Low Down Payment Firsttime Home Buyer Loans

Not everyone will qualify for a zerodown mortgage. But it may still be possible to buy a house with no money down by choosing a lowdownpayment mortgage and using an assistance program to cover your upfront costs.

If you want to go this route, here are a few of the best lowmoneydown mortgages to consider.

Why Mortgage Recasting Is Worth It

Crunch the numbers and youll quickly see how recasting pays off.

For example, say your original loan looks like this:

Current mortgage balance and payments

- Balance: $300,000

- Monthly payment: $1,430

- Total interest over life of loan: $215,600

Now, imagine if you had an extra $40,000 saved up. You put it toward your principal via a recast and pay your lender a $200 recast fee.

Your re-amortized loan would look something like this:

New balance and payments with mortgage recast

- Balance: $260,000

| Low up-front cost Pay a lot less interest over the life of the loan-No credit or income re-check | Cannot lower your interest rate Need a large lump-sum payment to be worth it Not all lenders allow recasting |

Can You Roll Closing Costs Into A Conventional Loan

See below: Fannie Mae : The only way to not pay your closing costs out of pocket would be to include a seller credit as a contingency of your offer or speak to your loan officer about a lender credit. … USDA: You can roll the closing costs into your loan only if the house appraises above the purchase price.

Recommended Reading: Who Is Rocket Mortgage Owned By

How Do You Generate Mortgage Leads

10 Lead Generation Strategies for Mortgage Brokers

How do I start an MLO? 4 Key Requirements to Becoming a Mortgage Loan Originator

What do I need to know to be an MLO? To become a licensed loan officer, youll need to be registered with the National Mortgage Licensing System and Registry , complete 20 hours of pre-licensure education courses, and pass the NMLS mortgage license exam, amongst other requirements determined by your state.

How do loan officers start out? Loan officers typically need at least a bachelors degree, preferably in a business-related field such as finance, economics or accounting. Mortgage loan officers need a mortgage loan originator license, which requires passing an exam, at least 20 hours of coursework and background and credit checks.

What Is A No Down Payment Mortgage

A no down payment mortgage is a home loan you can get without a down payment. It can take years to save for a down payment, so no down payment mortgages make it easier for borrowers to afford a home.

No down payment mortgages are only available on government-backed loans. These loans are issued by private lenders and insured by the federal government. Its less risky to the lender because the government foots the bill if you stop making your mortgage payments.

The government offers no down payment mortgages to individuals who need financial help to buy a home. These programs make mortgages available to people with poor credit and borrowers who cant afford a down payment.

Two government programs offer no down payment home loans: the USDA and the VA. Both loans have a specific set of criteria you need to meet to qualify.

If you dont meet the criteria for a USDA or VA loan, you might look into an FHA loan or conventional mortgage. These programs offer reduced down payment options.

You May Like: 10 Year Treasury Yield Mortgage Rates

Freddie Mac Home Possible Loans

If you qualify for a Freddie Mac Home Possible® mortgage, you take out a loan with a 3% down payment. This loan program is designed to help low-income borrowers, and is available to borrowers with less-than-ideal credit.

You can use a Freddie Mac Home Possible® mortgage to apply for a fixed-rate or variable-rate loan. And unlike FHA loans, you can cancel the PMI once you reach 20% equity in your home.

First-time home buyers are required to take a home buyer education course to qualify. Freddie Mac considers anyone who hasnt owned a home in the last 3 years a first-time home buyer.

Fha Loans: For Buyers With Lower Credit Scores And Limited Savings

Federal Housing Administration loans are popular among first-time home buyers since they offer lower credit score and down payment requirements. They often have more flexible lending requirements than conventional loans. Even with a weaker credit score, you may only be required to put 3.5% down. Keep in mind, putting less down could result in a higher interest rate.

All FHA loans require mortgage insurance. It protects the lender against any loss if you fail to pay your mortgage. A mortgage insurance premium includes an upfront fee and a monthly cost . You may be able to roll the upfront fee into your mortgage if you dont have enough cash on hand to pay the upfront fee. But, your loan amount and the overall cost of your loan may increase.

Recommended Reading: Who Is Rocket Mortgage Owned By

What’s The Right Call For You

No matter how much you end up spending on closing costs, think about the best way to pay those fees. If you can afford the extra money at closing, you may decide to just fork it over and be done. But if you’d rather keep more money in savings, you may want to roll closing costs into your mortgage instead. This holds especially true if you’re buying a home that needs a lot of work. You may need that money in the near term to get it into better shape.

Are Closing Costs Based On The Loan Amount Or The Purchase Price

Closing costs can be flat rates and charges are calculated off of the purchase price. Because each state and local municipality has their own specific set of charges, they can vary one to the next. Your lenders charges and other fees are typically based off the loan amount.

For instance, a $200,000 purchase price will usually require a 3.5% down payment. Some lender fees due at closing may be based off of loan amount and other county and state fees will be based off the full purchase price. 3.5% is a typical FHA loan down payment and closing costs will include a private mortgage insurance payment in addition to other related fees.

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youâll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

Increase Your Interest Rate In Exchange For A Credit

Some loans will allow you to increase your interest rate while giving you a credit that offsets some or all of your closing costs. However, keep in mind that this means youll be paying more on all of the money you borrow for the entire life of the loan .

If you hear about zero-down loans, they often work this way. The lender covers your closing costs in exchange for a higher interest rate. Theyre not usually the fantastic deal they seem to be.

You May Like: Reverse Mortgage Manufactured Home

Drawbacks To Recasting Your Mortgage

Finance expert Chane Steiner, CEO of Crediful, says theres a downside to recasting for some.

If you currently have a high interest rate, youll keep that same rate.

Also, not every lender offers recasting. And you may not qualify, depending on your lenders rules.

Make sure your lender is willing to do this. Banks are more likely to, while certain government loans are less likely to, says Steiner.

Can You Borrow Money To Make A Down Payment

Borrowing money to make a down payment is allowed, as long as you provide some of the down payment using the money you already have. The rules about where your down payment can come from are straightforward. Lenders require you to provide a minimum amount from your own resources: 5% of the purchase price up to $500,000, and 10% of the purchase price over $500,000.

If youâre wondering if you can use a home equity line of credit for a down payment, the answer is yes. Any money you borrow thatâs secured by asset, such as a loan secured by your home, RRSP, or life insurance policy, will work. However, HELOCâs are tricky for first-time home buyers, as you can only get one with a minimum amount of equity in a home â typically 20%.

Using other resources, like an unsecured line of credit, is only permitted by some lenders after the minimum has been met. That is to say, once youâve sourced the minimum down payment from savings, you may be allowed to borrow from other sources to increase your down payment. However, carrying debt could put your purchase price out of range if youâre near the top of how much you can afford to buy.

The good news is most Canadians use their personal savings as their primary source of down payment funds. But with mortgage rates in Canada at record-lows, itâs difficult to grow savings without taking on risk. So, is it a good idea to borrow for your down payment? Letâs look at the pros and cons.

You May Like: Mortgage Rates Based On 10 Year Treasury

Gathering A Down Payment

Although there are various ways to satisfy the FHA down payment requirements, drawing the money from your own savings account is usually the easiest. Setting money aside for a down payment can be challenging if youre already struggling to pay your bills. There are small things you can do on a daily basis to make it easier, though.

The first step in any savings plan is to set a goal. Determine how much youll need for a house in your target range and pinpoint how much youll need to save each month to make it happen. Look for small things you can cut in your budget that will add up over time, even if its taking your lunch to work or dropping cable TV. A side hustle can get you even further toward that goal, whether its dog-walking, tutoring or driving for a ride-sharing service.

Seek A Mortgage Lender That Allows You To Put 3% Down

You may be able to find a conventional loan with less stringent mortgage requirements, such as a 3% down payment. These mortgages are designed for low-income homebuyers who cannot afford a bigger down payment, and they can also be combined with down payment assistance programs.

Keep in mind that youll have to pay private mortgage insurance on most home loans with a down payment of less than 20%.

Read Also: Who Is Rocket Mortgage Owned By

How Much Are The Closing Costs

You also need to factor in how much those closing costs are and what your monthly payment will be with them rolled in. If you’re not careful, they could put you above your lender’s loan-to-value or debt-to-income thresholds, which might mean paying for private mortgage insurance or, in some cases, getting stuck with a higher interest rate. Both of these equal extra costs — and a slimmer profit margin to boot.

Who Pays Fha Loan Closing Costs

Every FHA loan includes closing costs, but they can be reduced. While closing costs are generally considered to be the responsibility of the homebuyer, you may not have to pay for everything yourself. One of the biggest advantages of an FHA loan is the ability to avoid large upfront costs. To avoid high closing costs that could derail your home purchase, consider some of these options.

You May Like: Rocket Mortgage Requirements

Low Down Payment: The Piggyback Loan

One final option if you want to put less than 20% down on a house but dont want to pay mortgage insurance is a piggyback loan.

The piggyback loan or 80/10/10 program is typically reserved for buyers with aboveaverage credit scores. Its actually two loans, meant to give home buyers added flexibility and lower overall payments.

The beauty of the 80/10/10 is its structure.

- With an 80/10/10 loan, buyers bring a 10% down payment to closing

- They also get a 10% second mortgage

- This leaves an 80% mortgage loan

- Since youre effectively putting 20% down, there is no PMI

The first mortgage is typically a conventional loan via Fannie Mae or Freddie Mac, and its offered at current market mortgage rates.

The second mortgage is a loan for 10% of the homes purchase price. This loan is typically a home equity loan or home equity line of credit .

And that leaves the last 10, which represents the buyers down payment amount 10% of the purchase price. This amount is paid as cash at closing.

This type of loan structure can help you avoid private mortgage insurance, lower your monthly mortgage payments, or avoid a jumbo loan if youre right on the cusp of conforming loan limits.

However, youll typically need a credit score of 680700 or higher to qualify for the second mortgage. And youll have two monthly payments instead of one.

Are Closing Costs Tax Deductible

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is no. The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

Also Check: Who Is Rocket Mortgage Owned By

Fha Down Payment Options

Once youve determined that you meet the basic requirements, there are some options that can help you collect the money you need. Its important to note that the FHA will trace the source of your down payment, so youll have to provide documentation on request. But you can accept the down payment as a gift from someone else or take it from a retirement fund like a 401.

Unless youre pulling your FHA loan down payment from your own savings, its important to understand the tax repercussions of the source youre using. In addition to the taxes youll pay if you use a retirement account, theres also a gift tax. If your parents give you the money, youll have to pay taxes unless it meets the IRSs exemption. Under the new tax laws, each of your parents can give you up to $15,000 per year without tax consequences.

Home Equity Line Of Credit Combined With A Mortgage

Most major financial institutions offer a home equity line of credit combined with a mortgage under their own brand name. Its also sometimes called a readvanceable mortgage.

It combines a revolving home equity line of credit and a fixed term mortgage.

You usually have no fixed repayment amounts for a home equity line of credit. Your lender will generally only require you to pay interest on the money you use.

The fixed term mortgage will have an amortization period. You have to make regular payments on the mortgage principal and interest based on a schedule.

The credit limit on a home equity line of credit combined with a mortgage can be a maximum of 65% of your homes purchase price or market value. The amount of credit available in the home equity line of credit will go up to that credit limit as you pay down the principal on your mortgage.

The following example is for illustration purposes only. Say youve purchased a home for $400,000 and made an $80,000 down payment. Your mortgage balance owing is $320,000. The credit limit of your home equity line of credit will be fixed at a maximum of 65% of the purchase price or $260,000.

This example assumes a 4% interest rate on your mortgage and a 25-year amortization period. Amounts are based on the end of each year.

Figure 1: Home equity line of credit combined with a mortgage

| $260,000 | $260,000 |

Buying a home with a home equity line of credit combined with a mortgage

- personal loans

- car loans

- business loans

Also Check: How Much Is Mortgage On A 1 Million Dollar House

Why Are Closing Costs Necessary

Youre probably already paying a down payment, not to mention an earnest money deposit to show good faith and a sizable mortgage payment for the foreseeable future. Why do you also have to pay closing costs?

A real estate transaction is a somewhat complex process with many players involved and numerous moving parts. Some states require certain inspections beyond the basic inspection for which you directly pay a home inspector of your choice. Then there are property and transfer taxes, as well as insurance coverage and various additional fees, addressed below.

How Much Do You Need For A Down Payment

You may have heard that you need a down payment equal to 20% of the total cost of the home you want to buy but thats not always the case. How much you actually need for a down payment depends on the type of mortgage youre considering.

Lets look at the different types of mortgage loans and their down payment requirements.

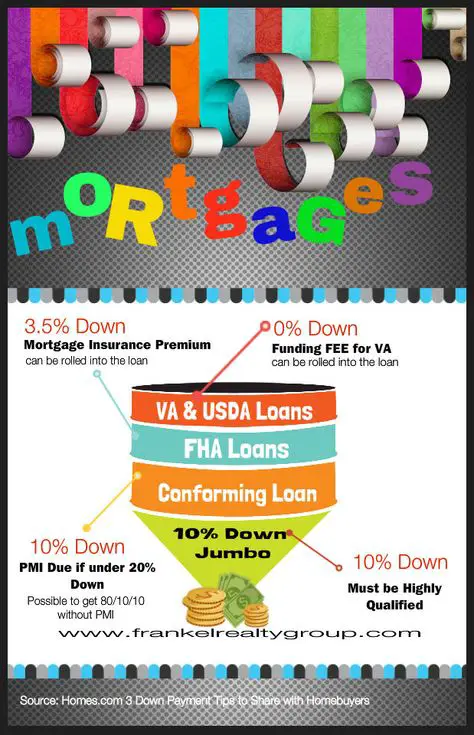

- Conventional loans Depending on the mortgage lender, down payment requirements can be as small as 3%. But if youre putting down less than 20%, most lenders will require you to pay PMI. Conventional loans are the most common, currently making up roughly two thirds of all mortgage loans.

- Federal Housing Administration loans FHA loans are available to borrowers who are putting down as little as 3.5%, but they require mortgage insurance.

- Veterans Affairs loans Current service members, eligible veterans and surviving spouses may be able to get a mortgage with a low, or even no, down payment without having to pay PMI. But borrowers may have to pay an upfront fee for VA loans.

- U.S. Department of Agriculture loans Zero down payment loans are available for eligible applicants, but youll need to pay mortgage insurance to the USDA to use this loan program.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates