Calculate New Home Expenses

The bank will give you a loan amount based on the amount of monthly payments they determined you can afford. They aren’t taking into consideration all of the new expenses that may come along with your new place. If you buy a house that needs some work, your home repair and renovation costs may be substantial. On the flip side, if you upgrade to a bigger house, you are sure to have increased expenses.

What Is The Best Age To Buy A House

Key Takeaways

- The median age for first-time homebuyers in 2017 was 32, according to the National Association of Realtors.

- The best age to buy is when you can comfortably afford the payments, tackle any unexpected repairs, and live in the home long enough to cover the costs of buying and selling a home.

How Much House Can I Afford With An Fha Loan

With a FHA loan, yourdebt-to-income limitsare typically based on a 31/43 rule of affordability. This means your monthly payments should be no more than 31% of your pre-tax income, and your monthly debts should be less than 43% of your pre-tax income. However, these limits can be higher under certain circumstances.

If you make $3,000 a month , your DTI with an FHA loan should be no more than $1,290 â which means you can afford a house with a monthly payment that is no more than $900 .

FHA loans typically allow for a lower down payment and credit score ifcertain requirementsare met. The lowest down payment is 3.5% for credit scores that are 580 or higher. If your credit score is between 500-579, you may still qualify for an FHA loan with a 10% down payment. Keep in mind that generally, the lower your credit score, the higher your interest rate will be, which may impact how much house you can afford.

FHA loans are restricted to a maximum loan size depending on the location of the property. Additionally, FHA loans require an upfront mortgage insurance premium to be paid as part of closing costs as well as an annual mortgage insurance premium included in your monthly mortgage payment â both of which may impact your affordability.

Recommended Reading: How Much Is Mortgage On 1 Million

Property Tax Breaks For Seniors

One final thing to consider as a senior homeowner is that you may qualify for a property tax break.

Rules to claim your senior property tax exemption and the amount your taxes could be reduced varies by state. So check with your local tax authority or financial planner for more information.

If you do qualify for reduced real estate taxes, this could help lower your debttoincome ratio and therefore increase the amount you can borrow on your new home loan.

Saving For Retirement: Where Are You Now

Whether you plan to live lavishly or frugally, youll need to have a certain amount of money saved by the time you retire. Think of this figure as a mountain summit, reachable by several different paths. If youve done everything right so far, that summit is still in plain view youve followed the most direct and least difficult path, and all you need to do is continue on in the same direction. If, however, your savings arent where they should be, its as if youve wandered in the wrong directionyoull need to recalibrate and start climbing in order to reach the summit.

To determine your current financial coordinates, you need to answer three questions:

- How much have I saved thus far?

- How many years until I retire?

- Whats my annual income ?

The answers to those questions will determine how much work you have to do to reach that mountaintop. If youve saved plenty and youre still young, greatyoure well on your way. If youve saved nothing and your sixties are just around the corner, not so much. Lets check out some examples using our retirement calculator to see how this works in reality.

Also Check: Rocket Mortgage Requirements

How Much Should I Have Saved When Buying A Home

Lenders generally want to know you will have a cash reserve remaining after youâve purchased your home and moved in, so you donât want to empty your savings account on a down payment.

Having some money in the bank after you buy is a great way to help ensure that youâre not in danger of default and foreclosure. Itâs the buffer that shows mortgage lenders you can cover upcoming mortgage payments even if your financial situation changes.

While maintaining a debt-to-income ratio under 36% protects you from minor changes in your finances, a cash reserve protects against major ones.

At a minimum, itâs a good idea to be able to make three monthsâ worth of housing payments out of your reserve, but something like six months would be even better. That way, if you experience a loss of income and need to find a new job, or if you decide to sell your house, you have plenty of time to do so without missing any payments.

How Down Payment Size Impacts Home Equity

| Percentage | |

|---|---|

| $250,000 | $0 |

The rule of thumb still stands: 20% of the home value is the ideal amount of money for a down payment. This amount buys you equity in the home, which helps secure the loan. When you donât have a least 20% to put down, you have to find alternate means to secure the mortgage.

This can mean private mortgage insurance , which is an added monthly charge to secure your loan. If you donât have enough money for a down payment, many lenders will require that you have mortgage insurance. Youâll have to pay your monthly mortgage as well as a monthly insurance payment, so itâs not the best option if your budget is tight.

Youâll stop paying PMI when your mortgage reaches about 78% of the homeâs value. While certain homebuyers can qualify for little or no down payment, through VA loans or other 0% down payment programs, most homeowners who donât have a large enough down payment will have to pay the extra expense for PMI.

Don’t Miss: Bofa Home Loan Navigator

What Home Can I Buy With My Income

A quick recap of the guidelines that we outlined to help you figure out how much house you can afford:

- The first is the 36% debt-to-income rule: Your total debt payments, including your housing payment, should never be more than 36% of your income.

- The second is your down payment and cash reserves: You should aim for a 20% down payment and always try to keep at least three monthsâ worth of payments in the bank in case of an emergency.

Let’s take a look at a few hypothetical homebuyers and houses to see who can afford what.

What Is A Credit Rating

Your credit rating is a ranking that indicates your financial health at a specific point in time. It compares the risk you pose for lenders to that of other Canadians.

Your overall credit rating is an important factor in determining the type and amount of credit you may be eligible to receive at any given time. That’s why it’s so important to establish and maintain the highest rating possible.

Recommended Reading: Mortgage Rates Based On 10 Year Treasury

You Can’t Eat Your Home

The basic concept behind taking out a home equity loan is “you can’t eat your home. Because your residence produces no income, home equity is useless unless you borrow against it. Historically, in the long term, homes provide rates of return below those of properly diversified investment portfolios. Because home equity typically makes up a substantial portion of a retiree’s net worth, it can arguably serve as a drag on income, net worth growth, and overall quality of life in retirement.

Carrying a mortgage during retirement can be troublesome if investment returns are variable, leading to problems paying a mortgage or uneasiness related to carrying a large amount of debt during a market downturn.

So, logically, the next move would be to shift your assets from your home by taking out a mortgage and investing the money in securities that should outperform the after-tax cost of the mortgage, thereby enhancing the net worth in the long run and your cash flow in the short run. Additionally, investments such as most mutual funds and exchange-traded funds are easily liquidated and can be sold piecemeal to meet extra spending needs.

This all sounds great, but it’s not that simple: Any time you introduce more leverage into your finances, there are a lot of things you need to consider. So, what are the benefits and drawbacks of this strategy?

Do Mortgage Lenders Look At 401k

The mortgage lender will want to see complete documentation of the 401k loan including loan terms and the loan amount. The lender will also want proof the funds were transferred into one of your personal checking or savings accounts so that it’s readily available when you are ready to close the mortgage loan.

Also Check: Chase Recast

Applying For A Mortgage

If youre ready to get a mortgage, you can streamline the mortgage process by working with your current lender or a financial institution thats familiar with your finances. If your current lender isnt offering competitive rates, shop around to find one with low rates and limited closing costs and origination fees. When researching lenders, also ask about any additional expenses like mortgage insurance and discount points that could get rolled into your loan balance.

Where available, take advantage of the preapproval process to find out what kind of mortgage youre likely to qualify for. Not only can mortgage preapproval right-size your expectations when shopping for a homeand a lenderits an excellent way to show sellers youre serious when its time to make an offer.

Preapproval can also shorten the application and final approval process because you already have easy access to documentation of personal details like your credit score, income and assets.

Qualifying For A Mortgage

Lets take a look at the constraints on housing deals using traditional mortgages. As weve said, the lens through which the vast majority of people look at home affordability is simply, how large a mortgage can they qualify for? Not surprisingly, the mortgage industry has a well-tested rule of thumb for making the determination. Its known as the 28/36 rule.

According to FreddieMac, and many other mortgage resources, you should take on no more than 28% of your monthly gross income in a mortgage payment principal, interest, property taxes, home insurance.

The relation of mortgage payment to gross income is known as the front-end ratio. Its found by dividing your monthly housing expenses by your gross income and multiplying by 100. Some underwriters allow higher percentages, and some require lower. Ive seen ratios as low as 25% and as high as 30%. But 28% is the most common rule.

For most people, gross income would just be wages. For a retiree, it would be the combination of pensions, Social Security benefits, and perhaps investment withdrawals, using a conservative safe withdrawal rate. Individual institutions are likely to have their own rules for getting a mortgage based on assets.

The 36% number is known as the back-end ratio. Its the suggested upper limit once you add in monthly payments on all other debt to your housing expenses and divide by your gross income. This is an attempt by your creditors to keep your overall debt manageable.

Recommended Reading: What Does Gmfs Mortgage Stand For

Managing Mortgages In Retirement

Lindsay VanSomeren is a credit card, banking, and credit expert whose articles provide readers with in-depth research and actionable takeaways that can help consumers make sound decisions about financial products. Her work has appeared on prominent financial sites such as Forbes Advisor and Northwestern Mutual.

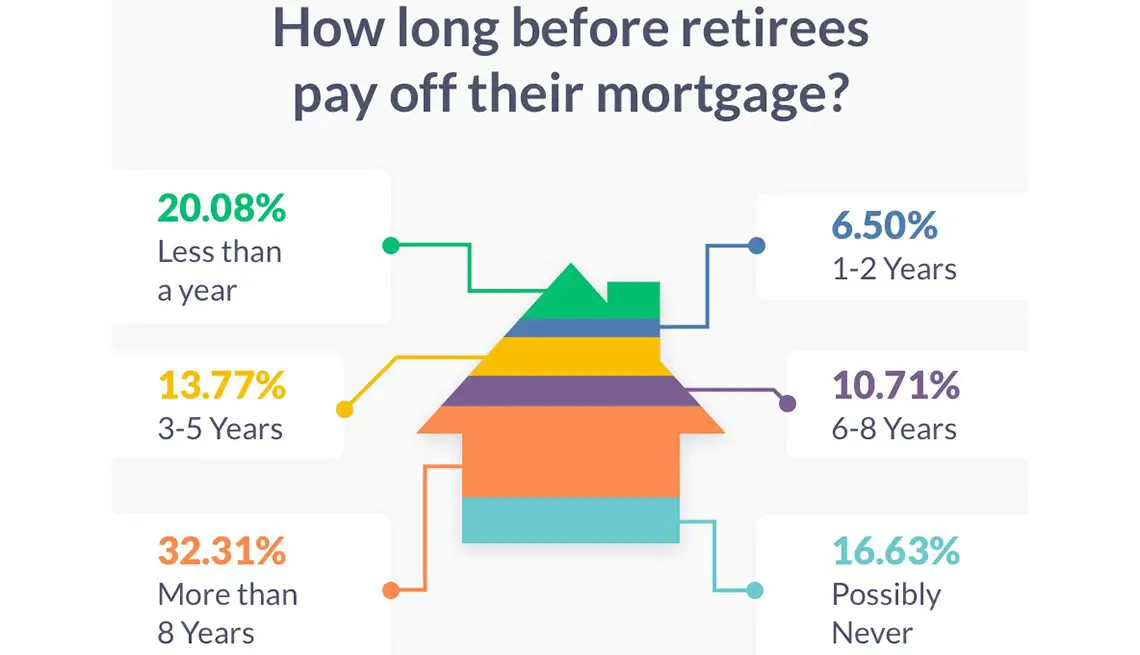

Paying off your mortgage before you retire is ideal, but it isnt always possible. In fact, many seniors choose to retire with a mortgage. In 2016, 46% of homeowners aged 65-79 had mortgage debt, with a median balance of $77,000, according to a Harvard University study.

Retiring with a mortgage can make managing your finances more difficult, but it doesnt have to be an outsize burden if you know what factors to consider.

What Kind Of House Can I Afford Making 80k

So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

Read Also: Can You Get A Reverse Mortgage On A Condo

Put Your Debt In Perspective

Debt that creates opportunities can actually work for you. If its also low cost and has tax advantages, so much the better. For instance, with mortgages or home equity lines of credit, youre borrowing to own a potentially appreciating asset. On top of that, home loans may be tax-deductible. So they fall into the category of good debt.

On the other hand, theres nothing positive about debt thats high cost, isnt tax-deductible, and is taken to buy an asset that will likely depreciate. Things like credit card debt and car loans fall into the bad debt category. The image of taking on high monthly payments for a new car that decreases in value the minute you drive it off the lot is probably one of the clearest examples of debt that works against you.

What should you do? If the ideal scenario of being debt-free is out of reach, your practical goal should be to pay down any bad debt while keeping the good debt working for you.

Fact: The average debt held by families headed by individuals 55 and older stood at $75,082 in 2010, up more than $1,300 from 2007, according to Federal Reserve data crunched by the Employee Benefit Research Institute.

Helocs And Reverse Mortgages

The answer with a HELOC is simple: HELOCs require regular repayments. Without income or assets outside of the house, you would have no way to finance the loan. You cant use up all your liquidity on real estate and then use a HELOC to bail yourself out.

Reverse mortgages are trickier. They are structured so that no repayments are required while you remain in your home. There is even a tenure option that will generate payments for life. So, in theory, you could dump an arbitrarily large sum into a house, then remove equity for living expenses as long as you lived in it. In practice, I suspect thats unworkable. For starters, reverse mortgages dont actually let you tap all of the equity in a home. A principal limit is computed based on several variables. In the examples Ive seen, the accessible principal might initially be around 50% of the homes value, and the related tenure payments are modest, not enough income to cover the typical retirees living expenses.

Recommended Reading: Rocket Mortgage Vs Bank

A Simple Formulathe 28/36 Rule

Here’s a simple industry rule of thumb:

- Housing expenses should not exceed 28 percent of your pre-tax household income. That includes your monthly principal and interest payments plus all the such as property taxes and insurance.

- Total debt payments should not exceed 36 percent of your pre-tax incomecredit cards, car loans, home debt, etc.

How To Find An Acceptable Monthly Payment

If you’re not sure what to enter into the rent payment you can afford box, that’s okay. Use the Budget Calculator to determine a proper housing allowance based on your income.

Another alternative is to start and maintain a budget that takes into account all your expenses.

The key is don’t make yourself house poor by committing too much of your budget to mortgage, taxes, and insurance. You need to leave enough money in your budget to fund retirement, the kids college, and have a little fun once in a while.

Life can be very difficult when you are strapped with mortgage payments greater than you can comfortably afford.

Related:Why you need a wealth plan, not a financial plan.

Also Check: Reverse Mortgage On Condo

What Salary Do You Need To Buy A $400k House

Now lets take what weve learned and put it into action with an example. Lets say you want to buy a $400,000 house. First, youll need to do the hard work of saving up $80,000 in cash as a 20% down payment.

With a 15-year mortgage at a 3% interest rate, your monthly payment could be around $2,200 . To manage that payment, youd need to be earning at least $8,800 as your monthly take-home pay .

So, to buy a $400,000 home, youd need to be earning a take-home salary of more than $105,000 per year . Keep in mind, youd actually need more than that after you add the cost of property tax and home insurance into your mortgage.

If that doesnt sound like you, dont worry. Try saving a bigger down payment to lower your monthly mortgage until its no more than 25% of your take-home pay. Or look for a smaller starter home in a more affordable neighborhood.

Housing Bubble Enabled Buyers

Lusardi and Mitchells study suggested that baby boomers mortgage balances were so high due to the housing bubble. They noted that many of the boomers were able to buy more expensive properties with lower downpayments during this time and older boomers who bought pre-housing bubble were much less likely to be underwater than newer boomers.

Whether youre approaching retirement or not, its never a prudent choice to buy more house than you can afford. Anyone whos seen a housing bubble can attest to that. Property prices will always fluctuate but its up to you to decide how much house you can afford. Just because a bank will loan you X amount, doesnt mean you should take it. A lot of the problems boomers with high mortgage balances are facing could have been avoided with some simple planning. But for those who find themselves in trouble, all is not lost.

You May Like: Reverse Mortgage For Condominiums