Highlights From The Bank Of Canada’s October 26 2022 Announcement

On October 26, 2022, the Bank of Canada increased the key overnight rate by 0.50%. The target for the overnight rate is now 3.75%.

- Canadians with variable-rate mortgages and home equity lines of credit will see their rates rise accordingly by 0.50%. They should calculate what their new mortgage payment will be and budget for more increases to come.

- Canadians with fixed-rate mortgages arenât affected by the announcement directly, but can expect higher rates when they renew at the end of their current mortgage term.

- As rates rise, so does the mortgage stress test. With today’s announcement pushing variable rates up by 0.50%, anyone who is getting a new variable-rate mortgage will need to pass a stress test that is 0.50% higher. To calculate how much you can qualify for, use our mortgage affordability calculator.

- Although the Bank made it clear that further rate hikes will be necessary to get inflation under control, it did say that it would be examining the economic effects of this year’s rate increases. This suggests that the end of rising rates may be on the horizon if the Bank feels that inflation is being pushed back down sufficiently.

Forbes Advisors Insight On The Housing Market

Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future.

To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection. However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection.

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their âforever homeâ have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. Thatâs why itâs so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

Average Mortgage Interest Rate By Type

There are several different types of mortgages available, and they generally differ by the loan’s length in years, and whether the interest rate is fixed or adjustable. There are three main types:

- 30-year fixed rate mortgage: The most popular type of mortgage, this home loan makes for low monthly payments by spreading the amount over 30 years.

- 15-year fixed rate mortgage: Interest rates and payments won’t change on this type of loan, but it has higher monthly payments since payments are spread over 15 years.

- 5/1-year adjustable rate mortgage: Also called a 5/1 ARM, this mortgage has fixed rates for five years, then has an adjustable rate after that.

| 5.57% |

Also Check: How Much Of Your Salary Should Your Mortgage Be

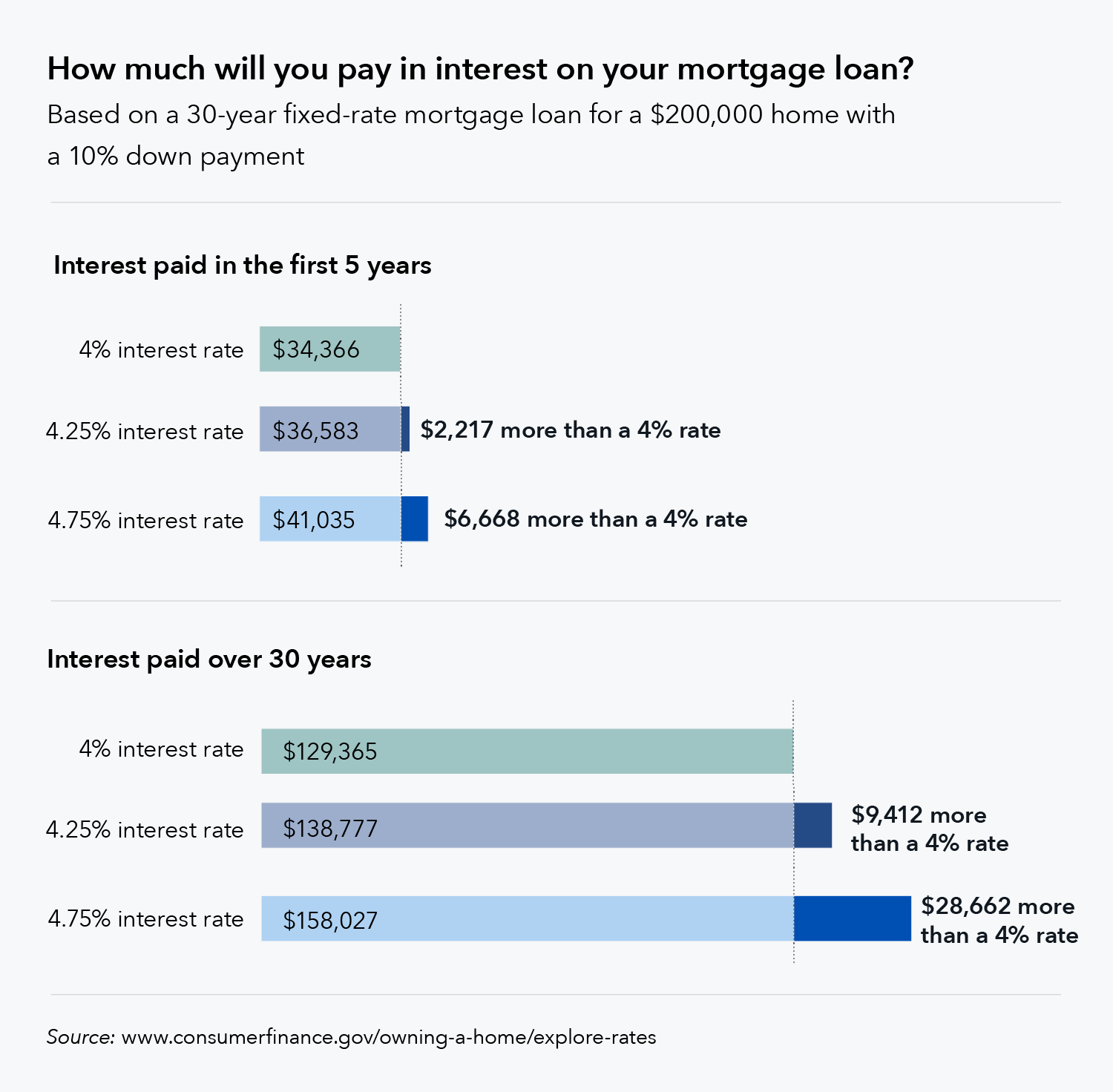

When You Apply For A Mortgage Theres One Factor That Could Save You Tens Of Thousands Of Dollars If You Play It Right: Your Interest Rate

Your interest rate impacts how much youll pay your lender over time. Fortunately, you may be able to influence the interest rate you get by taking steps to build your credit, saving for a big down payment and researching your options.

Mortgage experts predict that interest rates will jump by a half percentage point this year, which may seem trivial. But take a closer look: A 30-year, $250,000 mortgage with a 4.25 percent fixed interest rate will cost about $21,400 less over the life of the loan than the same mortgage with a 4.75 percent rate.

Whether youre planning on refinancing your current abode or purchasing a new home, heres what you can do to better your chances of scoring a great mortgage rate:

How Much Difference Does 1% Make On A Mortgage Rate

The short answer: It can produce thousands or even potentially tens of thousands in savings in any given year, depending on the purchase price of your property, your overall mortgage rate, and the total amount of the mortgage being financed.

By way of example, say that Taylor, a 30-year-old who is a first-time home buyer, wishes to obtain a 30-year fixed FHA loan on a new home with a 20% down payment. Below, you can get a sense of just how much that they stand to save given a 1% difference in interest savings on their 30-year mortgage.

Don’t Miss: Where Does Your Mortgage Statement Come From

Is 325% A Good Mortgage Rate

Lets preface this by mentioning that some borrowers are scoring rates in the 2s. Others, meanwhile, also timed the process right and locked in a 3% mortgage rate.

But dont be discouraged if you end up with a 3.25% rate. Even a 0.75% difference, when compared to a 4% rate, will prove to be worthwhile in the long run.

Look At Interest Rate And Apr

Most borrowers tend to focus on mortgage rates. But the APR you pay on a loan is often just as or even more important than the basic interest rate.

Annual percentage rate looks at all your costs of borrowing and spreads them over the potential life of your loan. So APRs are higher than straight rates. And they can tell you about what youre actually going to pay.

Just note, APR assumes youll keep your loan its full term, which most borrowers dont. They either sell or refinance before the mortgage term ends.

So look at APR, but remember that its not always the last word on what youll pay. You can learn more about how to compare interest rates and APR effectively in this article.

Also Check: How Much Income Do I Need For A 50k Mortgage

Whats Happening In The Market To Affect Rates

Inflation refuses to be tamed. Because of that, the Federal Reserve continues to increase the federal funds rate. When that happens, it costs lenders more to borrow money. So they must charge more for you to borrow from them. This causes interest rates on loans, such as mortgages, to go up.

In 2022, we’ve seen the U.S. central bank raise the benchmark short-term borrowing rate a total of six times. This includes 75 basis point increases in June, July, and September. The Fed also, surprisingly, raised rates on Nov 2, 2022.

At the time of this article, it’s expected they will continue to raise rates, including a half-point hike at the December meeting and then a few smaller raises in 2023.

This means time is of the essence. Whether you’re looking to buy a home or refinance for greater savings, you should contact a lender immediately to learn what options are available to you.

Typically mortgage lenders bake their rates ahead of potential Federal Reserve rate increases or decreases. Knowing that, if youre focused only on the lowest rate, it may be possible to get a better interest rate in front of the next rate hike or just after the last one if rates are expected to continue rising.

When Should You Avoid An Adjustable

For some homebuyers, an ARM will simply not be a sound financial choice. This is particularly true for those who are already having challenges obtaining a mortgage of any kind or are stretching their finances to make mortgage payments work within their operating budget.

An ARM should be avoided if you are right on the edge of qualifying, as I lean toward the elimination of as much risk as possible, says Hardy. A fixed-rate mortgage, however, is similar to buying insurance against a worst-case scenarionot all that unlike health or car insurance.

ARMs are also not the best choice for those who prefer the certainty of a reliable payment or for buyers whose finances fluctuate and therefore need long-term predictability in their monthly mortgage.

You May Like: How A Mortgage Refinance Works

Good Mortgage Rates Look Different To Everyone

What is a good mortgage rate? Thats a tricky question. Because many of the rates you see advertised are available only to prime borrowers: those with high credit scores, few debts, and very stable finances. Not everyone falls into that category.

Of course, you can look at average mortgage rates. But how reliable are those as a guide?

On the day this was written , Freddie Macs weekly average for a 30-year, fixed-rate mortgage was 6.61 percent. But the daily equivalent from The Mortgage Reports rate survey was 6.921% . So theres clearly a lot of variance across the market.

Should You Buy A House When Interest Rates Are High

Although rising interest rates can make home ownership less affordable for buyers by increasing their monthly mortgage payment, there are some benefits to buying a house when interest rates are high.

- When interest rates rise, it usually slows down the housing market. This means sellers may be more willing to negotiate housing prices and make concessions that may not be available in a hot market. This can lead to lower housing costs, making it easier for buyers to get into the market.

- Higher interest rates can also mean less competition from other potential buyers, which increases the likelihood of getting your offer accepted by the seller. This is especially true for buyers in competitive markets.

- Lastly, higher interest rates can mean more home inventory available on the market as people are hesitant to buy when interest rates are high. This gives buyers more options and a better chance of finding their dream home.

Recommended Reading: What’s The Rule Of Thumb For Mortgage Payments

What Is A Good Interest Rate On A Home Mortgage

Locking in low mortgage and refinance rates can save you thousands of dollars over the life of your loan. Heres how you can get a good interest rate on a home loan.

When applying for a home loan, one of the most important factors you should pay attention to is your interest rate. Having a lower mortgage interest rate could save you tens of thousands of dollars over the life of your loan.

Generally, the best time to apply for a mortgage or mortgage refinance is when national interest rates are low. However, the market rate does not always match the rate you could be given once you apply, since personal factors will also come into play. For the past few years, mortgage rates have remained historically low around 3% to 4% for a 30-year fixed-rate mortgage, according to Freddie Mac. However, just 30 years ago, rates were as high as 9% and 10%.

Getting a good interest rate on your mortgage relies on a variety of factors, but its important to determine what a good mortgage rate really means. You can explore mortgage rates across multiple lenders on Credible without affecting your credit score.

What is a good mortgage rate right now?

You can check out Credibles mortgage calculator for your potential monthly mortgage payment, including how much interest youll pay.

You May Like: Rocket Mortgage Vs Bank

What Is A Good Mortgage Interest Rate

In general, you can consider a good mortgage rate to be the average rate in your state or below. This will vary depending on your credit score better scores tend to get better mortgage rates. Overall, a good mortgage rate will vary from person to person, depending on their financial situation. In 2020, the US saw record-low mortgage rates across the board that continued into 2021. But rates have increased significantly since then.

Also Check: How Do Interest Rates Affect Reverse Mortgage

How Does Interest Work On A Car Loan

When you apply for a car loan, the car is used as collateral.Most lenders will require you to have auto insurance to protect the collateral while the loan is being repaid. If you miss any payments, the bank can repossess the car to cover the costs of the loan.

Because the process of repossessing a car is fairly straightforward and doesnt cost the lender very much in fees, borrowers can expect lower interest rates on car loans. Auto loans typically have interest rates in the 4-5% range.

How Mortgage Payments Are Calculated

With most mortgages, you pay back a portion of the amount you borrowed plus interest every month. Your lender will use an amortization formula to create a payment schedule that breaks down each payment into principal and interest.

If you make payments according to the loan’s amortization schedule, the loan will be fully paid off by the end of its set term, such as 30 years. If the mortgage is a fixed-rate loan, each payment will be an equal dollar amount. If the mortgage is an adjustable-rate loan, the payment will change periodically as the interest rate on the loan changes.

The term, or length, of your loan, also determines how much youll pay each month. The longer the term, the lower your monthly payments will typically be. The tradeoff is that the longer you take to pay off your mortgage, the higher the overall purchase cost for your home will be because youll be paying interest for a longer period.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Historical Mortgage Rates: Averages And Trends From The 1970s To 2022

See Mortgage Rate Quotes for Your Home

Since 1971, historical mortgage rates for 30-year fixed-rate loans have hit historic highs and lows due to various factors. Well use data from Freddie Macs Primary Mortgage Market Survey to do a deep dive into whats driven historical mortgage rate movements over time, and how rate fluctuations affect buying or refinancing a home.

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan and is built into your monthly payment. Mortgage fees are usually paid upfront and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

Don’t Miss: How To Remove Mortgage From Credit Report

When Is An Adjustable Rate Mortgage Right For You

So how to decide when an ARM is right for you? There are a variety of considerations to sort through as you figure out whats best for you and your financial needs. Perhaps the first and most important question to ask is how long you plan to be in the home.

While a risky bet for those with a long-term outlook, an ARM can make sense during shorter-term housing needs, says Hardy. In some cases, an individual or family will have a five-year window and know this upfront. In this scenario, a five- or seven-year year ARM makes sense, as the higher the level of certainty in a timeline, the better for planning to go in this direction.

Using an ARM may also make sense if youre looking for a starter home and may not be able to afford a fixed-rate mortgage. Historically, says McCauley, most first- and second-time homebuyers only stay in a home an average of five years, so ARMs are often a safe bet.

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners’ insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

Also Check: Why Is Mortgage Interest Rate Different From Apr