How Do Borrowers Adjust

Although the elasticities reported in table 7 are valid estimates of the amount by which borrowers reduce their first mortgage balance in response to the jumbo-conforming spread, they do not provide any information regarding the margins along which thisadjustment occurs. In this section we present suggestive evidence that helps to distinguish between several methods that borrowers may be using to adjust their mortgage balance.

There are three primary channels through which a borrower can reduce the size of her first mortgage, each of which have different implications for the interpretation of our main results. First, a borrower could simply bring more cash to the table, making a larger down payment and taking out asmaller loan.40 Second, she could take out an additional mortgage for the amount of debt desired in excess of the conforming limit. Finally, she could spendless on housing, which would lead her to take out a smaller mortgage.41 While borrowers likely use various combinations of thesethree strategies to lower their mortgage balances, if we consider the extreme cases in which only one of the three is used, we can provide a rough sense of the extent to which each may be contributing to the bunching behavior we observe.

These Charts Work For Adjustable

For the record, you can use the 30-year charts above for adjustable-rate mortgages too because theyre based on the same 30-year loan term. They just dont offer fixed rates beyond the initial teaser rate offered.

So if youre looking at a 5/1 ARM, you can still use those charts. Just know that your interest rate will adjust after those first five years are up, and the chart will no longer do you any good.

That is, unless youre looking to refinance your mortgage to a new low rate to avoid the interest rate adjustment.

Tip: Use the charts to quickly determine the impact of a higher or lower credit score on rates. If youre told you can get a rate of 4% with a 760 credit score or a rate of 4.5% with a 660 score, youll know how much marginal or bad credit can really cost.

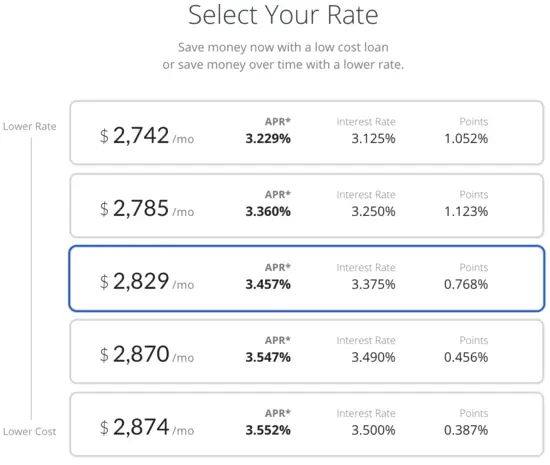

What Is A Discount Point

A discount point is a fee you can choose to pay at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

Also Check: How Much Would A 180 000 Mortgage Be A Month

How 5/1 Arms Work: An Example

To really get a feel for an ARM, lets do an example comparing it with a fixed-rate mortgage for a $250,000 loan amount. In our hypothetical example, lets say you can get a 30-year fixed-rate mortgage at 4%. Well compare that against a 5/1 ARM with 2/2/5 caps and an initial interest rate of 3.5%.

On the fixed-rate mortgage, youre looking at a monthly payment of $1,193.54, not including taxes and insurance. Our ARM has an initial payment of $1,122.61. You save $70.93 per month for the first 5 years of the loan, but its important to remember this adjusts in the sixth year. If your ARM interest rate goes up by the maximum amount allowed under the cap, your new payment would be $1,377.05. In the seventh year, if interest rates were higher and it went up by the maximum amount, the new payment at a 7.5% interest rate would be $1,648.71. Finally, if rates went way up, the lifetime cap on interest rate increases is 5%, so your new payment in the eighth year would be $1,788.81. Its important to take these potential adjustments into account when youre budgeting.

Other Factors Besides Your Credit Score

Remember, FICO is looking only at the difference your credit score makes in the chart above.

Lenders will check more than your credit history when you apply for a new mortgage loan. They will also need to know your:

- Debt-to-income ratio This ratio measures how much of your income goes toward existing monthly debts

- Income stability Homebuyers need to show W-2 forms or pay stubs to prove a steady income. If youre self-employed, you can provide tax forms or even bank statements

- Down payment Most loans require a minimum down payment amount . Putting more than the minimum down could help lower your interest rate

- Home equity for refinancing Mortgage refinance lenders will check your home equity which, measures how much your home value exceeds your mortgage debt. Having more equity can lower your rate

In short, the better your personal finances look, the lower your mortgage interest rate will be. Taking steps like raising your credit score or savings for a bigger down payment before you buy can help you get the best rates available.

Read Also: How To Negotiate Lower Interest Rate On Mortgage

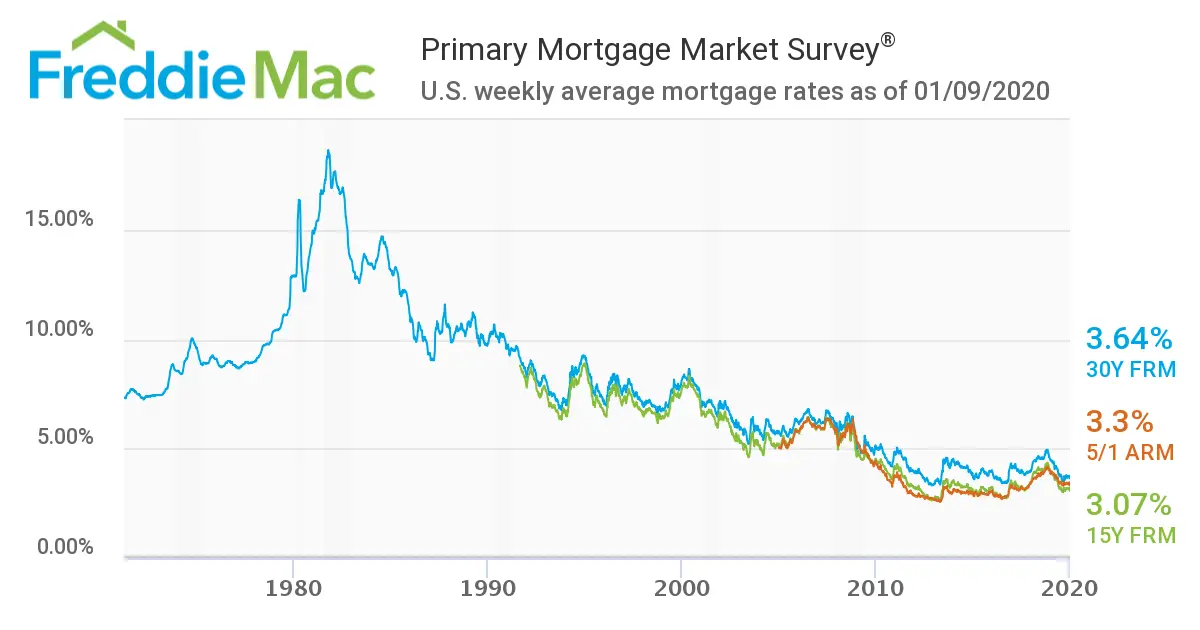

Whats Currently Happening With Mortgage Rates

COVID-19 pushed mortgage interest rates down to record lows, dipping to a jaw-dropping 2.67% in December 2020. But theyve since climbed back up to pre-pandemic levels, reaching a 5.5% average as of June 2022.

But dont feel too bummed out. Consider that back in the 80s a typical mortgage rate was between 10% and 18%, and a 5.1% rate doesnt seem too bad comparatively. Of course, the cost of real estate has risen since then, but mortgage rates themselves are still substantially lower than they could be.

Should You Choose A Five

When deciding if a fixed-rate mortgage is right for you, there are a number of key factors to consider, including the historical performance of five-year fixed mortgage rates. Depending on what happens with market interest rates during your term, you may pay extra, but those additional costs could save you from the stress of predicting ups and downs in the economy and interest rates.

Recommended Reading: What Is A Mortgage Holder

When Is The Best Time To Obtain A Mortgage

The best time to secure a mortgage is when the rates are the lowest. Compare the National Mortgage Rate average over the past 10 -20 years. If the rate is at one of its lowest points historically, then it can be a safe entry point into the market. Many investors purchased when the market was low, but it had not reached its lowest point. Now, home buyers owe more than the house is worth. Those who wish to sell cannot fully recoup the costs of the home. Therefore, instead of having equity in the home, consumers owe more than the home is worth. Many individuals, in this instance will negotiate with the bank and âshort sellâ in order to relieve themselves of the debt.

As stated above, the rates change based upon the Federal Reserve and the desire to keep the economy stable. Read the reports from the office and inquire with lenders to get a fair prediction of the direction of the Federal Reserve. If the Federal Reserve decides that consumers need to spend and borrow, interest rates will remain low. However, if the Federal Reserve decides that it needs consumers to save, invest, and deposit money, the interest rates will remain high.

Variable Interest Rate Mortgage

A variable interest rate can increase and decrease during your term. If you choose a variable interest rate, your rate may be lower than if you selected a fixed rate.

The rise and fall of interest rates are difficult to predict. Consider how much of an increase in mortgage payments youd be able to afford if interest rates rise. Note that between 2005 and 2015, interest rates varied from 0.5% to 4.75%.

Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, a fixed interest rate mortgage may be better for you. You may also consider fixed payments with a variable interest rate.

A variable interest rate mortgage may be better for you if youre comfortable with:

- your interest rate changing

- your mortgage payments potentially changing

- the need to follow interest rates closely if your mortgage has a convertibility option

Get information on current interest rates from the Bank of Canada or your lenders website.

Recommended Reading: How Big A Mortgage Can I Get With My Salary

What Is The Forecast For Mortgage Rates In Canada In 2022

Between January 2022 to June 2022 alone, fixed mortgage rates in Canada have gone up just over 85%. In the same time period, variable mortgages rates in Canada have increased by an average of over 300%.

The current consensus among economists is that mortgage rates will continue to rise in Canada in 2022 and possibly 2023 as well.

How To Calculate Your Mortgage Payment

Mortgage calculators take into account a variety of different factors when determining your monthly mortgage costs. They can include the price of your home, your down payment, your monthly interest rate and the term length of your mortgage. If your math skills are a little rusty, a mortgage calculator does the hard work for you in order to determine your monthly payment and associated costs.

The basic formula for calculating your mortgage costs: P = A/

- P stands for your monthly payment

- A stands for your loan amount

- T stands for the term of your loan in months

- R stands for the monthly interest rate for your loan

For example, lets say that John wants to purchase a house that costs $125,000 and has saved up a $25,000 down payment. His loan amount is $100,000, the term length is 15 years and the monthly interest rate is 4.20%. In this scenario, Johns monthly mortgage payment will be $749.75.

Johns mortgage cost formula will look like: 749.75 = 100,000[4.2^180/[^180-1)

If John wants to purchase the same house with a 30-year term length, the formula works in much the same way. In this scenario, his loan amount is $100,000, term length is 30 years and monthly interest rate is 4.20%. With a 30-year mortgage, Johns monthly mortgage payment will be $489.02.

Johns mortgage cost formula will look like: 489.02 = 100,000[4.2^360/[^180-1)

Also Check: How Do You Remove Pmi From Your Mortgage

Will Variable Rates Continue To Go Up In 2022

Economists are currently predicting that the Bank of Canada will increase the target for the overnight rate by a total of 3-4% between 2022-2023.

Between March 2022 and July 2022, the Bank of Canada has already increased the target for the overnight rate by a total of 2.25% . The next Bank of Canada announcement is on September 7, 2022 and the Bank has made it clear that it will continue to raise rates until inflation begins to moderate.

As a result of the Bank of Canadaâs rate hikes in 2022, most mortgage lenders have also increased their prime rates in 2022 by at least 2.25% and will continue to raise them in line with the Bank of Canadaâs key interest rate. It is therefore reasonable to assume that variable rates will continue to go up for the rest of 2022.

Current Mortgage Rates Can Be Deceptive

Its important to understand that shopping around means actually applying with multiple lenders and getting personalized quotes. It does not mean simply looking online and picking the lender with the lowest advertised rates.

Why? Because lenders tend to base their advertised rates on ideal borrowers. They often include discount points, too, which lower your mortgage interest rate but increase your upfront fees.

So unless you have great credit, a big down payment, and dont mind paying extra closing costs, you probably wont get those advertised rates.

The same applies to average rates. By definition, some borrowers will qualify for lower rates and some will get higher ones. What youll be offered will depend on your situation and personal finances.

Don’t Miss: Should You Refinance To 15 Year Mortgage

Fixed Payments With A Variable

Certain financial institutions will offer fixed monthly payments with a variable-rate mortgage. How does this work? If your interest rate decreases, you’ll pay more principal and less interest, and vice versa if it increases. When rates reach a certain percentage, your financial institution will contact you to adjust your mortgage payments.

Are fixed payments and variable rates the best of both worlds?

Not necessarily. Even if you have fixed payments, rate fluctuations will have an impact when you need to renew your mortgage. You may have to increase your monthly payments to keep the same amortization period. Or you’ll have to refinance your mortgage and extend your amortization to keep your lower payments.

Modeling The Prepayment Rate

Prepayment is undoubtedly one of the key issues an investor in MBSs would want to keep an eye on. Prepayments speed up principal repayments and also reduce the amount of interest paid over the life of the mortgage. Thus, they can adversely affect the amount and timing of cash flows.

Markets have adopted two main benchmarks that are used to track prepayment risk the conditional prepayment rate and the Public Securities Association prepayment benchmark.

Recommended Reading: Is It Better To Pay Off Mortgage Or Refinance

Factors That Can Affect Your Personal Interest Rate

Itâs important to understand that the best mortgage rate you qualify for may change depending on your unique borrowing profile. Here are some of the factors that influence what mortgage rate you qualify for:

The type of mortgage: If your mortgage is for a refinance, rather than a purchase or renewal, youâll be eligible for higher rates. For individuals with an existing mortgage who have good credit and more than 20% equity in their homes, in addition to refinancing, you can also explore a home equity line of credit .

Your down payment: If youâre purchasing a home andyour down payment is less than 20% of the purchase price and the value of the home you are purchasing is less than $1 million, youâll be required to purchase mortgage default insurance . This insurance is added to your mortgage amount and, while it will cost you money, it will result in a lower mortgage rate as your mortgage is less risky for your lender. If youâre renewing your mortgage, in order to be eligible for the lowest mortgage rates you would have needed to purchase CMHC insurance on the original mortgage.

Your intended use of the property: Your mortgage rate will be higher if you plan to rent your property out vs. live in it as your primary residence.

What Is The Difference Between A 5/1 And A 7/1 Arm

Its simply a matter of understanding the shorthand. The first number is the number of years in the introductory period. The second refers to how often the mortgage can reset the interest rate. So, a 7/1 ARM has a 7-year introductory period and the interest rate can be adjusted every year. A 7/6 ARM has a 7-year introductory rate and the rate can adjust every 6 months.

Don’t Miss: Can You Combine 2 Mortgages Into One

Fixed Interest Rate Mortgage

Fixed interest rates stay the same for your entire term. They are usually higher than variable interest rates.

A fixed interest rate mortgage may be better for you if you want to:

- keep your payments the same over the term of your mortgage

- know in advance how much principal youll pay by the end of your term

- keep your interest rate the same because you think market interest rates will go up

How To Compare Five

The table at the top of this article provides a glance at the best mortgage rates offered by a swath of Canadian lenders. If you are shopping for a mortgage on a new home purchase, input the home price, down payment amount and location to view the best mortgage rates available. The tool can also be used to view mortgage rates for products with different rate types, such as variable, and terms, such as 25 years.

Using the green tabs at the top of the table, you can also view mortgage rates for the following:

Mortgage renewal: If your mortgage term is coming to an end and you have an outstanding mortgage balance, you will have to renew your contract for another term. You can do this with either your existing lender or another onebut its always good to shop around. To view mortgage renewal rates for a new five-year term, enter your current mortgage balance, remaining amortization, mortgage payment frequency and location.

Mortgage refinance: If you want to break your current mortgage contract and negotiate a new contract, thats called refinancing. You may want to do this to take advantage of lower interest rates or access equity in your home. However, the decision to refinance should not be taken lightly, because you could end up paying significant penalty fees. If you want to see five-year mortgage rates on a mortgage refinance, enter your current mortgage balance, as well as the amount of equity you wish to access.

Also Check: Can A Mortgage Loan Be Used For Renovations

Ask Your Lender How To Get The Best Rate

If your mortgage lender offered you an interest rate without any type of explanation, you should certainly inquire about it. First, make sure you know what your FICO credit scores are. Then ask your lender if this is the lowest mortgage rate you can get, based on your credit score. Tell him you realize that the rate he’s offering is higher than the current average . Find out what factors are causing this, and what you can do about it.

Just because the lender has offered you an interest rate doesn’t mean you have to accept it. Along with the actual rate, your lender probably offered a rate-lock period as well. This guarantees the quoted interest rate for a certain period of time while your loan is being processed. It’s sort of like a reservation in that respect.

Most people choose to lock in their rate when they’re done shopping for rates. But technically, you can still shop around during this period. You might lose your lock-in fee if you jump ship and choose another lender. But that’s the worst that can happen.