Matching Arm With Ownership Duration

As I planned to either sell my home within 10 years in order to buy a nicer home in Hawaii or pay off the mortgage during this time frame, to me, taking out a 5/1 ARM was worth the risk.

At one point during my 5-year introductory fixed rate term, LIBOR rose to about 3%. Based on a net 2% margin, this would mean my ARM could potentially reset to 5.25%.

If I end up paying 5% for the next five years, my average mortgage rate over a 10 year period would be 5% + 2.5% = 7.5% / 2 = 3.75%. 3.75% is pretty much in-line with the rate I would have gotten if I just locked in a 30-year fixed rate mortgage back in 2014.

However, with the money saved from not paying a 30-year fixed mortgage and the $100,000+ less in downpayment, I ended up investing the difference and earned a ~12% return on average from 2014 2022 because the stock market went up.

The percentage of loans that are adjustable loans is still under 5%. This is unfortunate because this means 95% of American mortgage borrowers are paying a higher interest rate than they should.

Major Indexes For Adjustable

Most adjustable-rate mortgage rates are tied to the performance of one of three major indexes.

- Weekly constant maturity yield on one-year Treasury bill. The yield debt securities issued by the U.S. Treasury are paying, as tracked by the Federal Reserve Board.

- 11th District cost of funds index . The interest financial institutions in the western U.S. are paying on deposits they hold.

- The Secured Overnight Financing rate. The SOFR has replaced the London Interbank Offered Rate as the benchmark rate for ARMs.

Adjustable Rate Mortgage Calculator

An Adjustable-rate mortgage calculator is a type of calculator wherein the user can calculate the periodical installment amount wherein interest rate changes after fixed intervals throughout the life of the borrowing period.

Adjustable Rate Mortgage Calculator

- P is the loan amount

- R is the rate of interest per annum

- N is the number of period or frequency wherein loan amount is to be paid

Don’t Miss: Chase Mortgage Recast Fee

What To Do If Youre Declined For A Preapproval

Theres always a chance you wont get preapproved for a mortgage. But dont be disheartened. One rejection doesnt mean you can never get a mortgage. Especially during the pandemic, some lenders have tightened their standards for credit scores, down payments and more. But that wont last forever.

Weve been seeing these restrictions starting to soften as the market starts to recover and the economy becomes more accustomed to a completely virtual way of life, Watters said.

If you do get rejected, be sure you try applying with another lender. If one lender denied you for a credit score of 690, you can probably find a lender thats still qualifying borrowers for a conventional loan at 620 and above.

If you apply with a few lenders and still cant get preapproved, dont lose heart. Under the Equal Credit Opportunity Act , your lender has to tell you why your application was denied. It may have been your credit score, or it may be that you havent been at your current job long enough. Whatever the reason is, now you know what to work on so you can get preapproved in the future.

How It Works: Adjustable

An adjustable-rate mortgage is a loan with an interest rate that will change throughout the life of the mortgage. This means that over time, your monthly payments may go up or down.

While both fixed-rate and adjustable-rate mortgages have benefits to consider, you need to make sure you are financially prepared for the rate adjustments that might happen with an ARM.

All ARMs have adjustment periods that determine when and how often the interest rate can change. There is an initial period during which the interest rate doesn’t change this period can range from as little as six months to as long as 10 years. After the initial period, most ARMs adjust.

Also Check: Chase Mortgage Recast

What To Bring To Your In

We want you to be ready for the pre-approval process and being prepared will help. For your meeting, you should plan to bring the following:

- Current address

- If self-employed, the last 2 years Notice of Assessments from your Income Tax return

- Value of properties, automobiles, investments, and savings

- Most recent statements for mortgages, loans and lines of credit

- Most recent credit card statements

- Estimated value of your home

- Housing expenses

- Financial information for your co-borrower, if applicable

- Social Insurance Number

How Much Longer Do You Plan On Living In Your Home

If you plan on moving soon, it may make financial sense to stick with an ARM. But, should your plans change in the future, you will still be responsible for making your monthly mortgage payments if rates adjust upwards. Use our calculator to estimate how a higher mortgage rate can impact your mortgage payment.

Use our fixed- or adjustable-rate calculator to understand which mortgage type may be right for you. Or use our adjustable-rate mortgage calculator to estimate your monthly mortgage payment.

When it comes to mortgages, you have options. To determine the right mortgage for your situation, lean on your lender or financial professional for guidance. Be sure you know the details of how and when this type of loan may change your monthly payments.

Recommended Reading: 10 Year Treasury Yield And Mortgage Rates

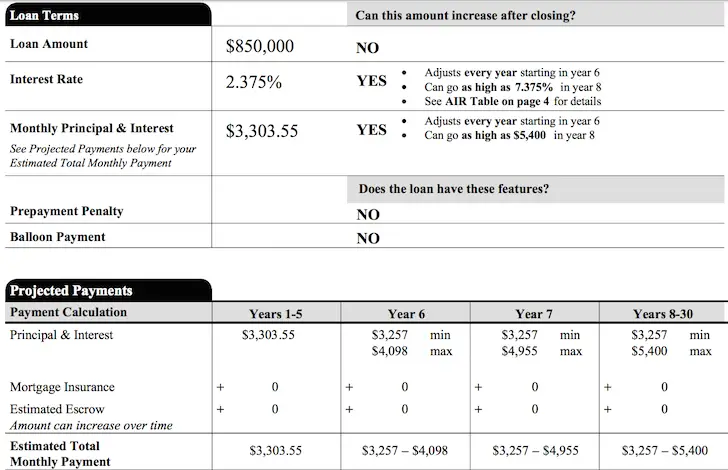

Terms Of My Arm Increase

But surprise! I didnt end up paying an estimated 5% mortgage rate in 2019. Instead, based on my adjustable rate mortgage increase cap, I received a letter saying that Ill be paying at most 4.5%. Have a look at the portion of the letter below.

The reason why my rate only goes up from 2.5% to 4.5% is that under the terms of my mortgage, my ARMcan only reset by at most 2%after the initial 5-year fixed rate of 2.5% is up.

This maximum reset amount is pretty standard among ARM loans. But this reset amount is something you must have your bank point out in the document.

Arm Rates And Rate Caps

Mortgage rates are determined by a variety of factors. These include personal factors like your credit score and the broader impacts of economic conditions. Initially, you may encounter a teaser rate to entice you with an incredibly low rate which will disappear at some point during the loan term.

The basis on an ARMs rate is the benchmark it names in the contract. For example, the contract may name the U.S. Treasury or the secured overnight finance rate as a rate benchmark. Essentially, the benchmark will serve as the starting point of any reset calculations.

U.S. Treasury and SOFR rates are among the lowest rates possible for short-term loans to their most creditworthy borrowers, generally governments and large corporations. From that benchmark, other consumer loans are priced at a margin, or markup, to these cheapest possible loan rates.

The margin applied to your ARM depends on your and credit history, as well as a standard margin that recognizes mortgages are inherently riskier than the types of loans indexed by the benchmarks. The most creditworthy borrowers will pay close to the standard margin on mortgages, and riskier loans will be further marked up from there.

The good news is that there may be rate caps in place, which indicates a maximum interest rate adjustment allowed during any particular period of the ARM. With that, youll have more manageable swings with each new rate change.

Recommended Reading: 10 Year Treasury Yield Mortgage Rates

How To Calculate An Arm Loan

- To calculate an ARM once it goes adjustable

- Simply combine the preset margin and the current index price

- Then multiply it by the outstanding loan amount

- Be sure to use the remaining loan term in months to determine the correct payment

Now that youve seen the many ARM loan options available, you might be wondering how to calculate an ARM adjustment.

After all, theres a chance you might face a rate adjustment if you hold onto your mortgage beyond the fixed period.

Fortunately, its not too difficult to calculate, you just need a few key pieces of information.

This includes the fully indexed rate , the outstanding loan balance, and the remaining loan term.

For example, if you took out a 5/1 ARM with a rate of 2.5% and a loan amount of $200,000, the monthly payment would be $790.24 for the first 60 months.

After 60 months, the principal balance would be $176,150.87.

Now lets assume your margin is 2.25 and the index is 1.50. Together, thats a new rate of 3.75%

We then have to apply that new rate of 3.75% to the remaining balance of $176,150.87 over the remaining term, which would be 300 months .

That results in a monthly payment of $905.65, at least for the 12 monthly payments during year six.

The loan will then re-amortize again at the start of year seven, and the monthly payment will be generated using the new outstanding balance and interest rate at that time. And so on down the line

What Advantages Do Adjustable

With mortgage rates on the rise, more Americans are opting for adjustable-rate mortgages over 30-year, fixed-rate loans as a way of saving money in a period of high inflation. But the strategy could backfire, depending on the terms and the length.

More: How Biden Is Impacting Social Security in 2022

ARMs accounted for 13% of all home loans by dollar volume in March their highest percentage since January 2020, ABC News reported, citing data from CoreLogic. At the same time, the average weekly rate on a 30-year mortgage recently reached a 13-year high of 5.3%, according to Freddie Mac. As of June 2022, the average rate is at nearly 6%.

The rise in ARMs has continued over the past couple of months, said Robert Heck, vice president of mortgage with Morty, a mortgage services platform.

Weve seen a noticeable uptick in demand for adjustable-rate mortgages amid increasing rates for fixed-rate loans, Heck told GOBankingRates in an email statement. The appeal of an ARM is that they offer lower initial interest rates than fixed-rate mortgages, but they certainly arent right for everyone.

POLL: Do You Have a Side Gig or Other Hustle?

Lower rates mean lower monthly payments a big draw in an economy where the prices of consumer goods are rising at their highest rate in more than 40 years.

Read Also: Rocket Mortgage Vs Bank

What Are The Disadvantages Of An Adjustable

As with any type of loan, an ARM isnt the right best solution for everyone. Here are some of the potential drawbacks:

- When interest rates rise or fall based on the market standards, your rates and payments can change as well, making it difficult to budget out how much your future payments may be.

- Some ARMs on investment properties can come with a prepayment penalty which is charged if you refinance or sell.

- They are complex. There are typically more rules, regulations, and fees on an adjustable-rate mortgage than there are on fixed-rate loans.

Need Financial Assistance? See if you qualify for a loan today!See if you Qualify

Need Financial Assistance? See if you qualify for a loan today!

The Short Answer: It Depends

Every time you make a bi-weekly or monthly mortgage payment, a portion of the money goes towards paying down the principal and a portion is taken off as interest. At the beginning of your mortgage amortization period, the majority of the payment goes towards interest. As you pay off the principal owed over time, the ratio skews to less interest and a higher percentage towards principal, as shown using a mortgage calculator.

With a closed variable rate mortgage, your regular payment remains the same regardless of whether or not interest rates change. If interest rates go up, the portion of your payment that goes towards interest, however, will increase, meaning it will take longer to pay down the principal. On the other hand, if rates go down, youll be paying more principal and less interest with every payment.

The one exception is in the case that interest rates rise to the point that your payment doesnt cover the interest portion of the payment . In this situation, your lender will either increase your payment amount or require you to make supplementary payments to cover the difference.

With an open variable rate mortgage, your mortgage payment will increase or decrease as rates change so that the interestprinciple ratio remains the same. The downside here is that if interest rates climb sharply, homeowners may have difficulty covering higher mortgage payments.

Read Also: Bofa Home Loan Navigator

Frequently Asked Questions About Arms

Can an adjustable-rate mortgage go down?Yes. Assuming the adjustable-rate mortgage is not in it’s fixed period , and is subject to adjustment, the interest rate can go down if the underlying indexdecreases. During the 1980’s when the interest rates were in the double digits, many homebuyers took out adjustable-rate mortgages to finance their home. As the interest rates decreased, the adjustable-rate on their mortgage also decreased.

Can you prepay an adjustable-rate mortgage?Probably. Read the loan papers you signed at settlement to determine whether there is a prepayment penalty for an early payoff. Typically, if there is a prepayment penalty, it is forthe first 3 to 5 years. For home mortgages issued after January 10, 2014, mortgage lenders are only permitted to charge prepayment penalties for the first three years of the loan with a maximum penalty of 2%.

Do adjustable-rate mortgages have prepayment penalties?Prepayment penalties were often a condition of sub-prime mortgages. Since the passage of the DoddâFrank Wall Street Reform, and Consumer Protection Act, prepayment penalties have largely gone away. Fortunately, the required loan estimate thatmust be provided to the borrower, states whether the proposed mortgage carries a pre-payment penalty.

Does FHA offer adjustable-rate mortgages?The Federal Housing Administration , permits adjustable-rate mortgages. Prepayment penalties are prohibited with FHA adjustable-ratemortgages.

Anytime Estimate

Should You Get An Arm

If you missed 2021s all-time low interest rates or the window earlier this year when they sat below 4%, an ARM could be an alternative way to lock in a historically low rate.

Choosing an ARM comes with potential access to below-market interest rates. And just like with an FRM, you can always refinance if rates drop again and you want to lock something in long-term.

Of course, going down this path will also depend on your risk tolerance and learning how adjustable rates work. If youre ready or just curious whether an ARM is the right home loan for you, reach out to a lender today and get started.

You May Like: Monthly Mortgage On 1 Million

What Mortgage Rate Can You Get With Your Credit Score

While it is sometimes easier to qualify for an adjustable-rate mortgage, your credit score still affects your interest rate and payment. For instance, if you have a low credit score, the extra points added to the interest by the lender might be higher if your credit score is lower.

It’s essential to price out several different ARMs through different lenders so you ensure youre getting the most favorable rates. You can also monitor the overall interest rates in the mortgage industry.

Who Should Consider An Adjustable

I recommend ARMs for anyone who isn’t planning to hold onto the property for a long period of time, or who has the financial flexibility to weather any variable interest storms. If you’re looking for a house to stay in for just a few years, before your mortgage interest rate changes from fixed to variable, you may want to consider an ARM. It may be possible to refinance your mortgage before the interest rate changes, but there’s no guarantee you’ll get a better rate and you’ll have to pay closing costs all over again.

But if you’re on the hunt for your forever home, you may not want to take on the added risk. You may be better off choosing the financial security of a fixed-rate mortgage.

At the end of the day, which mortgage you choose should be based on your financial picture and goals. Depending on your situation, ARMs can be a great tool to take advantage of lower rates and enjoy initial cash flow, helping you secure the right home.

Read Also: Reverse Mortgage Manufactured Home

What Are Adjustable Rate Mortgage Interest Rate Caps

As the term suggests, the adjustable-rate mortgages are subject to interest rate adjustment. Consequently your loan payment can go up when interest rates increase, however, if interest rates go down, the monthly paymentwill decrease with adjustable-rate mortgages.

Now you might be thinking, âwhy would anyone get involved with a loan with a variable interest rate? The reason for many home buyers is the lower interest rate for the 1st year. A lower interest rate means prospective home buyers can borrow more money from the bank or mortgage broker and thus purchase a more expensive home.

Another reason home buyers choose ARMs is because they believe interest rates will be going down, and consequently, their payment will decrease. In 1982 mortgage rates were 18%. So a prospective homeowner who took out an adjustable-rate mortgage in 1982 would have seen their monthly loan payment decrease as the years rolled along.

Home buyers who believe they will remain in the home for a few years are attracted to adjustable-rate mortgages because of the lower initial interest rate and the belief that even if the interest rates do increase, they will have moved on to another houseor will be transferred by their employer.

Sadly, many sub-prime mortgages were structured with an adjustable-rate mortgage and millions of homeowners were not able to keep up with the increasing interest rate adjustments.