Benefits Of Renting A Home

Although buying a home has many advantages, renting comes with its own set of benefits, such as:

-

If you need to move around for work, you can quickly relocate when you need to

-

Finding and renting a home is usually quicker than the process of buying

-

You will not lose money if the property’s price goes down

-

You wont need to pay for repairs and renovations

-

It is often cheaper and rental payments rarely change, making it easier to budget

-

You may be able to rent a bigger home in a nicer area than you could afford to buy

Areas Where It Is Relatively More Expensive To Own Than Rent

Not surprisingly, the metro areas where owning is a lot more expensive than renting compared to the national average are San Jose , San Francisco , Urban Honolulu , Barnstable Town , San Diego-Carlsbad , Seattle-Tacoma-Bellevue , and Yakima . For example, in the San Jose metro area, the expected monthly cost associated with owing a home is $11,291 compared to $2,709 to rent an apartment unit.

Financial Advisor No : Renting Makes More Sense

Licensed financial advisor Ed Conarchy is the rare mortgage broker who sometimes advises clients not to buy a home. Homeownership makes sense in the right circumstances, he says. But, Conarchy argues, many homeowners rush into a buying decision. Then, when they realize they made a mistake, they’re stuck paying hefty fees on both sides of the transaction. Conarchy, of Cherry Creek Mortgage Co. in Gurnee, Illinois, takes a contrarian approach to ownership.

I’m debating whether to buy a place or to keep renting. What factors should I consider?

Ed Conarchy:

Unless you can foresee living in that home for five to seven years, don’t bother. If you stay in a house for three years, you get crushed on transaction costs. Here’s an example: I had a customer who was buying a house for $455,000. The title fees were $3,100 for the buyer and $2,100 for the seller. I’ve had clients argue with me: “It’s $200 a month cheaper to own than to rent.” Yeah, but when your water heater goes out, you just lost two years of that monthly savings. I had a potential client who’s 33 and doesn’t know what the future holds, either professionally or personally. She wanted to buy a house, but she didn’t know where she’d be in three years. I told her not to buy.

So you’re a mortgage broker who advises clients not to take out mortgages?

Ed Conarchy:

When does it make sense to buy?

Ed Conarchy:

You’re skeptical about the benefits of homeownership. Do you own a house?

Ed Conarchy:

Ed Conarchy:

About the Author

Don’t Miss: What Are Current Mortgage Rates

Save Money By Renting If You Stay 3 Years Or Less

The above example shows that the typical break-even point is 3 years. If you are going to stay in a home for less than three years, its cheaper to rent. If you will be staying for 4 years or longer, then buying is cheaper than renting.

This is the typical break-even point for renting vs. buying costs: Marie Bromberg, Realtor with The Corcoran Group. Says, most of the time, when you do the math on how much someone is paying in rent vs. buying, it usually makes more sense to buy if you estimate youll be there for a few years.

That said, I do know some renters have an amazing deal from their landlord and are perhaps paying sub-market rental rates. In these situations, theyre loathed to give up the great rent and begin paying what is sometimes a larger monthly mortgage. Even in a case like this where your payment is less than it would be for a mortgage, buying is still more advantageous if you plan on staying in the property for more than 3 or 4 years.

Prove To Yourself That You Can Handle A Mortgage

When most people learn that the true cost of a mortgage is possibly 40% more than their actual mortgage payment, you would think that they would scale back their expectations and look at buying a less expensive home. However, people dont usually do this. They still try to buy the biggest or best house that they can possibly afford. If you think that you might fall into this category, set up an experiment to prove to yourself and your partner that you can actually afford the home you want.

Figure out what 40% of your rent is and then deposit that money into a separate savings account on the first day of each month. Do this for six months and then reflect on your experience. Did you struggle with making that extra payment, or did you learn to make it work? Were you late with your payment, or did you learn to faithfully pay on time? If your experiment was a success, you are probably ready for a mortgage and have some more money saved towards your purchase.

You May Like: What Is A Prepayment Penalty On A Mortgage

The Downsides Of Renting A Home

Lets be honest: there are some unappetizing things about renting. Heres are some not-so-great aspects to being a renter:

- Youre not building equity: While renters avoid taking out a mortgage and footing the bills for running a house , they also lose out on building equity. Instead, your monthly rent cheque goes towards paying someone elses mortgage.

- The landlord is boss: Weve all heard horror stories about deadbeat landlords and surprise eviction notices. Renting means youre living on someone elses turf and they get to call the shots .

- Instability: In accordance with local laws, the landlord can hike the rent. A spike in your rent payment could trigger you to start packing which is not only inconvenient but for cash-strapped people, could trigger a full-blown financial crisis.

The Case For Homeownership

Stable Housing Payments

If you finance your home purchase with a fixed-rate mortgage loan, you will know the precise amount of your principal and interest payments for the life of the loan, whose term could last as long as 30 years. This long-term predictability fosters financial stability. If you rent, however, you’ll have much more difficulty accurately predicting your monthly rent for years to come. You’ll likely be at the whim of your landlord and the rental market every year.Of course, for a homeowner, principal and interest payments are only part of the homeownership equation. Homeowners insurance premiums aren’t fixed, and they can and sometimes do soar. Property taxes and homeowners association dues are additional variable costs. Don’t forget repairs. If you need a new roof or air conditioner, you’re on the hook for the replacement costs.Nonetheless, taking out a 30-year fixed-rate mortgage means you can expect the same cost for principal and interest for 360 months, which provides considerable peace of mind. Also, if your income rises during that time, your principal and interest will dwindle relative to your overall budget.

A Home as an Investment

A Tax Break When You Sell

You’re in Charge

Your Kids Will Have Stability

It’s Cheaper Than Renting

Recommended Reading: What Does Qc Mean In Mortgage

Are There Extra Charges For Paying House Rent With Credit Card

We doesnt store any of your confidential information, including your credit card details. Are there any extra charges for paying house rent online? A small processing fee is charged for paying rent online with a credit card. This fee is 1% of the transaction amount if you are using either a VISA or a Mastercard credit card.

Cost Of Renting In Numbers

Theres a much smaller table for renters. Thats because landlords carry many of the continuing expenses that homeowners face.

Indeed, many tenants need find only the rent. But were including renters insurance because its a sensible expenditure and many tenants value the protections it brings.

Remember, all the figures in the table provide for an annual inflation rate of 1.9 percent.

| Expense |

| 143,212 |

Don’t Miss: How Much Is The Mortgage On A $300 000 House

Mortgage Payments Help You Grow Wealth

Homeownership helps you grow wealth. When you make monthly mortgage payments, you build equity in your home.

Thats different from paying rent. When you pay rent, youre not getting any long-term benefits in exchange for it .

However, its important to note that owning a home isnt automatically a better way to build wealth than renting if you arent planning on staying long at your address.

While its true that when you make a mortgage payment youre accumulating some equity in your home, says personal finance author Jane Hodges, if you dont stay very long, your initial payments, the first several years, mostly go to interest, so youre not actually building that much equity.

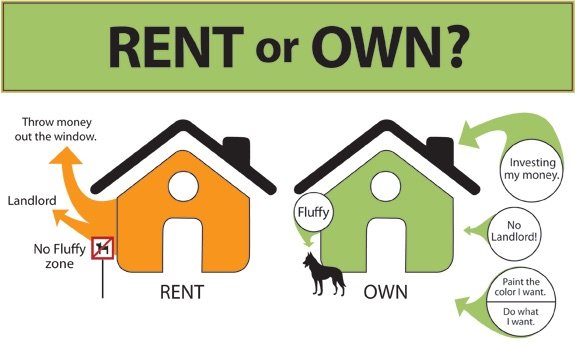

Renting Vs Buying A Home: Pros And Cons

The rent vs buy issue is much more than a financial one. There can be big differences between the lifestyles of renters and homeowners, which you need to consider alongside your finances. Here are some of the advantages of both renting and buying a home that considers both lifestyle and financial issues.

Don’t Miss: How To Pay Mortgage Online Rbc

How To Pay A House Sitter For A Month

Send a check at regular intervals, if someone is providing care for a vacation home. Bring a gift for a house sitter, if they have offered to take care of the house for free. Consider something they already like, such as wine, food or a gift from your travels. How much should I charge to watch a house for a month?

What Are The Disadvantages Of Buying A Home

Buying a home will initially be more expensive than renting. There are upfront costs like mortgage fees and potentially Stamp Duty, which you will need to budget for. Whats more:

-

If you get a joint mortgage and separate, it can be complicated to sell the property

-

Interest rate rises can increase your monthly payments although you can get a fixed rate to help you budget

-

You have to pay for repairs, including if something urgent goes wrong like a leak

-

The moving process can take a long time, particularly if there is a lengthy property chain

-

If your finances become tighter, moving to a cheaper property can take some time

-

There are financial consequences if you fall behind on repayments, like getting into debt

-

If you fall too far behind on your mortgage, you could face bankruptcy or have your home repossessed

Don’t Miss: What Are 15 Year Mortgage Interest Rates

Experts Debate Renting Vs Buying

In determining whether to buy or rent, your decision-making process should look beyond convenience and on-the-spot price comparisons. You’re also deliberating a long-term financial bet. How you should play it depends on your personal situation and finances. Whether you already have enough saved to buy a home or you are just at the planning stages to buy a home, consulting with a financial advisor or expert to see which option makes more sense for you is a wise move. You’ll need to figure in your own time horizon and financial situation, your passions and hobbies and your feelings about homeownership. Keep in mind that a completely right or wrong answer to the rent vs. buy question rarely exists, just better and worse options depending on your circumstances.

What Are The Benefits Of Renting

It may not a popular opinion, but renting a home has some perks worth considering. Here are the pros of renting a home:

- Cheaper: In general, rent payments tend to be lower than mortgage payments, and may cover other costs, such as utilities, hydro, cable, and internet.

- Flexibility: In the era of Airbnb, renting gifts you the ultimate flexibility. Most leases are one year, but its possible to score an agreement thats month-to-month. You may decide to get a short-term rental through a home-lending website. If youve got wanderlust or commitment-phobia, renting may work best for you.

- Little or no maintenance: You dont have to shell out a wad of cash when the dishwasher breaks or the basement floods. Call your landlord instead!

- Financial freedom: As a renter, youll likely have more free cash to sink into investments and retirement planning.

Don’t Miss: What Is A Future Advance Mortgage

Cost Of Being A Renter

To do a worthwhile side-by-side comparison between the costs of owning and renting a home, we should compare like with like. So lets assume were looking at the same house for each: one worth $260,000.

Landlords typically charge each month between 0.8 percent and 1.1 percent of a homes value. So why not go for the midpoint of 0.95 percent? That would give us a monthly rental of $2,470, which is $29,640 annually.

But, according to the US Census, the average gross rent in the US in 2017 was $1,082. It may not be for a comparable home that the average homebuyer purchases, however. Many renters tend to live in apartments that dont offer the same features as a home.

How To Find Out How Much Youll Pay

Real estate listings generally tell you what the current owner is paying. And that should be fairly close to what youll pay. However, in some locations, property taxes alter when the home changes hands, and that change usually involves an increase.

Mortgage lenders count property taxes in your debt-to-income ratios. They usually take the annual amount and divide by 12 to calculate a monthly cost.

Also Check: Can You Sell House Before Paying Off Mortgage

Reasons Why A Mortgage Payment Is Better Than Rent

Which is better: a mortgage payment or a rent payment?

Depending on who you ask, some say its a waste of money to rent when you could buy. Others insist its cheaper in the long run to make rent payments than mortgage payments.

While there are pros and cons to both options, there are three major benefits to making mortgage payments instead of rent payments that you should know.

The Mortgage Payment Isnt Everything Not Even Close

| Monthly Cost | |

| $1,900 | $1,843 |

While an advertisement might highlight the monthly mortgage payment, especially when mortgage rates are low, its just the tip of the iceberg.

I assume a lot of folks could afford a monthly housing payment of $1,012 in most parts of the country these days.

Thats well below the U.S. Typical Monthly Rent of $1,843 as of July, the latest data reported.

In fact, its nearly half of the typical rent Zillow is reporting, which tells me a mortgage is a screaming bargain, at least on the surface.

But the $1,012 mortgage payment isnt your all-in monthly housing expense. Its really just a starting point.

After all, the typical U.S. home is valued around $300,000, so a $240,000 loan amount assumes a 20% down payment.

One of the biggest reasons more renters arent homeowners is due to a lack of down payment funds.

Many renters could probably muster a $1,012 monthly mortgage payment, but how many could come to the table with $60,000 cash?

Sure, there are low and no down payment mortgage programs out there, but even then theres more to it.

Recommended Reading: What Percent Down Payment To Avoid Mortgage Insurance

Can You Afford The Monthly Mortgage Payments

The greatest difficulty in owning a home is not coming up with a down payment, its being able to afford the monthly mortgage payments. Mortgage payments must be paid each and every month without fail. If you buy more house than you can afford, you will struggle to make the payments. As our neighbours to the south have unfortunately demonstrated, it is easier to get a house then it is to keep it. Recently there have been more foreclosures in the U.S. than at any time in the past 40 years. The amazing thing is that 100% of the homeowners now in foreclosure once qualified for their mortgages. So the issue is not qualifying for a mortgage. It is being able to actually afford a mortgage along with the other costs of home ownership.

Want A Better Mortgage Rate

Compare the best mortgage rates available

- Maintenance on your home

- The cost of credit

The first two of these are simple enough to understand, but the cost of credit is a bit more complex. The cost of credit is either the cost of borrowing money with a mortgage or the opportunity cost of investing your money in a home, rather than more lucrative investments. The former applies to money that you still owe, while the second applies to your home equity. In either case, they are generally around the same amount, depending on factors including your mortgage rate and how much your home increases in price.

Read Also: Can A Mortgage Be Transferred

Is Homeownership A Good Investment

If you have the resources to buy, homeownership is more than likely a smart investment. Every time you make a mortgage payment, you are essentially paying down the principal and taking a step towards owning a piece of property that will appreciate over time. Think of your mortgage payment as an investment or a savings strategy: if you sell your house down the road, youll not only get back the money youve paid out but also likely turn a profit. If you stay put long enough, this can grow into a very healthy nest egg.

Of course, there are no guarantees and even buying a house comes with risks. In the past, CMHC has warned about overvaluation in certain areas of Canadas housing market, but for the most part, buying a house in Canada is a safe bet. Just make sure to buy within your budget and plan to hold onto the place for more than five years.