Drawbacks Of Lender Credits

Theres always a catch: In exchange for those lower closing costs, lender credits increase your interest rate. That means youll end up with a higher monthly mortgage payment and more interest paid over the life of the loan.

At some point this choice becomes more expensive, Bossler says.

Cohn also cautions borrowers to make sure a lender isnt inflating closing costs to the point where lender credits end up hurting you. She advises comparing apples to apples with multiple lenders to make sure you understand the base interest rates and closing costs, without points or credits, before adding in those adjustments.

If it looks too good to be true, it probably is, Cohn says.

Mortgage Points Cost Chart

Above is a handy little chart I made that displays the cost of mortgage points for different loans amounts, ranging from $100,000 to $1 million.

As you can see, a mortgage point is only equal to $1,000 at the $100,000 loan amount level. So you might be charged several points if youve got a smaller loan amount .

At $1 million, youre looking at $10,000 for just one mortgage point. And you wonder why loan officers want to originate the largest loans possible

Generally, its the same amount of work for a much bigger payday if they can get their hands on the super jumbo loans out there.

Be sure to compare the cost of the loan with and without mortgage points included, across different loan programs such as conventional offerings and FHA loans.

And remember that points can be paid out-of-pocket or priced into the interest rate of the loan.

Also note that not every bank and broker charges mortgage points, so if you take the time to shop around, you may be able to avoid points entirely while securing the lowest mortgage rate possible.

Would Mortgage Points Work For You

Whether to pay mortgage points depends on not only the break-even point, but also your plans for the home.

“In general, buying mortgage points is most beneficial when you both intend to stay in your home for a long period of time and can afford the upfront costs of mortgage points,” Mileo says. “Sometimes that money is better spent on closing costs, but it all depends on your financial situation.”

Most people stay in their homes for about eight years, according to a September 2020 report by ATTOM Data Solutions.

If you pay points when interest rates are low, you reduce the likelihood that you will need to refinance your loan later. As mortgage rates hover near historic lows, the fees for points may be lower than what you would have paid to refinance for your loan.

Getting the absolute lowest rate in a low-rate environment through paying points makes sense, Mileo says.

“You will likely never need to refinance and incur unnecessary closing costs again,” he says.

Raw HTML : MyFinance Initializer

Copyright 2022 U.S. News & World Report

Recommended Reading: Chase Mortgage Recast Fee

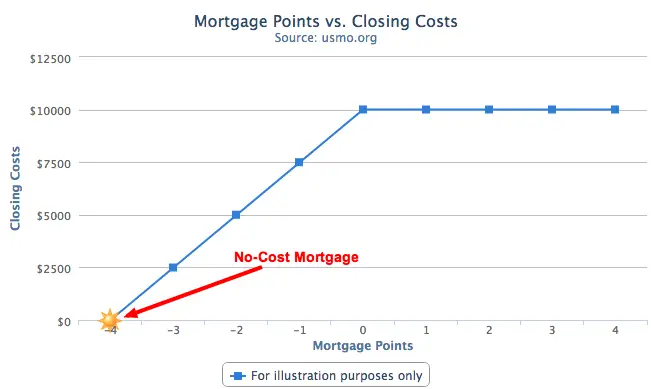

How Do Negative Points Work On A Mortgage

- Some lenders may offer so-called negative points

- Which is just another way of saying a lender credit

- These points raise your interest rate instead of lowering it

- But result in a credit that can cover closing costs so you dont pay them out-of-pocket

If points are involved and you are offered a higher rate, the mortgage points act as a lender credit toward your closing costs. These are known as negative points because they actually raise your interest rate.

Now you might be wondering why on earth you would accept a higher rate than what you qualify for?

Well, the trade-off is that you dont have to pay for your closing costs out-of-pocket. The money generated from the higher interest rate will cover those fees.

Of course, your monthly mortgage payment will be higher as a result. How much higher depends on the size of your loan amount and the points involved.

This works in the exact opposite way as traditional mortgage points in that you get a higher rate, but instead of paying for it, the lender gives you money to pay for your fees.

Both methods can work for a borrower in a given situation. The positive points are good for those looking to lower their mortgage rate even more, whereas the negative points are good for a homeowner short on cash who doesnt want to spend it all at closing.

What Are Origination Points

Origination points are paid by borrowers as a way to compensate a lender.

Not all lenders of mortgages require paying origination points. For those lenders who do require origination points to be paid on a loan, they are negotiable.

Origination points arent tax-deductible, and many lenders have moved away from them altogether in favor of no-fee or flat-rate home loans.

Don’t Miss: Recasting Mortgage Chase

When To Pay Points

Origination points typically arent charged on most loans and typically company specific. For example, traditional banks that happen to do mortgages often charge origination points on every loan. This is how they make additional money. In contrast, most mortgage bankers dont charge origination points.

Discount points are more specific to the loan and can be charged for a variety of reasons. The most common instances where discount points are charged are when escrow are waived, when credit scores are low, or when someone wants to buy down the interest rate.

Lets Look At Some Examples Of Mortgage Points In Action:

Say youve got a $100,000 loan amount and youre using a broker. If the broker is being paid two mortgage points from the lender at par to the borrower, it will show up as a $2,000 origination charge and a $2,000 credit on the HUD-1 settlement statement.

It is awash because you dont pay the points, the lender does. However, a higher mortgage rate is built in as a result of that compensation to the broker.

Now lets assume youre just paying two points out of your own pocket to compensate the broker. It would simply show up as a $2,000 origination charge, with no credit or charge for points, since the rate itself doesnt involve any points.

You may also see nothing in the way of points and instead an administration fee or similar vaguely named charge.

This could be the lenders commission bundled up into one charge that covers things like underwriting, processing, and so on.

It could represent a certain percentage of the loan amount, but have nothing to do with raising or lowering your rate.

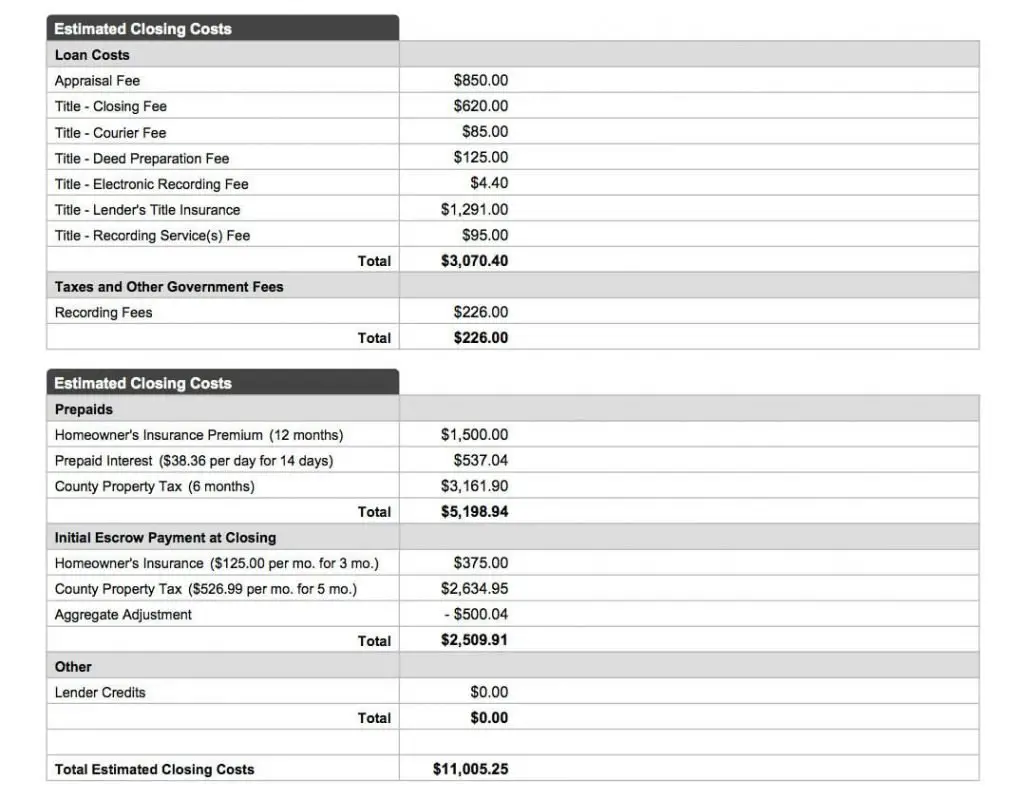

Regardless of the number of mortgage points youre ultimately charged, youll be able to see all the figures by reviewing the HUD-1 , which details both loan origination fees and discount points and the total cost combined.

*These fees will now show up on the Loan Estimate and Closing Disclosure under the Loan Costs section.

Don’t Miss: Mortgage Recast Calculator Chase

Maintain Good Credit After Your Home Purchase Or Refinance

It’s important that you take the time to improve your credit before buying a home or refinancing an existing mortgage loan. But even if you don’t plan to borrow money again in the near future, it’s critical that you stay on top of your credit for when you do need it.

Experian’s free credit monitoring service allows you to keep track of your credit file through real-time updates. You’ll also be able to view your FICO® Score powered by Experian data and your Experian credit report at any time.

Using this free service will make it easier to spot potential issues, including fraud, before they do some serious damage. It’ll also give you the information you need to maintain a good credit score and make adjustments to your financial habits as needed.

Pay Attention To The Numbers

Because youre paying more up front, the reduced interest rate will only save you money over the long term. The longer you plan to own your new home, the better the chance that youll reach the break-even point where the interest you’ve saved compensates for your initial cash outlay. If you have a shorter-term plan, have limited cash, or would benefit more from a bigger down payment, paying points may not benefit you.

Your mortgage loan officer can help you decide whether paying points is an option for you.

Also Check: Chase Recast

Discount Points Vs Origination Points

There are two different types of mortgage points: origination points and discount points. Discount points represent prepaid interest that can be used to negotiate a lower interest rate for the term of a loan.

Origination points, on the other hand, are lender fees that are charged for closing on a loan. Origination points dont save borrowers money on interest, although they can sometimes be rolled into the balance of a loan and paid off over time. Discount points, however, have to be paid up front.

How Do Mortgage Points Work Pros And Cons Of Buying Mortgage Points

Typically, when the general level of prices is increasing in the overall economy, central banks increase policy rates to curb inflation. One important channel of monetary policy operation is the bank lending channel, where rising policy rates increase interest rates on loans. In such periods, borrowers seek for the lowest possible interest rate on new loans, especially mortgages, where minor differences in rates can considerably affect payments and interest charges over a long stretch of time .

One option to lower the interest rate is to buy points on a mortgage. Paying points on a mortgage means paying additional upfront fees to your mortgage lender , called discount points, to get a lower interest rate and monthly payment.

While the big advantage of buying points on a mortgage is that you obtain a lower rate, regardless of your credit score, there are several aspects to consider before paying for mortgage loan points.

Considering the pros and circumstances when buying points on a mortgage can be beneficial:

- When your income does not qualify you for a mortgage, you may be able to qualify with a reduced interest rate and payment.

- If you have cash at hand, or if you can convince the seller to pay for the mortgage discount points.

- When you plan to live in the same house for a long time without refinancing your mortgage .

- If you expect rising mortgage rates.

However, there are some cons and situations where it is better not to buy points on a mortgage:

Also Check: Rocket Mortgage Requirements

Are Mortgage Points Tax Deductible

Mortgage points may be tax-deductible as mortgage interest on your primary residence if you meet the IRS requirements. First off, youll need to itemize your taxes, which is less common since the standard deduction was increased for 2021 to $12,550 for individuals, $18,800 for heads of households, and $25,100 for joint filers. Unless all of your deductions are greater than the standard deduction, you wont have any tax savings from paying discount points.

As with anything related to your taxes, its a good idea to consult with a tax advisor to ensure that you are taking advantage of every deduction available to you and properly documenting everything.

This article was updated on Sept. 4, 2020, to remove comments made by a source whose credentials do not meet NextAdvisor editorial standards.

What Do Discount Points Cost

Discount points cost roughly 1% of the loan amount per point.

Purchasing the three discount points would cost you $3,000 in exchange for a savings of $39 per month. You will need to keep the house for 72 months, or six years, to break even on the point purchase. Because a 30-year loan lasts 360 months, purchasing points is a wise move in this instance if you plan to live in your new home for a long time. If, on the other hand, you plan to stay for only a few years, you may wish to purchase fewer points or none at all. There are numerous calculators available on the Internet to assist you in determining the appropriate amount of discount points to purchase based on the length of time you plan to own the home.

The second factor to consider with the purchase of discount points involves whether or not you have enough money to pay for them. Many people are barely able to afford the down payment and closing costs on their home purchases, and there simply isn’t enough money left to purchase points. On a $100,000 home, three discount points are relatively affordable, but on a $500,000 home, three points will cost $15,000. On top of the traditional 20% down payment of $100,000 for that $500,000 home, another $15,000 may be more than the buyer can afford.

Using a mortgage calculator is a good resource to budget these costs.

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

What Are Points And Lender Credits And How Do They Work

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs. Points, also known as discount points, lower your interest rate in exchange paying for an upfront fee. Lender credits lower your closing costs in exchange for accepting a higher interest rate.

These terms can sometimes be used to mean other things. Points is a term that mortgage lenders have used for many years. Some lenders may use the word points to refer to any upfront fee that is calculated as a percentage of your loan amount, whether or not you receive a lower interest rate. Some lenders may also offer lender credits that are unconnected to the interest rate you pay for example, as a temporary offer, or to compensate for a problem.

The information below refers to points and lender credits that are connected to your interest rate. If youre considering paying points or receiving lender credits, always ask lenders to clarify what the impact on your interest rate will be.

Points

Points let you make a tradeoff between your upfront costs and your monthly payment. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

Lender credits

See an example

When comparing offers from different lenders, ask for the same amount of points or credits from each lender.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

Who Should Buy Points

People who are likely to keep their current mortgage for a long time. They would have the following attributes:

- Likes the local area and plans to live in the area for at least a half-decade or more.

- Stable family needs, or a home which can accommodate additional family members if the family grows.

- Homebuyer has good credit & believes interest rates on mortgages are not likely to head lower.

- Stable employment where the employer is unlikely to fire them or request the employee relocate.

How To Calculate Mortgage Points

Picture this scenario. You take out a 30-year-fixed-rate mortgage for $200,000 with an interest rate at 5.5%. Your monthly payment with no points translates to $1,136.

Then, say you buy two mortgage points for 1% of the loan amount each, or $4,000. As a result, your interest rate dips to 5%. You end up saving $62 a month because your new monthly payment drops to $1,074.

To figure out when youd get that money back and start saving, divide the amount you paid for your points by the amount of monthly savings . The result is 64.5 months. So if you stay in your home longer than this, you end up saving money in the long run.

Keep in mind that our example covers only the principal and interest of your loan. It doesnt account for factors like property taxes or homeowners insurance.

Recommended Reading: 70000 Mortgage Over 30 Years

Do Mortgage Points Affect Taxes

Mortgage points may be tax deductible as home mortgage interestbut that still doesnt make them worth buying. In order to qualify, the loan must meet a slew of qualifications on a lengthy list of bullet points, all of which are determined by the IRS.

If youve already bought mortgage points, check with a tax advisor to make sure you qualify to receive those tax benefits.

What Are Mortgage Points

Mortgage points are the fees a borrower pays a mortgage lender to trim the interest rate on the loan. This is sometimes called buying down the rate. Each point the borrower buys costs 1 percent of the mortgage amount. So, one point on a $300,000 mortgage would cost $3,000.

Each point typically lowers the rate by 0.25 percent, so one point would lower a mortgage rate of 4 percent to 3.75 percent for the life of the loan. How much each point lowers the rate varies among lenders, however. The rate-reducing power of mortgage points also depends on the type of mortgage loan and the overall interest rate environment.

Borrowers can buy more than one point, and even fractions of a point. A half-point on a $300,000 mortgage, for example, would cost $1,500 and lower the mortgage rate by about 0.125 percent.

The points are paid at closing and listed on the loan estimate document, which borrowers receive after they apply for a mortgage, and the closing disclosure, which borrowers receive before the closing of the loan.

Read Also: Reverse Mortgage Mobile Home