Im Interested In Debt Consolidation

The value of your home can also help you consolidate highinterest debts, like credit card debt or personal loans.

This is typically done using a cashout refinance. You tap your home equity, use it to pay off existing debts, and then effectively repay them to your mortgage lender at a much lower interest rate.

This can be a very smart way to save money on interest payments. But experts warn that using a cashout refinance for debt consolidation has risks, too.

Remember, the new loan is secured against your home. So if you run the debts back up and cant make loan payments, there could be a risk of foreclosure.

Other Common Questions About Mortgages

How do mortgage payments work?

After your mortgage is drawndown with a lender, you will be provided with a breakdown of how much the monthly payments will be. This will stay the same after the first payment for a fixed period of time for a fixed rate mortgage or will vary as base rate changes if you have a tracker mortgage. Once the initial fixed or variable rate ends, you will move onto a Standard Variable Rate unless you move to a new fixed or tracker rate mortgage.

At NatWest, our mortgage customers need to set up a Direct Debit, providing us permission to take monthly payments out of their bank accounts on an agreed date in the month.

How long will I have to pay off a mortgage?

When you take out a mortgage, you will agree a mortgage term with your lender. This is the period of time between drawdown of the mortgage and expiry of the mortgage terms, when the capital must be repaid.

- If you have taken out a repayment mortgage , the capital will be paid back to the lender by the end of the mortgage term .

- If the mortgage is an interest-only mortgage, your monthly payments only cover the interest on the amount you borrowed, meaning you pay the full amount back at the end of the mortgage term in one lump sum.

It’s important to consider the mortgage term carefully. A longer mortgage term may be more affordable on a monthly basis , but this would also mean the total cost of your mortgage is greater, as you would pay additional interest.

How To Get A Mortgage On A House You Already Own

Getting a mortgage on a house you already own lets you tap into the value of your home without selling.

The type of loan youll qualify for depends on your credit score, debttoincome ratio , loantovalue ratio , and other factors.

But assuming your personal finances are in good shape, you can likely choose from any of the following loan options:

Recommended Reading: How Does Rocket Mortgage Work

Why Take Out A Second Mortgage

There are several reasons why someone might take out a second mortgage:

- If youre struggling to get some form of unsecured borrowing such as a personal loan, perhaps because youre self-employed.

- If your credit rating has worsened since taking out your first mortgage, switching to a new mortgage to cover your house loan plus a further loan could mean you end up paying more interest overall. Taking out a second mortgage means you would only be paying extra interest on the new amount you want to borrow.

- If your current mortgage has a high early repayment charge, it might be cheaper for you to take out a second charge mortgage rather than to remortgage to release equity from your property .

The suitability of the examples above will depend on your personal circumstances. Provided youre up to date on your mortgage payments, its worth considering a further advance from your existing lender on better terms as it might be a better option.

How Does A Remortgage Work

You can remortgage at any time, but the cheapest way to do it is at the end of your current mortgages term.

Mortgages in Canada have a termor contractof typically one, three or five years. At the end of this period, youre free to remortgage with a different lender.

If you break your mortgage before the term is up, there will be a prepayment penalty. The amount will depend on the number of years left on the term, the rate, whether you have a fixed or variable mortgage and your banks prepayment policies.

For example, if you have a mortgage balance of $200,000 and a year left on your contract with a rate of 2.79%, the penalty could be as low as $1,658. For the same amount, but with four years left, that penalty could be as much as $8,263.

Before breaking your mortgage, contact your bank to find out how much the penalty will be or use this mortgage penalty calculator.

When you remortgage your home, you effectively change the terms or amount of your mortgage. Your new lender pays out your existing mortgage and registers a new one.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

What Is A Mortgage And How Do I Get One

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

Before you begin the process of buying a house, its important to understand mortgages since, for many, a mortgage is needed to purchase a home.

In this article, well explain what a mortgage is, how it works and how you can get one.

When Is Taking Out Equity A Good Idea

Taking out equity on your home is typically worth it if you have an emergency fund to cover large expenses. However, there are also some other situations in which taking out equity can be useful. For example, if you want to consolidate debt or pay for college tuition, withdrawing money from the bank may be less expensive than taking out a personal loan.

If your credit score is good, you may be able to get a better interest rate on the money you borrow if its tied up in equity rather than an unsecured personal loan. Equity can also help provide added security for loans like home improvement or car purchases so that you dont have to put as much money down initially.

Don’t Miss: Rocket Mortgage Loan Requirements

Assessment By The Lender

In addition to the Central Banks lending limits, its ConsumerProtection Code 2012 requires all regulated lenders to assess your personalcircumstances and financial situation thoroughly before agreeing to offer you amortgage.

The lender must carry out detailed assessments of the affordability of theproduct being offered and of its suitability for you. When offering you amortgage, the lender must give you a written statement, setting out the reasonswhy the mortgage product being offered is considered suitable for your needs,objectives and circumstances.

What Happens If You Just Walk Away From Your Mortgage

The lender either forgives the difference or gets a judgment against the borrower requiring payment of all or part of the difference between the sale price and the original value of the mortgage. Not all lenders will agree to a short sale, but if they will, the short sale provides an alternative to foreclosure.

Read Also: Chase Recast Mortgage

What Does It Mean To Take Out Equity On Your Home

Home equityhomedoequityouthome equityoutyourtake out

. Regarding this, is it a good idea to take equity out of your house?

To Pay Off High Interest LoansIf you are stuck with high-interest loans, something that can easily occur with credit cards and other types of unsecured debt, consider taking out a home equity loan at a lower interest rate. Use it to pay off those loans and enjoy a lower monthly payment with smaller interest costs.

Furthermore, can you pull equity out of your home without refinancing? Without refinancing your mortgage, there are two ways to borrow against your home equity. You can either take out a home equity loan or a home equity line of credit . While they may sound similar, they function very differently.

One may also ask, how do you use home equity?

Fortunately, there are a number of ways to build equity in your home.

What is a home equity loan and how does it work?

A home equity loan is basically a second mortgage, in which you take out the total amount you intend to borrow in one lump sum and pay it back every month. The time period is typically 5-15 years. A home equity line of credit, or HELOC, gives you the ability to borrow up to a certain amount over a 10-year period.

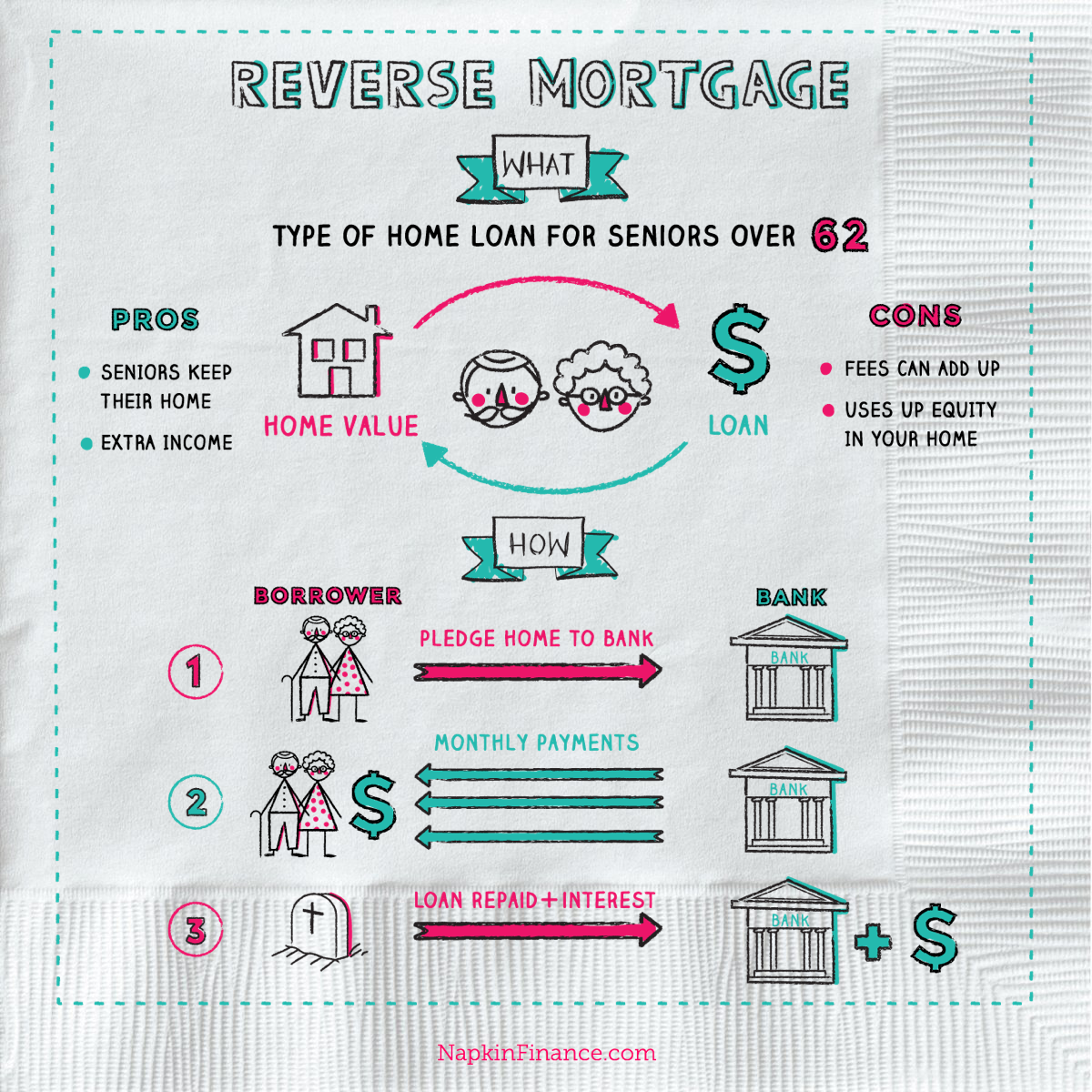

How Does A Second Mortgage Work

To obtain a second mortgage, you typically need to do the same things you do to qualify for a primary mortgage. The process includes submitting an application to a lender and providing documentation regarding your income, debts and more. You may also need to get an appraisal to confirm the value of your home.

Equity requirements vary, but many lenders prefer that you have at least 15 percent to 20 percent equity in your home. You can typically borrow up to 85 percent of your homes value, minus your current mortgage debts. If you have a home worth $300,000 and $200,000 remaining on your mortgage, for instance, you might be able to borrow as much as $55,000 through a second mortgage: $200,000.

You May Like: Bofa Home Loan Navigator

Options When You Own A Home With No Mortgage And Want To Buy Another House

Understand that mortgaging your current home isnt always necessary when buying a second home, vacation home, or investment property.

You may already have enough savings for a down payment without tapping into your equity, according to Jon Meyer, The Mortgage Reports loan expert and licensed MLO.

Before getting a mortgage on a house you already own, look into mortgage loans that allow low down payments.

Home buyers should consider the following types of loans.

Learn About The Options And Risks Of Taking Out A Second Mortgage

A second mortgage is a loan you take out using your home as collateral when another loan is already secured by that property. Some people take out a second mortgage to make a down payment on the home. Others do so to pay off debt or to complete home improvements.

The impacts of the decision can be far-reaching so you shouldn’t take it lightly. It’s key to understand how the process works, how to take out a second mortgage, and how it can affect your finances now and in the future.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Interest Rates And Fees If You Refinance Your Home

The interest rate on the refinanced part of your mortgage may be different from the interest rate on your original mortgage. You may also have to pay a new mortgage loan insurance premium.

You may have to pay administrative fees which include:

- appraisal fees

Your lender may have to change the terms of your original mortgage agreement.

Shop Around For The Best Mortgage Rates

With all that out of the way, its time to secure a loan. But dont let your excitement cause you to jump into a contract too soon. Choosing the right mortgage lender and loan offer requires some research and patience to ensure youre getting the best deal.

The mortgage interest rate you agree to will have a major impact on the total cost of your loan. Even a fraction of a percentage point can add up to a significant chunk of change over many years. Say you borrow $200,000 at 4.25% over 30 years. Youd end up paying a total of $154,197 in interest over the life of the loan. If your rate was 3.50% instead, youd pay $123,312 in interest, for a savings of $30,885 over those same 30 years.

In addition to the interest rate, pay attention to closing costs, origination fees, mortgage insurance, discount points and other expenses that can tack on thousands of dollars to your loan. These fees often are rolled into your loan balance, meaning you pay interest on them in addition to the principal.

Once simple way to compare the true cost of a mortgage is by examining the annual percentage rate . This is the total yearly cost of your loan once all fees are factored in, expressed as a percent of the total borrowed. However, one thing to keep in mind is that the APR assumes you will keep the loan for its entire term if you plan to move or refinance within a few years, the APR may be a bit misleading.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

What Is A Mortgage

A mortgage is a way of borrowing money to buy or refinance a property. These loans are generally repaid over relatively long periods, often 25 years or more, to spread out the large cost of buying a home.

- Mortgages are generally available from banks and other financial institutions, known as ‘lenders’. These lenders charge ‘interest’ and sometimes other fees, on top of the amount borrowed.

- The lender will also secure or guarantee the repayment of the loan, interest and fees by placing a ‘charge’ or ‘security’ on the title to property. This would allow the lender to sell the property in the event that the mortgage cannot be repaid.

Definition & Example Of Home Equity

Home equity starts with your homes current value. Now subtract the amounts owed on any mortgages or other liens against it. These liens might be purchase loans that you used to buy the house or second mortgages that were taken out later. The difference is your home equity.

For example, let’s say that your home is worth $300,000. If you have $200,000 left to pay on your mortgage, your home equity is $100,000.

Your lender doesnt own any portion of the property unless you’ve obtained a , which isn’t common. You own the house, but it’s being used as collateral for your loan. Your lender secures its interest by getting a lien against it.

Don’t Miss: Rocket Mortgage Conventional Loan

Can I Use A Home Equity Loan For Anything

A home equity loan can be used to purchase anything lenders typically dont have rules for its usage. Home equity loans can be used to pay for things like medical expenses or your dream wedding.

Although you can use it to finance those things, its better to use it for refinancing high-interest debt or home-renovation projects. Using it for the former can help you get out of debt quicker, provided you secure a lower interest rate. Using it for the latter can increase the value of your home.

If you use it for other purposes, such as investing or funding a business, theres no guarantee that youd see a good return on investment, and you could lose money.

Discharging After Paying Off Your Mortgage

You, your lawyer or your notary can discharge your mortgage once you pay it off. You also need to make sure you dont have any amount owing on any related products. For example, you may have a home equity line of credit with your mortgage. If thats the case, you need to pay it off and close it before getting a mortgage discharge.

You may not want to discharge your mortgage if you plan on using your home as security for a loan or line of credit with the same lender. This includes options such as HELOCs.

Don’t Miss: What Does Gmfs Mortgage Stand For

Refinance To A Shorter Loan

If you can afford to make higher monthly mortgage payments, consider refinancing to a shorter-term loan. For example, if you currently have a 30-year mortgage, think about switching to a 12-year mortgage so you can pay off your mortgage sooner and build home equity at the same time.

However, keep in mind that refinancing your mortgage to a shorter term will increase your monthly payments, so make sure you can afford to cover the added cost every month before refinancing. Refinancing also comes with closing costs just like a regular mortgage. Average closing costs are $5,000 however, the size of your loan and where you live makes a big difference in how much you pay. Some lenders offer no-cost refinancing, which means closing fees are wrapped into your mortgage loan.

How this affects equity in your house: When you refinance to a mortgage loan with a shorter term, less of your payment goes toward paying down the interest. That means more of each monthly payment goes toward paying down your mortgage principal, which increases your equity.

How To Calculate The Equity You Have In Your Home

Your home equity is the difference between the appraised value of your home and how much you still owe on your mortgage. In laymans terms, it represents the amount of your home that you own. For example, if your home is appraised at $200,000 and you owe $120,000, you have $80,000 of equity in your home. The rest is the part of your home still owned by the bank.

Remember that lenders will still impose a maximum amount you can borrow, often 80 percent or 85 percent of your available equity so a new loan or a refinance makes the most sense if the value of your home has increased or youve paid down a significant portion of your mortgage.

Youll have more financing options if you have a high amount of home equity. Borrowers generally must have at least 20 percent equity in their homes to be eligible for a cash-out refinance or loan, meaning a maximum of 80 percent loan-to-value ratio of the homes current value.

Also Check: Rocket Mortgage Loan Types