See How Much Home You Can Afford To Help Narrow Your Search

Buying a home is an exciting time, but it can also be overwhelming as you look for the perfect home to fit your needs. One step that can be beneficial is to prequalify for your loan, so you know how much house you can afford.

Its always a good idea to get prequalified with a mortgage lender before you start shopping for the home you want. But if you want to start house-hunting and arent quite ready to contact a lender, you can prequalify yourself.

Where Do You Want To Live

}, }

! Your browser does not support geolocation. Consider using another browser.

How much mortgage can I afford?

The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can determine how much mortgage you may be comfortable with and the potential price range of your future home. Knowing your total household income, how much youâve saved for a down payment, and your monthly expenses , plus new expenses youâd take on , you can get a reasonable estimate. Learn more about factors that can affect your mortgage affordability.

How to estimate affordability

To estimate mortgage affordability, lenders will use two standard debt service ratios: Gross Debt Service and Total Debt Service . According to the Canadian Mortgage and Housing Corporation¹Note 1:

-

– GDS is the percentage of your monthly household income that covers your housing costs . It should be at or under 35% of your pre-tax household income.

-

– TDS is the percentage of your monthly household income that covers your housing costs and any other debts . It should be at or under 42% of your pre-tax income.

How your down payment affects affordability

The amount you have saved for a down payment is also another important piece of information to help determine affordability. Depending on the purchase price of a home, there are minimum amounts required for your down payment²Note 2:

Step 2 of 6

Mortgage Rates Where You Live

Mortgage or refinance rates depend on different factors, including where you live. To better understand what rates you may qualify for, including what the average mortgage or refinance rate is in your area, take a look at Credit Karmas mortgage rate marketplace and our latest state-specific guides.

About the author:

Read More

Don’t Miss: Can I Use My Partner’s Income For A Mortgage

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

What You Should Do Next

Find a reputable home mortgage lender. Granville Homes has over 40 years of award-winning service and is proud to simplify the home mortgage process with Granville Home Loans. Granville Home Loans Officers have experience with home loans such as FHA, Conventional, VA, Jumbo, USDA, and more. They will connect you with the best possible mortgage available to ensure you qualify for your dream home. Click the link below to get in touch with an experienced Granville Home Loans Officer today.

Recommended Reading: What Information Do You Need To Prequalify For A Mortgage

How Is Prequalification Determined

Looking at income is just one of the components that is used to determine your buying power. Your monthly debt gets used as true measure against your monthly gross income when it comes to financial institutions. Most lenders feel comfortable with applicants who have less than a 36% debt-to-income ratio or a DTI. PropertyNests Prequalification Mortgage calculator also factors in the DTI to approximate your buying power.

Amortization Schedule On A $450000 Mortgage

You can use an amortization schedule to understand the principal and interest costs for each year of your loan, as well as the mortgages costs over the long haul.

As you can see in the examples below, your monthly payments largely go toward interest in the first few years of your loan. As you get closer to the end of your loans term, youll pay more toward the actual balance.

Heres what an amortization schedule for a 30-year, $450,000 loan with 3% APR looks like:

| Year |

|---|

| $0.00 |

Read Also: How Does A 5 1 Arm Mortgage Work

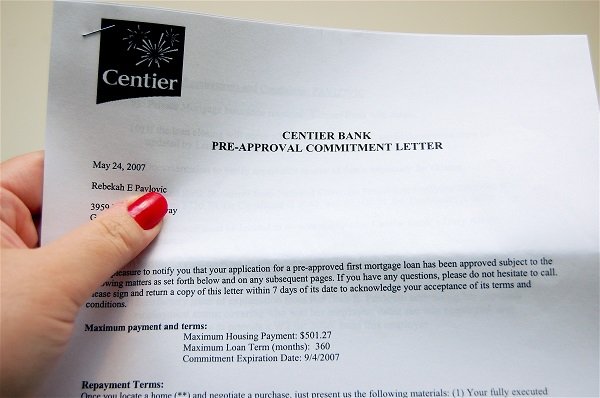

Assuming You Can Afford Your Pre

When you get a mortgage pre-approval, your mortgage lender will assess your income and debt, then give you a mortgage amount and estimated monthly payment that they think you can afford.

But thats the trick its just what they think. And it might be much higher than what you can actually afford.

Your lender wont ask you how much youre paying for groceries, for instance, nor what you pay in childcare, transportation, or your other monthly expenses. They typically have no idea what your budget looks like, which means they might approve you for an amount thats beyond your budgets scope.

First-time homebuyers often take the bait and buy homes they cant afford. But if youre savvy, youll look past the pre-approval amount and base your home-buying decision on your budget alone.

To decide how much of your income you can reasonably allocate to monthly mortgage payments, try the 28/36 rule. That is, your mortgage payment shouldnt be more than 28% of your total monthly pre-tax income nor more than 36% of your total debts. If you stay within these guidelines ignoring the upper limits on your pre-approval youll have a better understanding of how much you can afford.

How Much A $450000 Mortgage Will Cost You

A $450,000 mortgage comes with more than just a monthly payment. Depending on your rate and loan term, you could pay more than $200,000 in interest over the life of the loan.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

When buying a home, the potential monthly payment isnt all you should think about especially on a loan as big as $450,000. On mortgages of this size, interest costs can be significant, both monthly and over the long haul, so youll want to be well aware of these expenses before making your move.

If youre planning to take out a $450,000 mortgage, use this guide to understand what costs you can expect to pay over the life of the loan.

Heres what you need to know about a $450,000 mortgage loan:

Recommended Reading: Who Does 100 Percent Mortgages

Overcoming Common Challenges To Qualify For A Mortgage

The three most common barriers to homeownership are:

If you get rejected for a mortgage based on any of these three factors, it may feel like all is lost. However, it may be possible to overcome these challenges, often in less time than you might think.

What Is Mortgage Affordability

Mortgage affordability refers to how much youre able to borrow, based on your current income, debt, and living expenses. Its essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term affordability is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but its important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrowincluding the household income of the applicants purchasing the home, the personal monthly expenses of those applicants , and the expenses associated with owning a home .

Recommended Reading: Can Non Permanent Resident Get Mortgage

Understanding What A Prequalification Is

A mortgage prequalification is something you work through with a lender or bank. Going through the process will help the lender determine if you have the necessary criteria in terms of income, credit, and debt. It can be an eye-opening step to not only deem if you are ready to buy, but how much you can actually spend.

Shop For Homes During The Preapproval Period

When you receive your preapproval letter, itll probably say its good for 30 to 90 days. Since thats a relatively short period, youll probably want to wait to get preapproval letters until youre ready to start seriously shopping for a home. And remember, a preapproval is only a conditional approval. If you rack up more debt, change jobs or reduce your savings, you could get denied when you go to get final mortgage approval.

Read Also: How Much Does A Mortgage Payment Increase For Every 100000

Should I Get Preapproved For A Mortgage Before Looking

Getting a mortgage preapproval before looking for homes doesnt just give you confidence. Knowing your qualifications have been checked in advance also gives a seller comfort when dealing with you. They know your offer isnt likely to fall through if everything has been verified by an underwriting team.

Get Information From A Source You Trust

It’s natural to have questions. Besides the basics such as the interest rate and term, it’s a good idea to ask about other things like prepayment charges if you plan to sell your property or pay down your mortgage loan faster. To ensure that you get accurate, actionable information we recommend seeking answers from a trusted source. TD Mortgage Advisors are well versed in every aspect of the mortgage process and can be an easily accessible source of information.

Recommended Reading: Can I Throw Away Old Mortgage Papers

When Should You Get Pre

The best time for you to get pre-approved for a home mortage is now. This allows you to narrow your search by shopping for homes in your approved price range. Many financial factors affect your home loan approval, and you can start preparing to increase your approved mortgage amount by learning about how to improve your credit score. Other ways of getting your financial house in order include saving for a down payment and identifying which debt is negatively affecting your loan amount to develop a plan.

How Is My Mortgage Pre

Your lender will take into account:

Your household income

Any outstanding debt you already have that you will still have including credit cards, loans, and student loans

Your savings and down payment amounts

Any dependents

How much you can afford monthly after food, utilities, entertainment, transport costs, and other living expenses

You May Like: Can You Reverse Mortgage A Condo

How To Get Preapproved For A Mortgage

The preapproval process is essentially a mortgage application. This means your lender will want to take a comprehensive look at your finances. You should be prepared to provide information on the following:

- Proof of income

- Identification

- Debt-to-income ratio

Before starting the preapproval process, you’ll want the necessary documentation to ensure the process goes smoothly. Here are a few items you should have on hand:

- W-2 statements

- License

- Social Security number

Once you’ve submitted all your information to the lender, you can expect to receive your loan estimate within 3 business days, though this may be much shorter if you use an online lender. The loan estimate will let you know whether you’ve been preapproved and for how much.

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

Also Check: Do Multiple Mortgage Applications Hurt Credit

Stay In Touch With Your Broker

Stay reachable, in case your mortgage broker has any questions about your documentation. This means avoiding vacations or business trips where you wont have access to email or phone. If you arent available, they may make assumptions about your intent, and reject your mortgage pre-approval. If you absolutely must leave town, make sure to inform your mortgage broker in advance.

Apply For A Mortgage Pre

Most Canadians think the first step in the home-buying process is to contact a realtor and start looking at homes. This isnt correct. The first thing you should do is apply for a mortgage pre-approval. After all, if you find a home you like, youll want to move quickly. Being pre-approved for a mortgage removes an extra step in the process.

Being pre-approved also helps you know how much you can afford to spend. You can get a good estimate of how much you can afford with our mortgage affordability calculator. However, the hard limit will always be how much the bank will approve you for a mortgage pre-approval gives you that.

How long does it take to get a mortgage pre-approval? It can be done within an hour if you have your documentation together. Get in touch with a mortgage broker near you to get started.

You May Like: How Does The 10 Year Bond Affect Mortgage Rates

Why Getting Preapproved Is Such A Big Deal

Getting preapproved for a mortgage helps you shop for homes that you can afford and shows you are a serious buyer.

But a letter of preapproval is more than just a way to look good to sellers. It also helps you find the right mortgage lender and provides some flexibility in bargaining or negotiating for a better price range or specific costs, repairs, and improvements to a home.

Getting preapproved makes the entire closing process faster, too. It takes an average of 50 days to close on a house, and part of that period is due to the process of mortgage approval.

Being self-employed or having issues such as a low credit score previous, previous foreclosures, and outstanding debt can elongate the process.

Mortgage Approval Process Canada

The actual mortgage approval process starts when your offer has been accepted by the seller because your lender will need to know what the value of the property is based on current market conditions, as well as the amount of your down payment. In order for the approval process to be completed, your lender will require the purchase agreement as well as the MLS listing. The value of the property youve agreed to purchase will be assessed by an appraiser appointed by the lender to make sure that the price you agreed to pay is on par with what the home is actually worth.

The property will also need to be approved by the mortgage insurer if you are putting less than a 20% down payment. Your income, credit score, and debt, and any other financial information will be re-verified, and the specific type of mortgage product that youve decided on will be factored into the equation.

Take a look at this infographic to learn all about the true cost of borrowing.

Don’t Miss: How Long Till I Can Refinance My Mortgage

How Does The Pre

The information that you entered is calculated and will give you more detailed estimates of the home purchase price and loan amount that you can afford along with the down payment amount that would be required. You will also see your debt-to-income ratio which reflects your ability to manage monthly payments and repay debts.

The last section of the mortgage pre-qualification calculator will give you a total monthly payment and amountbroken down into principal, interest, taxes and insurance detailthat you can afford based on the information you provided.

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter you and your partners income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you dont know them.

With these numbers, youll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

You May Like: What Should My Mortgage Be

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understand how large a mortgage you can afford to borrow and the cash requirements will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.