Why Do Different Mortgage Types Have Different Rates

Each type of mortgage has a different rate because they have varying levels of risk. One of the primary sources of income for lenders is the money they earn from the interest you pay on your mortgage. For this reason, lenders consider the amount of risk associated with each loan when they set the interest rate. This is referred to as risk-based pricing and is premised on the idea that riskier loans like 30-year mortgages should carry a higher rate.

One of the reasons for this is that its easier to predict what will happen in the economy in the short-term than it is in the long-term. Similarly, theres more risk that something will happen to negatively affect your ability to repay the loan, for instance, if you lose your job or theres an economic downturn.

How Do You Shop For Mortgage Rates

First, start by comparing rates. You can check rates online or call lenders to get their current average rates. Youâll also want to compare lender fees, as some lenders charge more than others to process your loan.

Thousands of mortgage lenders are competing for your business. So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate.

Each lender is required to give you a loan estimate. This three-page standardized document will show you the loanâs interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years.

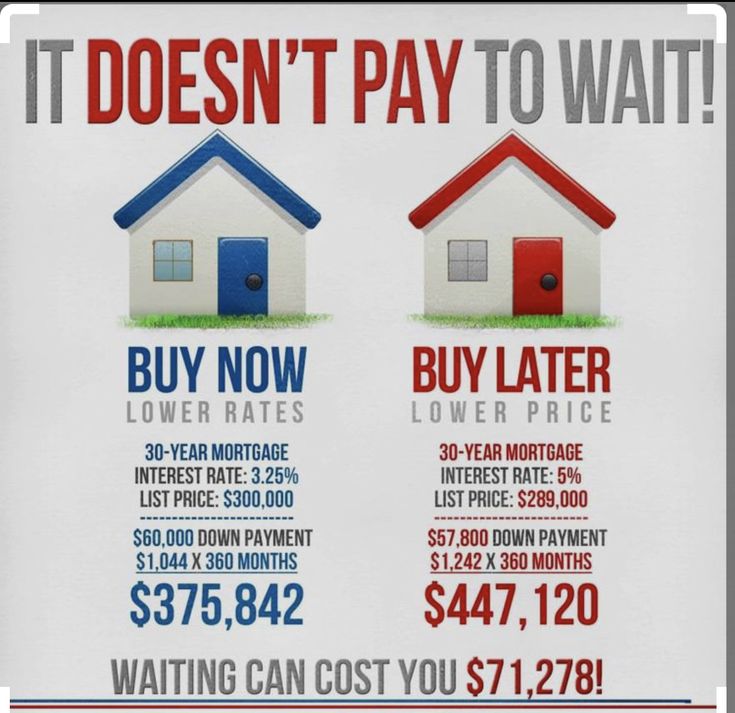

How Historical Mortgage Rates Affect Buying A Home

Broadly speaking, lower mortgage rates fuel demand among homebuyers and can increase an individuals buying power. A higher rate, on the other hand, means higher monthly mortgage payments, which can be a barrier for a buyer if the cost becomes unaffordable. In general, a borrower with a higher credit score, stable income and a sizable down payment qualifies for the lowest rates.

Read Also: Is Navy Federal Good For Mortgages

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

|

5.57% |

How To Compare 30

If you compare loan offers from mortgage lenders, youll have a better chance of securing a competitive rate. Heres how:

You May Like: How Much Is A Million Dollar Mortgage Per Month

Factors That Affect Your Mortgage Interest Rate

For the average homebuyer, tracking mortgage rates helps reveal trends. But not every borrower will benefit equally from todays low mortgage rates.

Home loans are personalized to the borrower. Your credit score, down payment, loan type, loan term, and loan amount will affect your mortgage or refinance rate.

Its also possible to negotiate mortgage rates. Discount points can provide a lower interest rate in exchange for paying cash upfront.

Lets look at some of these factors individually:

Other Mortgage Costs To Keep In Mind

Remember that your mortgage rate is not the only number that affects your mortgage payment.

When youre estimating your home buying budget, you also need to account for:

- Private mortgage insurance or FHA mortgage insurance premiums

- Homeowners insurance

When you get pre-approved, youll receive a document called a Loan Estimate that lists all these numbers clearly for comparison. You can use your Loan Estimates to find the best overall deal on your mortgage not just the best interest rate.

You can also use a mortgage calculator with taxes, insurance, and HOA dues included to estimate your total mortgage payment and home buying budget.

Read Also: How Much Does A 150k Mortgage Cost

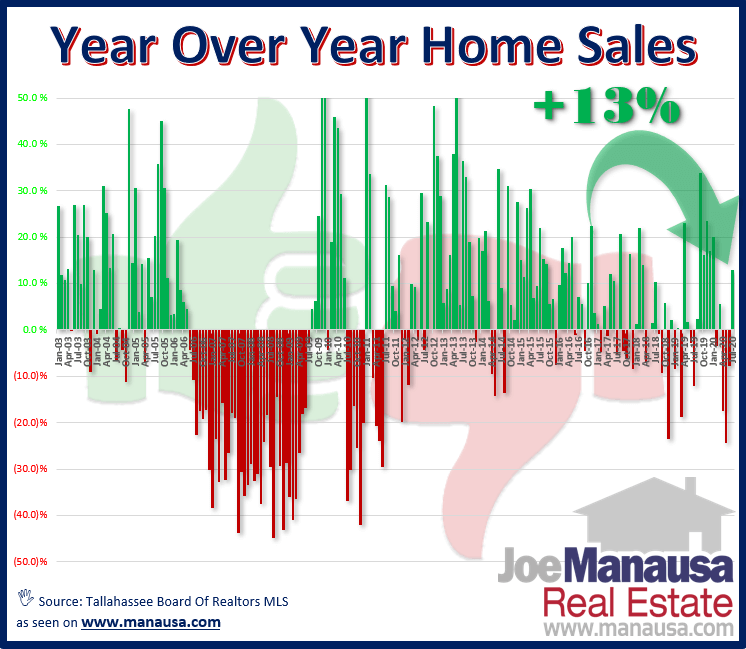

Forbes Advisors Insight On The Housing Market

Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future.

To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection. However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection.

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their âforever homeâ have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. Thatâs why itâs so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

How Do I Qualify For A 30

Lenders typically see refinances as riskier than purchase mortgages. So, while requirements will vary by lender, you will likely need to have a strong credit score if you want to qualify for a low refinance rate, a comfortable debt-to-income ratio and at least 20% equity built up in your home.

You will also need to show that you are in good standing with your current mortgage and that you have enough cash to pay for refinancing costs.

You May Like: How Much Is Mortgage Deduction Worth

How Do I Find The Best Mortgage Rate

Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done. The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you keep your home loan will impact your decision.

If you plan on keeping your home loan long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages. Locking in a low rate is a smart choice. But you can get lower mortgage rates with some adjustable-rate loans too. If you plan on only keeping your home for a short period of time, then you may be able to pay less interest with an ARM.

How Do Mortgage Rates Work

The mortgage rate a lender offers you is determined by a mix of factors that are specific to you and larger forces that are beyond your control.

Lenders will have a base rate that takes the big stuff into account and gives them some profit. They adjust that base rate up or down for individual borrowers depending on perceived risk. If you seem like a safe bet to a lender, you’re more likely to be offered a lower interest rate.

Factors you can change:

-

Your . Mortgage lenders use credit scores to evaluate risk. Higher scores are seen as safer. In other words, the lender is more confident that you’ll successfully make your mortgage payments.

-

Your down payment. Paying a larger percentage of the home’s price upfront reduces the amount you’re borrowing and makes you seem less risky to lenders. You can calculate your loan-to-value ratio to check this out. A LTV of 80% or more is considered high.

-

Your loan type. The kind of loan you’re applying for can influence the mortgage rate you’re offered. For example, jumbo loans tend to have higher interest rates.

-

How you’re using the home. Mortgages for primary residences a place you’re actually going to live generally get lower interest rates than home loans for vacation properties, second homes or investment properties.

Forces you can’t control:

» MORE: What determines mortgage rates?

You May Like: Can A Senior Get A Mortgage

What Are The Benefits Of Refinancing To A Lower Mortgage Rate

Some of the key benefits of refinancing to a lower mortgage rate are that you can:

- Pay less interest over time: If youre able to refinance to a lower mortgage rate, youll end up paying less interest over time than if you kept your old rate. For example, if you have a $250,000 mortgage with a 30-year fixed-rate term, you would pay $289,595.47 in interest over the 30-year term. The same mortgage with a rate of 3% would only have $129,443.63 in total interest over 30 years.

- Lower your payment: If you want to lower your P& I payment, getting a lower mortgage rate might help. The monthly P& I payment for a $250,000 loan with a fixed rate of 6% and a 30-year term would be $1,498.88. If you refinance the loan after five years to a 25-year fixed-rate loan with a 3% rate, your P& I payment would be reduced to $1,103.19, and you would still pay off the loan in the same amount of time.

- Potentially pay your loan off more quickly: Using the same example, lets say you decide to shorten your originally $250,000 mortgage to a 15-year term after paying on it for five years. The original P& I payment on your 30-year 6% fixed-rate mortgage was $1,498.88. If you were to refinance the balance into a 15-year 2.5% fixed-rate mortgage, your P& I payment would increase to $1.551.19, but it would be paid off 10 years sooner.

Average Mortgage Interest Rate By Type

There are several different types of mortgages available, and they generally differ by the loan’s length in years, and whether the interest rate is fixed or adjustable. There are three main types:

- 30-year fixed rate mortgage: The most popular type of mortgage, this home loan makes for low monthly payments by spreading the amount over 30 years.

- 15-year fixed rate mortgage: Interest rates and payments won’t change on this type of loan, but it has higher monthly payments since payments are spread over 15 years.

- 5/1-year adjustable rate mortgage: Also called a 5/1 ARM, this mortgage has fixed rates for five years, then has an adjustable rate after that.

| 5.57% |

Recommended Reading: How To Sell A Mobile Home With A Mortgage

How Do You Calculate A Mortgage Payment

In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees.

Your lender will be able to provide you with a line-item breakdown of your mortgage payment. Using a mortgage calculator is an easy way to find out what your monthly payments will be. You can also look at an amortization schedule, which shows you how much youâll pay over time.

When Should I Lock My Mortgage Rate

Its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, ask your lender for a float down. With this option, you get the lower of the two rates. Pay attention to the fine print, though. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

Also Check: When You Refinance A Mortgage What Happens To Your Escrow

How Do I Compare Current 30

Comparing 30-year fixed mortgage rates isnt as straightforward as looking at the mortgage interest rates you qualify for with different lenders. This is because a mortgage interest rate doesnt account for mortgage fees. To get an understanding of the overall cost of your home loan, you need to also compare annual percentage rates , which factor in other costs like loan origination fees and discount points.

After you apply for a mortgage youll get what is known as a Loan Estimate from the lender. Learning how to read a Loan Estimate is important because it shows an estimate of every fee the lender is charging you. Since every Loan Estimate form is the same, its a vital tool for comparing mortgage lenders and for keeping your closing costs low.

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rates and annual percentage rates . Thats understandable since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a $300,000 loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

Don’t Miss: How Much Is A Standard Mortgage

How To Compare Mortgage Rates

Mortgage rates like the ones you see on this page are sample rates. In this case, they’re the averages of rates from multiple lenders, which are provided to NerdWallet by Zillow. They let you know about where mortgage rates stand today, but they might not reflect the rate you’ll be offered.

When you look at an individual lender’s website and see mortgage rates, those are also sample rates. To generate those rates, the lender will use a bunch of assumptions about their sample borrower, including credit score, location and down payment amount. Sample rates also sometimes include discount points, which are optional fees borrowers can pay to lower the interest rate. Including discount points will make a lender’s rates appear lower.

To see more personalized rates, you’ll need to provide some information about you and about the home you want to buy. For example, at the top of this page, you can enter your ZIP code to start comparing rates. On the next page, you can adjust your approximate credit score, the amount you’re looking to spend, your down payment amount and the loan term to see rate quotes that better reflect your individual situation.

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

» MORE: Mortgage points calculator

What Is A Good Mortgage Rate

Rates have been on the rise since the beginning of 2022, but are still in the favorable range. If youre considering a refinance, a good mortgage rate is considered 0.75% to 1% lower than your current rate. New homebuyers can also benefit from the latest mortgage rates as they are comparable to rates prepandemic rates.

Even if youre getting a low interest rate, you need to pay attention to the fees. Hidden inside a good mortgage rate can be excessive fees or discount points that can offset the savings youre getting with a low rate.

Recommended Reading: How Is Interest Rate Calculated On A Mortgage

Mortgage Rates Continue To Decrease

Mortgage rates continued to drop this week as optimism grows around the prospect that the Federal Reserve will slow its pace of rate hikes. Even as rates decrease and house prices soften, economic uncertainty continues to limit homebuyer demand as we enter the last month of the year.

NOTE: Freddie Mac made a number of enhancements to the Primary Mortgage Market Survey® to improve the collection, quality and diversity of data used. Instead of surveying lenders, the weekly results are now based on thousands of applications received from lenders across the country that are submitted to Freddie Mac when a borrower applies for a mortgage. Additionally, the PMMS® will no longer publish fees/points or adjustable rates. The newly recast PMMS® was put in place on November 17, 2022, and the weekly distribution is Thursdays at 12 p.m. ET.

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan terms, interest rate types , down payment size, home location and loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Don’t Miss: How To Calculate Monthly Mortgage Payment Formula