgage has the potential to get more expensive.

Compare current mortgage rates in your area:

Sponsored

Who Are The Ideal Borrowers For Adjustable

ARMs can be a good option for homeowners who plan to sell their home when the introductory period ends. Borrowers with good monthly cash flow are also ideal ARM candidates since the extra cash provides a cushion in case interest rate hikes are maxed out later on in the loan. Other good candidates are those who expect higher income later, after the ARM introductory period expires.

“If a homebuyer thinks that their income will increase, and they believe that rates will come back down, then an adjustable is the right product,” says Melissa Cohn, executive mortgage banker at mortgage servicing company William Raveis Mortgage.

On the other hand, “if their income is capped, and they’re afraid to afford anything more, they might be more psychologically comfortable with a fixed-rate mortgage,” she says.

When shopping for an ARM, buyers should look for interest rate caps they can afford and avoid additional prepayment penalties, says DiBugnara. Prepayment penalties are charged if you pay off your loan, or too much of your loan, within the first few years. They can range from a set fee of a few thousand dollars to a percentage of the loan, like 2%.

DiBugnara advises buyers to “do the math” on the maximum monthly amount they might pay, using the highest possible interest rate. By looking at the worst-case scenario for monthly payments, buyers will know whether they can afford the loan and whether the initial savings are worth the risk.

You May Like: Can You Get Denied A Mortgage After Being Pre Approved

What Are The Disadvantages Of Arm Loans

ARMs are a double-edged sword and there are some disadvantages to getting one depending on your circumstances.

First, by starting an ARM, you become subject to market volatility and unpredictable interest rates down the road like what we are experiencing today. For example, there are folks who started a 5/1 ARM loan back in 2017 that are now paying more for their loan than they ever had before and that is due to the dramatic rise in interest rates over the last year and a half.

Similarly, if the rates increase dramatically the buyer could find themselves in a position unable to pay their monthly bill. While there is a cap limit to each ARM never more than 5% in the lifetime of the loan borrowers can still find themselves in a deep hole if the rates jump big time and their income doesnt.

Even something as simple as a 2% jump in rate could increase payment by over $600 a month!

What Are The Disadvantages Of A Fixed

Fixed-rate mortgages typically have higher rates than the starting interest rates on adjustable-rate mortgages. This means you may pay more money in interest at the beginning of the loan.

When interest rates go down, you won’t automatically benefit from the decrease. You will need to refinance your current mortgage, which often involves paperwork and fees, to get a lower rate.

Read Also: How To Pay Mortgage Online Rbc

Pros Of An Adjustable

- It has lower rates and payments early in the loan term. Because lenders can consider the lower payment when qualifying borrowers, people can buy more expensive homes than they otherwise could.

- It allows borrowers to take advantage of falling rates without refinancing. Instead of having to pay a whole new set of closing costs and fees, ARM borrowers just sit back and watch the rates and their monthly payments fall.

- It can help borrowers save and invest more money. Someone who has a payment thats $100 less with an ARM can put that money in a higher-yielding investment.

- It offers a cheaper way for borrowers who dont plan on living in one place for very long to buy a house.

Choosing Between A Fixed Rate Loan And An Arm

Now that you know how ARMs compare to fixed rate loans, how do you decide which one makes the most sense for your situation?

Sean O. McGeehan, a loan officer in Homer Glen, Ill., just outside Chicago, weighs in this way. Most of our clients fall into the fixed rate bucket. They are traditionally first-time homebuyers that are buying a condo or single family home and dont know their future plans, he says. If they end up having children and need to stay there in the long term, a fixed rate will give them certainty and stability in their mortgage payments.

Since interest rates have almost nowhere to go but up in todays market, most homebuyers arent interested in taking the risk on an ARM.

Due to the current low interest rate environment, Ive been utilizing the 30-year fixed loan option 90% of the time over the past six-plus years for first time homebuyers, says Lauren Abrams, a mortgage advisor with Absolute Mortgage Banking in San Ramon, Calif.

However, it is important to have a conversation about the buyers long-term plans for the property. In most cases buyers dont know or cant predict what those plans will be, she says. Clients sometimes insist that this is just a starter home and wont be in it for more than three to five years. In her experience, this time frame can actually be as short as one year if there is a divorce, job transfer, marriage or children, but that time frame can also easily extend to 10-plus years.

Read Also: How Calculate Pmi In A Mortgage

What Are The Advantages Of Arm Loans

There are three distinct advantages to getting an ARM Loan.

First, its a chance to start at a lower rate for an initial period of the loan, usually 510 years. Because this rate is established for a shorter period of time, it makes it significantly lower than a fixed rate 30-year mortgage.

Imagine it like this, instead of paying $3,500 a month for 30 years, your payment could be $2,200 a month for 7 years.

The second advantage of ARMs is that they increase cash flow up front, allowing the buyer to get more home for their dollar. Oftentimes with fixed-rate mortgages, the initial number is very high resulting in the buyer limiting themselves on options due to cost. When you go the ARM route, the initial payment during your term is lower, giving you some extra Benjamins to spend on the buy.

The third advantage to ARMs is that you can use the money saved up front on payments to slowly work away on the principal. While this is something that you can do with a fixed rate mortgage as well, the likelihood of having extra cash to drop the principal down is slim.

On the other hand, if you are paying significantly lower on your monthly because you have an ARM, you can then use the money saved to pay off the principal over time. This will lead to better opportunities to refinance when your initial term is up.

Should You Consider An Adjustable

With mortgage rates spiking in recent weeks to levels not seen for more than a decade, home loan borrowers are considering their options for financing. Approximately 11 percent of mortgage applications were for adjustable-rate mortgages in the first week of May, according to the Mortgage Bankers Association nearly double the share of ARM applications three months ago, when mortgage rates were lower.

We asked three mortgage lenders for advice about ARMs: Brian Koss, executive vice president of Mortgage Network in Danvers, Mass. Tom Trott, branch manager of Embrace Home Loans in Frederick, Md. and Kate Gurevich, managing director of Found It Home Loans, a division of Cherry Creek Mortgage in Denver. All three responded via email, and their responses were edited.

Q: Are you finding more borrowers want ARMs now? Are these repeat buyers, first-time buyers or both?

Koss: Borrowers are more open to ARMs right now due to the potential savings. Each situation is different, but we are seeing interest from both first-time and repeat buyers.

Trott: More buyers are certainly reviewing their options as they relate to adjustable-rate mortgages vs. fixed-rate mortgages. In my experience, most first-time home buyers are continuing with 30-year fixed-rate mortgages. Repeat buyers are more open to choosing an ARM.

Q: Why do borrowers want an ARM when rates are rising? Shouldnt they be worried about rates rising too much?

Q: What are the advantages of an ARM?

Don’t Miss: Where Is Rocket Mortgage Golf Tournament