Refinancing To Convert To An Arm Or Fixed

While ARMs often start out offering lower rates than fixed-rate mortgages, periodic adjustments can result in rate increases that are higher than the rate available through a fixed-rate mortgage. When this occurs, converting to fixed-rate mortgage results in a lower interest rate and eliminates concern over future interest rate hikes.

Conversely, converting from a fixed-rate loan to an ARMwhich often has a lower monthly payment than a fixed-term mortgagecan be a sound financial strategy if interest rates are falling, especially for homeowners who do not play to stay in their homes for more than a few years.

These homeowners can reduce their loan’s interest rate and monthly payment, but they will not have to worry about how higher rates go 30 years in the future.

If rates continue to fall, the periodic rate adjustments on an ARM result in decreasing rates and smaller monthly mortgage payments eliminating the need to refinance every time rates drop. When mortgage interest rates rise, on the other hand, this would be an unwise strategy.

Canada’s Most Popular Mortgage: The 5

In Canada, out of the $1.2 trillion CAD in outstanding residential mortgages in May 2021, the 5-year fixed rate mortgage takes the crown with over $660 billion, or more than 50%, of all mortgages in Canada. There are more 5-year fixed rate mortgages than all variable rate mortgages combined. The 5-year fixed rate mortgage is so popular that the CMHC uses the Bank of Canada’s 5-Year Benchmark Posted Rate for itsmortgage stress test.

How Do Mortgage Refinance Rates Work

Your refinance rate is the interest rate youll pay on the money youre borrowing. The total dollar amount youll pay in interest charges will vary not only with your interest rate, but also depending on the size of your loan and the length of your repayment term.

Your mortgages amortization schedule will show exactly how much of each monthly payment is paying off the loan principal and how much goes to paying interest. You can get a good estimate of your payments using the NextAdvisor amortization calculator.

Recommended Reading: Will Mortgage Rates Stay Low

Nerdwallets Mortgage Rate Insight

On Saturday, July 23rd, 2022, the average APR on a 30-year fixed-rate mortgagefell 9 basis points to 5.307%. The average APR on a 15-year fixed-rate mortgagerose 1 basis point to 4.595% and the average APR for a 5-year adjustable-rate mortgage rose 5 basis points to 4.541%, according to rates provided to NerdWallet by Zillow. The 30-year fixed-rate mortgage is28 basis points lower than one week ago and247 basis points higher than one year ago.

A basis point is one one-hundredth of one percent. Rates are expressed as annual percentage rate, or APR.

Decide On Your Loan Term

The length of your loans repayment term will also impact your refinance rate. Shorter term loans, such as 20-year or 15-year loans, have lower rates than longer repayment terms, all else being equal. Ideally, your new refinance loan wont be adding years onto your mortgage, but you can also pay off your mortgage more quickly with a shorter loan term. The downside is that shorter repayment terms will increase your monthly payment, so youll need to be able to afford a larger payment to capture the extra savings on interest over the course of the new loan.

Also Check: What Is The Interest Rate On A Reverse Mortgage Loan

Refinancing To Consolidate Debt

If you have enough equity in your home, you might be able to use built-up equity in your home to pay off high-interest debt through a mortgage refinance. For example, if you have a number of outstanding debts, such as a car loan, a line of credit or credit card bills, you may be able to consolidate this debt through the variety of mortgage refinance options available.

Today’s Mortgage Refinance Rates

| 4.69% | 4.61% |

Given the low interest rate environment in the United States, mortgage refinancing can be a great way to reduce your monthly principal and interest payment and overall interest costs. Plus, depending on your current rate, you might also be able to reduce your rate and pay your loan off quicker without a significant impact on your monthly P& I payment. This could save you a lot of money in the long run.

However, you shouldnt base your decision solely on the interest rate youll receive. Make sure to consider the costs associated with a refinance because it usually doesnt come free. If you decide to refinance your mortgage, the new loan should put you in a better financial position than your old loan. For example, you should receive a better rate or get better repayment terms. If youre not going to be in a better financial position, then you may as well keep your old loan.

You May Like: How To Calculate Mortgage Payoff Amount

Break Your Existing Mortgage Contract Early

You would consider breaking your mortgage early if you wanted to obtain a lower interest rate or access equity from your home. In this case, you eliminate your existing mortgage and take on a brand new one with any lender. Breaking your mortgage will incur a pre-payment penalty from your bank, which is normally equal to around three months worth of interest charges. If you can justify the cost of the pre-payment penalty with your new mortgage rate, then breaking your mortgage can still be worth it.

Switching Mortgage Lenders At Renewal

If you no longer want to stay with the same mortgage lender at renewal, you can always switch to another mortgage lender. This can be due to a variety of reasons, such as a better mortgage rate offered by another lender, or mortgage terms that are more suitable for you . There are costs to changing mortgage lenders that may be charged, such as appraisal and registration fees. Your new lender may cover these transfer costs.

Switching to a new lender also requires you to pass amortgage stress testif the lender is federally regulated. A mortgage stress test is not required if you renew your mortgage at the same lender. Provincially regulated, quasi-regulatedB Lenders, andprivate lendersare not required to conduct a mortgage stress test. You may be denied at a federally regulated lender if you fail the stress test when transferring over, such as if your income has dropped.

Also Check: How To Find A Cosigner For A Mortgage

Getting A Lower Interest Rate

Refinancing to get a lower interest rate can save you a lot of money over time, depending on the pre-payment penalty and the size of your outstanding mortgage. If you hold a variable rate mortgage, then expect to pay a penalty of three months’ interest, and if you hold a fixed rate mortgage, then you will pay the greater of three months’ interest or interest rate differential penalty . Donât let penalties deter you – understanding the numbers helps you calculate whether a refinance will save you money.

Why Are Refinance Rates Different From Traditional Mortgage Rates

As with a regular mortgage, the rate you can receive on a mortgage refinance will vary based on the type of mortgage you get, i.e., 15-year fixed-rate vs. 30-year fixed-rate. Plus, rates may be higher if youre planning to take a cash-out refinance. In either case, mortgage rates will typically be lower on mortgage refinances with shorter fixed-rate terms than on refinances with longer fixed-rate terms.

The reason rates are lower with shorter fixed-rate mortgages than with longer fixed-rate mortgages is because shorter terms are considered less risky than longer terms. One reason longer terms are riskier to lenders is that there is more interest rate risk. If rates go up, lenders are potentially stuck with a low rate loan for a longer period of time. This means they might not be able to make as many new loans, which could carry higher rates and make them more money.

Another reason longer terms are riskier to lenders is that theres more risk that something unexpected might happen that negatively affects your ability to repay the loan. For example, you might lose your job or there could be a recession or economic downturn that affects your ability to repay. To make up for this additional risk, lenders will charge a higher interest rate on longer fixed-rate term loans.

You May Like: Is Rocket Mortgage And Quicken Loans The Same

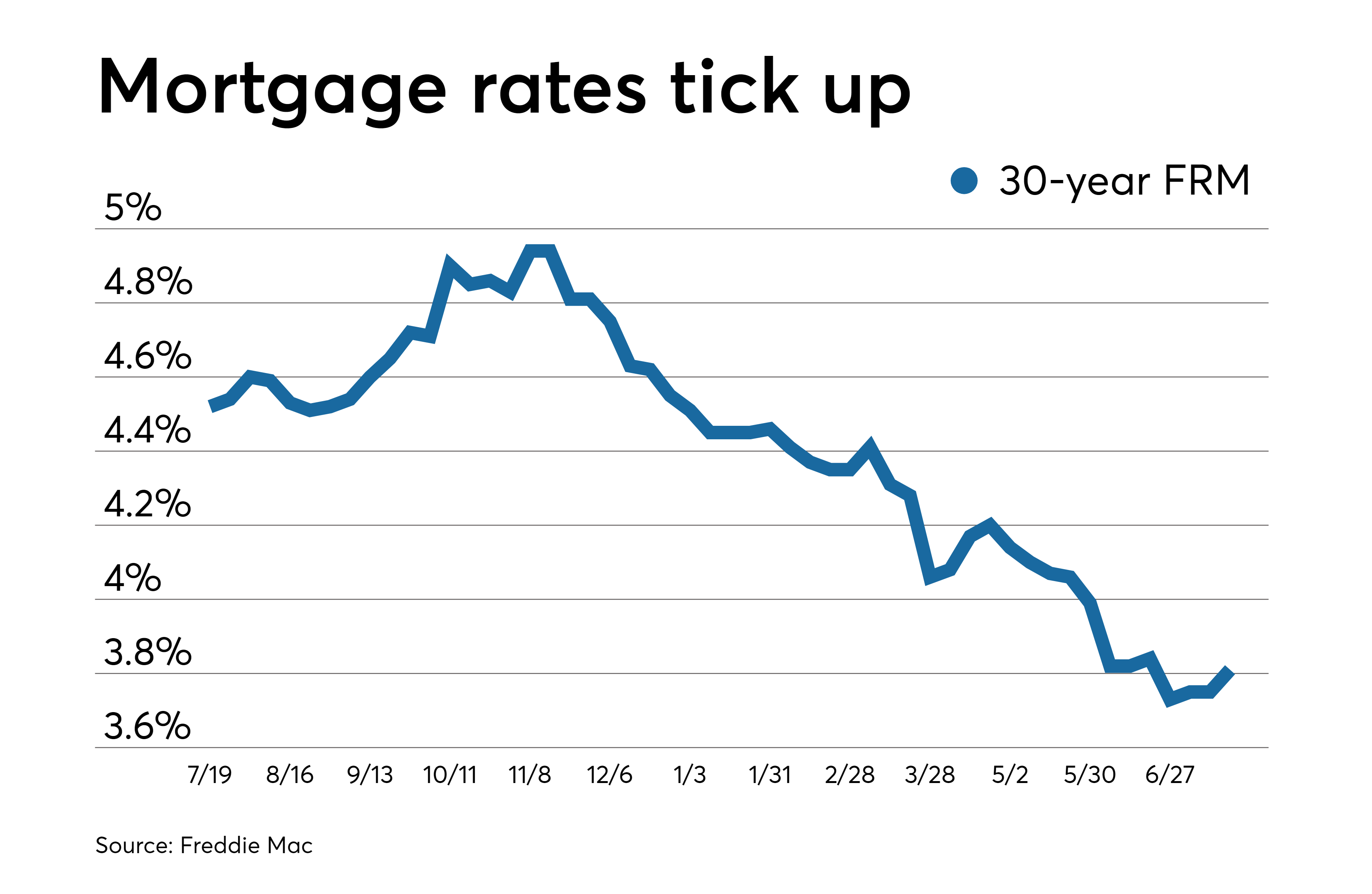

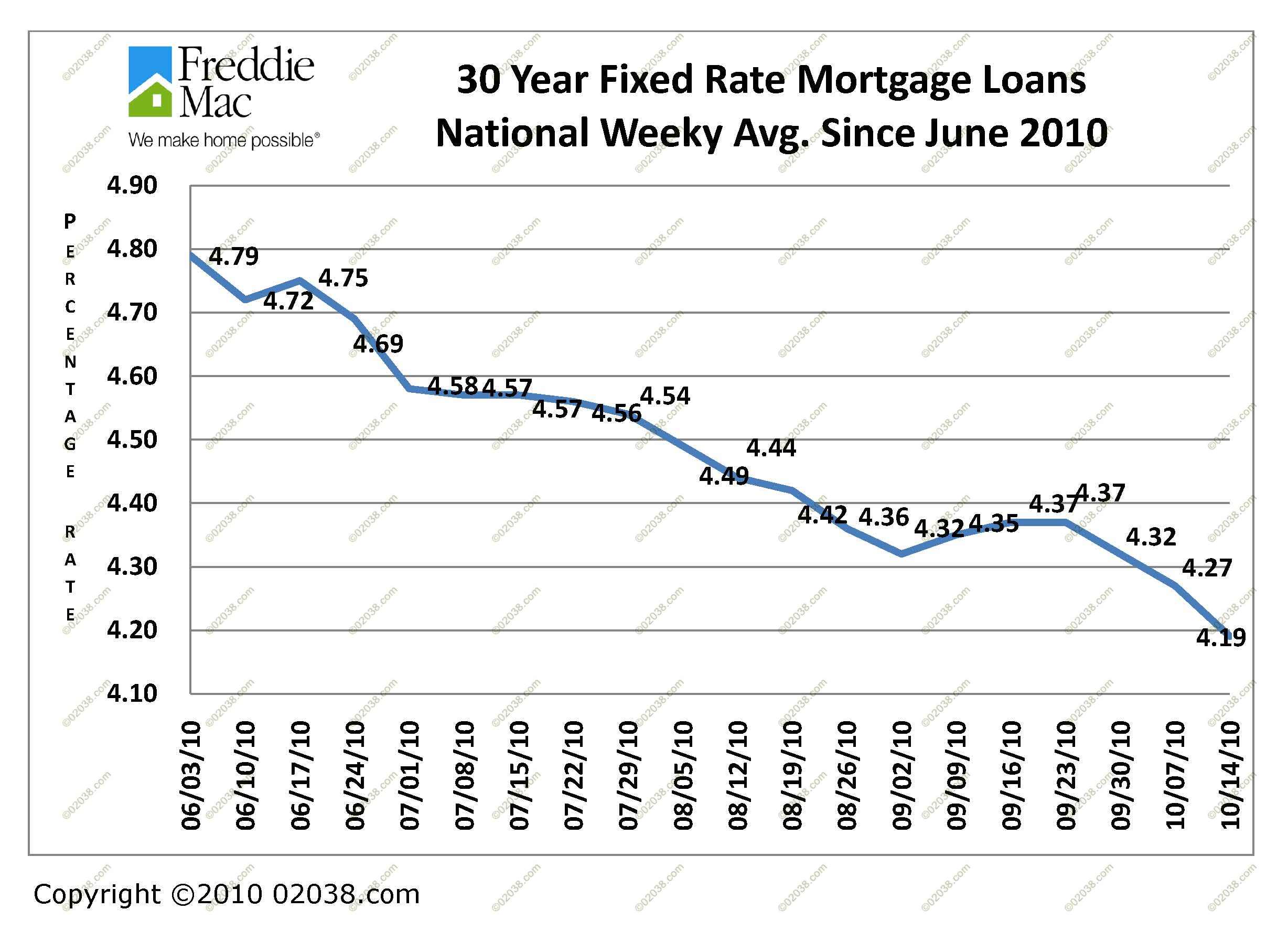

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage points . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

Todays 6 Best Mortgage Refinance Lenders

- Chase convenience and flexibility

- Rocket Mortgage quick online approval

- SunTrust Bank wide variety of loan options

- Bank of America flexible options with discounts for customers

- Guaranteed Rate easy online application

- Alliant low equity mortgage loans

- Navy Federal good rates for military members

Read Also: How To Assume A Va Mortgage

What About Home Equity Loans And Helocs

Experts say the higher mortgage rates have led to a resurgence of home equity loans and lines of credit as homeowners who want to tap the abundance of equity in their homes want to avoid losing good interest rates on their primary mortgages. For U.S. homeowners and mortgage holders, the total amount of tappable equity the amount available to borrow against while still keeping 20% rose by $1.2 trillion in the first quarter of this year alone thanks to rising home prices, according to the mortgage data and technology firm Black Knight.

Home equity loans and HELOCs allow homeowners to borrow money at lower interest rates than they would for personal loans. Theyre typically used for home improvements or other big expenses. Experts say there are risks namely, if you dont repay, you could lose your house but regulations have improved since the 2008 financial crisis. This product has been unloved for 15 years, Vikram Gupta, head of home equity at PNC Bank, told us. Is it now the return of home equity?

for more information on home equity lending products, including home equity loans and home equity lines of credit .

Should You Refinance Into A 30

There are two common reasons to refinance: to reduce monthly mortgage payments or to save on the overall interest you pay on your house over the long term. In some cases, refinancing will accomplish both of those goals, but not always. With rates at record lows, millions of homeowners could benefit from refinancing. Here are a few things to consider when deciding if it’s the right time to refinance:

- Your goal: Extending the length of your loan will lower your monthly payments while increasing the interest you pay over the life of the loan. Shortening the length of the loan will lower the interest you pay over the life of the loan but often increases your monthly payments.

- How long you’ll be in the home: Refinancing generally only makes sense if you plan to spend several more years in your home. It can sometimes take years to break even on the cost of refinancing. If you wont be in your home for much longer, it might not make sense to refinance.

- Your ability to qualify: Refinancing might make sense for you, but that doesn’t necessarily mean you’ll qualify. Lenders take into account a number of factors when considering whether to extend you a refinance offer, including the amount of equity you currently have in the home, your income and your credit score.

A 30-year refinance term presents many benefits. But whether it makes sense for you to refinance into a longer or shorter term depends on your financial situation.

Also Check: How Much Is Mortgage Insurance Monthly

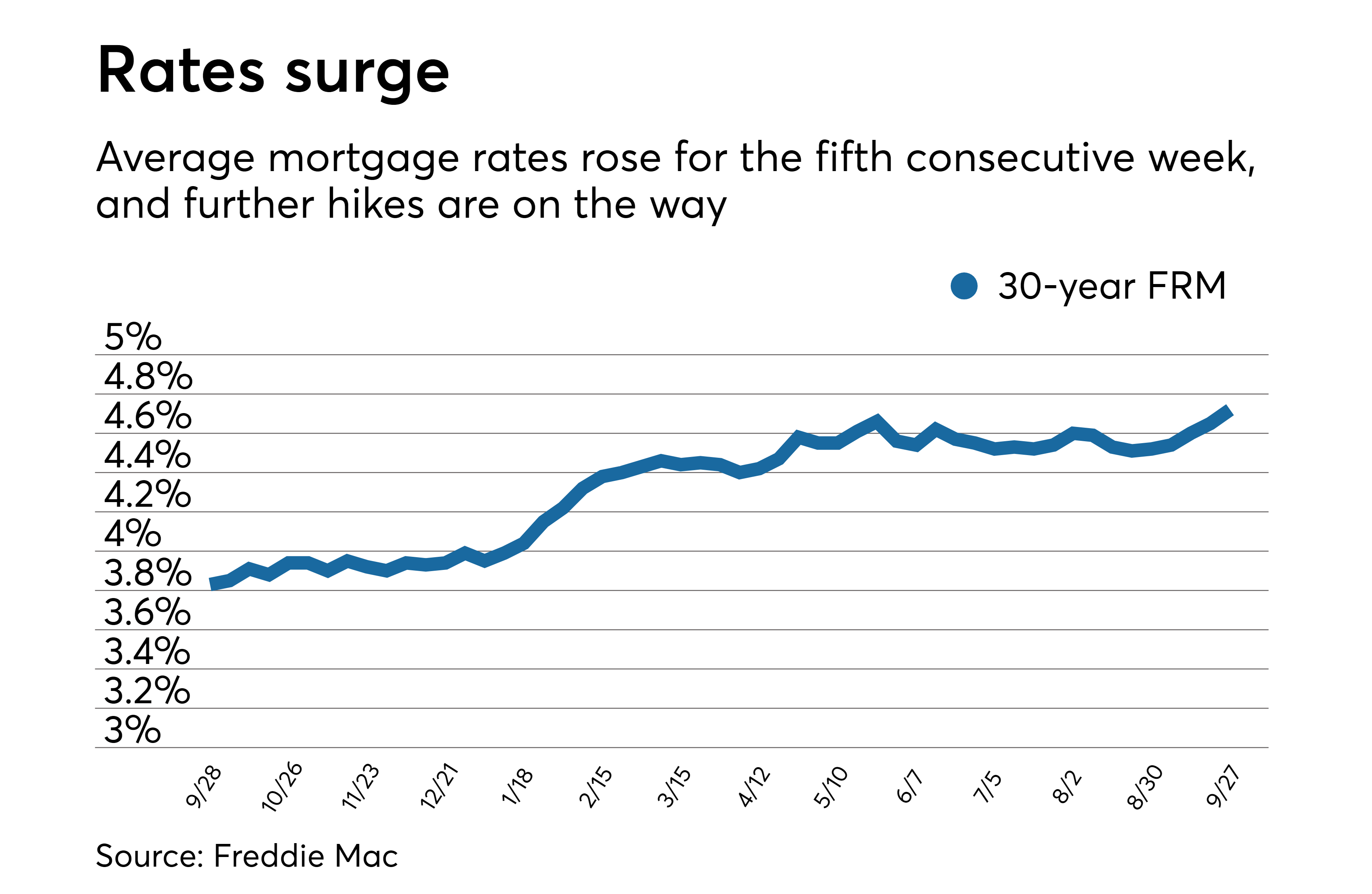

How Are Mortgage Rates Impacting Home Sales

Home sales continue to slow. The number of mortgage applications decreased by 1.7% for the week ending July 8, according to the Mortgage Bankers Association.

- The total number of purchase applications edged 4% lower week-over-week and was 18% lower compared to this time last year.

- Refinance applications saw a bit of a rebound, increasing by 2% from the previous week. Compared to this time last year, however, applications were down 80%.

Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

The payment frequency determines how often you will make mortgage payments.

Don’t Miss: How To Make A 30 Year Mortgage A 15

Improve Your Credit Score

Get your credit score in the best shape possible before refinancing your mortgage. Your credit score is one of the biggest factors affecting the mortgage rates offered to you by lenders. A higher credit score may result in a lower refinancing interest rate. Credit scores of 740 or greater tend to yield the most favorable interest rates. However, rates are still very good for most borrowers with credit scores of 620 or greater.Explore tactics to improve your credit score.

What Is A Good Refinance Rate

Even with the recent uptick in interest rates, todays refinance rates are exceptionally low compared to any time in the history of mortgage rates. There are a lot of personal factors that go into what rate youre eligible for, but even if you dont qualify for the lowest advertised rate youll likely be quoted a refinance rate that is lower than you could have qualified for 18 months prior.

But having a low rate doesnt mean its a good rate for you. A refinance rate needs to be compared to your current interest rate. A good rule of thumb: If you can reduce your interest rate by close to 0.75% or more then refinancing can make sense. This is because youll want to be able to save enough on interest to offset any loan fees you pay to refinance.

You May Like: How To Read Reverse Mortgage Statement

How Much Does It Cost To Refinance

As with a regular mortgage, there are significant closing costs involved with a refinance. Closing costs should be within the standard 2% to 5% range and will include fees charged by the lender, title company or attorney or other third parties, depending on your situation and the type of loan youre refinancing to.

You may be able to add your refi closing costs to the loan amount to pay them along with your monthly mortgage payments rather than finding the money for them upfront. This option can prevent you from having to pay a larger lump sum, but can add up in more interest paid over time.

Just make sure to do your homework and crunch the numbers before you commit to a refinance. What saves you money now may be extremely costly over the long haul.

Shop Around For The Lowest Fees

Dont only focus on the interest rate when shopping around. You should also pay attention to fees youll pay, which are factored into the annual percentage rate . A loans APR also takes into account certain loan fees, so one loan could have a lower interest rate, but have a higher APR. You can easily compare closing costs and fees by reading the Loan Estimate your lender provides after you apply.

Recommended Reading: What Is The Current Interest Rate For Second Mortgages

Refinance To Lower Your Mortgage Rate

To determine if you can save money with a lower mortgage rate, use our calculator to compare the monthly interest savings against the cost to refinance. As most mortgage brokers and lenders will cover your legal costs, the main cost you need to worry about is your break of mortgage penalty, known as the pre-payment penalty. This penalty is charged by your lender for breaking your mortgage contract early, and is based on your original contract date, current mortgage balance, mortgage rate and other factors.