Mortgage Rate Strategies For September 2022

Mortgage rates grew fast and furiously to open 2022. The pace slowed in the second quarter, then interest rates shot up after the Feds 0.75% federal funds rate hike in mid-June. The central bank said it anticipates multiple similar hikes in 2022. Mortgage rates could climb throughout the rest of the year as a means to offset inflation. However, opportunities to lock in a low interest rate do still exist for home buyers and refinancing homeowners.

Here are just a few strategies to keep in mind if youre mortgage shopping in the coming months.

How Do I Find Personalized Mortgage Rates

Finding personalized mortgage interest rates is as easy as talking to your local mortgage broker or searching online. While most factors that impact mortgage interest rates are out of your control, rates still vary from person to person. Lenders charge higher home mortgage rates to borrowers they deem riskier. So having a high credit score will get you the best interest rates. Lenders also look at how much you are borrowing compared to the homes value this is known as loan-to-value, or LTV.

Youll get a better rate when the LTV is below 80%. So if your future home has a value of $200,000, youll get the best rates if the loan is for $160,000 or less.

When shopping around for the best rates, consider a variety of lenders, like local banks, national banks, credit unions, or online lenders. Be sure to compare interest rates, fees, and other terms of the mortgage. Also, mortgage rates are constantly changing, so getting rate quotes from multiple lenders in a short time period makes it easier to get an accurate comparison. If thats too much legwork, you could work with a mortgage broker. Mortgage brokers dont directly issue loans. Instead, they work with lenders to find you the best deal. But their services arent free. They work on commission, which is usually paid by the lender.

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan and is built into your monthly payment. Mortgage fees are usually paid upfront and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

You May Like: What Kind Of Mortgage Can I Afford

Mortgage Interest Rates Forecast

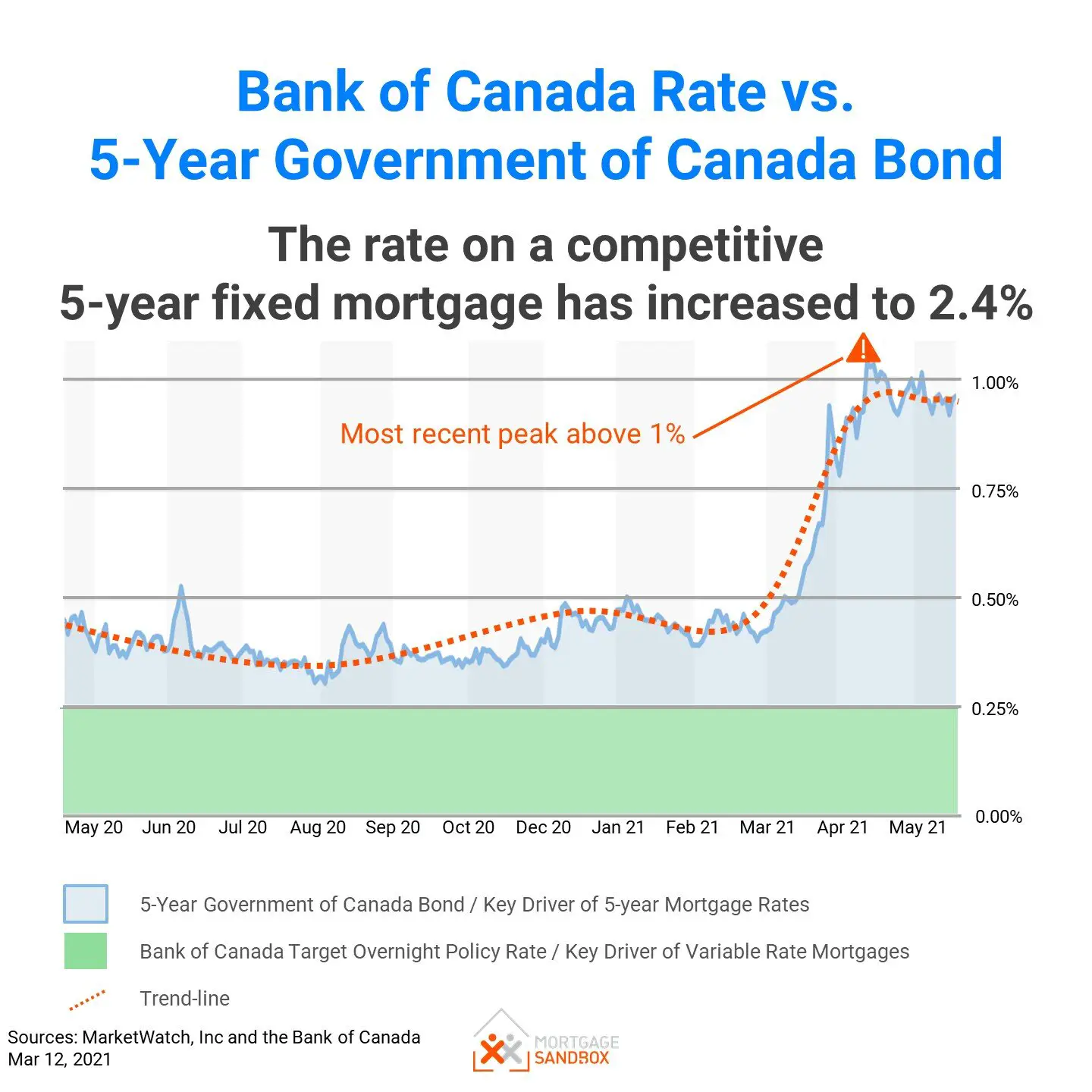

At their December 15 meeting, Fed officials announced that they expect to boost rates three times in 2022. However, it’s important to note that the Fed doesn’t raise mortgage interest rates directly. As of March 17, 2022, the Board of Governors of the Federal Reserve System voted unanimously to approve a 1/4 percentage point increase in the primary credit rate to 0.5%, affecting borrowers.

More recently, the Fed has indicated they may raise the federal funds rate more aggressively in an attempt to control inflation.

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rates and an annual percentage rates . Thats understandable since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a $300,000 loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

Also Check: What Is The Interest Rate On A Reverse Mortgage Loan

What Term Should I Fix My Interest Rate For In Todays Market

With current interest rates on the rise people might be thinking: Ive got to fix at a longer rate to avoid hiking interest rates.

But today there could be a real risk in people fixing a rate for too long a term.

Yes, the one-year rate is likely to increase potentially above what the 3 and 5-year rate is today, but on average the 1-year rate has tended to be cheaper.

For instance, interest rates are likely to rise, but after inflation is curbed they are likely to take a downturn. So if you lock in for 3 years, you risk locking in a rate that looks not great today, OK in a years time, and expensive in 3 years time.

So, in our view, there is more risk in fixing for too long than fixing for too short.

Yes, youll likely pay a higher interest rate in a years time, but on average your rate is likely to be lower.

Lets look at the maths, based on Tony Alexanders modelling.

This shows that if you fix on the 1-year rate for 2 years, your average interest rate will be 5.12% .

But, the current 2-year fixed rate is 5.19%. So that suggests that the 1-year rate is marginally cheaper.

Where is gets really telling is at the longer term rates. Fixing for the 1-year rate for 5 years, the average is modelled to be 4.7%, but the current fixed is 5.79%.

So youre saving an average of 1.09% in interest per year, based on the modelling.

Just remember, its not necessarily cheaper to lock in for longer because interest rates are going up.

What If You’re Wrong?

So What Are Opes Partners Interest Rate Forecast

Right, after all that jibber-jabber, whats the short answer to the initial question: What is our interest rate forecast?

The answer: 5.75% will be the peak in June 2023 for the 1-year fixed interest rate.

After this, rates will level out to a 4.5% long-term average.

This forecast is informed by 3 things.

The first is from the 10-year average for both the 1-year fixed term interest rate, and for the OCR .

The second is how that average plots against the Reserve Banks OCR track.

The third is an assessment of other economists forecasts and considers factors that might change the OCR track e.g. recession.

That said, these are forecasts, so arent set in stone and are subject to change. We cant see into the future to give an exact figure as much as we would like to. Wed have to build a time machine for that .

So, to be on the more cautious side, when youre running your numbers at home to see how your personal lending is going to fare over the next few years you may like to do a stress test for a prediction a few notches above just to give yourself a good idea of where youre sitting.

Who are Opes Partners?

What is the 3-Step Opes Coaching Programme?

1. Plan out your property investment portfolio

The first step in the programme is to co-create a plan using our MyWealth Plan software. We built this software specifically to help Kiwis create a financial plan in under an hour.

You’ll leave this 1-hour session with a written down plan. Pen to paper.

Why?

Recommended Reading: Should I Refinance My Jumbo Mortgage

How To Shop For Interest Rates

Rate shopping doesnt just mean looking at the lowest rates advertised online because those arent available to everyone. Typically, those are offered to borrowers with perfect credit and who can put a down payment of 20% or more.

The rate lenders actually offer depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment

- Your home equity

- Your loan-to-value ratio

- Your debt-to-income ratio

To figure out what rate a lender can offer you based on those factors, you have to fill out a loan application. Lenders will check your credit and verify your income and debts, then give you a real rate quote based on your financial situation.

You should get three to five of these quotes at a minimum, then compare them to find the best offer. Look for the lowest rate, but also pay attention to your annual percentage rate , estimated closing costs, and discount points extra fees charged upfront to lower your rate.

This might sound like a lot of work. But you can shop for mortgage rates in under a day if you put your mind to it. And shaving just a few basis points off your rate can save you thousands.

Is There Still Time To Refinance

Americans watch mortgage rates closely, and any time rates pull back even the slightest amount, more people apply for mortgages. With rates still substantially higher than a year ago, however, applications remain stuck near the lowest level in more than two decades, according to MBA data.

While refinancing options can lead to a lower monthly payment, not all of the options yield less interest over the life of the loan. For example, refinancing from a 5% mortgage with 26 years left on it to a 4% rate, but for 30 years, will cause you to pay more than $13,000 in additional interest.

Before you start shopping around for a lender, you can find out how much you could save by using a mortgage refinancing calculator.

Youâll also want to consider how long you plan on staying in your home as the closing costs can eat up your savings if you sell shortly after refinancing. The closing costs to refinance run between 2% to 5% of the loan amount, depending on the lender. So you should plan on keeping your home long enough to cover those costs and realize the savings from refinancing at a lower rate.

Keep in mind, the rate you qualify for also depends on other factors such as your credit score, debt-to-income ratio, loan-to-value ratio and proof of steady income.

Read Also: Do Medical Collections Affect Getting A Mortgage

How Does An Increased Rate Affect Loan Payments

Its important to note: The higher rates were currently seeing probably wont be game changers for most people. In truth, mortgage rates would have to hit 9.1% before renting becomes cheaper than buying a home in most major markets, says McLaughlin. Even in the most expensive markets, rates would need to be over 5% to tip the scale on the rent versus buy math. If you think you might move in five years, there are ways to get a lower interest rate . You could take on a five-year adjustable-rate mortgage, which could get you a lower interest rate plus rate increases at years four and five.

Mortgage Rate Trends In The 1980s

The 30-year fixed mortgage rate reached a pinnacle of 18.4 percent in October 1981, according to Freddie Mac, seesawing down to the 9 percent range by 1986 and closing the decade at 9.78 percent. The 1970s oil embargo against the U.S., which drove up inflation quickly, contributed to the increased borrowing costs.

Also Check: Can I Get A Mortgage After Chapter 7

Is It Time To Fix Uk Mortgage Trends And Predictions

People up and down the country are feeling the strain of the cost of living crisis.

With interest rates rising sharply in a bid to curb soaring inflation, the resulting higher mortgage rates will add more pressure to the monthly budgets of millions of UK homeowners.

To offer a helping hand here, we take a closer look at what’s going on in the mortgage market, and examine how things could change in the future.

One question you may be asking yourself right now is whether now is the right time fix your mortgage rate. Let’s weigh up your options.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Don’t Miss: When To Get Prequalified For A Mortgage

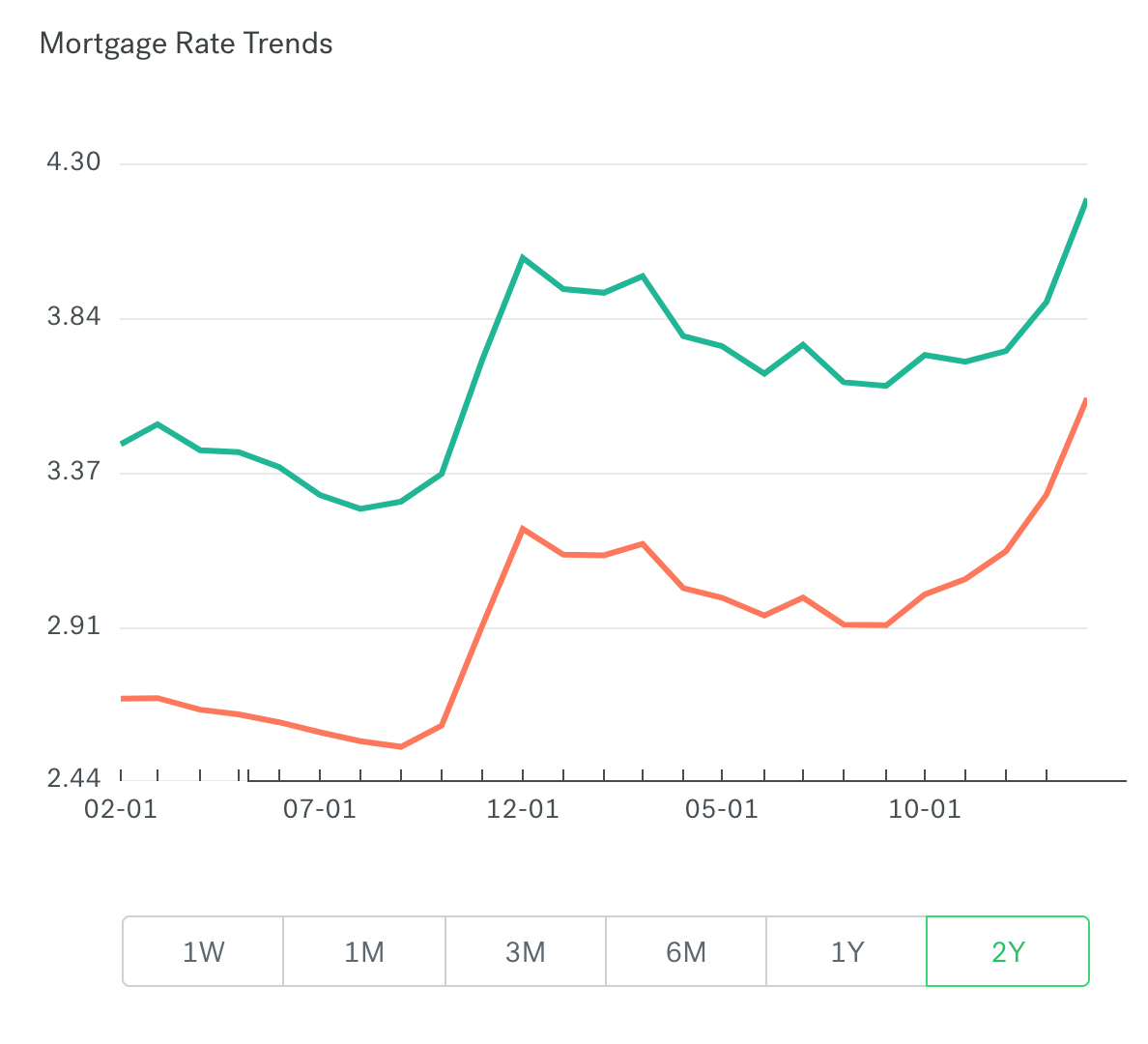

Current 30 Year Mortgage Refinance Rate Retreats 008%

The average 30-year fixed-refinance rate is 6.82 percent, down 8 basis points from a week ago. A month ago, the average rate on a 30-year fixed refinance was lower, at 6.13 percent.

At the current average rate, youll pay $646.61 per month in principal and interest for every $100,000 you borrow. Compared with last week, thats $7.98 lower.

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisors mortgage rate tables to get the latest information.

The lower the rate, the less youll pay on a mortgage. Depending on your financial situation, the rate youre offered might be higher than what lenders advertise or what you see on rate tables.

If youre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

Recommended Reading: What Are Jumbo Mortgage Rates

Work For A Lower Interest Rate

One of the biggest parts of home buying is the mortgage rate youre able to lock into. Everyone wants the lowest possible interest rate they can get but thats mostly determined by what the lending market offers on a given day. Unfortunately, timing isnt always in every borrowers favor.

Thats where mortgage discount points come in. Its a lever borrowers can pull to decrease their monthly mortgage costs and paying down your rate could save thousands of dollars over the life of your home loan.

Rather than asking the seller to drop their price, a buyer can leverage a seller concession to buy down their mortgage rate via points, said Taylor Marr, deputy chief economist at Redfin. This will have a much greater impact on lowering their monthly mortgage payment than a lower price would.

Although, paying for mortgage points adds more upfront costs at closing, which could be a barrier to entry for some borrowers. Shopping your rate around by contacting multiple lenders to see if they can offer a lower one only requires time and effort. Given how lenders differ and how volatile interest rates tend to be, taking your first offer could be a mistake.

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan terms, interest rate types , down payment size, home location and loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. Its estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didnt get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Recommended Reading: How And Why To Refinance Your Mortgage

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.