Could I Get Rejected For A Mortgage Because Of My Bank Statements

Mortgage lenders can reject your application based on what they see in your bank statements.

Usually, theyll just need to clarify something with you or get some additional information, but depending on the issues, it could potentially be the difference between getting accepted or rejected.

Here are the key things to look out for on your bank statements that could negatively affect your mortgage application:

- Bounced payments and cheques

- Large deposits that are unaccounted for

- Evidence of excessive gambling

- Evidence of being overdrawn for long periods of time

- Evidence of paying off a payday loan or other forms of undisclosed borrowing

- Its also advised to avoid any large purchases in the months leading up to your mortgage application as it can be a red flag for some lenders

And it goes without saying that if you cant prove your income streams or your deposit with your bank statements, then you wont be approved for your mortgage.

How Underwriters Analyze Bank Statements On Regular Deposits

One of the things that a mortgage loan underwriter will analyze is regular deposits.

- For example, with regular payroll check automated deposited electronically to a bank account every other week, that will be looked at as normal and no further explanation is necessary

- The mortgage underwriter will look at the electronic deposit and notice being payroll check being electronically deposited by employers payroll service and that is okay

- If there are other regular deposits on a regular basis to the bank account, whether it is electronically or a physical deposit, the underwriter will ask and question what the source of the deposit is

Borrowers with part-time jobs that are being cashed by the employer and depositing that cash, that cash deposit cannot be used.

Bank Statement Loan Related Questions

Do I have to be self employed to get a bank statement loan?At least one borrower on the loan must be self employed for a minimum of two years. There can be a second borrower that is a W2 wage earner.

How to bank statement lenders verify that you are self employed?Bank statement lenders will ask for your business license if applicable, they will look for a business listing online, your website and also a written letter from your accountant verifying that you have been in business for a minimum of 2 years.

Does the home have to be my primary residence?Bank statement lenders will finance your primary residence, a vacation home or an investment property too. Up to 4 unit properties and it can also be a condo. However, the down payment requirements may be different for investment properties.

Can I qualify for a bank statement loan without 24 months bank statements?You may still be able to qualify using just 12 months or if you have other compensating factors in your favor. There are lenders who have a 12 month bank statement mortgage program.

Can I qualify for a bank statement loan with bad credit?There are lenders who will still work with you even with low credit scores. Many individuals have been able to get a bank statement loan with credit scores as low as 500.

What is the maximum DTI ratio requirement?Some lenders will go up to a 50% DTI or more. So, fill out the form to have someone contact you to see whether you qualify.

Don’t Miss: Rocket Mortgage Loan Requirements

Can You Request A Bank Statement Early

Because you can print your statements yourself, you dont need to request one in advance. Follow the instructions from your mortgage representative or, if youre applying online without assistance, the application for the number of statements you need.

If, for example, you need 60 days worth, the lender will expect the most recent 60 days worth.

Solution To Bank Statements With Overdrafts And How Underwriters Analyze Bank Statements

Mortgage lenders require borrowers to only provide 60 days of bank statements:

- What if borrowers did not have any overdrafts in the past 60 days in bank statements but had overdrafts prior to the 60 days?

- Borrowers provide actual bank statements for the past 60 days

- If there are no overdrafts it is fine

- But if they had overdrafts prior to the 60 days, there is a column in bank statements that lists year-to-date overdraft fees

- This will alert the underwriter that they had bank overdrafts in the past 12 months

- If this is the case, borrowers should not submit actual bank statements

- What they need to do is go to bank and get 60 days of bank statement printouts

- On bank statement printouts, there are no year-to-date overdraft fees column

- A print out of bank statements can be used in lieu of actual original bank statements

- Borrowers with bank overdrafts in the past 12 months, go to bank and get 60 days of bank printouts and get those printouts signed, dated, and stamped by the bank teller

Borrowers with recent overdrafts and do not have any other bank accounts without overdrafts, then the only solution is waiting sixty days and let the overdrafts season for 60 days.

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

How Do Mortgage Lenders Check And Verify Bank Statements

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

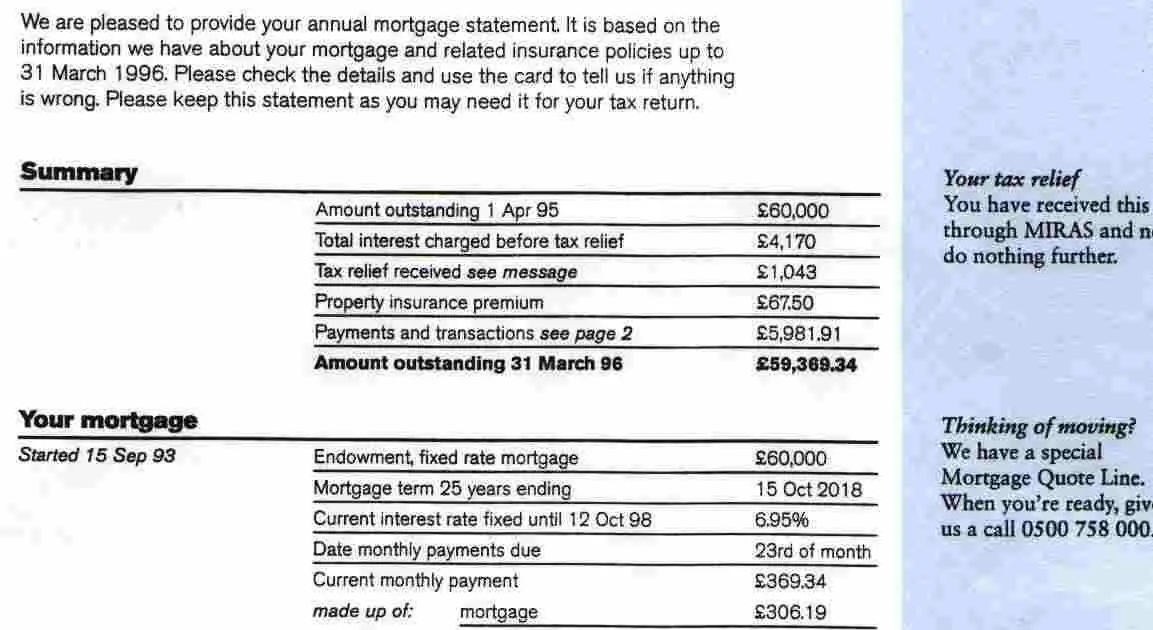

Borrowers seeking a mortgage to purchase or refinance a home must be approved by a lender in order to get their loan. Banks need to verify the borrower’s financial information and may require a proof or verification of deposit form to be completed and sent to the borrower’s bank. A proof of deposit may require the borrower to furnish at least two months of bank statements to the mortgage lender.

The Banks You Can Get A Mortgage From Without Having To Show Your Statements

Lenders often ask to see three months worth of statements before deciding if they’ll lend to you – but there are a handful who don’t need them

- 14:34, 10 Aug 2018

LENDERS want to see all sorts of paperwork when you apply for a mortgage to verify whether you can afford the loan.

But there are a handful which aren’t bothered about looking at your bank statements, according to Mortgage Solutions.

Most banks ask for three months worth of statements to verify your income and outgoings, even though regulation rules say that they don’t have to.

These rigorous background checks can lead to some borrowers watching what they spend in the months leading up to an application because an odd payment could be the reason they are rejected.

But Santander, Halifax and Virgin Money are among the lenders that have quietly moved away from this approach.

Instead, they focus on your credit score to determine affordability to work out where they will lend you the funds for your home.

Recommended Reading: Rocket Mortgage Launchpad

Do Lenders Look At Bank Statements Before Closing

Lenders typically will not recheck your bank statements right before closing. Theyre only required when you initially apply and go through underwriting.

However, there are a few things your lender will recheck before closing, including:

- Employment and income

You should avoid financing any large purchases or opening new credit lines between mortgage approval and closing.

New debts can affect your credit score as well as your debttoincome ratio , and could seriously affect your loan approval and interest rate.

In addition, if anything changes with your income or employment prior to closing, let your lender know immediately so it can decide whether this will impact your loan approval and help you understand how to proceed.

How Underwriters Analyze Bank Statements With Cash Deposits

Cash in the mortgage world cannot be used as sourced funds:

- However, borrowers with regular deposits from a regular part-time job and can provide the copy of a check and deposit slip, that regular deposit can be used to sourced funds

- Even though borrowers have regular deposits to the bank account, the deposits need to be sourced

Another example is when getting regular child support payments or alimony payments being deposited regularly to the bank account the underwriter will require to provide documentation of the deposit transactions and the terms.

You May Like: Reverse Mortgage For Mobile Homes

Special Considerations For Bank Statement Loans

- You may use statements form more than one bank account, but they cannot be a combination of personal and business accounts.

- Deposits which are transferred from a business account into a personal account are acceptable.

- You may combine W2 income with bank statement income as long as the income is not being double counted.

- No commingling of funds.

- Foreign Bank Statements and Foreign Assets may be considered and must be translated to English.

Bank Statement Mortgage Loan Rates

The bank statement mortgage rates are very competitive when you consider there is less documentation being provided to the lender. The rates will vary based upon your credit score, down payment amount, and whether you have a recent bankruptcy , and your average monthly bank deposits.

Bank statement mortgage loan rates will on average be at least 1-3% higher than conventional rates. Your credit score and down payment percentage will play a major role in determining your rate.

The difference in rates for a bank statement loan vs a conventional loan is due to lenders taking on additional risk with borrowers who cannot qualify using their tax returns. Rates for bank statement loans are not tied to what is happening in the market with conventional mortgage rates which is why you could see conventional rates falling while rates for bank statement loans could be rising.

Update January 2022 Lenders who offer bank statement loans have rates that are similar which is why we recommend working with someone who fully understands the program and can close the loan on time.

Read Also: Can I Get A Reverse Mortgage On A Condo

What You Need To Know

- A bank statement mortgage uses bank deposits instead of tax returns to verify your income on a mortgage application

- Bank statement loans are nontraditional mortgages that verify income with bank deposits rather than tax returns, W-2 statements and pay stubs

- Bank statement loans are harder to find because not all lenders offer them, but for self-employed borrowers, its worth the search

How Long Back Once Again Carry Out Lenders Look At Bank Comments

Lenders make use of these financial comments to confirm your discount and income, search for uncommon activity inside profile, and make certain you have not used on any current credit.

8 weeks worth of financial statements may be the norm because any credit score rating account avove the age of that will have indicated through to your credit file.

One uncommon exception is actually for selfaemployed individuals just who aspire to be considered considering bank statements rather than tax returns. In this case, you need to give you the previous 12a24 period of financial statements.

You May Like: Rocket Mortgage Loan Types

Advantages Of A Bank Statement Loan

In summary, these are the advantages of a bank statement loan:

- The lender does not need to look at your tax returns or tax transcripts.

- Your income statements are made up of regular monthly income deposits.

- The lender can look at 12 or 24-month bank statements.

- If you own a business, you can show 24 months of business statements and a P& L statement for the same period. A P& L statement is prepared by a Certified Public Accountant. Not all business owners will be required to present one.

- You can get a bank statement home loan for as little as 10 percent down.

- You can do a cash-out refinance loan of up to 85 percent of the value of your property.

- You can borrow up to $5 million.

- Typically, bank statement lenders will accept a debt to income ratio of a maximum 55 percent.

- You have the option of a fixed-rate or adjustable mortgage.

- You may have the option for an interest-only mortgage.

How Underwriters Analyze Bank Statements With Irregular Deposits

Irregular deposits are when there could be trouble.

- Irregular deposits are allowed

- Any irregular deposit over $200 will be questioned

- Proof of source will be required in order for the underwriter to count it as part of assets

- If irregular deposits cannot be sourced because it was a cash deposit from a gift from a family member, that cash deposit cannot be used as part of assets

- Its okay to make irregular deposits that have not been sourced but cannot use it as part of the funds available to use towards a down payment if the irregular non-sourced deposit has been made within the 60 days

- Any deposits, whether they are irregular deposits or large deposits, that are older than 60 days does not matter

Mortgage lender only requires 60 days of bank statements.

Also Check: Rocket Mortgage Vs Bank

Types Of Documents In Mortgage For Verification

A lender has to submit a POD form to a bank to receive the confirmation of the loan applicants financial information. There are other ways a lender can verify if the borrowers financial information is authentic or not. Although the document required for verification can differ from bank to bank. Here are the most common types of documents in mortgage approval:

- Account number

- Open or closed status and opening date

- Account holder names

- Balance information.

- Account closing date and the balance at the closing time .

A lender has the right to refuse a mortgage if the documents dont satisfy the verification requirements.

Why Verification of Bank Statements Is Needed?

Why do mortgage lenders need bank statements? To reduce the risk of use of acquired funds by the borrower for illegal activities such as terrorist funding or money laundering. Lenders have the right to ask for a borrowers bank statements and seek POD from the bank, some cautious lenders can ask for both of them. Lenders use POD and bank statements to ensure if the person is eligible for a mortgage.

Some lenders tend to ignore a once in a lifetime overdraft on the borrowers account during the account history verification. Although if a consumer has numerous overdrafts then giving a loan to consumers may be considered a risk for the bank.

How DIRO Verifies Bank Account Statements?

Specialist Mortgage Advice In Nottingham

When lenders ask for your bank statements, they will be looking for many different things. However, their main objective is to assess whether or not you are able to manage your money responsibly and is likely to keep up to date with their mortgage payments. In recent months, one question is being asked by applicants quite a lot: do gambling transactions look bad on my bank statements.

Recommended Reading: Chase Recast Mortgage

What Other Documents Do I Need To Provide To My Mortgage Lender

As well as your recent bank statements, youll also need to provide the below to your mortgage provider when you buy your home:

- 2-3 months of payslips proving your income

- Your latest P60 tax form

- A gift letter if you’re getting help with your deposit

- If youre self employed, youll need at least 2 years of tax returns and SA302 tax calculations – click here to find out where to download these documents

Why Do Mortgage Lenders Need Bank Statements & Tax Returns

By Brandon Cornett | April 6, 2016 | © HBI,

When you apply for a mortgage loan, theres a good chance the lender will ask for copies of bank statements and tax returns. These are some of the most commonly requested documents during the loan application process.

But why? Why do mortgage lenders need to see your bank statements? And why do they want to look at your tax returns? It has to do with income and asset verification. Primarily, they do it to see how much money you earn, and how much you have in the bank for closing costs and down payment.

Lets look at each of these topic individually, starting with bank statements:

You May Like: Can You Get A Reverse Mortgage On A Mobile Home

Receipt Of Gift Funds

Some people are fortunate to receive gift funds from a relative or another allowed party to help them close a mortgage loan. Often times lenders require the borrower to provide evidence to show the receipt of these funds. Lenders may allow bank statements to be used to show that the borrower received the gift in their account.

Understanding How Lenders Verify Bank Statements

Banks and mortgage lenders underwrite loans based on a variety of criteria including income, assets, savings, and a borrowerâs creditworthiness. When buying a home, the mortgage lender may ask the borrower for proof of deposit. The lender needs to verify that the funds required for the home purchase have been accumulated in a bank account and accessible to the lender.

A proof of deposit is evidence that money has been deposited or has accumulated in a bank account. A mortgage company or lender uses a proof of deposit to determine if the borrower has saved enough money for the down payment on the home theyâre looking to purchase.

For example, in a typical mortgage, a borrower might put 20% down towards the purchase of a home. If itâs a $100,000 home, the borrower would have to put down $20,000 upfront. The mortgage lender would use a proof of deposit to verify that the borrower actually has a $20,000 in their bank account for the down payment. Also, the lender will need to ensure adequate funds are available to pay the closing costs associated with a new mortgage. Closing costs are additional costs that can include appraisal fees, taxes, title searches, title insurance, and deed-recording fees.

The borrower typically provides the bank or mortgage company two of the most recent bank statements in which the company will contact the borrowerâs bank to verify the information.

Read Also: How To Purchase A House That Has A Reverse Mortgage

Don’t Miss: How Much Is Mortgage On A 1 Million Dollar House