Auto Loans And Your Credit Score

Auto lenders use what is known as a FICO Auto score, which is a customized scoring model for the car lending industry. It places less emphasis on payment histories with mortgages and credit cards, and pays closer attention to pay histories on car loans and other installment-type debt.

Even with the emphasis on auto loans, the difference from your regular FICO will usually amount to no more than 15-20 points in either direction. The FICO Auto score will look at whether you have a current car loan, a paid car loan, and, of course, your payment history on those loans specifically.

One major disadvantage of the FICO Auto score is that its a score that you cannot obtain on your own, even from the credit bureaus directly. Its a proprietary system used by auto lenders, and only available through them. Thus, you cant know your score before purchasing a car, and that can put you at a disadvantage when arranging financing through a car dealer.

Theres a secondary disadvantage in getting your auto credit score, too. As Ive found out recently from a couple of car-buying experiences, car dealers often refuse to pull your credit before you select a car that you want to buy. Unlike the mortgage loan process, if you shop at a dealer, there is no pre-qualification function helping you to determine how much car you can afford, what your score is, and what kind of rate to expect.

Why Is My Mortgage Credit Score So Much Lower

There can be a disconnect between the credit scores you obtain for free and the ones your mortgage lender is using.

Typically banks, credit card companies, and other financial providers will show you a free credit score when you use their service. Also, credit monitoring apps can show free credit scores 24/7.

But the scores you receive from those third-party providers are meant to be educational. Theyll give you a broad understanding of how good your credit is and can help you track overall trends in your creditworthiness. But they arent always totally accurate.

Thats partly because free sites and your credit card companies offer a generic credit score covering a range of credit products.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back large debts.

For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan.

Mortgage lenders, on the other hand, are required to use a unique version of the FICO score almost exclusively.

Since mortgage companies loan money on the scale of $100,000 to $1 million, theyre naturally a little stricter when it comes to credit requirements.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back those large debts.

So theres a good chance your lenders scoring model will turn up a different lower score than the one you get from a free site.

How Is This Score Different From A Credit Score And Which Is Used For Car Loans

FICO scores are related to your credit score, but they are far more useful than that. They are used by over 90% of top lenders, and the widespread nature of their use brings uniformity to the loan approval process, which leads to more informed financial decisions.

Non-FICO credit scores can differ by as many as 100 points. The amount of variance can distort your belief in your likelihood in getting approved. If you think you qualify for a better line of credit or a low interest rate when you dont, it can lead to some damaging consequences in the future.

There are also different types of scores. For instance, FICO Auto Scores are generally used for car loans.

You May Like: Can You Get A Second Mortgage With An Fha Loan

What Are Older Fico Models

FICO 8 and 9 arent the only versions in use. Some lenders and industries use older versions like FICO 2, 4, and 5. In fact, these are still used by the mortgage industry when assessing creditworthiness for new mortgages and deciding on interest rates.

FICO 2, 4, and 5 are very similar. The main differences between the three is that 2, 4,and 5 use data from Experian, TransUnion, and Equifax respectively. Mortgage lenders pull one of each and compile the reports in a document called a Residential Mortgage Credit Report. Duplicate data is screened and removed, and the middle score of the three is picked to represent your worthiness to pay back the mortgage.

FICO 8 and 9 use data from a single credit bureau, so using FICO 2, 4, and 5 together gives mortgage lenders a more complete view of your creditworthiness because they can see the history of every account youve opened. This is especially helpful for mortgage lenders as many creditors don’t report account history to all three credit bureaus.

Fico Score : What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

FICO Score 9 is the second-latest version of the well-known credit scoring model, but it still isn’t being used as widely as its predecessor, the FICO 8.

All credit scores come from data in your credit reports, weighed according to proprietary formulas that calculate a score, typically on a 300-850 scale. Your credit score is designed to reflect the risk in lending you money, and the FICO Score 9 is a better predictor of that risk, says Tommy Lee, principal scientist at FICO.

The two biggest providers of credit scores are FICO and VantageScore.

Read Also: Is It A Good Idea To Pay Off Your Mortgage

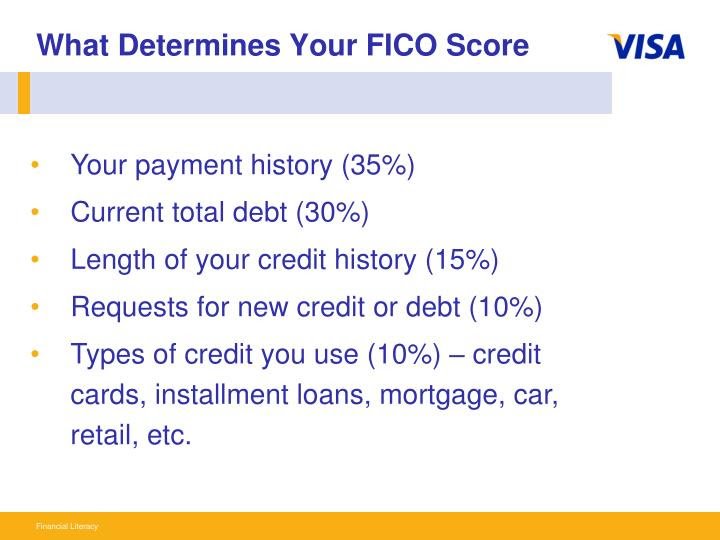

What Is A Fico Score

FICO stands for Fair Isaac Corporation. Fair, Isaac and, Company, later transformed into Fair Isaac Corporation or FICO, is primarily a data analytics company based in San Jose, California. It was established in 1956 by the hands of engineer William R Bill Fair and mathematician Earl Judson Isaac.

FICO score is an indicator of consumer credit risk. It has become the primary criteria of assessment of personal loans in the United States. Lenders use the FICO scores to evaluate the creditworthiness of a loan applicant. It ranges from 300 to 850, where the over 650 ratings advocate a rather strong credit history.

Nowadays, the FICO ratings are used as a measure of credit risk by major US financial reporting firms such as Equifax, Experian, and TransUnion. Many countries, including Mexico and Canada, and the fourth U.S. credit reporting agency, PRBC, are also using FICO scores because of its large degree of acceptability.

Mortgage Lenders Pull All Three Reports But Only Use This One

According to Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,” tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

Recommended Reading: How Much Is Mortgage Insurance In Michigan

Which Fico Score Version Is Important To Me

Consider these guidelines:

Financing a new car? You’ll likely want to know your FICO Auto Scores, the industry specific scores used in the majority of auto financing-related credit evaluations.

Applying for a credit card? You’ll likely want to know your FICO Bankcard Scores or FICO Score 8, the score versions used by many credit card issuers.

Purchasing a home or refinancing an existing mortgage? You’ll likely want to know the base FICO Score versions previous to FICO Score 8, as these are the scores used in the majority of mortgage-related credit evaluations.

For other types of credit, such as personal loans, student loans and retail credit, you’ll likely want to know your FICO Score 8, which is the score most widely used by lenders.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

How Do My Fico Scores Affect My Ability To Get A Mortgage

Lending a huge amount of money is risky business. Thats why mortgage lenders need a good way to quantify the risk, and your FICO® scores with all of the data and research that go into them fit the bill.

Different lenders have different requirements for their loans. And because there are many different types of mortgages from many different types of lenders, theres no one single minimum FICO® score requirement.

Recommended Reading: What To Expect When Applying For A Mortgage Loan

Fico Scores Are Evolving To Keep Up With Modern Behaviors And Needs

Think of how people use different versions of computer operating systems or have older or newer generations of smart phones. They all share the same base functionality, but the latest versions also have unique updated features to meet evolving user needs.

The same goes for FICO Scores.

The various FICO Score versions all have a similar underlying foundation, and all versions effectively identify higher risk people from lower risk people. Every time the FICO Score algorithm is updated it incorporates unique features, leverages new risk prediction technology, and reflects more recent consumer credit behaviors.

The end result is a more predictive score that helps lenders make more informed lending decisions, which ultimately makes the credit process easier, faster and fairer.

Fico 8 Vs Fico : What Are The Differences

FICO 9 is similar to FICO 8 but differs when it comes to collections and rent payments. FICO 9 counts medical collections less harshly than other accounts in collections, so a surgery bill in collections will have less of an impact on your than a credit card bill in collections.

Additionally, FICO 9 ignores accounts in collections that have a zero dollar balance. If you had a credit card account go to collections but later paid it off, FICO 9 will no longer use said collections account against your score. This is different than FICO 8, which factors all collections amounts of $100 or more into your FICO scoreeven if theyre completely paid off.

Just because collections with a zero balance are ignored by FICO 9 does not mean that lenders will ignore them. Credit bureaus will still show these collections on your full credit report, and lenders will see them when they reviews your full credit history.

Finally, FICO 9 factors rental history into your credit score. This makes it easier for people with no credit to build a high credit score with their monthly on-time rent payments. Unfortunately, this is dependent on your landlord actually reporting rent payments to credit bureaussomething not yet seen on a large scale.

Don’t Miss: What Does A Commercial Mortgage Broker Do

How Do Fico Score 8 Credit Scores Differ From The Scores You See On Credit Karma

FICO® scores arent the only credit scores youll see. Another popular credit-scoring model is VantageScore.

On Credit Karma, you can get your free VantageScore® 3.0 credit scores from TransUnion and Equifax. These scores may not match up exactly with credit scores based on the FICO® Score 8 credit-scoring model, but they rely on many similar factors. For example, your credit card utilization rate is considered a high-impact factor in both the VantageScore® 3.0 and FICO® Score 8 credit-scoring models.

Here are some other key similarities and differences among the most popular VantageScore® and FICO® score models.

How Do Lenders Use Credit Scores

Mortgage lenders mainly use credit scores to evaluate whether you will be able to repay your mortgage loan.

They often will order your full credit report, which contains various scores based on the types of credit you have.

Lenders evaluate your credit score to determine which loans you can get, and the interest rates you will pay. If you have a low score, it could mean anything from paying more for a loan to not qualifying for one altogether.

When refinancing, your credit score is used in a similar way to determine the rates and terms of your new mortgage and whether you are able to refinance at all.

Thats why its important to keep your credit score in check and work closely with your lender to determine the best time to refinance.

Recommended Reading: How Long Does It Take To Do A Reverse Mortgage

How Your Credit Scores Are Made And Why They Matter

Since there are few numbers that matter as much to your financial well-being as your credit score, it helps to know what your scores mean and how they work.

First, know that theres a big difference between a credit report and a credit score.

- Your credit report is a record of your borrowing history Each loan or line of credit youve opened, dates on those accounts, payment history , and so on. Overall, it shows how reliably you manage and pay back your debts

- Your credit score sums up your credit report in a single number It weighs every item on your credit report to come up with an overall score that sums up how responsible of a borrower you are

The big three credit bureaus Equifax, Transunion, and Experian operate in the realm of credit reporting.

Each one keeps a separate record of your borrowing history, based on the information your creditors send them.

The other players in the game FICO and VantageScore are responsible for credit scoring. They determine your score based on whats included in those credit reports.

For example, keeping your credit utilization ratio low can help your credit scores, while repeatedly neglecting to pay your credit card bills on time can hurt them.

Minimum Fico Credit Scores Needed For Different Types Of Loans

Who does not want to get a dream home, get an everyday car, or plan an event like a wedding or a once-in-a-lifetime dream holiday? Activities like this can cost a lot of money. And the fact is, that you usually do not have enough cash on hand when you really need it.

Sometimes there is really only one choice left when you are in these situations, and that is to take a loan from a bank or lender.

It is not easy to get personal loans or do something like refinance a mortgage when you have nothing to show up as collateral.

Contents

Don’t Miss: How Much Is Mortgage For A Million Dollar Home

Which Credit Score Is The Most Important

You may think that you have just one credit score, but you actually have many. In fact, FICO® is just the name of a brand. Under that brand there are many types of credit scores under two main categories: base FICO® Scores and industry-specific FICO® Scores.

Base FICO® Scores are the most commonly used type of FICO® Score. You have three different base FICO® Scores made up of credit reports from the three major credit bureaus. When applying for a bank loan or credit card, lenders will use your base credit score.

Industry-specific FICO® Scores are used when purchasing specific items such as auto loans and credit cards. Types of industry-specific scores include the FICO® Bankcard Score and the FICO® Auto Score

If you are unsure what FICO® Score your lender will look at, contact your creditor and ask which one they use to evaluate applicants. Dont worry though, the basic scoring criteria is similar for most FICO® Scores. So, if one of your FICO® Scores is considered to be in the good range, your other scores may also be in the good range.

When It Comes To Getting A Mortgage There Are Enough Numbers Flying Around To Make Any Mathematician Happy Lenders Will Look At A Number Of Items Which Can Include Your Credit History Your Income And How Much Debt You Have Among Other Things

But one number is perhaps one of the most important numbers of all. Your FICO® scores can impact whether you get a loan or not, and if so, at what interest rate. Thats why its important to understand the nuances of your FICO® scores. Luckily, its not rocket science. Heres the scoop on how your FICO® scores can affect your mortgage.

Read Also: Does Pre Approval For Mortgage Affect Credit

Where To Check Your Fico Score Before Applying For A Mortgage

Many free credit services dont use the FICO scoring model, which is the one your mortgage lender will be looking at.

To be sure the score you check is comparable to what a mortgage lender will see, you should use one of these sites:

- AnnualCreditReport.com This is the only official source for your free credit report. Youre typically entitled to one free credit report per year, but the site is offering free reports each week during the coronavirus pandemic

- MyFico.com

Whether its free, or you pay a nominal fee, the end result will be worthwhile.

You can save time and energy by knowing the scores you see should be in line with what your lender will see.

As long as you continue to make your payments on time, keep your credit utilization relatively low, and you dont go shopping for new credit you dont need, over time your score is going to be pretty high for every credit scoring model.