Should I Pay Off My Pmi Early

Its very important that you cancel your mortgage insurance as soon as you can because the savings can be significant for your monthly payments. Lets take our previous example of a $300,000 loan amount and assume this is a one-unit primary property. Recall that you can request mortgage insurance termination when you reach 20% equity and it auto cancels at 22% equity.

On a 30-year fixed loan there are nine payments between the time you cross the 20% threshold and when the payments would auto cancel after breaking through the 22% barrier. If you had a mortgage insurance rate that was 0.5% of your loan amount, your savings would be $1,125. If you had a 1% mortgage insurance rate, you would save $2,250 in mortgage insurance payments over those 9 months.

How Can I Prepare To Buy A Home With A Mortgage Loan

If youre ready to buy a home with a mortgage, here are some tips to get your finances ready to buy a house.

- Check your credit: The best mortgage rates often go to people with credit scores in the mid-700s and above. But that doesnt mean you cant qualify with lower scores just make sure to do your homework.

- Calculate your DTI: Your debt-to-income ratio is your monthly debt payments divided by your gross monthly income. Do some math so you know what yours is. You may find many lenders prefer a DTI of no higher than 43%.

- Save for a down payment: To get to as close to 20% down as possible, you might need to cut some expenses, boost your income or wait a little longer to buy. And dont forget about things like moving costs, closing costs and an emergency fund.

- Shop around: Not all mortgage lenders are created equal. Explore your options so you can compare their rates, terms and fees. Make sure to gather your financial documents for when youre ready to apply.

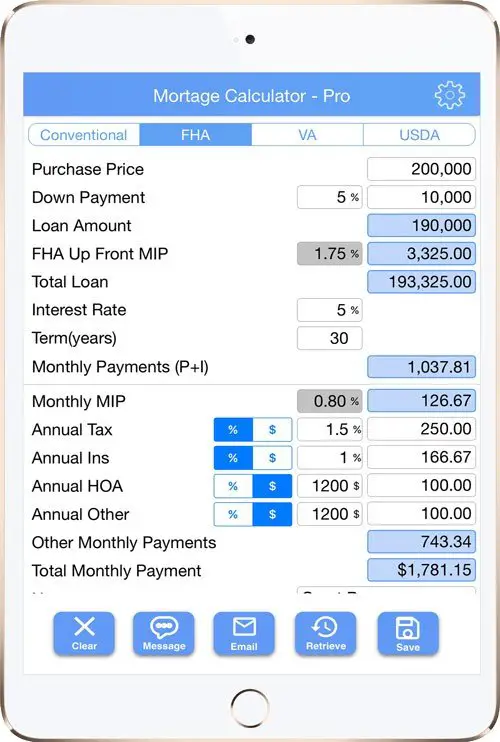

How Do I Calculate Pmi Mortgage Insurance

Related Articles

PMI stands for “private mortgage insurance.” Real estate mortgage companies usually demand that borrowers take out PMI if they pay less than 20 percent of the home’s value as a down payment. The PMI lender will pay the mortgage lender if the borrower defaults on the loan. You can calculate PMI with a calculator or by using a formula. The PMI formula is actually simpler than a fixed-rate mortgage formula.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

What Is A Jumbo Loan

A jumbo loan is used when the mortgage exceeds the limit for Fannie Mae and Freddie Mac, the government-sponsored enterprises that buy loans from banks. Jumbo loans can be beneficial for buyers looking to finance luxury homes or homes in areas with higher median sale prices. However, interest rates on jumbo loans are much higher because lenders don’t have the assurance that Fannie or Freddie will guarantee the purchase of the loans.

How To Avoid Lender

Another option is for your lender to pay your mortgage insurance premiums as a lump sum when you close the loan. In exchange, youll accept a higher interest rate. You may also have the option to pay your entire PMI yourself at closing, which would not require a higher interest rate.

Depending on the mortgage insurance rates at the time, this may be cheaper than BPMI, but keep in mind that its impossible to cancel LPMI because your payments are made as a lump sum upfront. If you wanted to lower your mortgage payments, youd have to refinance to a lower interest rate, instead of removing mortgage insurance.

Theres no way to avoid paying for LPMI in some way if you have less than a 20% down payment. You can go with BPMI to avoid the higher rate, but you still end up paying it on a monthly basis until you reach at least 20% equity. In that case, youre back to the original amount from the BPMI scenario.

Recommended Reading: Rocket Mortgage Conventional Loan

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Cost Versus Benefit Of Private Mortgage Insurance

Todays homeowners are building wealth like few times in history.

According to the Federal Housing Finance Agency , home values in the third quarter of 2020 were up more than 7% from the same period one year prior.

The typical U.S. homeowner is earning $13,000 per year.

Whats more, home value appreciation is nothing new. FHFA says home prices have increased by about 5% per year since 2012. And home values have increased every quarter dating back to 2011.

That means a renter who bought the average home four years ago has gained more than $40,000 in home equity to date. Some have earned much more six figures in some cases.

Whats surprising, then, is advice saying you should buy a home only when you have a 20% down payment.

Putting 20% down is less risky than making a small down payment, but its also costly.

Even strong opponents of mortgage insurance find it hard to argue against this fact: PMI payments, on average, yield a huge return on investment.

PMI return on investment

Home buyers avoid PMI because they feel its a waste of money.

In fact, some forego buying a home altogether because they dont want to pay PMI premiums.

That could be a mistake. Data from the housing market indicates that PMI yields a surprising return on investment.

Imagine you buy a house worth $233,000 with 5% down.

Remember, you can cancel mortgage insurance on a conventional loan when your mortgage balance falls to 80% of your homes purchase price.

Also Check: Does Rocket Mortgage Sell Their Loans

What Is Mortgage Insurance

PMI private mortgage insurance is a type of insurance policy that protects mortgage lenders in case borrowers default on their loans. Heres how it works.

If a borrower defaults on their home loan, its assumed the lender will lose about 20% of the homes sales price.

If you put down 20%, that makes up for the lenders potential loss if your loan defaults and goes into foreclosure. Put down less than 20%, and the lender is likely to lose money in the event of a foreclosure.

Thats why mortgage lenders charge insurance on conventional loans with less than 20% down.

Mortgage insurance covers that extra loss margin for the lender. If you ever default on your loan, its the lender that will receive a mortgage insurance check to cover its losses.

That might sound like a tough deal. But the upside is, mortgage insurance gives you a fast track to home ownership.

Without mortgage insurance, many people would have to wait years to save up for a bigger down payment before buying a house.

Those are years they could have spent investing in their home and building equity rather than paying rent to a landlord each month.

How To Get The Best Deal On A Loan

This one is simple: get a loan that helps you manage your monthly payments.

Now that you know how to calculate your monthly payment, and understand how much loan you can afford, its crucial you have a game plan for paying off your loan. Making an extra payment on your loan is the best way to save on interest . But it can be scary to do that. What if unexpected costs come up like car repairs or vet visits?

The Kasasa Loans® is the only loan available that lets you pay ahead and access those funds if you need them later, with a feature called Take-BacksTM. They also make managing repayments easy with a mobile-ready, personalized dashboard. Ask your local, community financial institution or credit union if they offer Kasasa Loans®.

Taking out a loan can feel overwhelming given all the facts and figures , but being armed with useful information and a clear handle on your monthly payment options can ease you into the process. In fact, many of the big-ticket items like homes or cars just wouldnt be possible to purchase without the flexibility of a monthly loanpayment. As long as you budget carefully and understand what youre getting into, this credit-building undertaking isnt hard to manage or calculate especially if you keep a calculator handy.

Read Also: Reverse Mortgage Manufactured Home

Choose A Different Government Loan Type

If you really want to avoid MIP payments, you may want to consider another type of government loan.

You may be buying a home in a rural area and have a median FICO®Score of 640 or higher. In that case, why not consider a USDA loan? Unlike an FHA loan, USDA loans dont require a down payment. You also dont need to pay PMI or MIP with a USDA loan. Instead, you pay a monthly guarantee fee thats less expensive than the FHA monthly premium.

On the other hand, you might want to consider a VA loan if youre a current or former member of the armed forces or a qualifying spouse. To qualify for a VA loan, youll need a median FICO®credit score of at least 620 and a DTI ratio of 60% or less. Theres no down payment requirement for a VA loan. You also dont have to pay any type of monthly mortgage insurance on a VA loan. Instead, youll pay a one-time VA funding fee and the home must be your primary residence. Veterans receiving VA disability benefits and surviving spouses of veterans who passed in the line of duty or as a result of a service-connected disability are exempt from the funding fee.

Contact a Home Loan Expert to learn more about these FHA loan alternatives and to find out whether you qualify.

How Do I Make Pmi Payments

There are three primary schedules for making PMI payments. The options available to you will vary depending on your lender.

- Monthly: The most common method is paying PMI premiums monthly with your mortgage payment. This boosts the size of your monthly bill, but allows you to spread out the premiums over the course of the year.

- Upfront: Another option is an upfront PMI payment, meaning you pay the full premium amount for the year all at once. Your monthly mortgage payment will be lower, but you need to be ready for that larger annual expense. Additionally, if you move sometime in the year, you might not be able to get part of your PMI refunded.

- Hybrid: The third option is a hybrid one: paying some upfront and some each month. This can be useful if you have extra cash early in the year and want to limit your monthly housing costs.

Ask your lender if you have a choice for your payment plan, and decide which option is best for you.

You May Like: Rocket Mortgage Loan Types

Split Premium Mortgage Insurance

This mi program is a blend between the single plan and the monthly plan. There is a modest upfront charge and a reduced monthly premium. As with the single premium, the borrower is permitted to finance the upfront premium, or a third party can pay it. The monthly premium decreases as the upfront payment increases.

| Fixed-Rate 30-Year – NON-REFUNDABLE – For loans with level payments for the first 5 years |

|---|

| UPFRONT .75% |

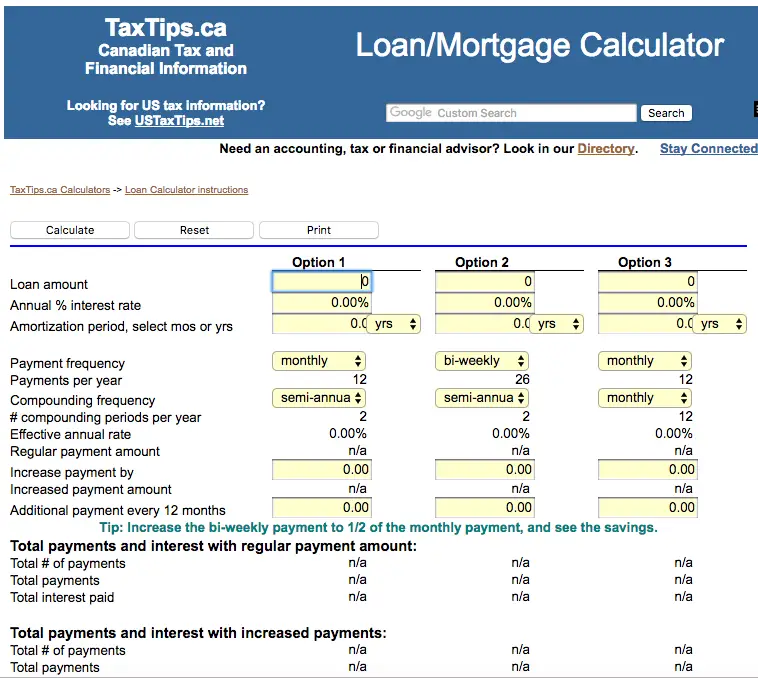

How Do You Calculate Mortgage Default Insurance

To understand how mortgage default insurance is calculated and paid for quickly, watch the video below. Scroll down further for more details on the calcultions.

Lets say you just purchased a home for $300,000 and made a $40,000 down payment. Your mortgage default insurance premium would be calculated as follows:

You May Like: Does Navy Federal Sell Their Mortgages

Read Also: Chase Recast

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

What Is Pmi And How Is It Calculated

When you take out a home loan or refinance your mortgage, your lender may require you to pay for an additional type of insurance private mortgage insurance.

When do you have to pay private mortgage insurance and how much will it cost you? It depends on your loan-to-value ratio. Find out when you have to pay PMI and learn how to calculate the cost.

Don’t Miss: What Does Gmfs Mortgage Stand For

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Add A Free Private Mortgage Insurance Calculator Widget To Your Site

You can get a free online private mortgage insurance calculator for your website and you don’t even have to download the private mortgage insurance calculator – you can just copy and paste! The private mortgage insurance calculator exactly as you see it above is 100% free for you to use. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. Click the “Customize” button above to learn more!

Recommended Reading: Rocket Mortgage Vs Bank

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost thats often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

What Does Piti Stand For

Most loans are repaid in two parts: principal and interest . This includes repaying the money you borrowed along with interest to the bank.

But when it comes to a mortgage loan, P& I arent your only expenses. You also have to pay for homeowners insurance and property taxes.

All these homeownership costs are bundled together in one monthly payment, often referred to as PITI.

The PITI acronym stands for:

- Principal The amount of your mortgage loans principal balance repaid each month

- Interest The amount of interest your mortgage lender collects on the loan

- Taxes Property taxes required by your city and county government

- Insurance Homeowners insurance and, if required, private mortgage insurance premiums

If you want to know how much house you can afford, you need to consider your entire PITI payment not just principal and interest.

Budgeting for taxes and insurance as well as P& I will get you much closer to the loan amount a lender will actually approve you for.

Also Check: Chase Recast Mortgage

How Is Private Mortgage Insurance Calculated

If you’re obtaining a conventional loan and borrowing more than 80 percent of the value of the property , the lender will require mortgage insurance. The mortgage insurance gives the lender a cushion between the loan amount and the resale of the home in the event of a foreclosure. In other words, if the down payment is only 5%, and the home goes into foreclosure, the lender only has 5% equity. If the house sells for less than 95%, the lender loses money. If however, the down payment was 20%, the lender can sell the home for 20% less and still break even. Mortgage insurance fills the gap between a low down payment and 20% of the property value.

The private mortgage insurance calculation depends on a number of variables, including:

- mortgage insurance plan

| 29% | 33% |

Along the left side of the chart is the loan-to-value. Loan-to-value is a simple calculation that determines the equity in the home. The calculation is simple for a purchase. Simply subtract the down payment number from 100 and you have the loan-to-value. For example, with a 5% down payment, 100 – 5 = 95%. For a 10% down payment, 100 – 10 = 90%. Another way to determine the loan-to-value is to divide the loan amount by the sales price . For example, if the sales price is $100,000 and the mortgage amount is $95,000, the loan to value is 95%