Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage point . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

Will Current Mortgage Rates Last

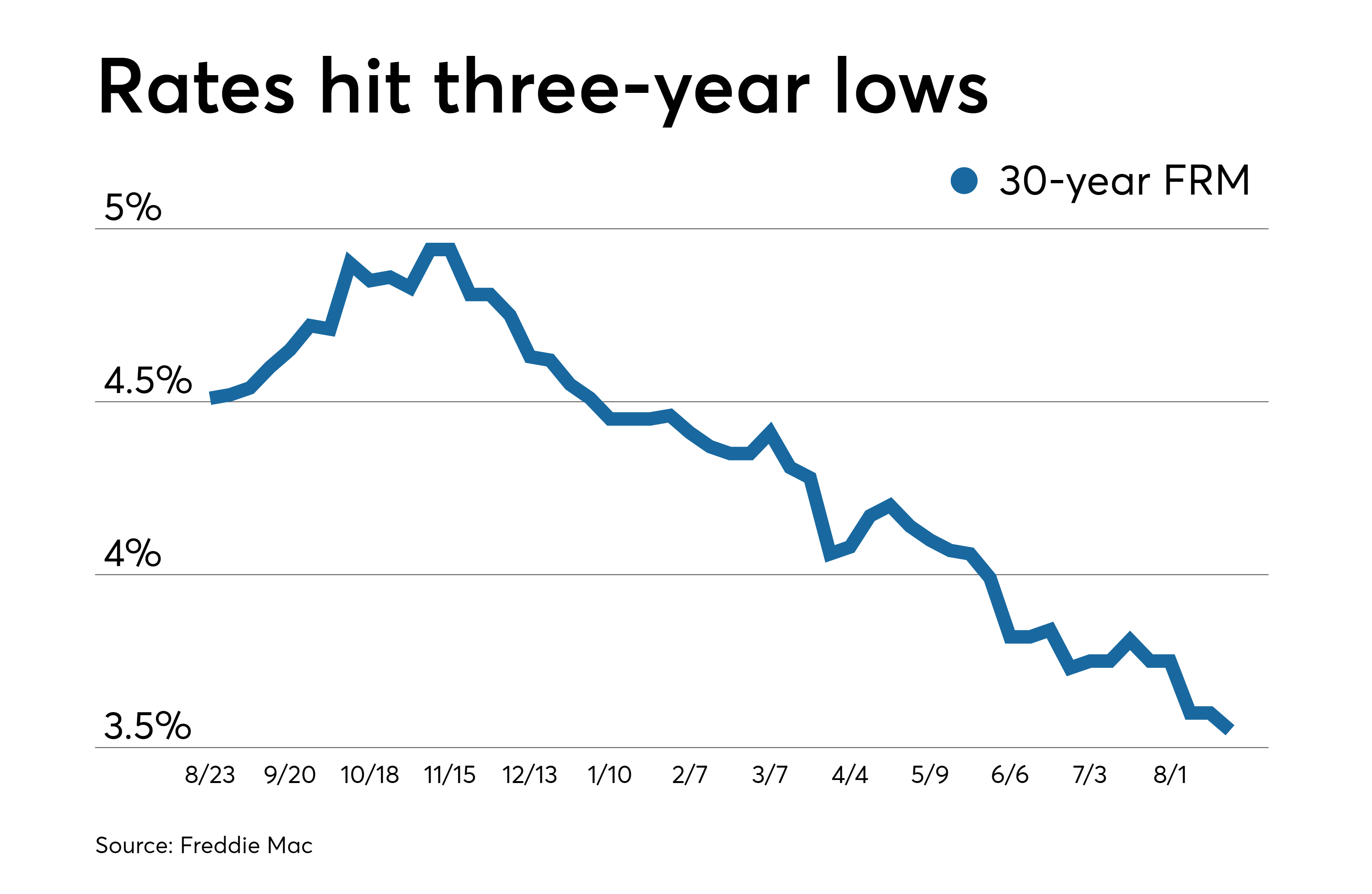

As the new Omicron variant causes a new surge of the virus, uncertainty around the economic recovery is putting downward pressure on rates. With a little over a week left in the year, expect mortgage rates to remain near historic lows. Looking into next year, however, all signs are pointing to increasing rates.

Next year, the Federal Reserve expects to tighten monetary policy sooner than previously thought. Last week, the central bank announced that it expects to end its bond purchasing program by spring 2022 and raise the federal funds rate three times next year. Both of these moves will put upward pressure on mortgage rates.

On Thursday, the yield on the 10-year Treasury note opened at 1.457%, just 0.001 percentage points lower than Wednesday’s close of 1.458%. There tends to be a spread of about 1.8 percentage points between the 10-year Treasury and average mortgage rates.

What Controls A Variable Interest Rate

Your variable interest rate is directly controlled by your lender via theirPrime Rate. Each lender can choose to increase or decrease their own prime rate, in turn increasing or decreasing your variable interest rate.

Lenders will usually adjust their prime rate to reflect changes in theBank of Canadas Policy Interest Rate. This means that lenders will tend to have similar or identical prime rates. All major Canadian banks currently have a prime rate of 2.45%.

Also Check: Reverse Mortgage For Mobile Homes

How To Get A Good 15

Lenders take your finances into consideration when determining an interest rate. The better your financial situation is, the lower your rate will be.

Lenders look at three main factors: down payment, credit score, and debt-to-income ratio.

- Down payment: Depending on which type of mortgage you take out, a lender might require anywhere from 0% to 20% for a down payment. But the more you have for a down payment, the lower your rate will likely be. If you can provide more than the minimum, you could snag a better rate.

- : Many mortgages require at least a 620 credit score, and an FHA loan lets you get a mortgage with a 580 score. But if you can get your score above the minimum requirement, you’ll probably land a better interest rate. To improve your score, try making payments on time, paying down debts, and letting your credit age.

- Debt-to-income ratio: Your DTI ratio is the amount you pay toward debts each month in relation to your monthly income. Most lenders want to see a minimum DTI ratio of 36%, but you can get a lower mortgage rate with a lower ratio. To decrease your DTI ratio, you either need to pay down debts or consider ways to increase your income.

You should be able to get a low 15-year fixed rate with a sizeable down payment, excellent credit score, and low DTI ratio.

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

You May Like: Reverse Mortgage Mobile Home

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

Wells Fargo Best For Low Fees

Of course, the phrase best for low fees always comes with a catch. In the case of Wells Fargo, that catch may be that you must meet specific parameters to qualify for its favorable terms for a 15-year mortgage rate. First, that theres a 25% down payment, which, among other things, eliminates the requirement to purchase mortgage insurance. Second, the applicant must have a minimum FICO score of 740. Third, the rates assume the purchase of discount points. However, with those elements in place, Wells Fargos deal offers a financially attractive path to homeownership.

How Do I Compare 15

When shopping for the best mortgage rate you need to consider the overall cost of the loan, not just the interest rate. Mortgage closing costs can be 3%-6% of the loan amount and the fees you pay vary by lender. The lender with the lowest rate could be more expensive overall if it is charging higher origination fees or adding in discount points. This is why you should compare annual percentage rates , which factor in certain fees in addition to the interest rate, as opposed to just the interest rate.

You can compare interest rates and fees by looking at the Loan Estimate, which the lender must provide within three business days from when you submit a mortgage application. Since all lenders are required to use the same Loan Estimate form, its easy to evaluate multiple offers.

Read Also: Chase Recast

What Is A Mortgage Rate

A mortgage rate is the interest rate on a mortgage. Its also known as the mortgage interest rate. The mortgage rate is the amount youre charged for the money you borrowed. Part of every payment that you make goes toward interest that accrues between payments.

While interest expense is part of the cost built into a mortgage, this part of your payment is usually tax-deductible, unlike the principal portion.

About 15year Fixed Mortgage Rates

15year fixed mortgage rates are often significantly lower than those for 30year fixedrate loans.

Better yet, the total amount of interest you pay will be much, much lower because youre borrowing the same sum for half the period. And interest is only due for the time you owe money.

So why doesnt everyone choose the 15year option? Because each mortgage payment is a lot higher.

Higher monthly payments are inevitable because youre repaying the entire loan amount in 180 installments instead of 360 .

Many borrowers especially firsttime home buyers simply cant afford those higher payments, no matter how much it saves them in the end.

But if you have plenty of monthly cash flow, this might be the right loan type for you.

Read Also: Can I Get A Reverse Mortgage On A Condo

What Are Prepayment Options

Prepayment options outline the flexibility you have to increase your monthly mortgage payments, or pay down your mortgage principal as a whole. The monthly prepayment option is a percentage increase allowance on your original monthly mortgage payment.

For example, if your monthly mortgage payment is $1,000 and your prepayment allowance is 25%, then you can increase your monthly payments up to $1,250. The lump sum prepayment option on the other hand, applies to the original mortgage amount. So, if your lump sum prepayment allowance is 25% on a $100,000 mortgage amount, then you can pay $25,000 off the principal every year.

Should I Choose A Fixed Or Variable Rate

Variable rates allow you to take advantage of future decreases in interest rate. On the other hand, fixed rates are preferable if interest rates rise in the future. Unfortunately, long-term fluctuations in the prime rate are difficult if not impossible to predict.

However, a2001 studyfound that between 19502000, choosing a variable interest rate resulted in lower lifetime mortgage cost than a fixed rate up to 90% of the time. According to the study, if you are comfortable with the risks involved, a variable rate may reduce your long-term mortgage cost.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The 5-year fixed rate mortgage is the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wont have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

Is It Harder To Qualify For A 15year Fixedrate Mortgage

On paper, its no harder to qualify for a 15year mortgage loan than a 30year one. Guidelines vary by loan type , but within each program, requirements for a 15 and 30year loan are generally the same.

For instance, a 15year FHA loan will likely require a credit score of at least 580, down payment of 3.5%, and debttoincome ratio below 50%, just like a 30year FHA mortgage.

But in reality, its much harder to qualify for a 15year loan because of the higher monthly payments.

A bigger mortgage payment means your home loan will eat up more of your monthly income. This will have an impact on your debttoincome ratio.

For most home buyers, a 15year mortgage payment plus existing debts will take up more than 43% to 50% of their monthly income, which is the maximum DTI range most lenders allow.

If youre set on a 15year mortgage but have a tighter monthly budget, paying down existing debts before you apply for the home loan could help you qualify.

Also Check: Rocket Mortgage Loan Requirements

See Other Mortgage Types

| Avg. Days on Market | Home Costs as % of Income |

|---|

Methodology A healthy housing market is both stable and affordable. Homeowners in a healthy market should be able to easily sell their homes, with a relatively low risk of losing money. In order to find the big cities with the healthiest housing markets, we considered the following factors: stability, affordability, fluidity and risk of loss. For the purpose of this study, we only considered U.S. cities with a population greater than 200,000.

We measured stability with two equally weighted indicators: the average number of years people own their homes and the percentage of homeowners with negative equity. To measure risk, we used the percentage of homes that decreased in value. To determine housing market fluidity, we looked at data on the average time a for-sale home in each area spent on the market – the longer homes take to sell, the less fluid the market. Finally, we calculated affordability by determining the monthly cost of owning a home as a percentage of household income in each city.

Affordability accounted for 40% of the healthiest markets index, while each of the other three factors accounted for 20%. When data on any of the above four factors was unavailable for cities, we excluded these from our final rankings of healthiest markets.

Your Rights And Responsibilities As A Borrower

Its important to know your rights as a mortgage borrower. When applying for a mortgage, your lender must provide information such as your mortgage principal amount, your mortgage interest rate, your annual percentage rate , term, payments, amortization, prepayment privileges and charges, and other fees. This can be provided in an information box in your mortgage agreement.

Changes to your mortgage agreement will need to be made in writing within 30 days, or it can be disclosed electronically. Your lender must also give you a renewal statement at least 21 days before the end of your term, or let you know if they will not be renewing your mortgage. If your lender is a member of the Canadian Banking Association, which includes most major banks operating in Canada, your lender may have agreed to provide additional information, such asonline financial calculatorsor other information that can be used to calculate mortgage prepayment charges.

Your lender also has rights, such as the right to inspect your title or the right to sell your home if you dont make your mortgage payments.

You also have responsibilities as a mortgage borrower. It’s important to carefully read your mortgage agreement and ask your lender questions if you don’t fully understand any terms or conditions.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Year Home Purchase Loans

Suppose youre in the same position as the refinancing example above: halfway through paying down your 30year mortgage loan. But want to move instead of refinancing.

You can still make huge savings by choosing a 15year purchase mortgage.

In fact, your savings could be even bigger because purchase rates are sometimes lower than refinance rates.

For example, on the day this was written, the average rate on a 15year purchase mortgage was 2.630% as opposed to that 3.030% on a 15year refinance.

Building home equity

Another benefit to buying a house with a 15year loan is that youll build home equity much faster, thanks to something called an amortization schedule.

An amortization schedule outlines how long it takes to pay down your mortgage principal and interest.

At the beginning of your loan term, a larger portion of your payment goes toward interest. Toward the end of your term, you finally start paying more toward the loan balance.

With a longer term of 30years, you spend a long time paying down mortgage interest before you make a meaningful dent in your loan principal. With a shorterterm loan, youll start to pay down the loan balance and build equity a lot faster.

Again, run your own numbers, this time using The Mortgage Reports purchase mortgage calculator. Select both the 30year and 15year loan terms in turn to make your comparison.