Will I Need A Down Payment

It depends on the type of loan.

VA loan

Backed by the Department of Veteran Affairs , VA loans dont require a down payment. To qualify for a VA loan, you or your spouse must have served 90 to 181 days in active service, or over six years in the Reserves or National Guard. The VA also extends loans to borrowers with a family member who died in the line of duty.

Conventional loan

Lenders typically require a down payment of at least 20%. So, for a $100,000 mortgage, youd need a down payment of $20,000 excluding closing costs and taxes. Some conventional lenders will accept down payments as low as 3%, but youll most likely need to purchase private mortgage insurance to secure the loan.

FHA loans

Insured by the Federal Housing Administration, these loans require a down payment of at least 3.5%. For a $100,000 mortgage, that means youll cough up $3,500. The down payment aside, youll pay an upfront mortgage insurance premium, and then continue to make monthly payments until you build 20% equity in your home.

USDA loans

Another type of government loan, USDA loans are backed by the US Department of Agriculture. They dont demand a down payment, but youll need to carry private mortgage insurance until youve built up 20% equity in your home.

Payment Per Thousand Financed

This calculator produces a detailed breakdown of the interest paid per $1000 of a mortgage. Straightforward and easy to use just enter your appropriate loan information.

The default entries provided in the calculator show a $250,000 mortgage at 4.75% interest for 30 years. Additionally, there is a 1.000% percentage point charge, no origination fees and closing costs of $1,200. The Financial Analysis results show total closing costs of $3,700.00 total monthly payments of $469,482.60 total loan cost of $473,182.60 a monthly payment per thousand of $5.26 annual payment per thousand of $63.09 and lifetime payment per thousand of $1,892.73.

To use the calculator, enter the following information:

Loan information: Amount , Interest Rate and Length . Additional information: Points, Origination Fees and Closing Costs.

The calculator will compute the following information:

Total Closing Costs

How To Get A $100000 Mortgage

Getting a $100,000 mortgage isnt as complicated as it seems.

Once youre ready to apply, just follow this nine-step process, and youll be well on your way to buying the home of your dreams:

Learn More: How Long It Takes to Buy a House

Recommended Reading: How Much Is Mortgage On 1 Million

What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

Is It Better To Get A 30

Refinancing from a 30-year, fixed-rate mortgage into a 15-year fixed-rate note can help you pay down your mortgage faster and save lots of money on interest, especially if rates have fallen since you bought your home. Shorter mortgages also tend to have lower interest rates, resulting in even more savings.

You May Like: Reverse Mortgage Manufactured Home

Why Should I Use A Mortgage Calculator

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Also Check: 70000 Mortgage Over 30 Years

What Causes Mortgage Payments To Increase

increasepaymentincreasingmortgagepaymentThe smaller your balance, the less interest you’ll pay to the bank.

Understanding 0% Financing Vs Factory Rebate

Many times dealerships will offer a choice of 0% financing or a factory rebate. How do you know which is better? Figure out the interest you would pay for the life of the loan if you financed with your bank. If the interest is more than the rebate, then take the 0% financing. For instance, using our loan calculator, if you buy a $20,000 vehicle at 5% APR for 60 months the monthly payment would be $377.42 and you would pay $2,645.48 in interest. If the rebate is $1,000 it would be to your advantage to take the 0% financing because the $1,000 rebate is less than the $2,645.48 you would save in interest. Be aware though, that unless you have a good credit rating, you may not qualify for the 0% financing and this option may only be offered on selected models. People with poor credit are a major source of profits because they can be charged far higher interest rates. Some “buy here, pay here” dealerships specifically focus on subprime borrowers.

Read Also: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

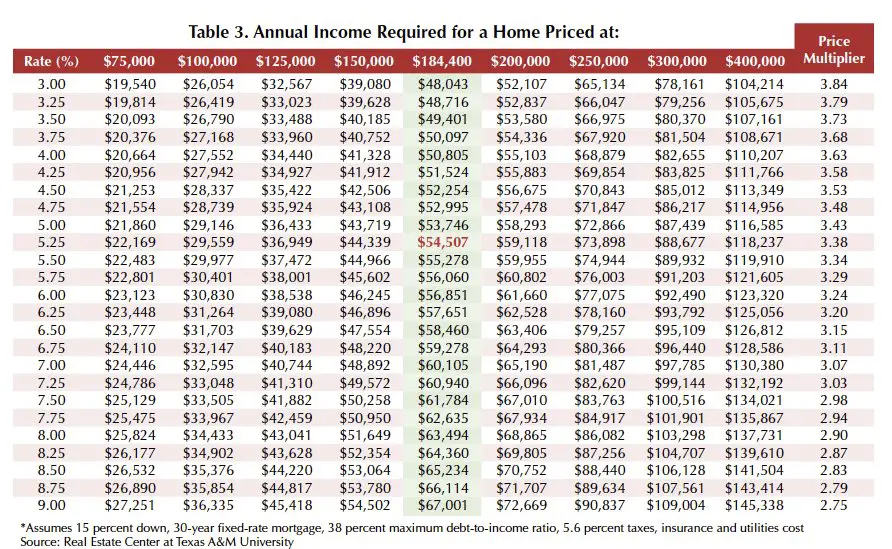

$$$: How Much House Can You Buy For $1000 Per Month

A simple analysis and interesting historical perspective.

========

These days with conventional mortgage rates running about 4% a $1,000 monthly Principle & Interest payment gets you a 30-year loan of about $210,000.

Assuming a 10% downpayment, thats a $235,000 home.

IMPORTANT: That doesnt take into account real estate taxes or insurance that are usually added to your monthly payment and held by the lender in an escrow account.

Heres a chart that gives you a quick way to estimate the mortgage amount over a range of interest rates assuming a $1,000 per month P& I payment.

Just take the interest rate that you can get , draw a vertical line, and ricochet it off the blue line to estimate the corresponding mortgage amount.

Of course, as interest rates go up, the corresponding mortgage amount goes down.

If youve got a budget bigger than $1,000 per month, just divide your budget by 1,000 and multiply times the mortgage amount corresponding to the $1,000 payment charted above.

For example, if your monthly P& I budget is $2,000, just double the mortgage amount on the chart . $210,000 times 2 gets a $420,000 mortgage which gets a $465,000 house, assuming a 10% down payment.

=========

How Much Deposit Is Needed

Lending is based on how much you need to borrow offset against the value of the property and this is generally referred to as the loan to value ratio.

If you were to put down a deposit of £10,000 on a property worth £100,000, you would own 10% of it outright and need to borrower 90% of its value from your mortgage lender so, your LTV ratio would be 90%.

The maximum LTV you will find for a residential property in the UK is 95%, so you will need at a deposit of at least £5,000 to get a mortgage for a £100k house.

Some mortgage lenders may prefer you to put down more than that to lessen any risk involved in the deal, and many might insist upon it if you have any bad credit on your file or the property youre buying has non-standard construction.

Also Check: 10 Year Treasury Vs Mortgage Rates

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

How Much Mortgage Can I Afford

Usually lenders allow a debt to income ratio between 28 and 36%, which means that your total debt monthly payment allowable cannot represent a proportion in your monthly earnings higher than the percentages mentioned.

Apart from a strict math calculation which can easily be done with this mortgage affordability calculator, when estimating how much you can actually borrow you should take into consideration the two aspects we bring into discussion within the next rows:

- Actually the question aims to answer which is the optimal level of payment you can afford in such a way to keep your family safe, to keep a balanced life standard for you and your family and even put some money aside for other unexpected or unwanted events such as health problems, job instability or for accidents. The main idea we try to define in here is that together with your lender you have to understand which is the level of the stable income you expect to have over a period between 10 to 30 years depending on the mortgage term, which are the current needs of your family and which are the potential needs of your family that may negatively impact the monthly budget you forecast.

- The criteria used by the lenders such as the credit score, eligibility or current debt to income are most likely quantitative ones, while when assessing your affordability you have to look both at these plus some qualitative. So, which are the other aspects you have to look at:

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums, In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

You May Like: How To Get Preapproved For A Mortgage With Bad Credit

How Does This Mortgage Affordability Calculator Work

This affordability tool helps you figure out how much you can actually borrow by analyzing 2 scenarios. First one is based on your assumptions on how much you think you can pay while the 2nd what if scenario is based on the monthly payment you can afford by taking account of the desired debt to income ratio.

So, you are requested to fill in the following data:

- monthly gross income meaning your monthly salary and any other stable income you earn on each month

- existing monthly debts if the case, meaning all the other payments you have to make as owner or co-borrower on debts such as: auto loan, other home loan you have, students or credit cards debts

- monthly debt to income ratio you would prefer, meaning either a level of 28% which is a safer approach or a level of 36% which is a riskier level. DTI is a percentage and represents your total “minimum” monthly debt divided by your monthly income.

- payment frequency for your mortgage meaning either monthly or bi-weekly

- assumed term and interest rate you negotiate with the bank or credit institution.

The algorithm of this web form uses the compound interest formula and the importance of the debt to income ratio when assessing someones capacity to repay a mortgage within certain period of time.

Recommended Reading: Rocket Mortgage Conventional Loan

What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

The Internet Has Changed Automotive Shopping

Research Before You Shop

After you have determined the car you want to buy, go to Edmunds.com to find the invoice price. Do not shop without this information in hand. It’s your leverage in the negotiating process. If you don’t have this piece of information, the dealer will work from the MSRP which is a much higher price. Consider MSRP as retail price and invoice price as dealer cost.

Never pay higher than invoice price. And don’t worry, the dealer still makes a profit. There is something called holdback which the manufacturer gives the dealer for each vehicle. It’s usually 2-3 % which they receive quarterly. At times the manufacturer also offers dealer incentives for specific models.

If you have looked ahead and planned your purchase, note that some times of the year are better than others to buy a car. Salesmen work on commission and have monthly, quarterly and yearly goals to meet. So buying at the end of one of these periods can save you money, especially if the salesman hasn’t hit his quota.

Get a Free Online Quote

If you have made a decision on the exact vehicle you want, visiting the dealership late in the day may work to your advantage because everyone is eager to go home. Aside from the information we provide here, you may want to read some personal stories of sale negotiations to better visualize and prepare yourself:

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

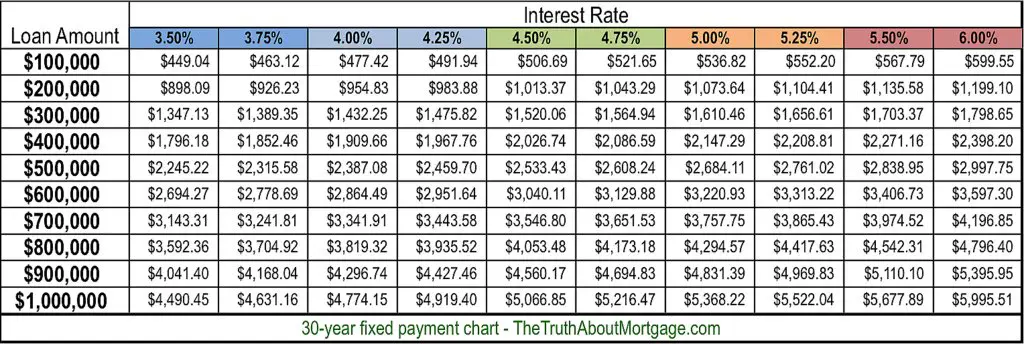

Calculate The Cost Of Borrowing

When you buy a home, you already know that you’re going to pay a lot of interest over the life of the loan. However, you may not be prepared for just how much you are going to have to pay. In many cases you could buy your house two or three times over with the amount you end up paying back to your loan.

A good mortgage calculator like the ones we offer at MortgageCalculator.org can help you determine your monthly payment and your total interest payments. However, looking at the total interest you pay may seem too abstract. For instance, if you pay 5 percent on a $250,000 30-year fixed loan, you will end up paying $233,139.46 in interest alone. Since this amount is spread out over 30 years, it may be harder to contextualize the impact of.

Understanding exactly how much you pay in interest each month and each year rather than cumulatively over several decades can help make the amount seem more concrete and immediate. Breaking it down further by every thousand dollars of your mortgage can help you how it all adds up.

On that same $250,000 loan with 5 percent interest, you would pay $5.41 in interest each month for every $1,000 of the loan. You would pay $64.91 each year for every $1,000 of the loan.

Is there something else you could or should have invested in which would have offered better returns?

Higher Returning & More Diversified Opportunities