Jumbo Loan Or Conforming Loan

The last thing to consider is whether you want a jumbo loan or conforming loan. Lets take a look at the difference between the two.

A conforming loan is any home loan that follows Fannie Mae and Freddie Macs conforming guidelines. These guidelines include credit, income, assets requirements and loan amount. Currently the limit in most parts of the country is $417,000, but in certain designated high-price markets it can be as high as $938,250. Wondering if youre in a high-cost county? Here is the entire list of conforming loan limits for high-cost counties in certain states.

Loans that exceed this amount are called jumbo loans. Theyre also referred to as non-conforming mortgages. Why would you want a jumbo loan? The easiest answer is because it allows you to buy a higher-priced home, if you can afford it. But these loans have flexibility that conforming loans dont have, such as not always requiring mortgage insurance when the down payment is less than 20 percent. Why wouldnt you want a jumbo loan? Compared to conforming loans, interest rates will be higher. And they often require higher down payments and excellent credit, which can make them more difficult to qualify for.

You can read more about these and other programs here. Its also a good idea to talk to a local lender to hear more about their options get prepared by familiarizing yourself with mortgage-related terms using our handy glossary.

AFFORDABILITY CALCULATOR

Should I Go For Daily Calculation Or Annual Calculation Of Interest

Mortgage lenders generally calculate the amount of interest you are due to pay daily, monthly or annually. It seems like a very detailed point, but understanding this will protect you from unfair lenders that may rely on borrowers confusion to make interest calculations that are blatantly unfair and add many thousands of pounds to a cost of a mortgage.

Without hesitation you should go for daily calculation, and avoid any mortgage with annual calculation.

With annual interest calculation, the lender will calculate the interest rate once for the entire year and you risk being charged interest on debts youve already repaid. For example, if your interest rate is calculated on January 1st, and you pay off £5,000 on January 2nd, youll still be charged interest as if that payment never happened. Its legal, but it is morally questionable and should be avoided at all costs.

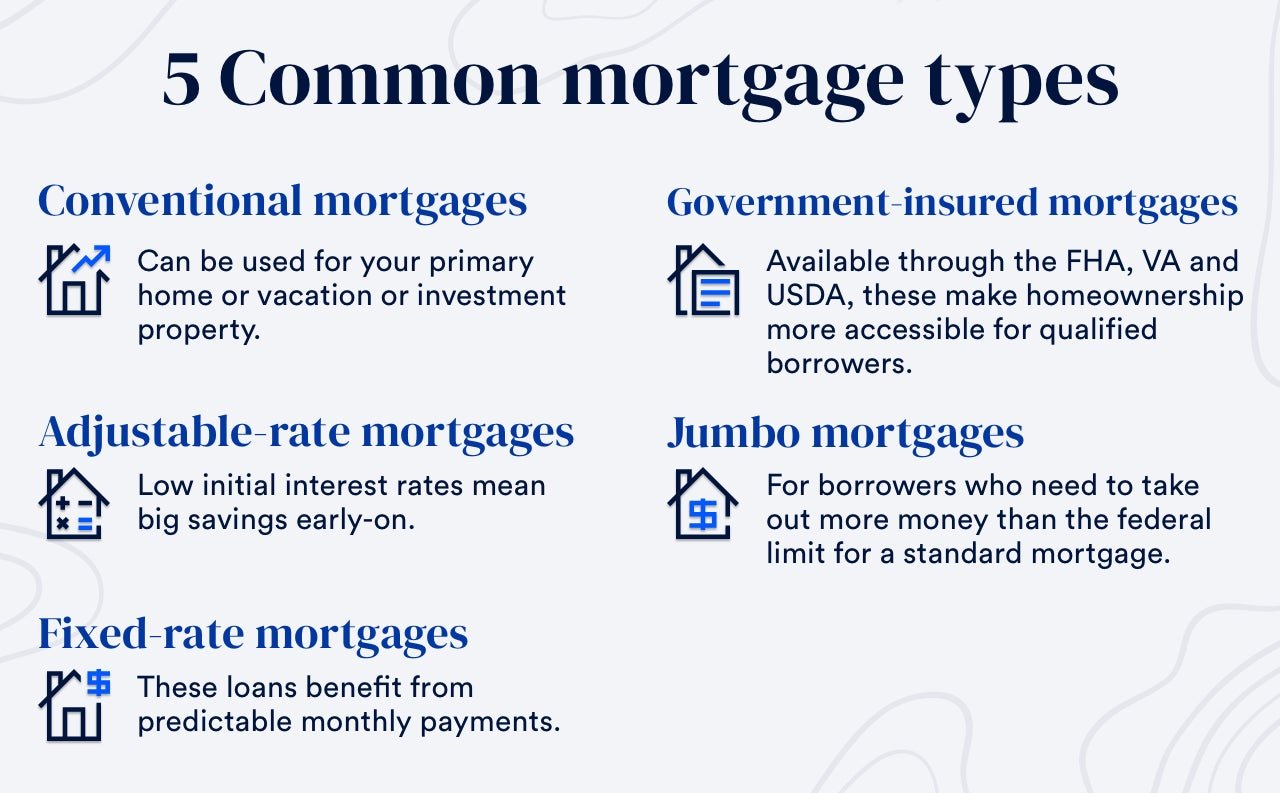

What Is A Conventional Mortgage

If you can come up with at least a 20% down payment , then you may be eligible for a conventional mortgage. No more than 80% of the appraised value of a property is loaned out with a conventional mortgage, so if you are unable to put at least 20% down, you may have to seek other options.

Trying to save for a down payment? Read this.

If you need to borrow more than 80% of the appraised value of the home, then your mortgage is considered to be a high-ratio mortgage, which refers to the percentage of the borrowed funds compared to the homes value. These home loans can be approved for with as little as a 5% down payment. Generally speaking, the down payment for conventional mortgages cant be borrowed money.

Read Also: Can You Get A Mortgage On A Foreclosed Home

Traditional Mortgage Versus A Fha Loan

If you are buying a house for the first time or you have not had a mortgage in three years, you may qualify for an FHA loan. The FHA loan can help you with closing costs and may reduce the amount that you need to put down to buy a home. The choice you make here really depends on your current situation. In many ways, saving up for a down payment and putting down twenty percent can demonstrate to yourself that you are ready for the financial responsibility of taking on a home. This does not mean that you should rule out an FHA loan or other first-time home buyers assistance. If the market makes it a good time to buy, you should take advantage of it, as long as you can truly afford the home.

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Recommended Reading: How To Transfer A Mortgage To Someone Else

What If I Want To Buy With A Friend

Some friends or siblings club together to buy a property normally lenders allow up to four people to get a joint mortgage. Pooled salaries will increase your buying power, but remember you are jointly and severally liable for the mortgage.

You need to consider what would happen if one of you wanted to sell your share or lost your job. The lender won’t care if three out of four of you paid your share. It’ll want its money and will pursue all of you for the debt. In reality, it’s likely to put more effort into chasing the person who is still working than the person who isn’t.

Buying with other people isn’t something to be taken on lightly. Once you take on a mortgage together you’re financially linked your friend’s credit rating will now affect yours and even a partial missed payment will go on all your credit files. Don’t do this without sorting a legal contract between you covering all the ‘what if’ possibilities and what your rights are.

Should I Go For A Fixed Rate Mortgage

A fixed rate mortgage is when the rate is fixed for a set number of years, after which it reverts to the lenders standard variable rate. More than 90% of homeowners chose a fixed rate mortgage in 2017, according to the Financial Conduct Authority.

Fixed rate mortgages are a popular option, because you know exactly what your monthly repayments will look like over a set period. You are shielded from any increases in interest rates by the Bank of England during your fixed rate period.

However you may pay more for a fixed rate mortgage than you would with a variable rate mortgage and you wont benefit if interest rates fall so you could be trapped in a higher rate mortgage. You also limit your ability to remortgage, as fixed rate mortgages almost always come with early redemption fees.

Read Also: Who Has The Best Mortgage Loan Rates

Mortgages A Beginners Guide

Buying a home is the largest purchase youre likely to make. Before you arrange your mortgage, make sure you know what you can afford to borrow. Find out where to get a mortgage, the different types and how the process works.

Buying a home is the largest purchase youre likely to make. Before you arrange your mortgage, make sure you know what you can afford to borrow. Find out where to get a mortgage, the different types and how the process works.

A mortgage is a loan taken out to buy property or land.

Most run for 25 years but the term can be shorter or longer.

The loan is secured against the value of your home until its paid off.

If you cant keep up your repayments the lender can repossess your home and sell it so they get their money back.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

You May Like: Does Chase Allow Mortgage Recast

Defining A Deed Vs Title

If a deed is the document outlining who the property owner is, then what is the title? Great question. Most people think the title is the legal form when actually the title is more of a concept its the legal way of saying who is the property owner. In real estate language, when buying a home, you are getting a deed and taking the title of the new property. This happens through a title search, to ensure there are no liens against the home before you take on ownership.

Did you know title searches are even required during a mortgage refinance? Check out this article to learn more about title search and title insurance.

What Types Of Mortgage Loans Do I Have To Choose From When Refinancing

By | Co-Author: Dennis J. Sullivan | Submitted On July 29, 2009

Just like a first mortgage, you have many types of refinance loans to choose. Here are some of the most popular:

1. 30-year fixed mortgage rate

- Offers a low fixed rate with a monthly payment due to the long term.

- Your credit, income and assets must be verified to qualify.

- Cash-out refinancing is available up to 85% of the home value through FHA and 90% for Conforming. Mortgage insurance is required over 80%.

2. 15-year fixed mortgage rate

- The conditions are the same as a 30-year-fixed rate, but the rate is slightly lower because the term is shorter.

3. Jumbo Loans

- These are loan amounts higher than $417,000.

- Either fixed-rate or adjustable-rate mortgages can be applied to Jumbo Loans.

- You can refinance up to 90% of the home’s value with private mortgage insurance.

4. Interest only mortgage

- Interest only payments can be made for the first 3, 5, 10 or 15 years of the loan.

- You’re free to make voluntary principal-payments during the interest only periods of the loan to reduce the balance.

- This mortgage will bill you only for your interest due each month, resulting in a lower payment mortgage than a conventional “principle and interest” mortgage.

- Additional principal payments must be made in order to pay the down the balance.

5. No Document refinancing loan6. Second mortgage or home equity loan

Glenn Belt, President

Recommended Reading: What Is The Difference Between A Mortgage Rate And Apr

How To Compare Mortgages

Banks, savings and loan associations, and credit unions were virtually the only sources of mortgages at one time. Today, a burgeoning share of the mortgage market includes nonbank lenders, such as Better.com, LoanDepot, Rocket Mortgage, and SoFi.

If you’re shopping for a mortgage, an online mortgage calculator can help you compare estimated monthly payments, based on the type of mortgage, the interest rate, and how large a down payment you plan to make. It can also help you determine how expensive a property you can reasonably afford.

In addition to the principal and interest, you’ll be paying on the mortgage, the lender or mortgage servicer may also set up an escrow account to pay local property taxes, homeowners insurance premiums, and certain other expenses. Those costs will add to your monthly mortgage payment.

Also note that if you make less than a 20% down payment when you take out your mortgage, your lender may require that you purchase private mortgage insurance , which becomes another added monthly cost.

Where To Buy Mortgage Disability And Critical Illness Mortgage Insurance

You can buy mortgage disability and critical illness insurance through your mortgage lender, or through another insurance company or financial institution. Shop around to make sure youre getting the best insurance to meet your needs.

Your lender cant force you to buy a product or service as a condition for getting another product or service from them. This is called coercive tied selling.

Read Also: How To Know How Much Mortgage You Can Qualify For

Do I Need A Mortgage Broker

Even if youve bought a home before, it can be difficult to know which product is the best, which is where a mortgage broker comes in.

A broker, sometimes known as a mortgage adviser, will be able to recommend the most suitable mortgage for you and guide you through the application process.

This article will help you decide whether its worth hiring a broker.

If youre buying your first home, there are more tips in our first-time buyer guide.

Open And Closed Mortgages

There are a few differences between open and closed mortgages. The main difference is the flexibility you have in making extra payments or paying off your mortgage completely.

Open mortgages

The interest rate is usually higher than on a closed mortgage with a comparable term length. It allows more flexibility if you plan on putting extra money toward your mortgage.

An open mortgage may be a good choice for you if you:

- plan to pay off your mortgage soon

- plan to sell your home in the near future

- think you may have extra money to put toward your mortgage from time to time

Closed mortgages

The interest rate is usually lower than on an open mortgage with a comparable term length.

Closed term mortgages usually limit the amount of extra money you can put toward your mortgage each year. Your lender calls this a prepayment privilege and it is included in your mortgage contract. Not all closed mortgages allow prepayment privileges. They vary from lender to lender.

A closed mortgage may be a good choice for you if:

- you plan to keep your home for the rest of your loans term

- the prepayment privileges provide enough flexibility for the prepayments you expect to make

Don’t Miss: Does Pre Approval For Mortgage Affect Credit

Working Out What You Can Afford

Use our Mortgage Affordability calculator to work out how much you can afford.

Dont stretch yourself if you think youll struggle to keep up repayments.

Also, think about the running costs of owning a home such as household bills, council tax, insurance and maintenance.

Lenders will want to see proof of your income and certain expenditure, and if you have any debts.

They might ask for information about household bills, child maintenance and personal expenses.

Lenders want proof that you will be able to keep up repayments if interest rates rise.

They might refuse to offer you a mortgage if they dont think youll be able to afford it.

How Your Mortgage Choices Can Affect Your Future

Mortgage lenders charge a penalty fee when you break your contract. This means, if you sell your home, you could owe the lender thousands of dollars in penalty fees.

You could also pay penalty fees if you pay off your mortgage early. Unless you plan on owning your home until you pay it in full, you may need flexibility on your mortgage.

Options related to mortgage flexibility include if your mortgage:

- is open or closed

Don’t Miss: What Is A 30 Year Fixed Jumbo Mortgage Rate

What Type Of Mortgage Should I Get

There are literally thousands of different types of mortgages on the market, and choosing one can be daunting. But before deciding which mortgage to go for, you need to decide what type of mortgage to get repayment, interest only, fixed, tracker or discounted. Which one is right for you depends on your circumstances. Get the wrong one, and it could cost you thousands.

Choosing the right type of mortgage is incredibly important and getting it wrong can cost you a lot of money. Narrowing down the mortgage type that is best suited to your finances will help you to choose a lender and a mortgage product.

Where Can I Get A Mortgage

Mortgages are offered by a variety of sources. Banks and credit unions often provide home loans. There are also specialized mortgage companies that only deal specifically with home loans. You may also employ an unaffiliated mortgage broker to help you shop around for the best rate among different lenders.

Recommended Reading: What’s An Affordable Mortgage

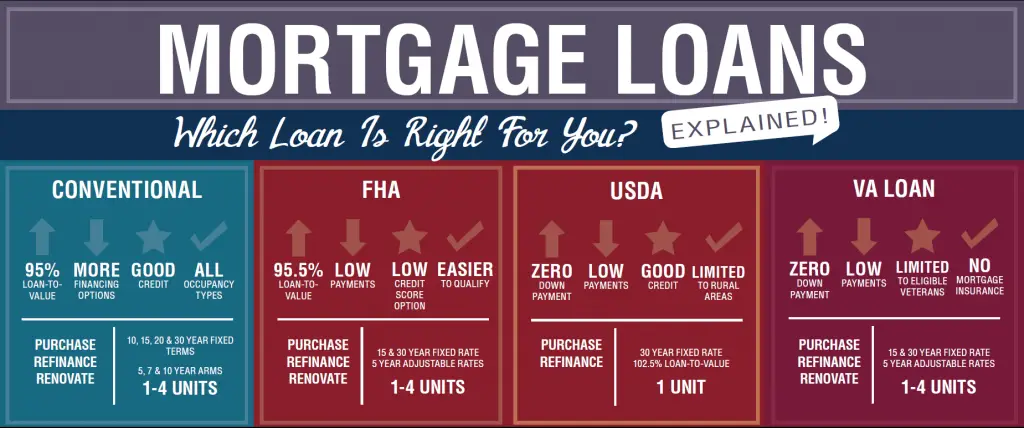

Conventional Loan Or Government

Youll also want to consider whether you want or qualify for a government-backed loan. Any loan thats not backed by the government is called a conventional loan. Heres a look at the loan types backed by the government.

Federal Housing Administration loans

FHA loans are mortgages insured by the Federal Housing Administration. These loans are designed for borrowers who cant come up with a large down payment or have less-than-perfect credit, which makes it a popular choice for first-time home buyers. FHA loans allow for down payments as low as 3.5 percent and credit scores of 580 or higher. A credit score as low as 500 may be accepted with 10 percent down. You can search for FHA loans on Zillow.

Because of the fees associated with FHA loans, you may be better off with a conventional loan, if you can qualify for it. The FHA requires an upfront mortgage insurance premium as well as an annual mortgage insurance premium paid monthly. If you put less than 10 percent down, the MIP must be paid until the loan is paid in full or until you refinance into a non-FHA loan. Conventional loans, on the other hand, do not have the upfront fee, and the private mortgage insurance required for loans with less than 20 percent down automatically falls off the loan when your loan-to-value reaches 78 percent.

Veterans Administration loans

USDA loans