Should You Buy Down Your Rate As Mortgage Interest Rates Rise

Since the start of 2022, mortgage rates have risen sharply, and that might make mortgage points seem more attractive to many borrowers. The calculation is a little more complicated, however, than just figuring out how to get the lowest possible rate in the current market, McBride says.

While borrowers may give greater consideration to paying points when rates have been on the rise, the breakeven point is still nearly six years, McBride says. The benefits of paying points only truly accrue if you expect to have the loan longer than that, which might be very plausible when rates were at all-time lows near 2.5 percent, but with rates at 4.5 percent, youre more likely to be looking to refinance if we see a drop in rates.

Basically: Points could be a good way to go if you want to set and forget your mortgage, but if you plan to manage the account more actively and refi into a lower rate if the market recedes, it might not be worthwhile to buy them now.

How Much Is 2 Discount Points On A Mortgage

Each point equals 1 percent of the loan amount, for example 2 points on a $ 100,000 loan would cost $ 2,000. You can buy up to 5 points. On the same subject : How much do banks make selling mortgages?. Enter the annual interest rate for this mortgage with percentage discount points.

How much does 2 points save on mortgage?

How much is 2 points on a loan?

Each point is one percent of the loan amount. For example, one point on a $ 100,000 loan would be one percent of the loan amount or $ 1,000. Two points would be two percent of the loan amount, or $ 2,000.

How much does a discount point lower your rate?

Points also called mortgage points’ or discount points’ are fees used to buy a lower rate. Each discount point costs 1% of the size of your loan and usually lowers your mortgage by about 0.25%.

Benefits Of Purchasing Mortgage Points

It goes without saying that paying points comes with some benefits. Here are some of them:

Reduced Interest Rate

If your credit score is low, youll almost certainly pay a higher interest rate on your loan. As such, you should strategize to improve your credit before applying for a mortgage.

This helps lower your rate. Nevertheless, if youd like to buy a house immediately, all hope is not lost. You could still lower your rate by paying points.

Reduced Monthly Payments

Because interest is a core component of your monthly payments, getting a lower interest rate means having a smaller monthly mortgage payment. As such, housing expenditures will occupy less space in your budget. Best part? You can save money faster or spend more on other vital aspects of your life!

Overall, Youll Pay Less.

You May Like: How To Pay Mortgage Online Rbc

Mortgage Points Vs Origination Points

Mortgage points give you the option to lower your interest rate and decrease your monthly mortgage payments. There are two types of these points: discount points and origination points.

Discount points are a form of prepaid interest that you can purchase to reduce your interest rate. Doing so will give you ongoing savings on your mortgage costs over a number of years.

Origination points are a fee paid to the lender that provides your mortgage for the evaluation, processing and approval of your loan. These also help lower the interest rate on your mortgage.

In most cases, youll pay a fee equal to 1% of the mortgage amount for each discount point.This fee is typically paid directly to your lender or as part of a fee package.

Advantages Of Buying Mortgage Points

The biggest advantage of purchasing points is that you get a lower rate on your mortgage loan, regardless of your credit score. Lower rates can save you money on both your monthly mortgage payments and total interest payments for the life of the loan.

- If your income is too low for you to qualify for the house you want, you may be able to qualify with a reduced interest rate and payment

- If you have the cash available, or if you can convince a home seller to pay discount points for you, buying down your rate may help you qualify for your mortgage loan

- Purchasing points can save you money over the life of the loan, but typically when you dont sell or obtain a mortgage refinance for enough year to break even

- Understand, though, that the upfront cost of mortgage points can be substantial

Recommended Reading: Is It Cheaper To Pay Mortgage Or Rent

When Discount Points Are Worth It

Katherine Alves, executive vice president of Homeowners First Mortgage, says you want to ensure that purchasing discount points will result in a financial advantage.

To do so, you need to calculate the cost versus savings over time. This is done by comparing rates with no points to a loan with points and reviewing the overall annual savings in the monthly payment, recommends Alves.

Then, you need to decide if you are going to remain in your home or the current mortgage loan long enough to recoup the costs of your discount points, she explains. This is known as the break-even point.

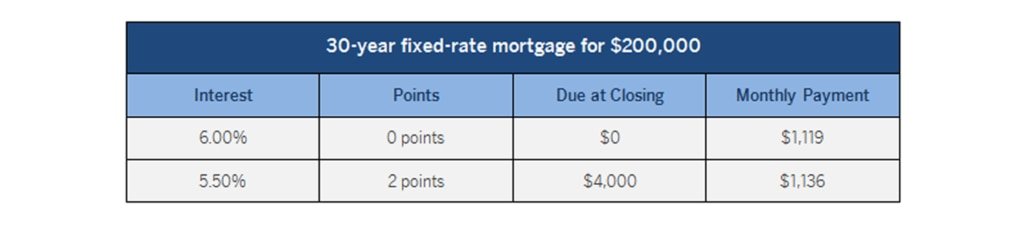

Take a look at an example.

Assume a borrower named Steve purchases a home and takes out a 30-year mortgage for $400,000. Hes offered a 3.25% fixed interest rate.

- If Steve purchased one discount point a $4,000 upfront cost he would save about $108 on each monthly payment

- It would take Steve 37 months to reach his breakeven point and recoup the $4,000 he paid upfront

If Steve held onto the loan over its full 30-year term, he would save around $35,000 overall in interest by purchasing that single discount point, Killinger says.

Here, the assumption is that Steve will stay put in his home and not refinance or sell until more than three years have passed. In this case, paying for a discount would be well worth it.

Drawbacks Of Buying Mortgage Points

Purchasing mortgage points has its drawbacks as well. The following are some disadvantages of paying points.

Larger Initial Payment.

Buying points means paying extra in advance, which means your closing expenses will be higher. Typically, the closing expenses range from 2% to 5% of the homes buying price. As such, people who cannot comfortably afford such a large sum would find it financially incapacitating.

You Might Not Be Able To Recoup the Cost of Points if You Move.

Mortgage points can run into thousands of dollars if paid all at once. With each monthly payment, the savings from your lower interest rate will add up over time. However, if you relocate too soon, the savings wont be worth it. This is also true if you opt to refinance your mortgage, which would incur additional closing expenses.

You May Like: How Much Does A Mortgage Appraisal Cost

How Many Points Do Lenders Usually Charge

Choosing to take out mortgage points is completely optional, but it is one way to lower your overall interest rate and monthly payment. Most lenders allow you to buy between one and three points that you pay in advance as part of the closing costs.

Do Lenders always charge points?

And remember that points can be paid out of your own pocket or included in the interest rate of the loan. Also keep in mind that not every bank and broker charges mortgage points, so if you take the time to buy, you may be able to avoid points altogether while ensuring the lowest possible mortgage rate.

How much is 25 points on a mortgage?

Reducing the interest rate by 25 percentage points and costs $ 1,000.

What is a good number of points on a mortgage?

According to a survey of lenders conducted weekly by Freddie Mac, in the last 5 years, the average number of points applied for a 30-year fixed-term conventional loan was between 0.5 and 0.6 points. It is important to note that you do not have to pay the full point to get a lower rate.

Mortgage Points: Frequently Asked Questions

1. Is it possible to deduct mortgage points from your taxes?

Your points may be tax-deductible because they are considered prepaid interest. However, there are some restrictions, so consult the IRS. For example, youll be required to itemize your deductions. If you can deduct all of your mortgage interest, you may also be able to deduct all of the points paid.

2. Is there a limit to the number of points one can buy?

While there is no formal limit on how many points you can acquire, federal and state laws limit how much you can spend on closing costs. As a result, most lenders will not allow you to buy more than 4 points.

Also Check: How To Find Mortgage Note

What Are Borrower Discount Points

Discount points are a form of prepaid interest that mortgage borrowers can purchase to lower the interest rate on their next monthly payments. Discount points are a one-time fee, which is paid in advance either at the first mortgage agreement or during refinancing.

What are discount points on a refinance?

A mortgage point sometimes called a discount point is a fee you pay to lower your interest rate on buying a home or refinancing. One point discount costs 1% of the amount of your home loan. For example, if you take out a $ 100,000 mortgage, one point will cost you $ 1,000.

Are loan discount points negotiable?

Discounts and points of origin can be negotiated, even if your lender claims they are not. Discount points have value for you and may have less negotiation than the variety of origin. Still, you can still save some valuable money by convincing the lender to reduce the points they ask for.

How much do discount points reduce interest?

When you buy one point discount, you will pay a 1% mortgage fee. As a result, the lender usually reduces the interest rate by 0.25%.

What Is The Benefit Of Paying Discount Points As Part Of The Closing Costs

What is the benefit of paying rebate points as part of closing costs? Generally, points lower the interest rate on the mortgage. The more points a buyer pays in advance, the lower the interest rate.

What is the benefit of paying discount points?

Paying discount points reduces the interest rate and therefore the monthly payments. Your monthly savings depend on the interest rate, the amount borrowed, and the length of the loan .

Are points part of closing costs?

No, it’s not the same thing, but lenders often use the language to describe the same costs. One point corresponds to 1% of the value of the loan. It is a cost you pay to qualify for a lower interest rate on a loan.

Do discount points lower the cost of a home loan?

If you can afford to buy rebate points in addition to the down payment and closing costs, you’ll lower your monthly mortgage payments and could save a lot of money. The key is to stay in the house long enough to collect the prepaid interest.

Also Check: What Happens To Mortgage Rates During Inflation

Using The Mortgage Points Break

This mortgage points calculator assumes that you’ll roll the cost of your points into the mortgage. Enter the total cost of the mortgage with points in the box marked “Mortgage amount.” The calculator will determine the size of the loan without points for comparison.

- “Term in years” is the length of the mortgage.

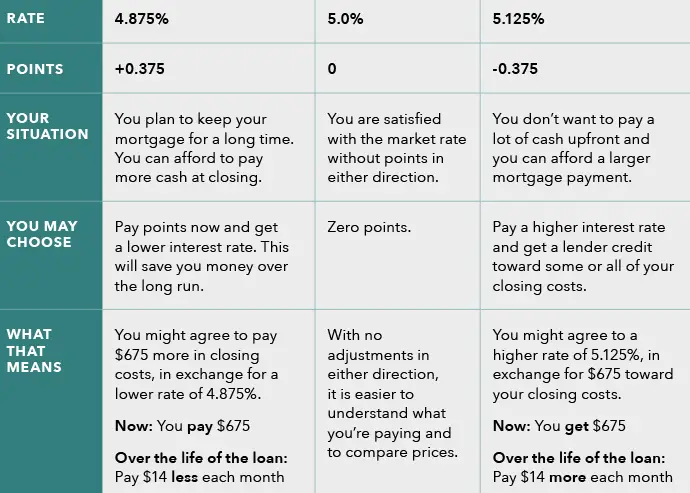

- Enter the number of points under “Discount points” note that you can enter negative points as well, to reduce your closing costs in return for a higher rate. Fractional points can also be entered manually, though the slider will only reflect whole numbers.

- Under “Points rate” enter the reduced rate you will pay with discount points.

- Under “Interest rate” enter the standard rate you would pay with no points. .

- “Years in home” is how long you expect to stay in the home. Based on this figure, the calculator will determine how much your will save or it will cost you to pay for points.

- To find your break-even point, use the green triangle slider to adjust “years in home” to find the point you go from costs to savings.

- “View report” will provide you with an amortization schedule comparing the loan with and without points. This will allow you to compare interest savings over time as well as the rate at which you’re paying down loan principle, so you can project your home equity at any point in the loan.

Will Applying For Different Mortgages Hurt My Credit

The generally consider credit checks from multiple mortgage lenders as one credit check because they assume you’re searching for the best deal. But you have to limit your applications to a short window of time. Some credit-scoring models consider multiple mortgage inquiries within 14 days as just one inquiry, while others treat several inquiries as a single one if you made them within 45 days. Because you probably won’t know what scoring model a particular lender will use now or if you apply for credit in the future, submit each of your mortgage applications within a 14-day period to be on the safe side.

You May Like: How Can I Get Qualified For A Mortgage

Pros And Cons Of Mortgage Discount Points

The advantages and disadvantages of purchasing mortgage discount points are pretty simple.

The pros are that the borrower receives a lower payment and pays less interest over time, Meier says. The cons are that they have to put more money into the transaction upfront out-of-pocket, and if they dont remain in the home for a certain time, the cost is more than the benefit received.

That might seem straightforward. But it takes a little math to apply those rules to your own situation. Heres what to consider.

What Is The Advantage Of Buying Points On A Mortgage

The biggest benefit of buying points is that you get a lower rate on your mortgage, regardless of your credit rating. Lower rates can save you money on your monthly mortgage payments and total interest payments for the life of the loan.

What is the advantage of points on a mortgage? The Benefits of Mortgage Points People buy points to lower their interest rate and save on the overall cost of the loan. Points can increase your closing costs by thousands of dollars, but the high upfront cost can be worth it if you stay in the house long enough to see the savings from the lower interest rate.

Also Check: What Is The Lowest Mortgage Amount You Can Borrow

How Much Does One Mortgage Point Reduce The Rate

When you buy one discount point, youll pay a fee of 1% of the mortgage amount. As a result, the lender typically cuts the interest rate by 0.25%.

But one point can reduce the rate more or less than that. Theres no set amount for how much a discount point will reduce the rate. The effect of a discount point varies by the lender, type of loan and prevailing rates, as mortgage rates fluctuate daily.

Buying points doesn’t always mean paying exactly 1% of the loan amount. For example, you might be able to pay half a point, or 0.5% of the loan amount. That typically would reduce the interest rate by 0.125%. Or you might be given the option of paying one-and-a-half points or two points to cut the interest rate more.

Mortgage Discount Points Faq

Is purchasing points on an adjustable-rate mortgage a good idea?

Paying for mortgage discount points on an adjustable-rate mortgage only provides a discount during the ARMs initial fixed-rate period. With a 0.25% discount rate, it generally takes around 4-6 years of homeownership to break even with these loan terms. Therefore, your opening fixed-rate period should be longer than 4-6 years to see a real savings.

Are mortgage origination points the same as mortgage discount points?

Discount points and origination points are different. Origination points refer to the origination fees a borrower pays to their mortgage lender for processing and underwriting a home loan. Whereas, discount points are upfront fees home buyers pay at closing to reduce their mortgage interest rate.

How much does a mortgage point cost?

One point costs 1% of your loan amount, or $1,000 for every $100,000. As an example, if your mortgage loan is $400,000, then one discount point would be $4,000. Additionally, many mortgage lenders will allow home buyers to purchase fractional points. On a $4000,000 home loan, a half point would cost $2,000.

You May Like: What Is The Forecast For Mortgage Interest Rates

Do Lenders Make Money On Points

Mortgage lenders can earn money in a variety of ways, including origination fees, yield spread premiums, discount points, closing costs, mortgage-backed securities, and loan servicing . Lenders can also get money for servicing the loans they package and sell through MBS.

How do lenders make money on refinancing? In short, they take advantage of credits from lenders to cover your closing costs. And these lender credits are generated by offering you a higher interest rate than you might otherwise qualify for.

Mortgage Discount Points Faqs

Discount points are paid to reduce the amount of interest you pay on the loan.

How Much Do Points Cost?

Every point on the loan is equal to 1 percent of the total loan cost. For example, 1 point on a $200,000 loan would be $2,000. If you paid 4 points, you would pay $8,000.

Can You Buy Partial Points?

Yes. Some lenders showcased in the above mortgage rate table list whole-number points while others may offer loans with no points or fractions of a point like 0.79 points.

How Many Discount Points Can I Buy?

The maximum number of points varies by lender, but it is uncommon for consumers to pay more than 4 discount points.

How Much Does a Point Lower Interest Rates?

The amount you can save on your interest rate by paying for points will vary by lender. However, for each loan point you purchase, you can typically reduce the interest rate on your loan by 1/8 percent or 1/4 percent. 25 basis points or a quarter of a percent is the most common value associated with a discount point.

How Are Points Treated for Tax Purposes?

Discount points are used to buy a lower interest rate throughout the loan. From a tax persepctive they are treated as pre-paid interest. Provided your mortgage document states the number of discount points which were purchased and the number of points you purchased is within the normal range where you live then you may deduct the cost of discount points from your income taxes.

Who Should Buy Points?

Who Should Avoid Points?

Can You Have Negative Points?

Don’t Miss: How Much Mortgage Can I Afford Florida