You Dont Need A Down Payment Calculator To Run The Numbers

- Its very easy to calculate potential mortgage down payments

- Just whip out a standard calculator

- And multiply the percentage by the purchase price

- For example 20% down would be .2 x $500,000 = $100,000

Now lets talk about calculating a down payment when home shopping.

Its actually very easy to calculate a down payment once you have a purchase price in mind, and no fancy mortgage calculator is required, honest.

Want a fast, free rate quote? Quickly get matched with a top mortgage lender today!

Simply take a regular calculator and multiply the purchase price by the percentage youd like to put down and youll get your answer.

For example, if you want to put down 20% on a $300,000 home purchase, just type in .2 and multiply it by 300,000. That would result in a $60,000 down payment.

Or if you want to put just 10% down, input .1 and multiply it by 300,000. That would give us a $30,000 down payment.

You can also do this in reverse if you know you have a certain amount saved up and earmarked for a house down payment.

Say youve got $50,000 in the bank and you wont/cant muster any more than that. Again, lets assume you want to put down 20% because of the associated benefits.

To calculate the maximum purchase price, just input 50,000 into a standard calculator and divide it by .2.

This will result in a sum of 250,000, meaning if youve got $50,000 set aside, you can buy a $250,000 house and put 20% down.

Whats The Purpose Of The 20/10 Rule

The point of the 20/10 rule of thumb is to get a handle on your debt in relation to your annual and monthly take-home pay. In other words, its designed to help you avoid getting into more debt than you can afford.

For the 20% part of the equation, youll want to calculate if your consumer debt exceeds 20% of your annual after-tax income.

Example:

Lets say you take home $50,000 a year after taxes. You have a car loan balance of $10,000, owe $5,000 to your student loans, and have $2,000 in credit card debt. Thats a total debt of $17,000, which, when you divide that sum by net income, means your debt is 34% of your yearly take-home pay.

Not great by the standards of the rule , but not terrible. This tells you its time to make some changes to pay off some of those bills.

Looking at the 10% portion of the rule, you want to use 10% or less of your monthly take-home funds for debt payments.

Lets go back to the above example. If youre bringing home $50,000 a year, divide that by the 12 months in a year, and you get $4,167, which is your net monthly income. Of that number, you should ideally only spend about $417 per month on monthly debt payments.

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

Read Also: Can You Use A Mortgage To Build A House

What Does It Mean To Be House Poor

Your home is your castle. Its the place where youll raise your family, welcome friends and make memories that last a lifetime. Theres also no denying that a home can be a major financial asset as part of your wealth and investment portfolio. With that investment, some monthly cost is worth the long-term benefits. However, the problem comes from overdoing it.

Your house and the expenses that go with it still represent only one piece of your monthly budget. Becoming house poor can affect your ability to save for retirement, pay off debt or afford other purchases. It can create feelings of stress and anxiety around your finances and make you feel as if youre only one setback away from financial disaster. These problems can even put a strain on your relationships and your mental well-being.

How To Calculate An Affordable Mortgage

Although you cannot determine an exact budget until you know what mortgage rate you will get, you can still estimate your budget.

Assuming an average 6% interest rate on a 30-year fixed-rate mortgage, your mortgage payments will be about $650 for every $100,000 borrowed. .

For the couple making $80,000 per year, the Rule of 28 limits their monthly mortgage payments to $1,866.

x $100,000 = $290,000

Ideally, you have a down payment of at least 10%, and up to 20%, of your future homes purchase price. Add that amount to your maximum mortgage amount, and you have a good idea of the most you can spend on a home.

Note: if you put less than 20% down, your mortgage lender will require you to pay private mortgage insurance , which will increase your non-mortgage housing expenses and decrease how much house you can afford. Read all about PMI in our article here.

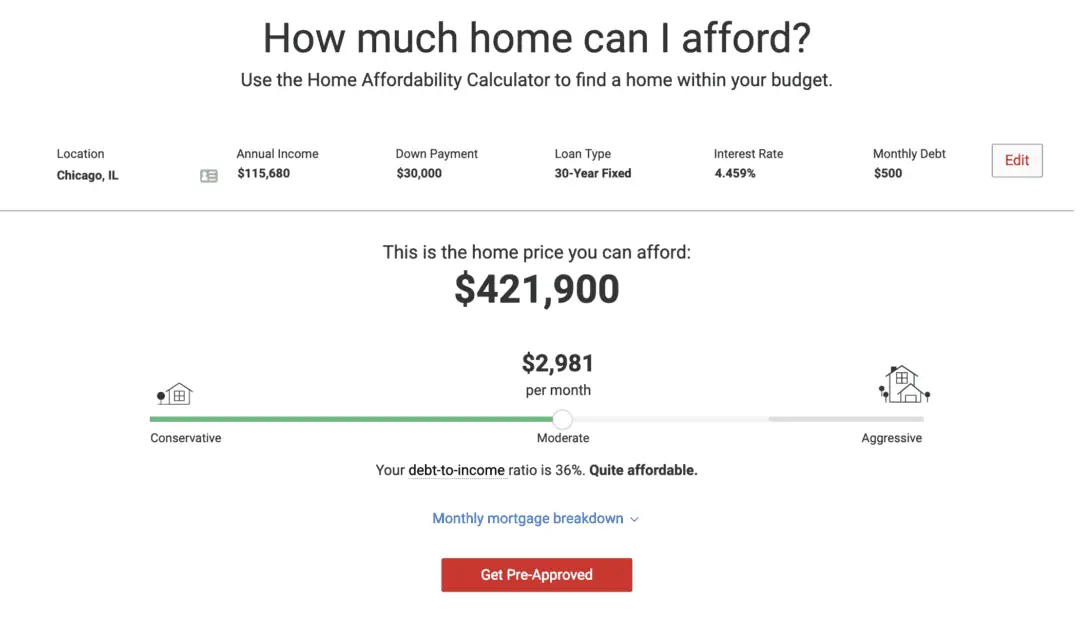

To get a better sense of your payments, check out our mortgage calculator below:

You May Like: How Much Do You Pay On A 200 000 Mortgage

How Does Where I Live Impact How Much House I Can Afford

Where you live plays a major role in what you can spend on a house. For example, youd be able to buy a much bigger piece of property in St. Louis than you could for the same price in San Francisco. You should also think about the areas overall cost of living. If you live in a town where transportation and utility costs are relatively low, for example, you may be able to carve out some extra room in your budget for housing costs.

How Much House Can I Afford With An Fha Loan

To calculate how much house you can afford, weve made the assumption that with at least a 20% down payment, you might be best served with a conventional loan. However, if you are considering a smaller down payment, down to a minimum of 3.5%, you might apply for an FHA loan.

Loans backed by the FHA also have more relaxed qualifying standards something to consider if you have a lower credit score. If you want to explore an FHA loan further, use our FHA mortgage calculator for more details.

Conventional loans can come with down payments as low as 3%, although qualifying is a bit tougher than with FHA loans.

Also Check: What Is The Lowest Mortgage Amount You Can Borrow

Multiply Your Annual Income By 25

In this rule of thumb, you begin with your gross annual income. Thats the income from your W-2 . Multiply this number by 2.5 to estimate the maximum value of the home you can afford. However, keep in mind that the lower the interest rate you can obtain, the higher the home value you can afford on the same income. This is why your credit score is so important. Lets take a look at a few examples.

How much house can I afford if I make $50K per year?

On a 50k salary, how much mortgage could you afford? According to this rule of thumb, you could afford $125,000 . Lets say you have a 4.5 percent interest rate and choose a 30-year mortgage. Your monthly mortgage payment would be $633. With interest, youd pay a grand total of $228,008.

How much house can I afford if I make $70K per year?

Lets look at a mortgage on 70k salary. Assuming the same 4.5 percent interest rate and a 30-year term, you could afford a mortgage of $175,000 . This translates into $887 per month, totaling $319,212 after 30 years.

How much house can I afford if I make $100K per year?

If youre wondering with 100k salary how much house can I afford, the 2.5 rule gives you a mortgage of $250,000. Using a 4.5 percent interest rate and a 30-year term, this translates into $1267 monthly, which equals $456,017 over 30 years.

How much house can I afford if I make $200K per year?

What Is A Good Rule Of Thumb For How Much Mortgage Someone Can Reasonably Afford

- Muskoka

- 11 upvotes

- 680 posts

- Niagara Falls

- Muskoka

your personal opinion

bambam wrote:So tell me this, how much can one person with good employment history who is making $xxK+%xx bonus who only has $200 a month monthly loan payment can get. Let’s say $200 for monthly tax and another $150 heating& hydro.

scottyb wrote:I would strongly disagree that banks won’t give you more than you can afford. I was floored to discover how much a bank would lend me for a mortgage.

Recommended Reading: How To Shorten Your Mortgage Term

The Math Behind Your Monthly Mortgage Payments

Now that I knew how much I could afford, it was time to estimate my monthly mortgage payments. With that amount handy, I would have an informed picture of my cash flow and financial well-being while living in my new home.

Lets keep with our previous example of a 25-year mortgage for a $500,000 home, offered on a 5-year term and 3% fixed interest rate, to illustrate how a larger down payment can save you money in the long run. You can also use a mortgage payment calculator to help you get started.

| Scenario 1 | |

|---|---|

| $1,893 | $1,420 |

While making a larger down payment is a better financial move, Calla believes that securing any mortgage is a smart decision, even when you can only afford to put 5% down.

With homeownership, over 50% of the payment goes directly into your equity, while with renting, 100% goes to someone else, she says. And the gift of todays low-interest rates gives you the ability to invest in yourself at an unprecedented rate.

Still, following years of soaring real estate prices, saving for that 5% down payment remains a major hurdle for most people. In some cases, it may make more financial sense to continue renting and not stretch yourself too far. And if buying isnt immediately in the cards for you, there are other strategies you can use to ensure you stay on track with your financial goals.

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

You May Like: How Does Reverse Mortgage Work After Death

Take A Longer Mortgage Term

The longer your mortgage term, the lower your monthly payment. If you take a longer term, you spread your payments over a larger number of months and years, which reduces the amount youll owe each month. While taking a longer term will increase the amount you pay in total interest over time, it can free up monthly cash to keep your DTI low.

What Is The 28/36 Rule Of Thumb For Mortgages

When mortgage lenders are trying to determine how much theyll let you borrow, your debt-to-income ratio is a standard barometer. The 28/36 rule is a common rule of thumb for DTI.

The 28/36 rule simply states that a mortgage borrower/household should not use more than 28% of their gross monthly income toward housing expenses and no more than 36% of gross monthly income for all debt service, including housing, Marc Edelstein, a senior loan officer at Ross Mortgage Corporation in Detroit, told The Balance via email.

It’s important to understand what housing expenses entail because they include more than just the raw number that makes up your monthly mortgage payment. Your housing expenses could include the principal and interest you pay on your mortgage, homeowners insurance, housing association fees, and more.

Read Also: When Is A Mortgage Payment Considered Late

Follow The 25 Percent Rule

Theres a straightforward way to make sure you can afford your mortgage while managing your other goals, according to Eve Kaplan, a certified financial planner in New Jersey. Housingincluding maintenanceideally shouldnt consume more than 25 percent of a household budget. This goes for folks who rent, too, Kaplan says.

Mortgage bankers would disagree. They use various calculations to figure out how much you can afford, and the amount is often much higher than financial planners recommend. A common measure that brokers use is the debt-to-income ratio , which, for a qualified mortgage, limits your total debt payments, including your mortgage, student loans, credit cards, and auto loans, to 43 percent.

Lets say you and your spouse make a combined annual income of $90,000, or about $5,600 per month after taxes. Based on your DTI and depending on your other debts, you could be approved for a mortgage of $600,000. That might sound exciting at first, but with a monthly payment of about $3,225, it would eat up more than half your take-home pay.

Following Kaplans 25 percent rule, a more reasonable housing budget would be $1,400 per month. So taking into account homeowners insurance and property taxes, youd be better off sticking to a mortgage of $240,000 or less. If you have enough for a 20 percent down payment, the maximum house you can afford is $300,000.

The Bottom Line: How Much Home Can You Afford

So, what percentage of your income should go toward your mortgage? The answer will vary depending on your income and how much debt you have. But your income is only one of the many factors that determine how much home you can afford. Lenders look at everything from your credit score to your liquid assets when they decide how much to offer you.

If youre ready to get started on your mortgage application, you can apply online or give us a call at 452-0335.

You May Like: Can You Add Money To Mortgage For Improvements

The Conservative Model: 25% Of After

On the flip side, debt-hating Dave Ramsey wants your housing payment to be no more than 25% of your take-home income.

Your mortgage payment should not be more than 25% of your take-home pay and you should get a 15-year or less, fixed-rate mortgage Now, you can probably qualify for a much larger loan than what 25% of your take-home pay would give you. But its really not wise to spend more on a house because then you will be what I call house poor. Too much of your income would be going out in payments, and it will put a strain on the rest of your budget so you wouldnt be saving and paying cash for furniture, cars, and education.

Notice that Ramsey says 25% of your take-home income while lenders are saying 35% of your pretax income. Thats a huge difference! Ramsey also recommends 15-year mortgages in a world where most buyers take 30-year mortgages. This is what Id call conservative.

How Do People Become House Poor

Buying a home can be an exciting prospect. Maybe youve prequalified for a mortgage so you think you know the top end of your budget. You also have a checklist of everything you want in your house and youve found one that has it all but its an older home that takes you right up to your preapproval limit.

Lets consider Ryan, who is seeking preapproval. Theyre an avid amateur equestrian who is looking for a home. Their lender wont know this about them. But theyll certainly need to figure their horse-related expenses into their monthly budget and not merely rely on the lenders preapproval unless theyre prepared to give up this aspect of their life in service to the mortgage debt or the homes needed repairs.

Ryan could be an avid foodie who likes to enjoy trendy new restaurants at least once a month. Or someone who likes to travel. Whatever it is that you still plan on doing after you become a homeowner, make sure you factor that into the post-new-house budget you create to compare to the amount you are preapproved for.

Before making an offer on that home that may stretch your ability to afford the payment or make necessary renovations, you should take a second to reassess whether you want to risk your lifestyle by making yourself house poor. Remember, when you apply for mortgage preapproval, lenders only know you by your numbers. They dont know how you like to live.

Also Check: How Do You Figure Out Your Mortgage Payment

Why Affordability Matters

Unless you can pay cash for a house, youll rely on a mortgage lender to cover the expense. Youll then have to pay that lender for 15 or 30 years, depending on the terms you choose.

Read more: 15-year mortgages vs. 30-year mortgages: how to choose

As with any loan, mortgage lenders like to keep their risk low. Youll complete an application and wait for approval, and that approval will typically limit your loan to a certain amount. This limit is based on various factors, including your credit score and debt-to-income ratio .

But even if a lender says youre approved for a $500,000 or $1 million house, that doesnt mean you should go for it. You also need to look at what you can reasonably afford to pay each month.

Thats where the three rules of home affordability can help out.