Types Of Mortgage Loan

There are different types of mortgage loans depending upon the nature of mortgage. Know them before you apply for one.

- Simple mortgage: It involves personal mortgaging of an immovable property, which bestows upon the lender a right to sell such property for loan recovery in case a borrower fails to repay the amount

- English mortgage: It involves the creation of personal liability for the borrower, whereby mortgage involves property transfer to the lender and recovery, thereby after successful repayment

- Usufructuary mortgage: The arrangement involves the transfer of property possession, allowing a lender to receive rent or any other payment for such property until loan repayment in full

- Mortgage via a deposit of title deed: It comprises the process of a borrower depositing the mortgaged propertys title deed with the lender until repayment is complete

- Conditional sale mortgage: It refers to an arrangement wherein the property is sold to the lender with such sale becoming effective only in the case of repayment defaults. However, successful repayment nullifies the sale arrangement.

If identifying a particular mortgage type within these classifications is not possible, it is termed as an anomalous mortgage.Lenders provide mortgage loans customised to suit diverse funding needs of borrowers. Features, benefits, and mortgage loan interest rates on such advances vary with the credit option and lender selected. They include:

Selecting A Mortgage Term

Choosing between a short-term mortgage or a long-term mortgage can also affect your interest rate. A short-term mortgage generally offers a lower rate, and, as it requires more frequent renewal, you can benefit from lower interest rates when you renew, if rates stay low at your renewal. Long-term mortgages, on the other hand, offer stability, as you wonât need to renew it often. However, long-term mortgage holders may not be able to take advantage of lower interest rates if the market fluctuates.

Before Taking The Plunge

With the historically low mortgage rates of late, its no wonder many buyers want to take advantage of this opportunity. But before you do, assess your financial situation, which will affect your rate as well.

Before taking the plunge, understand your budget and home affordability.

Some suggestions include:

Pay off higher-interest debt. First, if you have debt, youre likely paying a lot of money in interest. This money could be going toward other things like a mortgage payment once you pay off your debt. Second, carrying a large amount of debt means you lower your chances of approval for a home loan. Save more for a large down payment. Buyers who put down less than 20% may end up paying private mortgage insurance, which typically costs between 0.5% and 1.5% of the loan amount annually. Review your credit history and check for errors. The government offers a free annual credit report, which will help you review your credit history. However, it doesnt show your credit score. If you spot any errors, be sure to address them to enhance your ability to get a home loan.

Making sure your finances are in order before you apply for a mortgage will likely help you obtain a better interest rate and loan terms.

You May Like: Can You Do A Reverse Mortgage On A Condo

Interest Rates Are Always Moving

Interest rates. They can drive you crazy. It may seem like they go up and down on their own, but there is a bit of a method to the madness. Indicators exist in the market that can help you predict what these rates are about to do.If youre thinking about buying a car, refinancing your home or have a big purchase around the corner its always in your best interest to understand market conditions in order to poise yourself for success. In this blog, well look at how interest rates are set, what makes them fluctuate and some of the biggest economic indicators of an interest rate move.While you should always consult your lender to get the most accurate information on rates and the market, these tips and tricks will help you have a better grasp of what to watch for!

Consider Private Mortgage Insurance

Though they do count towards the overall cost of your mortgage, closing costs are a one-time hit. But there’s another bite that keeps on biting. If your down payment is less than 20%, youre considered a higher risk, and you may be required to carry private mortgage insurance, or PMI.

This makes you a safer bet for the lender. Trouble is, you’re the one paying for itto the tune of 0.5% to 1% of the entire loan each year. That can add thousands of dollars to what it costs to carry the loan. If you do end up having to pay for PMI, make sure it stops as soon as you’ve gained enough equity in your house to be eligible.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

Hur Mycket Mste Du Tjna P Ett R Fr Att Ha Rd Med Ett Hus P 500000 Xnumx Dollar

Hur mycket måste jag tjäna för att ha råd med ett hus på $500,000 20? Som en allmän regel bör din bolånebetalning inte överstiga en tredjedel av din månadsinkomst. Så med en handpenning på 30 % på ett 4-årigt bolån och en ränta på XNUMX %, skulle du behöva göra minst $90,000 XNUMX ett år tidigare beskatta.

Hur mycket bolån kan jag få om jag tjänar 30000 28 om året? Om du skulle använda XNUMX%-regeln hade du råd med en månatlig betalning av bolån $700 i månaden med en årlig inkomst på 30,000 2.5 USD. En annan riktlinje att följa är att ditt hem inte får kosta mer än 3 till 30,000 gånger din årslön, vilket innebär att om du tjänar 90,000 XNUMX USD per år bör din maximala budget vara XNUMX XNUMX USD.

Hur mycket inkomst behöver jag för en 400k inteckning?

Vilken inkomst krävs för ett bolån på 400k? För att ha råd med ett hus på 400,000 55,600 dollar behöver låntagare 10 30 dollar i kontanter för att lägga ner XNUMX procent. Med ett XNUMX-årigt bolån bör din månadsinkomst vara minst $ 8200 och dina månatliga betalningar på befintliga skulder bör inte överstiga 981 USD.

Is 325% A Good Mortgage Rate

Let’s preface this by mentioning that some borrowers are scoring rates in the 2s. Others, meanwhile, also timed the process right and locked in a 3% mortgage rate.

But don’t be discouraged if you end up with a 3.25% rate. Even a 0.75% difference, when compared to a 4% rate, will prove to be worthwhile in the long run.

You May Like: How Much Is Mortgage On 1 Million

Whats Going To Happen To Interest Rates In 2022

Some experts believe that the base rate wont increase this year some say its unlikely so close to Christmas while others cite the new Omicron variant and the potential impact that could have as a reason why the rise will be delayed until next year.

But whenever the first rate rise happens there is already speculation there will be two further rate rises next year, with the base rate reaching 1% by the end of 2022.

A rising base rate means youll pay more on your mortgage each month if youre on a tracker mortgage or if youre on your lenders SVR and your lender passes on the increase. If youre on a fixed deal it wont impact you until you come to remortgage.

Find out more in our guide How can I protect myself against rising interest rates?

Other Factors Besides Your Credit Score

Remember, FICO is looking only at the difference your credit score makes in the chart above.

Lenders will check more than your credit history when you apply for a new mortgage loan. They will also need to know your:

- Debt-to-income ratio This ratio measures how much of your income goes toward existing monthly debts

- Income stability Homebuyers need to show W2 forms or pay stubs to prove a steady income. If youre selfemployed, you can provide tax forms or even bank statements

- Down payment Most loans require a minimum down payment amount . Putting more than the minimum down could help lower your interest rate

- Home equity for refinancing Mortgage refinance lenders will check your home equity which, measures how much your home value exceeds your mortgage debt. Having more equity can lower your rate

In short, the better your personal finances look, the lower your mortgage interest rate will be. Taking steps like raising your credit score or savings for a bigger down payment before you buy can help you get the best rates available.

Don’t Miss: Rocket Mortgage Qualifications

Whats The Right Interest Rate For You

Its important to understand interest rates, because they are a major determining factor in how much your debt will cost you. The right rate for you depends on your credit history and goals.

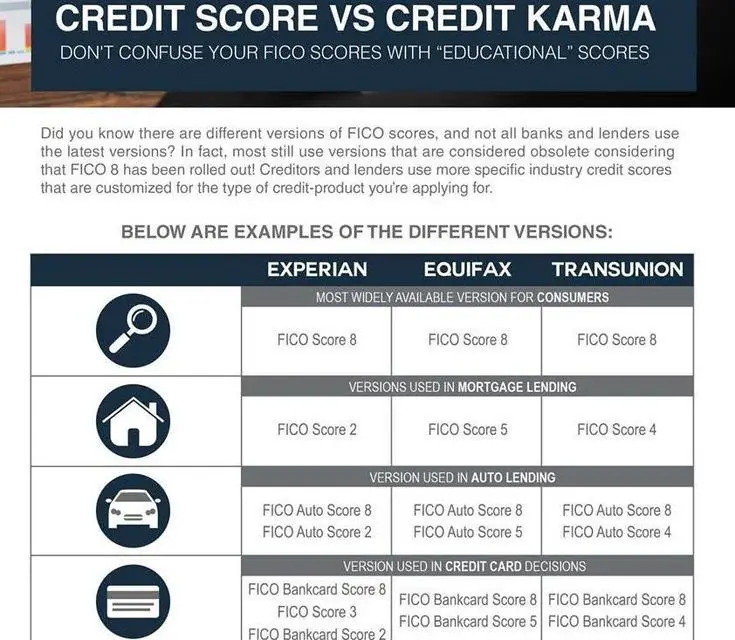

Before you apply for loans or settle for what might seem like a high rate, ensure you know what your credit score is. You can to get access to 28 of your FICO® scores. These are often the types of scores mortgage lenders, auto lenders, and credit card lenders look at, so youll be better prepared to understand the offers youre being made.

One More Thing To Consider: The Trade

As you shop for a mortgage, youll see that lenders also offer different interest rates on loans with different points.

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs.

- Points, also known as discount points, lower your interest rate in exchange for an upfront fee. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

- Lender credits might lower your closing costs in exchange for a higher interest rate. You pay a higher interest rate and the lender gives you money to offset your closing costs. When you receive lender credits, you pay less upfront, but you pay more over time with the higher interest rate. Keep in mind that some lenders may also offer lender credits that are unconnected to the interest rate you payfor example, a temporary offer, or to compensate for a problem.

There are three main choices you can make about points and lender credits:

Learn more about evaluating these options to see if points or credits are the right choice based on your goals and financial situation.

You May Like: Reverse Mortgage For Condominiums

Factors That Can Affect Your Personal Interest Rate

Itâs important to understand that the best mortgage rate you qualify for may change depending on your unique borrowing profile. Here are some of the factors that influence what mortgage rate you qualify for:

The type of mortgage: If your mortgage is for a refinance, rather than a purchase or renewal, youâll be eligible for higher rates. For individuals with an existing mortgage who have good credit and more than 20% equity in their homes, in addition to refinancing, you can also explore a home equity line of credit .

Your down payment: If youâre purchasing a home andyour down payment is less than 20% of the purchase price and the value of the home you are purchasing is less than $1 million, youâll be required to purchase mortgage default insurance . This insurance is added to your mortgage amount and, while it will cost you money, it will result in a lower mortgage rate as your mortgage is less risky for your lender. If youâre renewing your mortgage, in order to be eligible for the lowest mortgage rates you would have needed to purchase CMHC insurance on the original mortgage.

Your intended use of the property: Your mortgage rate will be higher if you plan to rent your property out vs. live in it as your primary residence.

House Prices Vs Interest Rates

Which should drive your decision to buy a new home? There are so many elements that can determine what you will end up paying for your home in the end. When house prices are low, interest rates tend to be higher and vice versa. In either landscape, there are different aspects to consider before you buy a mortgage.

Also Check: Rocket Mortgage Loan Types

How To Get The Best Mortgage Rate

Several things factor into your mortgage rate besides what’s going on in the world. For example, you won’t receive anywhere close to the lowest rate possible if you have poor credit. That’s why we suggest improving your score before talking to a lender.

Other than credit score, lenders want to see how much debt you’re handling at a given time. More specifically, they’ll pay close attention to your debt-to-income ratio, a figure that measures how much of your income goes toward recurring debts. You can improve your DTI by paying down these balances and avoiding new high-interest debt before applying for a mortgage.

Additionally, the lender, loan program, and term you choose all affect your rate in one way or another. No two borrower situations are the same, which is why you shouldn’t get caught up in obtaining a lower rate than your friend or neighbor. Maintain a goal of doing what’s best for you and your budget and that’s it.

There’s no right or wrong answer in terms of deciding when to lock your mortgage rate. That’s why it’s important to find a dependable lender who you can rely on for guidance. This person should go above and beyond to find the most sensible loan program for your needs and at the lowest rate.

The mortgage industry continues to evolve every day. From desktop appraisals to drive-thru closings, lenders are doing whatever is necessary to ensure a smooth, safe transaction.

Quanto Devi Guadagnare In Un Anno Per Permetterti Una Casa Da 500000 Dollari

Quanto devo guadagnare per permettermi una casa da $ 500,000? Come regola generale, la rata del mutuo non dovrebbe superare un terzo del tuo reddito mensile. Quindi con un acconto del 20% su un mutuo di 30 anni e un tasso di interesse del 4%, dovresti fare almeno $ 90,000 un anno prima imposta.

Quanto mutuo posso ottenere se guadagno 30000 euro all’anno? Se dovessi utilizzare la regola del 28%, potresti permetterti una rata mensile del mutuo di $700 al mese con un reddito annuo di $ 30,000. Un’altra linea guida da seguire è che la tua casa non dovrebbe costare più di 2.5-3 volte il tuo stipendio annuo, il che significa che se guadagni $ 30,000 all’anno, il tuo budget massimo dovrebbe essere $ 90,000.

Di quanto reddito ho bisogno per un mutuo da 400k?

Quale reddito è richiesto per un mutuo da 400k? Per permettersi una casa da $ 400,000, i mutuatari hanno bisogno di $ 55,600 in contanti per mettere giù il 10 percento. Con un mutuo di 30 anni, il tuo reddito mensile dovrebbe essere almeno $ 8200 e i tuoi pagamenti mensili sul debito esistente non dovrebbero superare $ 981.

You May Like: Monthly Mortgage On 1 Million

Kotak Mahindra Bank Slashes Home Loan Rates

Kotak Mahindra Bank has recently cut down its home loan interest rates. The rate of interest now starts at 7% p.a. and is at par with the rates of the State Bank of India .

The bank has also announced that customers can save up to Rs.20 lakh in the case of balance transfers from other lenders. The new rates have been announced as a part of the Khushi Ka Season festive offers of the bank.

22 October 2020

Vad Anses Vara Ett Hgt Boln

Om din belåningsgraden är större än 80 %, anses det vara högt, och det utsätter långivaren för en större risk. Detta kan resultera i en högre bolåneränta, särskilt i kombination med en lägre kreditvärdighet.

Även Vilket är det högsta belåningsvärdet? Ju högre belåningsgraden är desto högre finansieras andelen av en fastighets köpeskilling. Belåningsgraden är ett riskmått som används av långivare när de bestämmer hur stort ett lån som ska godkännas. För ett bostadslån är den maximala belåningsgraden typiskt 80%.

Vilken LTV behövs för att refinansiera?

Tumregeln är att din LTV-kvot ska vara 80 % eller lägre till refinansiera. Det betyder att du har minst 20% eget kapital i ditt hem. Du kan dock kunna refinansiera med ett högre förhållande, särskilt om du har en mycket bra kreditvärdighet.

Vad är ett bra LTV UK? Som en allmän tumregel bör ditt idealiska förhållande mellan lån och värde vara någonstans under 80%. Allt över 80 % anses vara en hög LTV det finns gott om bolån tillgängliga för personer med LTV på 80, 90 eller till och med 95 %, men du kommer att betala mycket mer på ränta.

Don’t Miss: Does Chase Allow Mortgage Recast

How Do I Calculate Mortgage Payments

For much of the population, buying a home means working with a mortgage lender to get a mortgage. It can be difficult to figure out how much you can afford and what youre paying for.

Using a mortgage calculator can help you estimate your monthly mortgage payment based on your interest rate, purchase price, down payment and other expenses.

To calculate your monthly mortgage payment, heres what youll need:

- The home price

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

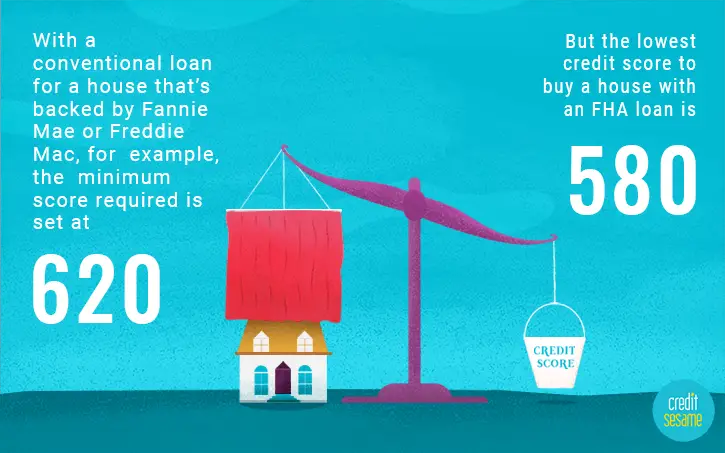

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

Also Check: 70000 Mortgage Over 30 Years