Example Of How The Mortgage Interest Deduction Works

Its important to calculate your mortgage interest deduction and compare your itemized deductions with the standard deduction.

If your loan is under the $750,000 limit or other limits that apply to your situation you dont have to do any calculations. You will be able to claim the full amount of interest you paid.

But if your loan is above the limits, you will only be able to claim a portion of your interest payments.

For example, lets say you have a $1.5 million dollar mortgage and are filing single or married, jointly you can only claim an interest deduction based on the $750,000 limit. Lets say you paid $90,000 in interest over the year.

You would use a formula to calculate your mortgage interest tax deduction.

In this example, you divide the loan limit by the balance of your mortgage . This gives you 0.5, which you multiply by the total interest payments you made for the year .

The amount you can claim as your mortgage interest tax deduction is $45,000.

Tax Savings For High Earners

All in all, the mortgage tax deduction is a fool’s game for middle-class earners in low-cost areas, and a boon for high-income earners in high-cost areas.

Someone who owns a million-dollar home and who pays interest on a $1 million mortgage will inevitably be able to deduct more of their mortgage interest than someone who pays interest on a $100,000 mortgage.

So, while the mortgage interest tax deduction is touted as one of the best reasons to buy a home, it often provides little help to people who don’t live in a modern-day McMansion.

Deducting Interest From A Heloc Or Home Equity Loan

Equity is the current value of your home minus how much you have left on your mortgage. If your home is worth $300,000 and youâve made $50,000 in payments against the mortgage principal, you have $50,000 in equity.

You can receive part of the equity as cash without selling your home, by using it as collateral for a home equity line of credit or a home equity loan.

Whether you take out a HELOC or a home equity loan, the interest may be deductible just like ordinary mortgage interest. As with mortgage interest, the HELOC or home equity loan debt must be secured by a qualified home âif you default on the HELOC or home equity loan, your home could go into foreclosure, meaning you could lose the home.

Don’t Miss: Bofa Home Loan Navigator

Can You Deduct Property Taxes If You Don’t Itemize

A: Unfortunately, this is not still allowed, and there is no way to deduct your property taxes on your federal income tax return without itemizing. Five years ago, Congress passed a bill allowing a single person to deduct up to $500 of property taxes on a primary residence in addition to their standard deduction.

What Mortgage Interest Can I Deduct 2019

For the 2019 tax year, the mortgage interest deduction limit is $750,000, which means homeowners can deduct the interest paid on up to $750,000 in mortgage debt. Married couples filing their taxes separately can deduct interest on up to $375,000 each. The maximum amount applies to home loans originated after Dec.

Also Check: Chase Recast Mortgage

Should I Try To Make My Mortgage Interest Tax Deductible

So, in conclusion, mortgage interest payments are not tax deductible, except under specific circumstances, such as renting out your property to earn an income. Once again, home based businesses that do not involve renting of any kind, will not benefit from mortgage interest tax deductions. So, if you are thinking about turning your home into a small business or rental property, thereby saving yourself a bit of money in taxes, just remember to consider all the factors, and know what youll be getting yourself into.

Whats the difference between a tax credit and a tax deduction in Canada? Find out here.

Like any kind of investment, trying to make your mortgage interest tax deductible by turning your primary residence into an investment property comes with its own share of risks. You have to be certain that youll get back whatever youve invested in the property in the first place. It could be months, if not years until you see a return, and later, if you decide to sell your home, you need to be prepared to pay taxes on whatever profit you made. So, if youre thinking about doing this, discuss it with a financial advisor first. They will be able to tell you if your business venture will likely be profitable.

Rating of 4/5 based on 43 votes.

Understanding The Mortgage Interest Deduction

See Mortgage Rate Quotes for Your Home

One of the main mortgage tax benefits of homeownership is the mortgage interest deduction. When you deduct the interest paid on your mortgage, you reduce your taxable income by that amount. Heres what to know about the deduction, its limitations and how it may affect you at tax time.

Recommended Reading: What Information Do You Need To Prequalify For A Mortgage

Home Equity Loans And Helocs

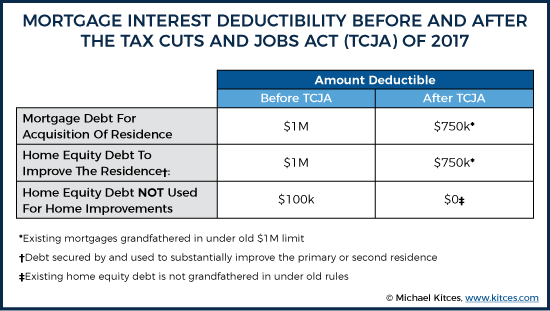

The IRS considers any home equity loan or line of credit funds used to buy, build, or substantially improve the home to be home acquisition debt, so the interest is still deductible.

For example, say you take out a $700,000 mortgage to buy your home, then a $100,000 HELOC to remodel the kitchen. You could deduct all interest paid on the first mortgage and half the interest on the HELOC. All funds were used to buy and improve your home, but youre limited to $750,000.

On the other hand, say you take out a $700,000 mortgage to buy your home, then take out a $20,000 HELOC to refinance some high-interest credit card debt. Interest on the first mortgage is deductible, but none of the HELOC interest is deductible because it doesnt count as home acquisition debt.

Also, keep in mind that the $750,000 limit applies to all combined mortgages on your main residence and second home.

Why Does My Mortgage Interest Not Reduce My Taxes

The home mortgage deduction is a personal itemized deduction that you take on IRS Schedule A of your Form 1040. If you don’t itemize, you get no deduction. … As a result, far fewer taxpayers will be able to itemizeas few as 5%. This means far few taxpayers will benefit from the mortgage interest deduction.

You May Like: How Much Is Mortgage On 1 Million

Your Mortgage Is Too Large

There is a limit on the size of a home mortgage for which interest is deductible. If you purchased your home before December 15, 2017, you may deduct mortgage interest payments on up to $1 million in loans to buy, build, or improve a main home and a second home. If you purchased your home after December 15, 2017, new limits imposed by the TCJA apply: You may deduct the interest on only $750,000 of home acquisition debt: a reduction of $250,000 from prior law. The $750,000 loan limit is scheduled to end in 2025. After then, the $1 million limit will return.

What Qualifies As Mortgage Interest

There are a few payments you make that may count as mortgage interest. Here are several you may consider deducting:

Interest on the mortgage for your main home: This property can be a house, co-op, apartment, condo, mobile home, houseboat or similar property. However, the property will not qualify if it doesnt have basic living accommodations, including sleeping, cooking and bathroom facilities. The property must also be listed as collateral for the loan youre deducting interest payments from. You can also use this deduction if you got a mortgage to buy out an exs half of the property in a divorce.

You can still deduct mortgage interest if you receive a non-taxable housing allowance from the military or through a ministry or if you have received assistance under a State Housing Finance Agency Hardest Hit Fund, an Emergency Homeowners Loan Program or other assistance programs. However, you can only deduct the interest you pay. You cannot deduct any interest that another entity pays for you.

Interest on the mortgage for a second home: You can use this tax deduction on a mortgage for a home that is not your primary residence as long as the second home is listed as collateral for that mortgage. If you rent out your second home, there is another caveat. You must live in the home for more than 14 days or more than 10% of the days you rent it out whichever is longer. If you have more than one second home, you can only deduct the interest for one.

Get approved to refinance.

Read Also: Does Rocket Mortgage Service Their Own Loans

Mortgage Tax Deduction Faq

Are mortgage payments tax-deductible?

You cant deduct your full monthly payment. But you can deduct the portion of it that goes to interest. At the start of your loan, a large portion of each monthly payment is interest. By the end, almost none of it is. The portion falls steadily over the life of your mortgage. Again, you can only make this deduction if you itemize your deductions.

Are mortgage points tax-deductible?

Yes. But not as a lump sum. With a 30year mortgage, you deduct onethirtieth of the cost of the points each year. With a 15year loan, you deduct onefifteenth. And so on.

Is mortgage insurance tax-deductible?

Yes, for the 2021 tax year, provided your adjusted gross income is below $100,000 . Above $109,000 you cant make any deductions for mortgage insurance. Between those two incomes, you can deduct progressively less for each extra $1,000 you earn.

Do I have to pay taxes on a cash-out refinance?

You dont pay tax on the amount you cash out. Its a loan like any other and those arent taxable as income. But you may be able to deduct interest paid on the cashout amount if the money was used to buy, build, or substantially improve your primary or second home.

Are home equity loans tax-deductible?

Again, interest on home equity loans isnt usually taxdeductible. But it should be if you used the proceeds of your loan to buy, build, or substantially improve your main residence or second home.

Is a home equity line of credit tax-deductible?

Mortgage Interest Deduction Vs Standard Deduction

The Tax Cuts and Jobs Act lowered the maximum mortgage interest deduction amount, but increased the standard deduction amounts. Due to these changes, fewer taxpayers may choose to itemize their deductions.

The 2019 standard deduction amounts are:

- Single/married filing separately: $12,200

- Head of household: $18,350

- Married filing jointly: $24,400

We calculated the approximate amount of mortgage debt youd likely need for the interest payments in the first year of your loan to outweigh the standard deduction.

| Filing Status | |

|---|---|

| $24,400 | $680,000 |

Based on first-year interest costs for a 30-year, fixed-rate mortgage at the current national average rate of 3.65%.

The table above shows that if youre single taxpayer, youd need at least $340,000 in mortgage debt to claim the mortgage interest deduction. But even if your mortgage balance isnt quite that high, you may also claim other deductions on your tax return, which could still make itemizing the better choice. For example, you can deduct up to $10,000 in state and local taxes including property taxes. The limit is $5,000 for married couples filing separately, however.

Of course, your particular situation will depend on your mortgage rate, as well as the number of monthly mortgage payments you make before tax season arrives. And because fixed-rate mortgages are amortized into equal monthly payments, with every month that passes you pay fewer dollars toward interest and more toward principal.

Don’t Miss: Chase Recast

How To Make Your Canadian Mortgage Interest Tax Deductible

Here in Canada, we dont get to write off home mortgage interest on our personal residences they do in the United States without formal planning. Many Canadians have to pay every dollar of interest with after-tax dollars. The name of the game here is tax savings and wealth creation through strategic conservative leverage wealth strategy.

But there is a way around that for many Canadian homeowners that was formerly called the Smith Manoeuvre. This popular tax planning tactic is named by Fraser Smith, a well-known Canadian author of a popular personal finance book, The Smith Manoeuvre. While the book is somewhat antiquated on the mortgage side now much of the core fundamentals still hold true. In the interest of full disclosure, I met with the late Fraser Smith in 2003 to discuss how to support Canadians at a broader level with this strategy.

Heres how it works

Canada does not allow you to deduct personal mortgage interest. But it does allow you to deduct interest on loans you make for the purposes of investment, as long as you do it within a non-registered account and meet CRA guidelines for deductibility which can be found on CRAs website in a simplified version here:

But how do you turn your personal home loan into an investment loan? Well, you cant do it all at once. But you can do it a little at a time, using a tool called a re-advanceable mortgage.

Heres the intended result:

A few caveats:

Recommended team:

How To Claim A Mortgage Interest Deduction

Sitting down to fill out your income tax return and claim your deduction can be a daunting task. But preparation is key. As long as you have all the documents you need, its just a matter of following the instructions in the tax form booklets or online.

Here are the steps you should take so that youre prepared to claim:

These are good steps to follow, but please remember to always consult a tax professional on tax matters.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

Is A New Air Conditioner Tax Deductible 2021

Now, as of January 15, 2021, the Tax Credit has been extended again. This means that certain qualifying air conditioners and heat pumps installed through December 31, 2021 are eligible for a $300 tax credit. The tax credit also retroactively applies to new air conditioners installed in the 2018-2020 tax year.

What is the IRS mileage rate for 2021? More In Tax Pros

| Period |

|---|

Nov 26, 2021

Are closing costs deductible?

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is no. The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

Are moving expenses tax deductible for retirees? If you are retired and you were working abroad, and you move to the United States, you may be allowed to deduct your moving expenses provided you meet the following conditions: You must be considered permanently retired and both your former main job location and your former home must have been outside the United States

How To Receive A Mortgage Interest Deduction

In order to receive a mortgage interest deduction, you need to ensure that you obtain and fill out all of the appropriate forms. At the beginning of the year, you should receive a Form 1098 from your mortgage lender. The 1098 will state exactly how much you paid in interest and mortgage points over the course of the year, and act as proof that youre entitled to receive a mortgage interest deduction. Be aware that you will only receive this form if you have paid at least $600 in interest during the tax year.

To qualify, you will also need to itemize your deductions and report them on Schedule A, Form 1040. This form will have you list all of your deductions, including donations to charity, medical expenses and the information about your mortgage interestfound on your 1098.

Don’t Miss: 10 Year Treasury Yield Mortgage Rates

Complete Guide To Claiming Your Mortgage Interest Deduction

The mortgage interest deduction reduces your taxable income and your tax bill. But youll have to itemize your deductions to claim it.

Edited byChris JenningsUpdated October 12, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

The IRS mortgage interest tax deduction can reduce your taxable income by allowing you to write off the interest you pay on your home loan during the tax year:

- If you took out your mortgage before Dec. 16, 2017 and used it to buy, build, or improve your home, youre able to deduct the mortgage interest you paid on the first $1 million of your mortgage .

- If you took out your mortgage after Dec. 15, 2017 and used it to buy, build, or improve your home, youre able to deduct the interest paid on the first $750,000 of your mortgage .

Heres what you should know about qualifying for the mortgage interest deduction and how to deduct it: