Do I Need To Find A Tenant And Have A Written Lease Agreement Before I Apply

Regarding the potential rental income the market rent is determined by the appraiser, not by the amount on a lease . The appraiser will include one of the following:

- For a one-unit property Single-Family Comparable Rent Schedule .

- For two to four-unit properties Small Residential Income Property Appraisal Report with your appraisal report.

The appraiser will list the fair market rent for the subject property on these forms.

Fannie And Freddie Minimum Income Guidelines

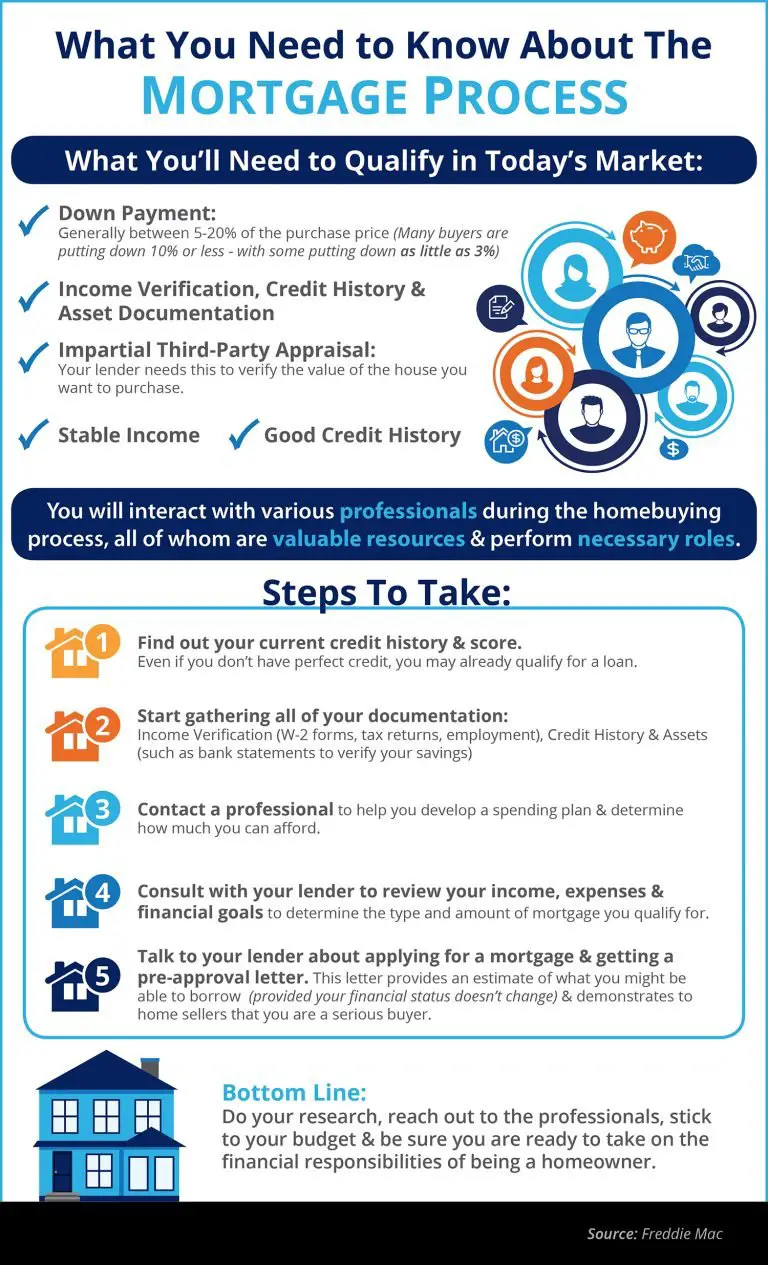

When underwriting mortgage loans, most lenders follow the guidelines of Fannie Mae and Freddie Mac .

Fannie and Freddies list of acceptable income documentation is extensive, but it isnt set in stone. For example, if you have a relationship with a bank that knows your history and thinks youre good for a loan, you might be able to secure a mortgage without meeting every standard requirement.

Navy Federal Credit Union is an example of an institution that considers a customers relationship with the institution. Were open to considering loans for customers who might not meet normal standards, says Randy Hopper, former senior vice president of mortgage lending at Navy Federal.

There are also borrower programs that deviate from standard income requirements.

For example, Federal Housing Administration loans have no specific income requirements. For these loans, lenders look at how much income is eaten up by monthly bills and debt service, as well as your employment track record. A borrowers salary doesnt play a big role in FHA underwriting, though typically, a lender will assess applicants with higher salaries as less-risky borrowers.

People reporting income from second jobs must provide tax documents in support. Those who are self-employed usually have to show proper tax documents and complete Fannie Maes Cash Flow Analysis, or another similar tool as part of their application.

For the most part, however, borrowers will want to make sure these documents are in order:

Can You Receive Money For A Down Payment From A Friend Or Relative

Lenders generally allow homebuyers to receive gift money from loved ones for their down payment. Under Fannie Mae and Freddie Macs requirements, these gifts can only come from a family member related by blood, marriage, adoption, or legal guardianship. The gift may also come from a fiancé or domestic partner.

If you receive your down payment money as a gift, youll also have to provide a gift letter written by the donor. The gift letter should specify the dollar amount of the gift, the date, and confirmation that the gift isnt a loan and no repayment is expected.

Don’t Miss: Why Is Mortgage Cheaper Than Rent

Cfpb Shifting From Dti Ratio To Loan Pricing

Both Fannie Mae and Freddie Mac have allowed higher DTI ratios for buyers carrying significant student debt.

While measuring debt-to-income is useful for getting a baseline feel for what you may qualify for, the CFPB proposed shifting mortgage qualification away from DTI to using a pricing based approach.

What Change did the CFPB Propose?

“the Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach.”

Why Did They Suggest the Change?

“The Bureau is proposing a price-based approach because it preliminarily concludes that a loans price, as measured by comparing a loans annual percentage rate to the average prime offer rate for a comparable transaction, is a strong indicator and more holistic and flexible measure of a consumers ability to repay than DTI alone.”

How Does This Impact Loan Qualification for Low-income Buyers?

“For eligibility for QM status under the General QM definition, the Bureau is proposing a price threshold for most loans as well as higher price thresholds for smaller loans, which is particularly important for manufactured housing and for minority consumers.”

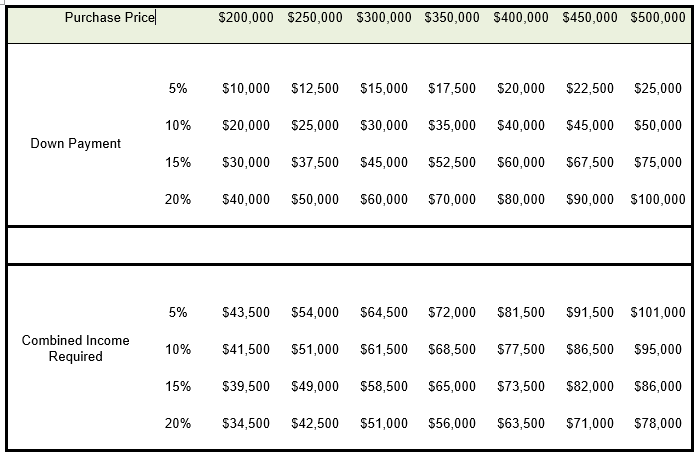

How Much Income Do You Need To Buy A House

Youll need to show your lender you earn enough to comfortably make the monthly mortgage payment, but theres no universal income requirement.

Edited byChris JenningsUpdated October 12, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

When you apply for a mortgage, your lender wants to be sure you can repay the money. Income is a big factor that helps your mortgage lender make its decision but you dont have to be a high-earner to qualify for a home loan.

The lender will check your overall financial standing and look at the cost of the home you want to buy.

Heres how your income can affect what mortgage you get:

You May Like: How Long After Bankruptcy Can You Get A Mortgage

Rules Applying To Types Of Income

Now, weve already established that different mortgages and lenders can have different rules. And that they can apply them more or less strictly.

So theres no such thing as a definitive list of the rules that apply to income streams. All we can do is sample some of the most common ones to give a guide.

So weve chosen to use Fannie Maes rule book. Your lender may have a different one.

But dont expect huge variations from Fannies. After all, theyre all trying to achieve the same goal: to make a reasonable, good faith determination of a consumers ability to repay.

Social Security And Pensions

You might not think that you’ll be applying for a mortgage loan after retirement. But people do. And when they do, they can use their Social Security payments and pension payments as part of their regular monthly income.

Lenders can’t deny borrowers based on their ages. If a mix of Social Security or pension payments plus other monthly income gives you enough dollars each month to fall under that 43 percent threshold, you have as good a chance as anyone of qualifying for a mortgage loan, assuming that your credit score and other factors are solid.

Also Check: What Would My Mortgage Be On A 300 000 House

Examples Of Mortgage Payment Percentage

Now, lets look at some examples of mortgage payment percentages so you can work out how much you can afford to borrow from a lender and what percentage of income you need for your mortgage.

What value of property can you afford on a $60,000 a year income?

As mentioned above, the rule of thumb is that you can typically afford a mortgage two to 2.5 times your yearly wage. Thats a mortgage between $120,000 and $150,000 at $60,000 per annum. However, youll have to be able to afford the monthly mortgage payments.

What are the payments on a $200,000 mortgage?

Lets imagine a $200,000, 30-year mortgage with a 4% interest rate. This would set you back about $954 per month.

What are the monthly payments on a $300,000 mortgage?

With a 4% fixed interest rate, monthly mortgage payments on a 30-year mortgage would total around $1,432.25 a month. However, if you opt for a 15-year plan, it could cost up to $2,219.06 a month.

General Income Qualification Requirements

Likely, youre not qualifying for a mortgage based on investment income alone.

If thats the case, youll have to document any other income streams being used for mortgage qualification.

Regardless of the type of income, Fannie Mae instructs lenders to look for income that is stable, predictable, and likely to continue.

- For mortgage borrowers who earn a salary or regular wage, that requirement is generally not difficult. Paystubs and W2s are usually all thats needed to document their income history. And, their employer can usually assist in verifying the likelihood of continued employment

- For self-employed workers, documenting income can be more challenging. Still, bank statements, profit and loss statements, and previous years tax returns are typically a good indication of stability and predictability of continued income

When it comes to income generated from your investments, the rules are a little more complex.

Unlike the income from a job, you cant rely on pay stubs or W2s. Nor can you reach out to an employer for clarification.

That means youll have to jump through a few extra hoops to document the source and stability of your investment income.

Recommended Reading: What Is A Good Ltv For Mortgage

How Do You Get Paid

This is the first question your loan officer will ask, how do you get paid? When you are asked this, basically, there are several things we need to know:

- Are you paid a straight Salary?

- Are you paid hourly? How many hours do you work?

- Are you full time or part time?

- Do you have a second job?

- Do you work overtime?

- Is more than 25% of your income from Commission?

- Are you self employed? What kind of business?

- Do you itemize your tax returns?

- Do you write off 2106 expenses?

- Do you own rental properties?

The answer to any one of these questions can change the way that your income is calculated.

Get A Subprime Mortgage

The term subprime mortgage has a negative connotation because of the housing bubble and financial crisis its often associated with, but subprime mortgages can actually be a gateway to home ownership for some people.

A subprime mortgage is a home loan with higher interest rates than their prime mortgage counterparts. The higher interest rates are in place to offset the risk of loan default by subprime mortgage borrowers who are risky customers because of poor credit. These mortgages can be either fixed or adjustable.

The benefit of a subprime mortgage is that people with poor credit dont have to wait as long to own a home. They can repair their credit by paying their mortgage each month, rather than waiting years to repair their credit and then buy a home.

The obvious disadvantage, besides higher rates, is that closing costs and fees associated with home loans will be usually higher for subprime borrowers. Although credit score requirements arent as stringent for subprime loans, borrowers must still show proof that they can afford the mortgage payments each month.

Also Check: Is Fico Score 8 Used For Mortgages

Can I Use A Mortgage Calculator Based On Income

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

Also Check: Can A Mortgage Be Transferred

Irs Tax Return Schedules For Self

Schedule C: Reports income or loss from a sole proprietorship.

Schedule D: Reports income from capital gains or losses. This type of income comes from sale of stock or real estate typically. Usually these are one-time events and cant be counted toward ongoing income. However, day traders, property flippers and the like may be able to use schedule D income if they prove three years worth of consistent income.

Schedule E: Income and loss from leased and rented real estate is reported on this form. Borrowers who maintain a full time job while owning rental properties will have net income or loss from schedule E. The lender will add or subtracted this income from their employment income. Depreciation claimed on the schedule E can typically be added back to the borrowers income.

Schedule F: This schedule is used for farming income.

How Is Investment Income Calculated For Mortgage Qualification

If you plan to use investment income for mortgage qualification, lenders will want to see at least two years maybe three years worth of income tax returns.

Lenders will generally average the income youve earned from dividends and interest over those 23 years.

For example:

- Qualifying income: $80,000 per year

Sounds simple enough, right? Maybe not. Read on.

Recommended Reading: What Portion Of Your Income Should Be Mortgage

How Much Income Do You Need To Buy A Home

Your income is one of the most important factors lenders consider when you apply for a mortgage. But theres no minimum amount of income youll need to buy a home. Instead, lenders look at your debt-to-income ratio, which shows the percentage of your gross monthly income that goes toward debt obligations.

What the lender would be reviewing when issuing a pre-approval is what we call DTI, which stands for debt to income ratio, said Polina Solis, a Realtor in Texas. There are certain loan packages, such as conventional versus FHA, which have different DTI requirements. Generally speaking, you dont want to have your home monthly payment be more than 30% of your gross income.

There are two ratios lenders will look at. Your front-end DTI is your future monthly housing expenses compared to your gross monthly income. Your back-end DTI is all of your debt payments, including your housing payments, compared to your gross monthly income.

An acceptable DTI to purchase a home depends on other factors, including your credit score. But according to Solis, lenders generally require that borrowers have a DTI of no more than 45%. In some cases, they may be willing to allow for as high as 50% if the borrower has exceptional credit and additional cash reserves.

Claiming Rental Income To Qualify For A Mortgage: How Do Lenders View It

See Mortgage Rate Quotes for Your Home

As a landlord or aspiring real estate investor, its possible that a lender will let you use rental income to qualify for a mortgage. Whether they actually do so will depend on your ability to provide proof of income, or if its for a new rental, proof of the earnings potential of the property. Lenders have to adhere to specialized guidelines when making their decision. Read on to learn more about these stipulations, as well as how they may impact your eligibility.

Recommended Reading: Is A Home Loan A Mortgage

Read Also: Who Should You Get A Mortgage From

Save For A Bigger Down Payment

A larger down payment reduces the amount your lender needs to loan you. This makes your loan less risky for the lender because they lose less money if you default. Saving for a larger down payment can help you become a more appealing candidate for a loan and can even convince a lender to cut you some slack in other application areas. Use these tips to increase your down payment fund:

- Budget for savings. Take a look at your monthly budget and decide how much you can afford to save each month. Hold your down payment fund in a separate savings account and resist the temptation to spend any of it.

- Pick up a side hustle. In the on-demand gig economy, its never been easier to earn extra cash outside of your job. Drive for a ridesharing service, deliver food for local businesses or pick up a few spare tasks on a site like TaskRabbit.

- Sell some of your things. Sites like eBay, Poshmark and ThredUp make it simple to sell old things you no longer use. Search around your home for things you think you can sell and list them.

A Comprehensive Accounting Of What You Can Count As Income Towards A Mortgage Loan In Winnipeg Mb

Salary/Wages

Theres no grey area here. Whether paid by the hour or on a salary, this T4 item is directly counted towards your mortgage. Proof of income can come easily through an employment letter, current pay stubs, T4 slips, T5 slips, and any other official document that is used to declare your income to CRA. If the income is consistent over the last two years, you will be much more attractive to lenders.

If youve recently started a new job, heres what you need to know about how your new income can be applied to your mortgage application.

Commissions/Bonuses

If you receive commissions and bonuses on top of your wage/salary, this can be included too. Consistency is the key. If commissions/bonuses have been steady over two years then the more likely lenders are to consider it for your home loan.

However, if you work solely on commission, you will appear more risky to lenders. While your commission history may show dramatic and favorable spikes, they will look closely at the low periods, and use that to determine what you can afford when it comes to monthly mortgage payments. Again, the more consistent your commission history is, the more favorable you look as an investment.

Tips

Self-Employed Income

Rental Income

If you currently own a rental property, you can absolutely apply the revenue as income towards another mortgage. Thats pretty clear.

Investment Income

Alimony and/or Child Support

Retirement Pension

You May Like: Is Bank Of America Good For Mortgages

Estimate How Much House You Can Afford

To help you get started, you can use our calculator on top to estimate the home price, closing costs, and monthly mortgage payments you can afford based on your annual income. For our example, lets suppose you have an annual income of $68,000. Youre looking to get a 30-year fixed-rate loan at 3.25% APR. For your down payment and closing costs, youve saved $55,000. See the results below.

- Annual income: $68,000

| Total Monthly Mortgage Payment | $1,587 |

Based on the table, if you have an annual income of $68,000, you can purchase a house worth $305,193. You may qualify for a loan amount of $252,720, and your total monthly mortgage payment will be $1,587. Since your cash on hand is $55,000, thats less than 20% of the homes price. This means you have to pay for private mortgage insurance . Take note: This is just a rough estimate. The actual loan amount you may qualify for may be lower or higher, depending on your lenders evaluation.

The following table breaks down your total monthly mortgage payments:

| Monthly Payment Breakdown | |

|---|---|

| Total Monthly Mortgage Payment | $1,587 |

According to the table, your principal and interest payment is $1,099.85. When we add property taxes and home insurance, your total monthly mortgage payment will be $1,481.34. But because you must pay PMI, it adds $105.30 to your monthly payment, which results in a total of $1,587 every month.