What Happens To My Cmhc Insurance If I Change Lenders

If you choose to change lenders when its time to renew your insured mortgage, you do not have to pay for CMHC insurance again. CMHC insurance covers your mortgage until it is paid off, and will follow you from lender to lender. Simply provide your CMHC certificate of insurance or certificate number.

Corporate Tax Harmonization And Simplification

For taxation years ending after December 31, 2008, corporations are required to file a harmonized T2 Corporation Income Tax Return with the Canada Revenue Agency . The harmonized tax return includes the following Ontario corporation taxes:

- corporate income tax

- corporate minimum tax

- capital tax, and

- special additional tax on life insurance corporations.

However, the harmonized tax return does not include the Ontario Insurance Premium Tax . For taxation years ending in 2009 and 2010, corporations subject to Premium Tax previously filed the Insurance Premium Tax Return with the Ontario Ministry of Finance . For taxation years ending in 2011 and beyond, corporations will file the new CT – Insurance Premium Tax Return with the ministry.

Many Factors Impact The Cost Of Homeowners Insurance

How much youll pay for your homeowners insurance depends on many factors such as the value of the home, how much coverage you need, the deductible, the type of coverage you need, and the claims history of the area where the home is located, just to name a few.

Your insurance agent also takes into consideration discounts for bundling policies, discounts for where you work, and your credit score.

The cost of homeowners insurance is based on the replacement cost of the home and not the purchase price.

This means that the homes value is established by an appraisal method that estimates how much it would cost to rebuild or repair your home to get it back to its original condition after a disaster or damage.

The national average is $95.51 per square foot, but may be different for where your home is located.

If youre in the early stages of home buying, you can ask your real estate agent to ask the seller what they pay for their homeowners insurance to get an idea of how much you may have to pay. According to valuepenguin.com, the average annual cost of homeowners insurance in 2016 is $952.

Read Also: What’s Refinancing A Mortgage

Calculation Of Premium Tax Payable

In the calculation section, determine the total Premium Tax on lines 18 and 19, enter the payments made on line 20, and determine the net Premium Tax payable or refundable on line 21. If there is a refund and it should be applied to the next taxation year, check the box Apply credit to future reporting period.

Today’s Mortgage Rates In California

| Product |

|---|

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Total Monthly Payment

Based on a $350,000 mortgage

Based on a $350,000 mortgage

| Remaining Mortgage Balance |

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Read Also: How Does Mortgage Appraisal Work

What Is Mortgage Loan Insurance

Mortgage loan insurance is typically required by lenders when homebuyers make a down payment of less than 20% of the purchase price. Mortgage loan insurance helps protect lenders against mortgage default, and enables consumers to purchase homes with a minimum down payment starting at 5%* with interest rates comparable to those offered with a larger down payment. To obtain mortgage loan insurance, lenders pay an insurance premium. Typically, your lender will pass this cost on to you. The premium is based on the loan-to-value ratio . The premium can be paid in a single lump sum or it can be added to your mortgage and included in your monthly payments.

Today’s Mortgage Rates In Minnesota

| Product |

|---|

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Total Monthly Payment

Based on a $350,000 mortgage

Based on a $350,000 mortgage

| Remaining Mortgage Balance |

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Also Check: How Much To Earn For 200k Mortgage

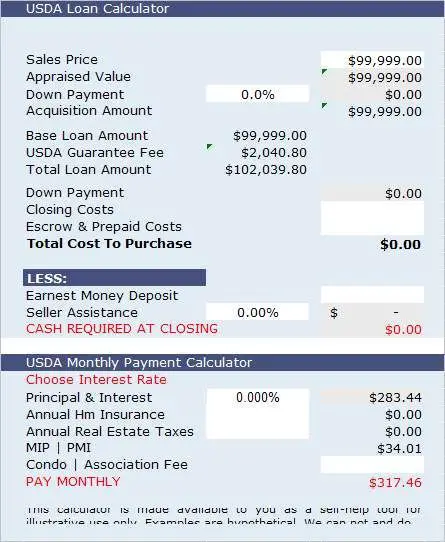

How Does A Mortgage Payment Calculator Work

Our mortgage payment calculator estimates your total monthly mortgage payment, including: Principal, Interest, Property taxes, Homeowners insurance, and HOA dues, if applicable.

Mortgage calculators determine your monthly principal and interest based on your loan amount, loan term, down payment, and interest rate. These factors are used to make a payment schedule. It shows how the loan amount will deplete over the course of your mortgage, with regular monthly payments.

In addition, The Mortgage Reports uses national and state databases to estimate your monthly payments for taxes and insurance. Actual numbers will vary. But its important to include these costs in your estimate, as they can add a few hundred dollars per month to your mortgage payment.

Formula For Calculating A Mortgage Payment

The mortgage payment calculation looks like this: M = P /

The variables are as follows:

-

M = monthly mortgage payment

-

P = the principal amount

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

You May Like: What Is Verifiable Income For A Mortgage

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if youre in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

How To Calculate Mortgage Payments

Your monthly mortgage costs include more than just loan payments and interest. So you can really crunch the numbers, weve included all the typical monthly costs youll be responsible for once you own a home.

Play around with different home prices, locations, down payments, interest rates, and mortgage lengths to see how they impact your monthly mortgage payments.

If you enter a down payment amount thats less than 20% of the home price,private mortgage insurance costs will be added to your monthly mortgage payment. As the costs of utilities can vary from county to county, weve included a utilities estimate that you can break down by service. If youre thinking about buying a condo or into a community with a Homeowners Association , you can add HOA fees.

The only amounts we havent included are the money youll need to save for annual home maintenance/repairs or the costs of home improvements. To see how much home you can afford including these costs, take a look at theBetter home affordability calculator.

Fun fact:Property tax ratesare extremely localized, so 2 homes of roughly the same size and quality on either side of a municipal border could have very different tax rates. Buying in an area with a lower property tax rate may make it easier for you to afford a higher-priced home.

Read Also: How Long Will I Pay Off My Mortgage

Factors In Your California Mortgage Payment

Your monthly mortgage payment will consist of your mortgage principal and interest. On top of that bill, youll have to consider property taxes and homeowners insurance as two more recurring expenses.

Property taxes in California are a relative bargain compared to the rest of the nation. With limits in place enforced by Proposition 13, generally property taxes cannot exceed 1% of a propertys market value. Assessed value cannot exceed increases of more than 2% a year. With those rules, Californias effective property tax rate is just 0.73%. On the local and county level, additional taxes can be levied if you live in a special district thats financing an improvement or other local concern.

Unlike many other states which employ local assessors to determine market value, California bases your initial property tax rate on the purchase price of the property. Each year the value will increase by the rate of inflation, capped at 2%. If the property is your principal place of residence, youre entitled to the homeowners exemption of $7,000 decreased assessed value, which cannot surpass $70 in savings.

As for homeowners insurance, California has reasonable rates. Despite the relatively frequent occurrence of natural disasters, including wildfires and earthquakes, the state has lower insurance costs than half of the nation. The average annual policy is about $1,166 a year, according to Insurance.com data.

Costs To Expect When Buying A Home In California

One of the costs youll want to consider during the home-buying process is a home inspection. Before you close the deal on a house, theres usually a period where you can arrange a home inspection to determine the state of the house and any potential problems with the property. If problems are found, you generally have some negotiating power over the seller for repairs or price. Typical costs range from $300 to $550, with larger houses falling on the higher end of the price range. Some types of mortgages will require additional tests such as termite inspections. Any additional services will cost extra, but may help you discover serious issues prior to moving in, such as a mold infestation. One last consideration for testing is radon. California doesnt have as high of risk for radon as some regions in the U.S. However, there are some areas, such as Tulare, that are depicted as having high concentrations of radon, according to the California Department of Conservations indoor radon potential map. Youll want to check to see if your property is in one of those high-risk areas.

If the inspection goes well and you set a closing date for the home, youll have to budget for the additional fees that are called closing costs. These costs vary based on the location and value of the home, your mortgage lender and a number of other factors. On a county to county basis, closing costs in California average between 0.86% and 2.67% of your home’s value.

Also Check: When Do Mortgage Rates Come Out

Costs To Expect When Buying A Home In Minnesota

If youre still in the initial stages of home-buying planning, youll want to consider some of the one-time upfront costs. One of the first costs youll come across is a home inspection. This is when you find a home youd like to buy. Generally most buyers will arrange for a home inspection after putting in an offer on the house, but some buyers will negotiate for a pre-offer inspection. Whichever you choose, the cost is the same. Most home inspections run between about $350 and $500, and depend on the size and type of home. Smaller square footage dwellings and condos generally are on the lower end of the scale. While a home inspection covers structural system, roof, plumbing, electrical and more, it wont cover specialties such as radon, termite damage or mold. If youd like to arrange additional tests, it will cost you extra and is optional.

One of the last costs youll factor in is a bundle of service fees and charges known as closing costs. These fees are for your mortgage lender, the state and county and a number of other entities, depending on who was involved in the mortgage and buying process. The exact sum depends on a number of factors, and youll pay it on the day you finalize paperwork and get keys to the property.

Los Angeles Homebuyers Can Take Advantage Of Historically Low Mortgage Rates Today

Own your very own piece of Los Angeles. Lock in low rates currently available in and save for years to come! In spite of the recent rise in rates current mortgage rates are still below historic averages. If you secure a fixed mortgage rate your payments won’t be impacted by future rate hikes. By default we show 30-year purchase rates for fixed-rate mortgages. You can switch over to refinance loans using the radio button. Adjustable-rate mortgage loans are listed as an option in the check boxes. Alternate loan durations can be selected and results can be filtered using the button in the bottom left corner. You can select multiple durations at the same time to compare current rates and monthly payment amounts.

Help your customers buy a home today byinstalling this free mortgage calculator on your website

As Seen In

Also Check: What Is Mortgage On A 500k House

How To Use The Mortgage Calculator With Taxes And Insurance

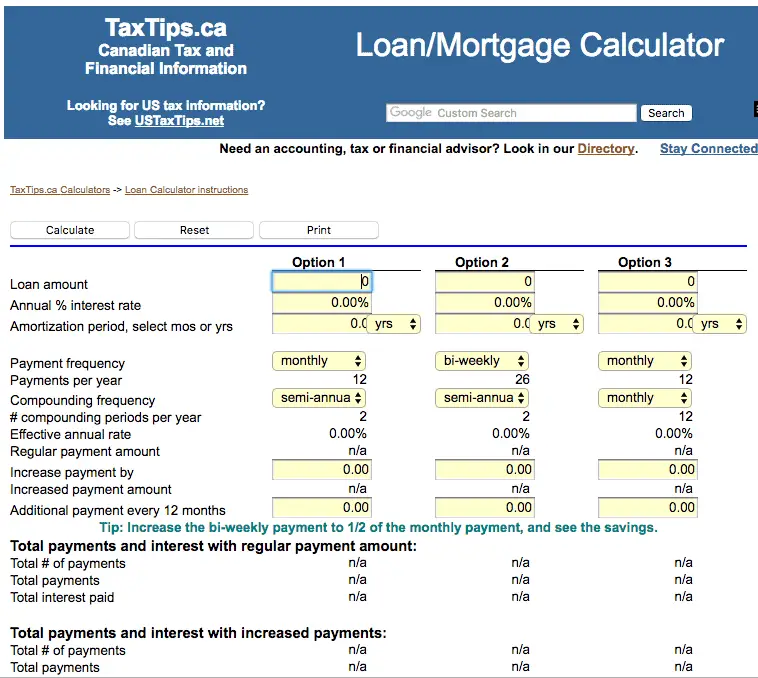

To use the calculator, you need to set the parameters in its first two sections. In addition, you can input more information about extra payments in the advanced mode.

1. Main specifications

- Home value – the purchasing price of the property.

- Down payment and down payment percentage

This is the part of the home value that you can pay before you get the mortgage. Its percentage is crucial when applying for a mortgage. It often represents the main obstacle to getting a loan. The required minimum varies depending on the loan provider and the related legislation. In the US, for example, the minimum down payments range from 3.5% to 20-25% of the purchase price. Furthermore, since a smaller down payment is typically associated with a higher risk for the lender, it also affects the interest rate and cost of Private Mortgage Insurance .

-

Mortgage amount – The amount you need to borrow from the bank in order to make the purchase. This constitutes the principal of your loan.

-

Interest rate

- Loan term

It’s the term in which you need to pay off the loan and fulfil the condition set out by the mortgage contract. Note, that in some cases, you can accelerate the repayment of the principal by making extra payments. In this way, the amortization term, which is the actual mortgage payoff time, will be shorter.

- Payment frequency

You may have several options of regularity for making payments. You can choose monthly, bi-weekly, or weekly payment in this tool.

- Interest calculation method

Applicable Fees Taxes And Remaining Costs

Like any other purchase, the government may charge tax. When you buy a home, you pay the following costs.

- Land transfer tax. The government may charge land transfer tax when you buy a property. The tax is based on the homes purchase price, and sometimes other factors. Most provinces charge provincial land transfer tax, but some cities charge their own municipal land transfer tax, too. Taxes vary by province and first-time home buyers may sometimes receive a rebate for part of the cost.

- GST or HST. Newly constructed and substantially renovated homes may be subject to GST or HST. If you pay GST and HST, you may qualify for a new housing rebate.

- Property taxes, utilities and condo fees. The seller may have prepaid property taxes, utility bills or condo fees before you take ownership of the property. You reimburse the seller for the portion of the costs from the closing date forward.

Also Check: How Quickly Will I Pay Off My Mortgage

You Might Be Able To Cancel Your Mortgage Escrow Account And Pay Property Taxes And Insurance On Your Own

Mortgage lenders often require borrowers to have an escrow account. With this kind of account, you pay a few hundred dollars extra every month on top of your monthly mortgage payment of principal and interest. The servicer keeps this extra money in the escrow account until your property tax and homeowners’ insurance bills are due. It then uses the money to pay the bills on your behalf.

Some borrowers like the ease of having an escrow account by paying a little bit each month, they can avoid worrying about having to pay large amounts when the tax or insurance bill comes due. But if you prefer to pay these bills on your own, you might be eligible to cancel the accountif you meet specific criteria and depending on the type of loan you have.

Pmi Tax Deduction: Legislation Timeline

The Tax Relief and Health Care Act first introduced the deduction for mortgage insurance back in 2006. In 2015, Congress extended the deduction with the Protecting Americans from Tax Hikes Act, but the deduction expired on Dec. 31, 2016. The extension was good for only one year.

Congress then stepped in again. The Bipartisan Budget Act of 2018 extended the mortgage insurance premiums deduction retroactively again through 2017. On Jan. 8, 2019, California Representative Julia Brownley introduced the Mortgage Insurance Tax Deduction Act of 2019, which would make the mortgage insurance deduction a permanent part of the tax code and would apply retroactively to all amounts paid or accrued since Dec. 31, 2017.

The Further Consolidated Appropriations Act of 2020 allowed PMI tax deductions for 2020 and retroactively for 2018 and 2019.

Also Check: How Much Money Do You Get With A Reverse Mortgage