How We Calculate Our Mortgage Interest Rates

To see where mortgage rates are going, we rely on information collected by Bankrate, which is owned by the same parent company as NextAdvisor. The daily rates survey focuses on home loans where the borrower has a high credit score , 20% equity or more, and lives in the home.

The current average rates listed below and based on the Bankrate mortgage rate survey:

Current average mortgage interest rates| Loan type |

|---|

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Monthly Interest Accrual Versus Daily Accrual

The standard mortgage in the US accrues interest monthly, meaning that the amount due the lender is calculated a month at a time. There are some mortgages, however, on which interest accrues daily. The annual rate, instead of being divided by 12 to calculate monthly interest is divided by 365 to calculate daily interest. These are called simple interest mortgages, I have discovered that borrowers who have one often do not know they have one until they discover that their loan balance isnt declining the way it would on a monthly accrual mortgage. Simple interest mortgages are the source of a lot of trouble.

You May Like: Can You Borrow More Than You Need For A Mortgage

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward your interest.

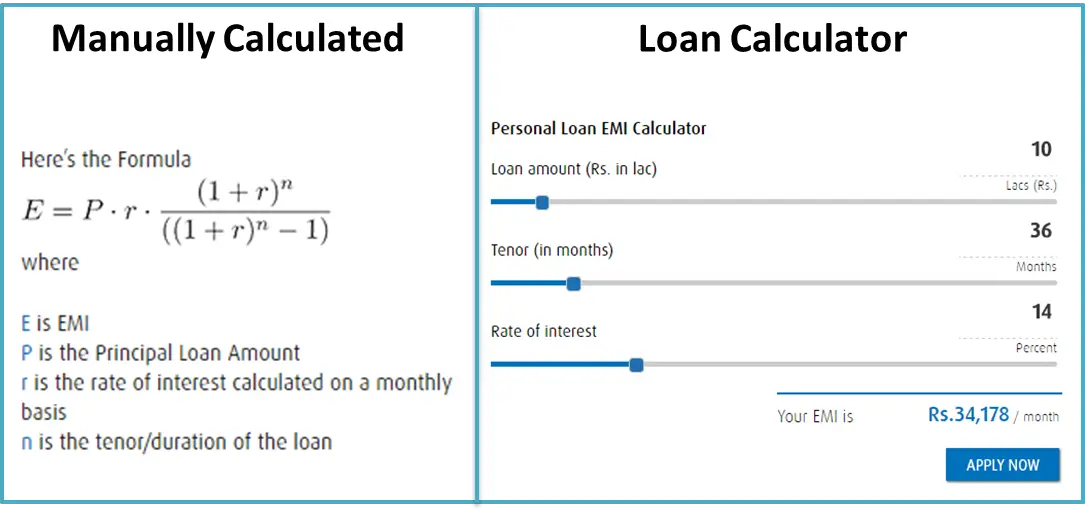

How Is My Interest Payment Calculated

Lenders multiply your outstanding balance by your annual interest rate, but divide by 12 because youre making monthly payments. So if you owe $300,000 on your mortgage and your rate is 4%, youll initially owe $1,000 in interest per month . The rest of your mortgage payment is applied to your principal.

Don’t Miss: How Long To Pay Off 70000 Mortgage

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

Read Also: Can You Add Someone To Your Mortgage Loan Without Refinancing

Typical Costs In A Mortgage Payment

There are several costs associated with a mortgage payment. Most of the money is the principal interest, but there are other considerations.

Here are the most common costs:

-

Principal: The initial amount borrowed from the lender.

-

Interest: Additional charges from the lender for borrowing the money.

-

Homeowners insurance: Any insurance policy to cover potential damage, such as floods or theft. You pay a twelfth of the premium each month.

-

Property tax: A tax that local authorities determine for your home.

-

Mortgage insurance: An extra insurance premium, often required if your down payment is under 20% of the price.

The monthly lump sum covers your principal and interest, but it likely contains these items as well.

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Don’t Miss: How Can I Avoid Paying Pmi On My Mortgage

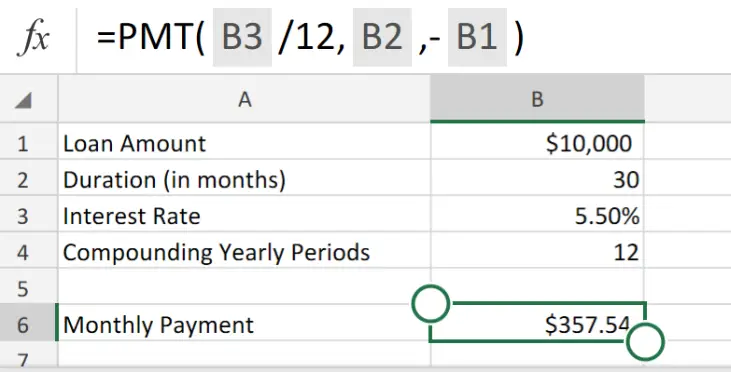

How To Use The Loan Amortization Calculator

With HSH.coms mortgage payment calculator, you enter the features of your mortgage: amount of the principal loan balance, the interest rate, the home loan term, and the month and year the loan begins.

Your initial display will show you the monthly mortgage payment, total interest paid, breakout of principal and interest, and your mortgage payoff date.

Most of your mortgage loan payment will go toward interest in the early years of the loan, with a growing amount going toward the loan principal as the years go by until finally almost all of your payment goes toward principal at the end. For instance, in the first year of a 30-year, $250,000 mortgage with a fixed 5% interest rate, $12,416.24 of your payments goes toward interest, and only $3,688.41 goes towards your principal. To see this, click on Payment chart and mouse over any year.

Calculate

The effect of prepayments

Now use the mortgage payment calculator to see how prepaying some of the principal saves money over time. The calculator allows you to enter a monthly, annual, bi-weekly or one-time amount for additional principal prepayment.To do so, click + Prepayment options.

You may also target a certain loan term or monthly payment by using our mortgage prepayment calculator. Of course youll want to consult with your financial advisor about whether its best to prepay your mortgage or put that money toward something else, such as retirement.

Loan amount

Read Also: How Do Mortgage Appraisals Work

Deferred Payment Loan: Single Lump Sum Due At Loan Maturity

Many commercial loans or short-term loans are in this category. Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity.

Read Also: What Is Mortgage Insurance For Fha Loan

Don’t Miss: Can You Get A 30 Year Mortgage On Land

Whats The Difference Between Interest Rate And Apr

The interest rate is the amount that the lender actually charges you as a percent of your loan amount. By contrast, the annual percentage rate is a way of expressing the total cost of borrowing. Therefore, APR incorporates expenses such as loan origination fees and mortgage insurance. Some loans offer a relatively low interest rate but have a higher APR because of other fees.

How To Lower Monthly Mortgage Payments

Maybe you have your dream home but cant afford the mortgage payments. There are a few ways to lower the monthly payments for your mortgage.

Here are some of the best ways to lower your monthly payments:

-

Pick a cheaper home: A less expensive house means lower payments. You might be able to find your dream home in a different location or in a different style.

-

Invest in a better down payment: The higher the down payment, the lower the monthly cost. Aim for at least 20% to ensure you get better rates for the other mortgage fees.

-

Look for a lower interest rate: Interest builds over time, so the lower the rate, the better. However, some need you to pay upfront.

-

Look out for PMI: Pay at least 20% on your down payment to steer clear of PMI. The more you pay, the safer you can be on that front.

-

Pick a longer loan: The longer the loan, the lower each monthly payment. It might mean paying more in the long run.

These can all help lower the monthly payment and make your mortgage more afordable.

If you cant afford the loan, it doesnt make sense to buy out of your price range. You may lose your home.

You May Like: What Is A Recorded Mortgage

How Mortgage Interest Rates Are Calculated In Canada

Canadian Mortgage Interest Rate Fundamentals

For most Canadians, the biggest financial transaction they will undertake is buying a home. Very few Canadians can afford to purchase their home outright, meaning, most have to qualify for a mortgage. Unfortunately, few Canadians fully understand how mortgages work and are priced. Most know they want a low interest rate, but dont appreciate what kind of impact a seemingly small 0.25% mortgage interest rate hike will have on the total cost of their mortgage or how it will impact their day-to-day living.

A quarter point rate hike might not seem like a lot, but it adds up. If you have a $200,000 mortgage and an interest rate of 2.8%, you would pay around $926 monthly. With a mortgage rate of 3.6%, that same mortgage will now cost $1,009 per month.

Fixed-Rate or Variable-Rate Mortgages?

One big factor that dictates mortgage interest rates is whether you have a fixed-rate or variable-rate mortgage. The majority of Canadian homeowners have a fixed-rate mortgage with this, you make the same interest rate mortgage payments each month.

Homeowners like fixed-rate mortgages because they like knowing how much they pay each month and the security of knowing they are protected if interest rates rise.

Nothing is fool proof though, fixed-rate mortgages often come with harsher penalty fees should you break the mortgage.

How Is Mortgage Interest Calculated in Canada?

To figure out your interest rate:

- Principal = x

- Payment = /

Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

“In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.” – Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to “help” people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

Read Also: What Type Of Mortgage Is Best For First Time Buyers

What Are My Monthly Costs For Owning A Home

There are five key components in play when you calculate mortgage payments

- Principal: The amount of money you borrowed for a loan. If you borrow $200,000 for a loan, your principal is $200,000.

- Interest: The cost of borrowing money from a lender. Interest rates are expressed as a yearly percentage. Your loan payment is primarily interest in the early years of your mortgage.

- Property taxes: The yearly tax assessed by the city or municipality on a home that is paid by the owner. Property taxes are considered part of the cost of owning a home and should be factored in when calculating monthly mortgage payments. However, lenders dont control this cost and so it shouldnt be a major factor when choosing a lender.

- Mortgage insurance: An additional cost of taking out a mortgage, if your down payment is less than 20% of the home purchase price. This protects the lender in case a borrower defaults on a mortgage. Once the equity in your property increases to 20%, you can stop paying mortgage insurance, unless you have an FHA loan.

- Homeowners association fee: This cost is common for condo owners and some single-family neighborhoods. Its money that must be paid by owners to an organization that assists with upkeep, property improvements and shared amenities.

You May Like: What Is Needed For Mortgage Application

How To Save Interest On Your Mortgage

Now that you know a bit more about how interest is calculated lets look at the ways you can actually pay less of it.

- Get the best rate. Shopping around for a better interest rate can save you thousands of dollars. If you already own a home, you may want to consider refinancing with your current lender or switching to a new lender.

- Make frequent payments. Because there are a little over four weeks in a month, if you make biweekly instead of monthly mortgage repayments, youll end up making two extra payments a year.

- Make extra payments. The quicker you pay down your loan amount, the less interest youll need to pay on your smaller outstanding loan amount. If you have a variable interest rate, you can save even more by making extra payments when interest rates are low.

- Choose a shorter loan term. The longer you take to pay off your loan, the more interest youll end up paying. Remember, banks calculate interest on your loan amount daily, so choosing a 25-year loan term instead of 30 years can make a big difference.

Don’t Miss: What Is An Investment Mortgage

Calculating Arms Refinances And Other Mortgage Types

The equations that we’ve provided in this guide are intended to help prospective borrowers understand the mechanics behind their mortgage expenses. These calculations become more complicated if you’re trying to account for ARMs or refinances, which call for the use of more specialized calculators or spreadsheet programs. You can better understand how these loan structures work by referring to one of our guides about mortgage loans below:

Why Do Interest Rates Change

The Bank of England sets the base rate for the UK and usually its reviewed each month. Although banks dont need to follow the base rate, it does tend to be reflected in mortgage interest rates, typically from the month following any change.

As a rule of thumb, when the base rate is higher, interest rates on mortgages tend to be higher and when the base rate is lower, mortgage interest rates are also often lower.

Don’t Miss: What Is My Monthly Payment On A 250 000 Mortgage