Selling A Mortgage Note

Selling a mortgage note is legal and can be done as long as the borrower is notified during the application for the loan. Whether the seller is an institution or private entity, they are legally required to notify the borrower of the change.

A mortgage note is usually sold to a buyer when the seller no longer wants to wait for the payments and needs a lump sum of cash immediately. In this case, the current owner of the mortgage note would sell the note, relinquishing his or her claim to the obligations of the borrower. The only difference to the borrower is where and to whom they send their payments.

What Can I Learn From A Mortgage Note

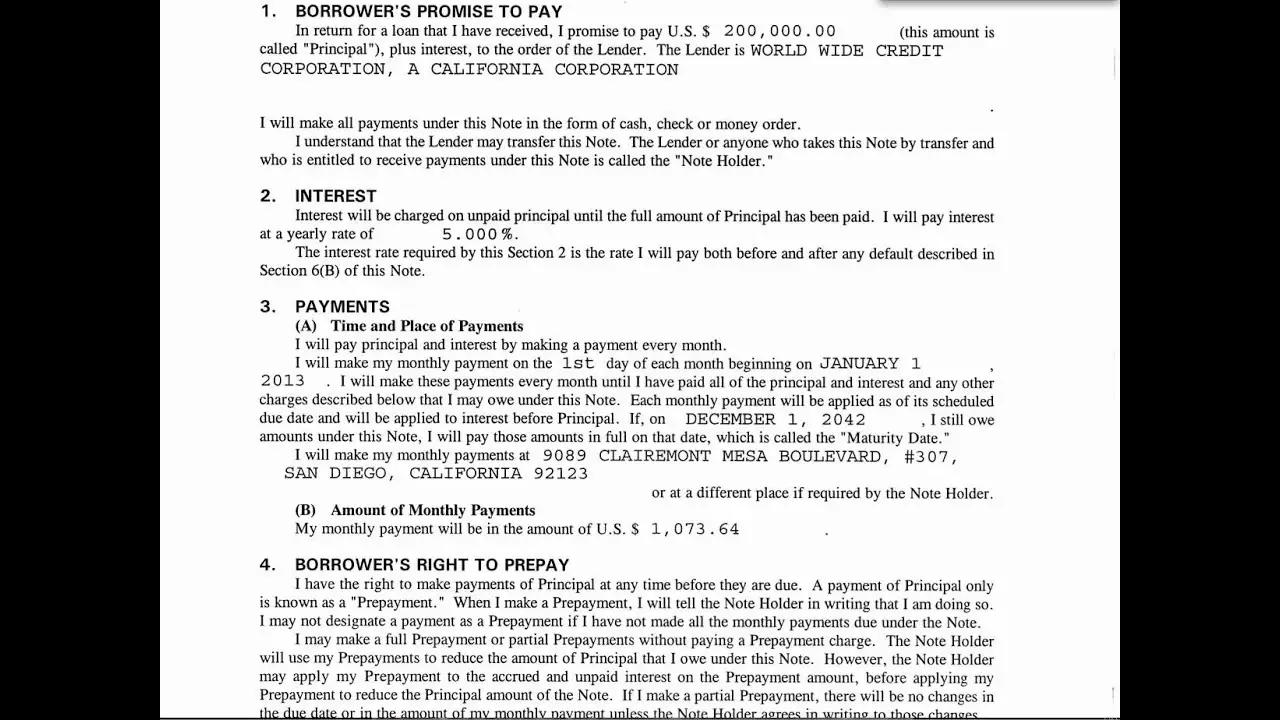

Among the information found in a real estate mortgage note is the following:

- The name of the lender and borrower

- Type of loan

- Amount of your down payment

- Loan amount

- If the loan includes a prepayment penalty

- What happens if you stop making payments

A promissory note is a legal document. If you or the lender don’t comply with the agreement contained within the four corners of this legal document, the other party has the right to sue. For that reason, it’s important to know exactly what the document says, and what you’re promising.

It’s important to know that a mortgage note gives the lender control of the property until you’ve repaid the debt in full. Let’s say you take out a 30-year mortgage and make the monthly payment as promised for 10 years. During the 11th year, you stop making payments. The mortgage company has the legal right to begin foreclosure, repossess the property, sell it, and recoup its loss. Your home acts as the real property collateral the bank needs to feel secure in lending you a large sum of money.

Can A Lender Foreclosure If They Have Lost The Mortgage Note

In some cases, a lender will lose the note during or before a foreclosure proceeding. When a lender cannot produce a note, then they are not able to prove when they took ownership or assignment of the note. A court may dismiss the case as a result.

Florida Statute provides that when a person, who does not have an instrument, is entitled to enforce the instrument if the person seeking to enforce the instrument was entitled to enforce the instrument when a loss of possession occurred, the person cant reasonably obtain possession of the instrument because its whereabouts cannot be determined. If a person is seeking enforcement of a lost instrument, the terms of the instrument and the persons right of enforcement must be proved.

Don’t Miss: 10 Year Treasury Yield Mortgage Rates

How Do I Sell A Private Mortgage Note

The process is simple. Many companies are willing to buy your mortgage note and take on risk because these are collateral-backed securities. You will need the security you received when completing your financing, which is called a mortgage or trust deed.

Once you decide to work with a company that buys mortgage notes, you can call them or complete a form online to get an offer. Offers are based on the current market, an appraisal of the property, the terms of the note and the companys competitive rates.

While fees for using a real estate attorney can cost you thousands, these companies often provide an attorney and directly fund you to give you a competitive rate.

You are not limited to the total amount you have to sell. Your selling options include:

- Sell your entire mortgage note, so you stop receiving mortgage payments and get cash now

- Sell a specific dollar amount, so you receive a lump sum of cash now and later will not receive several of your mortgage payments

- Sell a percentage of each scheduled payment, so you continue to get smaller payments and a lump sum of cash now

If you have questions about what is a fair rate or want a recommendation for companies to work with, were here to help. When you call our hotline, youll be connected with financial experts who will listen to the specifics of your situation before making recommendations and answering any questions you have.

What Are Mortgage Notes

Put simply, a mortgage note is a promise to repay a specific mortgage debt.

A mortgage note is a legal document which describes the terms of repayment of a loan secured by real estate. The terms include a loan amount, interest rate, payback period among other items. A mortgage note is a transferable instrument that can be sold and traded between parties. The entity or person collecting on the payments can choose to sell the mortgage note on the open market for a lump sum of cash. When someone decides to sell a mortgage note, this is called a loan assignment.

Also Check: Chase Recast Mortgage

Fha Loan Requirements Oregon

1. FHA Loan Limits for OREGON Lending Limits for FHA Loans in OREGON Counties $483,000, $618,300, $747,400 County Name1 Unit2 Units3 Units4 UnitsBAKER$420,680$538,650$651,050$809,150BENTON$483,000$618,300$747,400$928,850CLACKAMAS$598,000$765,550$925,350$1,150,000View 33 more rows Oregon FHA Lenders FHA Loans The down payment requirements for an FHA loan is the same in every state. The minimum requirement

Hedge Funds And Private Equity Funds

Hedge funds and private equity funds pool money from investors, letting them amass the millions of dollars of purchasing power needed to directly buy a group of loans from a lender. Most funds have a set strategy for their notes, so they sometimes sell loans that dont fit their parameters on the secondary market.

Read Also: 70000 Mortgage Over 30 Years

Buying Performing Real Estate Notes

In the case of performing notes, you can also find these through the individual investor/sellers that I referenced above who are already skilled at unearthing these assets directly from the note holders themselves.

But if you want to maximize your profits, you can do your own marketing in order to find these individual note holders who are or may want to sell their note for cash.

If Im looking for performing notes today and I have any kind of a marketing budget, Im looking at purchased lists of seller-financed note holders which have already been compiled through the public records and pre-screened by experienced researchers .

You just craft your I will buy your note for cash marketing message and send it out to the list. From our experience, for every 1,000 note holders on the list, somewhere around 2% are seriously interested in selling their note at any given time this means 20 out of 1,000 and also those not yet motivated will become motivated the next month and so on and so on 20 out of 1,000 potentially represents anywhere from $60,000- $100,000 in face profit, which can be well worth the $200 bucks or so .

Mortgage Notes And Deed Of Trust

In some state, mortgages are called deeds of trust.

The two operate essentially the same way, but while mortgages have mortgage notes, which name two parties â borrower and lender, deeds of trust have a separate promissory note that names three parties âborrower, lender, and trustee.

When you take out a mortgage, you hold the property title. The mortgage note, filed with the local government, ensures that if you donât pay, the lender can sue you through the court system to start foreclosure. This is called judicial foreclosure.

If you have a deed of trust, instead of you holding the property title, the trustee hold the title until the loan is repaid. If you donât pay, the trustee may start the foreclosure process without going through court. This is called non-judicial foreclosure.

Get your finances right, one money move at a time. Sign up for our free ebook.

An ebook to e-read while youâre e-procrastinating everything else. Download âFinance Your Futureâ today.

Get your copy

Recommended Reading: How Much Is Mortgage On 1 Million

Negotiate A Purchase Price For The Note

Always make sure you make a written offer that spells out clearly the $ amount that the note holder will come away with and what they should do next if they would like to go with this offer. I ask why they need to get out of the transaction or what they need to get out of the transaction so that I can better tailor the offer and increase the likelihood of it being accepted.

You want them to sign a preliminary agreement which gives you the right to purchase the note if X, Y, etc check out subject to our due diligence . Only when the preliminary agreement is signed will you then begin the due diligence process.

If there are no surprises*, your attorney or servicing company will draft the formal agreement along with the other closing documents

* If the payors credit turns out, upon investigation, to be less than initially stated or if there are issues with title or anything else regarding the mortgage loan or the underlying real estate , the potential transaction will not move past the preliminary agreement and the note purchase will either not take place or else a modified offer will then be made to which the seller must agree before proceeding.

What If The Borrower Pays Off The Mortgage In Full

When a borrower pays off a mortgage, the note holder gives the note to the borrower. This means that the home is theirs, free and clear.

If a borrower refinances a mortgage, the new mortgage pays off the original lender and a new note is created, to be held by that lender until the new mortgage is paid in full. In the event of a refinance, the borrower will not have the note or deed to the home.

Instead, theyll continue to make payments to a third party, and the lender can sell the mortgage note on a secondary market. In this event, real estate investors will still own the mortgage note until the borrower pays off their mortgage.

Also Check: Does Rocket Mortgage Sell Their Loans

Learn The Difference Between A Promissory Note And A Mortgage

Most people who take out a loan to buy a home sign two main documents:

- a promissory note and

- a mortgage .

Homebuyers usually think of the mortgage or deed of trust as the contract they’re signing with the lender to borrow money to buy a house. But the promissory note is the document that contains the promise to repay the amount borrowed. The purpose of the mortgage or deed of trust is to provide security for the loan that’s evidenced by a promissory note.

Here’s a summary of what’s in these documents and how they relate to your home-loan transaction.

Key Elements In A Mortgage Note

A mortgage note usually includes:

- Amount of the loan, also known as the principal

- Interest rate for the loan

- Amount of money for the down payment

- Monthly payment amount

- Due dates for mortgage payments

- Repayment schedule for the loan and an estimated final payment date

- Any other relevant terms of the mortgage

Recommended Reading: How Does Rocket Mortgage Work

Make Mortgage Notes Easier With Adobe Acrobat Pro With E

A mortgage is one of the most important documents in a home buyers life. Buying a single-family home is the largest financial transaction that most people will perform in their lives, and its essential that the information about that transaction be clear, easy for the borrower to access, and compliant with all relevant laws and regulations. Adobe Acrobat Pro with e-sign makes it easy to sign mortgage notes and other relevant documents. E-sign everything from prepayments to promissory notes safely and quickly with technology that cuts down on paperwork and gets the job done faster.

What Is A Mortgage Agreement

The mortgage agreement grants the lender the right to repossess the property if the borrower fails to make timely payments or otherwise abide by the loan’s terms. This document is also known as a mortgage, trust deed, or security instrument.

The mortgage specifies whether the property is being used as a primary home or an investment property. Another requirement of the mortgage agreement might be a ban on or near the property of the use of dangerous chemicals.

See an example of a mortgage.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

How To Buy A Mortgage Note From The Bank

Steve Byrne is founder of EquiSource and has been in commercial real estate investment, management and finance for nearly 40 years.

getty

Investing in mortgage notes is an appealing alternative to purchasing properties outright and becoming a landlord. However, unlike a hard real estate purchase, you dont own the property when you secure a mortgage note. Instead, you become the borrowers new creditor by taking the banks place in the transaction.

If you are looking for passive income without purchasing a physical property, mortgage notes can be an ideal real estate investment. You will receive a monthly income in the form of principal and interest repayments on the underlying mortgage. Depending on your long-term strategy, you have the option to hold the note until maturity or resell it in the secondary market.

What is a mortgage note?

A mortgage note is simply a promissory note used exclusively in real estate transactions. As the name suggests, it represents the borrowers promise to the note holder that they will repay the obligation. These mortgage notes are typically not listed in the public record but are nonetheless legally binding documents.

Once the borrower signs the required documentation and provides the note, the lender holds the paper until the borrower makes the final loan repayment. However, while the loan remains outstanding, the lender can sell the note on the secondary market.

Tips For Getting The Best Value From Your Mortgage Sale

Not all mortgage notes have the same value. While some are difficult to sell, others can be purchased with a low discount rate, which means you get more money.

Here are some insider industry tips for getting the best value from your notes:

- Contracts that include a building and land are more likely to be approved.

- You may receive more value if you sell only a portion of your note.

- Sell payments due in the next few years to get higher value.

- Notes with shorter overall terms will receive a greater cash value.

- Its easier to sell notes with clear terms in the deed and promissory note.

- The value of your mortgage will increase when low interest rates dominate the market.

- It will be difficult to sell a note if a borrower has missed note payments.

- If a borrower has excellent credit, your discount rate will be smaller.

If youre ready to sell your mortgage note but dont know where to start, give us a call. Our financial experts will be able to answer any questions you have about the process, can make recommendations for mortgage note purchasing companies and may be able to provide you an offer over the phone.

Also Check: 10 Year Treasury Yield And Mortgage Rates

Mortgage Notes And Owner Financing

Banks and other lending institutions are not the only ones to issue mortgage notes. In fact, Mortgage notes are often associated with sales of property using owner financing, says Alan Noblitt, owner of Seascape Capital, based in San Diego.

With owner financing, the homeowner not only sells the home, but also loans the buyer the money to make it possible.

Oftentimes, owner financing can be a form of financing for buyers who experience difficulties obtaining a traditional mortgage loan through a bank, Noblitt explains.

The buyer then pays this loan back monthly, plus interest, much like a conventional loan. This type of financing, however, typically lasts only a few yearsat which point the buyer tries to refinance and apply for a conventional loan from a regular bank.

What Is A Real Estate Note

A real estate note, also called a mortgage note, is a promissory note associated with a mortgage or deed in trust. The mortgage allows the lender to take possession of the real estate in the case of a default, while the note is the borrowers promise to pay back the loan.

Notes can be bought, sold, or otherwise transferred as long as there is an outstanding balance. When you purchase a real estate note, you acquire the right to receive the borrowers future mortgage payments.

Related: How to Get Started in the Note Investing Business

Read Also: Chase Mortgage Recast Fee

What To Look For

So how do you know if you can trust a prospective note buyer or broker? Here are some important considerations and things to look for:

There are a few warning signs of which to also be aware when talking to prospective notebuyers, such as: