Chapter 7 Bankruptcy Puts The Brakes On Foreclosure

Filing for Chapter 7 bankruptcy may not free you from making your mortgage payments, but it can buy you time to get back on your feet. That is because the minute you file your petition for bankruptcy, the court will enter an automatic stay on all debt collection proceedings. As long as the foreclosure sale hasnt actually happened yet, your home cannot be sold until after the bankruptcy is completed. Mortgage companies may file a motion to lift that automatic stay and sell your home in a Sheriff sale, but most will simply wait until the bankruptcy process is complete.

That is because filing for bankruptcy puts the brakes on a foreclosure sale, but it doesnt stop it entirely. Unless you make good use of your time, you should expect for the Sheriffs sale to be rescheduled after the bankruptcy process is complete.

Partial Equity Of A Junior Mortgage

There is one exception to avoiding a 2nd mortgage where there is some small equity. If under the terms of the mortgage the final payment is due within the term of the Chapter 13.

Example: The mortgage on its own terms is due to expire in 4 years and its current balance is $12,000. After deducting all senior liens there is equity of $3,000. A Chapter 13 can be constructed for a term beyond the 4 years to pay the $3,000 in full and the balance of $9,000 to be paid as a general unsecured claim with, hopefully, a small dividend. The term of the Chapter 13 must go beyond the 4 year term of the mortgage.

When Do Bankruptcy Waiting Periods Start

Understand that the waiting periods after Chapter 7 bankruptcy dont start until a bankruptcy court discharges or dismisses your bankruptcy.

Thats at the end of the bankruptcy proceedings typically 4-6 months after you first file.

If youre counting down the days until you can buy a house after bankruptcy, be sure to start your calendar on the correct date of the discharge or dismissal because it will make a big difference in when you hit the two-year mark.

You May Like: Do Mortgage Lenders Need Bank Statements

Offer To Settle Your 2nd Mortgage

So, in summary, making an offer to settle the balance on the 2nd after a Chapter 7 Bankruptcy, should aim to pay . However if the house is seriously upside down on the 1st mortgage already, you may be able to offer lower. But it does have to be paid in one payment once they accept and you must get them to accept it in advance in writing. You must not pay them unless you have it from them in writing that they will accept your settlement offer and that they will RELEASE the lien once they get the payment.

Ill say it again just in case you didnt hear me, they must agree to RELEASE the lien in writing once they get your payment. If they dont agree to release the lien, dont send the check.

Usually You Cannot Strip Junior Liens Second Mortgages Or Helocs In Chapter 7 Bankruptcy But You Might Be Able To In Alabama Florida And Georgia

If you satisfy certain requirements, you can eliminate a second mortgage, home equity loan, home equity line of credit , or other junior lien from your house in bankruptcy through a process called lien stripping. In most jurisdictions, lien stripping is not allowed in Chapter 7 bankruptcy cases . But the 11th Circuit Court of Appeals has recently decided that you may be able to use lien stripping in a Chapter 7 case.

Recommended Reading: How Much Will My Va Mortgage Be

Consult With Oaktree Law For Second Mortgage Help

OakTree Law specializes in bankruptcy and debt services. Our Los Angeles debt attorney can assess your financial situation and explain suitable options to help you make the best possible decisions. We can help eliminate second mortgage debt in various ways, including filing for bankruptcy, which can avoid foreclosure and repossession. To learn more and speak to a Los Angeles or Orange County debt attorney, request a free evaluation online or call .

Thank you so much OakTree Law for everything you did for me. What a year this has been and what we each have been through. May 2012 be an amazing year for both of us. I know you will be so blessed for all you do for others. Thank you.

Debbie, Los Angeles

OakTree Law has a team of members that go above and beyond the call of duty to get the job done. Having little knowledge of real estate law and being bullied by my mortgage company prior to, OakTree Law made me feel confident and comfortable throughout the process. If you need help with a bankruptcy, loan modification or anything real estate law related, I suggest you give them a call. Friendly service and they have your back from start to finish and beyond.

Artis H., Compton

Debra T., Santa Ana

Mike & Lisa G., Riverside

Fantastic firm. Made me feel very safe in their hands.

Rachel H., Long Beach

John H., Fullerton

The Need For Advice From A Bankruptcy Lawyer

If your home is tied to senior and junior liens, you may have to consider this rule when you consider applying for Chapter 7 bankruptcy. Bankruptcy proceedings may offer relief to debtors but it is covered by hundreds of legal provisions with technical meanings and loopholes that a non-lawyer may miss.

In Vancouver, Washington, Attorney Erin McAleer has years of experience in Chapter 7 bankruptcy, helping individuals overcome their financial challenges through bankruptcy proceedings. He holds a Superb Rating of 10.0 from Avvo and is listed by the National Trial Lawyers as one of the top 40 attorneys in Washington under age 40.

We invite you to call us today at to schedule a consultation and discuss your individual situation.

Also Check: How Much Mortgage Can I Really Afford

Refinancing Your Second Mortgage

Yes, it may be an actual option. And as unlikely as it may seem or feel, if you have home equity now then a refinance may work but only if you have good enough credit. But how do you manage that after having filed a Chapter 7 Bankruptcy? Believe it or not, credit repair services use the same techniques outlined in the following Guide. The Attorneys Guide to Credit Repair. Its Fast, Easy and Guaranteed.

In fact many use the very same Guide. Follow this guide to repair your credit fast, including how to write letters to settle debts such as your 2nd Mortgage. Download it Now and Get Started Right Away with The Attorneys Guide to Credit Repair. Its Fast, Easy and Guaranteed.

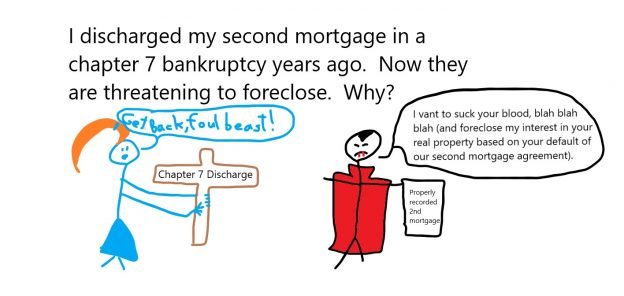

Chapter 7 Wipes Out Mortgage Debt Not Mortgage Liens

A mortgage loan is a secured debt. When you entered the loan contract, the lender created a lien on the property by taking the home as collateral to secure payment of the loan. If you don’t pay your mortgage, the lender can enforce its lien by foreclosing on the house. It’s the lien that makes the mortgage a secured debt.

Even though your Chapter 7 discharge wipes out your obligation to pay back the loan, it doesn’t eliminate the mortgage lien. If it did, everyone could file bankruptcy and then own their homes free and clear. As a result, if you want to keep your home, you need to continue making timely mortgage payments .

Don’t Miss: Are Points Worth It Mortgage

Heres How They Are Treated By The Bankruptcy Court

HELOC in Chapter 13 on Bankruptcy: In Chapter 13, paying entities are required to make payments to the main mortgage lender and trustee of bankruptcy. The trustee distributes these payments to priority debtors. After the HELOC case is over, you can eliminate . The lender will receive a percentage of the trustees payments during the case.

HELOC in bankruptcy in chapter 7: in chapter 7 you can cancel a debt under a share credit line, but you cannot cancel a pledge on your home. In fact, the HELOC lender may still be able to close access to the archiving entitys home after bankruptcy . One way to avoid exclusion after the end of Chapter 7 is to confirm the payment to the HELOC lender during bankruptcy.

Second Mortgages in Chapter 13: Second mortgages that are no longer secured by the value of the house may be written off in Chapter 13 bankruptcy. Underwater houses may have a second or third mortgage that is no longer secured by the value of the house However, repayment of the second mortgage will not affect what the debt collector owes for the first mortgage.

Mortgage Options After Bankruptcy

Consumers have multiple options for so-called bankruptcy home loans. Once youve satisfied the waiting period, your next step is to find a lender willing to work with borrowers who have a bankruptcy in their credit history. Fortunately, this isnt as difficult as you may think.

Heres an overview of the loan options and requirements for mortgage approval after bankruptcy.

Conventional loan

Conventional mortgages follow guidelines established by Fannie Mae and Freddie Mac the two main agencies that buy and guarantee most mortgages in the U.S. Conventional loans have either a fixed- or adjustable interest rate, and terms typically range from 10 to 30 years.

Getting approved for a conventional mortgage after bankruptcy requires meeting the appropriate waiting period and demonstrating that youve reestablished your credit. This means paying your bills on time and keeping low balances on revolving credit accounts.

Requirements

- 3% minimum down payment

FHA loan

An FHA loan is a mortgage insured by the Federal Housing Administration. These loans typically offer lending requirements that are more flexible than conventional mortgages. FHA loans are available for 15- or 30-year terms, and rates may be fixed or adjustable.

Requirements

- One- to two-year waiting period

- 580 minimum credit score

- 3.5% minimum down payment

VA loan

Service members, veterans and their families may be eligible for a loan backed by the U.S. Department of Veterans Affairs .

Requirements

USDA loan

Requirements

Don’t Miss: How Much Can You Get A Mortgage Loan For

How Can You Eliminate Your Second Mortgage By Filing For Chapter 13 Bankruptcy

Many people can eliminate their second mortgage simply by filing for Chapter 13 bankruptcy. This is because of a process that is known as lien stripping.

You may qualify for lien stripping if the current market value of your home is less than the amount of your first mortgage. For example, say your first mortgage is worth $400,000 and your second mortgage is worth $100,000. If your homes current market value is less than $400,000, you may qualify for lien stripping in a Chapter 13 bankruptcy proceeding.

If you qualify for lien stripping, the court will convert your second mortgage from a secured debt to an unsecured debt. Basically, this means your second mortgage will be treated the same way that credit card debt, medical debt, and other unsecured debt is treated in a Chapter 13 bankruptcy proceeding.

The court will require you to create a repayment plan that explains how you will make monthly payments on your debts. Once the plan is approved by the court, you will be required to comply with its terms. This means you will need to make monthly payments on these debts over the course of three to five years. At the end of this time period, the court will discharge whatever debt remains. So if you still owe $90,000 on your second mortgage, it will be discharged at this time, meaning you will no longer have to pay this balance.

Whats The Difference Between Chapter 7 And Chapter 13

If youre thinking about filing bankruptcy, its important to understand your options. Chapter 7 bankruptcy and Chapter 13 bankruptcy are the bankruptcies that people most frequently seek out.

Chapter 7 bankruptcy is also known as total bankruptcy. Its a wipeout of much of your outstanding debt. Also, it might force you to sell or liquidate some of your property in order to pay back some of the debt. Chapter 7 is also called straight or liquidation bankruptcy. Basically, this is the one that straight-up forgives your debts .

Chapter 13 bankruptcy is more like a repayment plan and less like a total wipeout. With Chapter 13, a borrower files a plan with the bankruptcy court detailing how they will repay their creditors. The borrower will pay some debts in full while paying otherspartially or not at all, depending on what they can afford. Chapter 7 = wipeout. Chapter 13 = plan.

Don’t Miss: How Much House Is A 1200 Mortgage

Contact Our Kerrville Bankruptcy Attorney

If you are a homeowner who is having trouble paying debts and meeting other financial obligations, you will want to determine the best steps you can take to avoid potential foreclosure. At Law Offices of Chance M. McGhee, we can explain your options for using bankruptcy to address your debts, and we will help you find solutions that will ensure that you can maintain ownership of your home. Contact our today at 210-342-3400 to arrange a free consultation and take your first steps on the road to debt relief.

Discharge Your Second Mortgage With The Help Of Our Firm

The amount of debt relief available to people who need it is enormous. In order to successfully obtain a discharge of your debts, and to ensure that your second mortgage can be considered an unsecured and dischargeable debt, you need to work with an experienced legal team. We can guide you through the Chapter 13 bankruptcy process. While our firm can help you determine if you are fully eligible to eliminate your debt through Chapter 13 bankruptcy, your home must be worth less than you owe in order to qualify. If you would like more information about the ways in which you can manage your debts, eliminate your second mortgage, and take control of your finances, contact a Charlotte bankruptcy attorney from Law Office of Jack G. Lezman, PLLC to schedule a free case evaluation.

Read Also: Can You Undo A Reverse Mortgage

Ps In January 2015 Bank Of America Forgives The Whole Amount

Ahmad filed bankruptcy with me in 2011. He got the best possible dealBank of America offered to forgive the whole amount of his seocnd mortgage.

We had a BOA home equity line of credit for around $33K that was included in our BK back in 2011. I received a letter today from BOA that they have agreed to forgive this amount and we dont owe them a penny on that. I had a question will that show up in our credit and will it hurt our credit in any way? It took us few years to build our credit and get back up and we dont want this to damage our credit but we are grateful that is being forgiven..

Dont worry, Ahmad, this will nto hit your credit. and not have any tax consequences either. And Ill straighten it out if it does.

This nerves of steel strategy does not always work but it works a lot.

How To Get Out Of My Second Mortgage

Filing for bankruptcy can eliminate your second mortgage debt. If an appraiser determines the value of your home is less than your first mortgage, or is upside down, Chapter 13 lien stripping may be possible. The bankruptcy court essentially converts your second mortgage into an unsecured debt. When it does, the lender removes its lien from your property. This process only works with junior liens, like those associated with second and third mortgages.

However, the second mortgage lien cannot be stripped through bankruptcy if its partially secured by equity, and the value of your home exceeds the balance you owe on the first mortgage.

Stripping a second mortgage with a Chapter 13 bankruptcy requires a court proceeding. The lender may object to stripping your second lien. If so, a hearing will be set by the bankruptcy court, in which the debtor and their creditor can present relevant evidence. The evidence presented may include the fair market value of your home, and that it lacks equity. If the balance of your first mortgage and value of your home are only slightly different, a second appraisal may be ordered.

Lien stripping usually requires a special motion by the court. The typical scenario is not to strip the lien until the bankruptcy is discharged, but as to when a second mortgage is stripped from your home, the courts dont always agree.

You May Like: Should You Refinance To 15 Year Mortgage

Getting A Mortgage After Bankruptcy

You may not be able to get a mortgage during bankruptcy, but you can get one after bankruptcy if you otherwise qualify. Nonconforming loans like those from government agencies may not even have a waiting period.

Next up, learn what you need to know if youre trying to buy a new house or refinance your current home after a bankruptcy.

Before diving into specifics around guidelines, its also worth noting in general that a bankruptcy of any kind has a major negative impact on your credit. Its not impossible to move forward and get a mortgage down the line, but you may have some recovery to do. A secured credit card or credit builder loan can help. Discover the keys to buying a house with bad credit.

Using Chapter 13 Bankruptcy To Discharge A Second Mortgage

By filing Chapter 13 bankruptcy, homeowners are able to reorganize their debts into a consolidated and more feasible payment plan. Depending on your unique financial situation, this plan may last for either three or five years. At the end of the Chapter 13 plan, bankruptcy courts can grant a discharge of the remaining debts you owe, including any second mortgages. This means that when homeowners successfully comply with the terms and conditions of Chapter 13 bankruptcy plans, second mortgage debts will only have to be paid for pennies on the dollar.

Eliminating second mortgages can not only provide peace of mind to homeowners who may have felt hopeless about their seemingly insurmountable debts but also allow for new financial flexibility. Free from the burdens of preexisting debts, including those associated with second mortgages, homeowners may find new opportunities to gain control of their finances and work toward a brighter economic future. Lenders and creditors will also be more willing to negotiate loan modifications once second mortgages have been stripped away.

Also Check: How Many Times Can Refinance A Mortgage