Loanspecific Fees: Can Be 12% Of Loan Amount

In addition to closing costs and interest charges, different loan types have their own fees associated with them.

For example, governmentbacked loans all have an initial fee associated with them:

- FHA Loans mortgage insurance premium

- VA loans loan origination fee

- USDA loans upfront guarantee fee

FHA loans have a closing fee called Upfront Mortgage Insurance Premium , along with a yearly mortgage insurance fee. This mortgage insurance helps ensure the loan if the borrower defaults.

UFMIP costs 1.75% of the loan amount and can be rolled into the loan balance. Yearly mortgage insurance is usually 0.85% of the loan amount, broken into monthly payments.

On a $200,000 loan amount, the UFMIP is $3,500. And MIP costs $1,700. While you dont need to pay both these costs at closing, they still have to be factored into the overall cost of the mortgage.

Similarly, VA loans include a funding fee to help cover the cost of the VA Home Loan program.

The cost varies depending on the size of your down payment and whether its your first time using the loan program.

As an example, a secondtimeuse VA loan with zero down would require a funding fee of 3.60%. On a $200,000 loan amount, thats $7,200 added to your loan amount.

And a USDA loan includes an upfront guarantee fee to help cover the cost of the USDA Home Loan program. The cost of the fee is 1% of the loan amount and is typically rolled into the loan balance.

How To Get Rid Of Your Pmi Payment

If you are currently making PMI payments, you have a few ways to get rid of them. Once you reach any of the equity requirements, you’ll need to request your mortgage provider to cancel the PMI payments via, this is not a typo, writing them a letter. They certainly don’t make it easy, do they? Here are the requirements you’ll need to reach to complete your request:

- Reaching 20% equity in your home â in this case, the payments do not have to be removed you can only request that they are.

- Reaching 22% equity in your home â in this case, the payments are typically automatically canceled if not, make a request.

- Your home value has increased enough where you’d have 20% equity or more â This can be due to improvements you’ve made to your home or due to market conditions raising the value of your home. In either case, you’ll your home appraise to prove its value on the open market.

- Refinancing â If you refinance your home with an LTV of 80% or less, you’ll avoid paying PMI on the new loan.

From The Front Lines To The Home Front

The postwar boom wasnt just the result of a demographic shift, or simply the flowering of an economy primed by new consumer spending. It was deliberately, and successfully, engineered by government policies that helped multiply homeownership rates from roughly 40 percent at the end of the war to 60 percent during the second half of the 20th century.

The pent-up demand before the suburban boom was immense: Years of government-mandated material shortages due to the war effort, and the mass mobilization of millions of Americans during wartime, meant homebuilding had become stagnant. In 1947, six million families were doubling up with relatives, and half a million were in mobile homes, barns, or garages according to Leigh Gallaghers book The End of the Suburbs.

The government responded with intervention on a massive scale. According to Harvard professor and urban planning historian Alexander von Hoffman, a combination of two government initiativesthe establishment of the Federal Housing Authority and the Veterans Administration home loans programsserved as runways for first-time homebuyers.

Initially created during the 30s, the Federal Housing Authority guaranteed loans as long as new homes met a series of standards, and, according to von Hoffman, created the modern mortgage market.

Also Check: 10 Year Treasury Vs 30 Year Mortgage

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and the loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

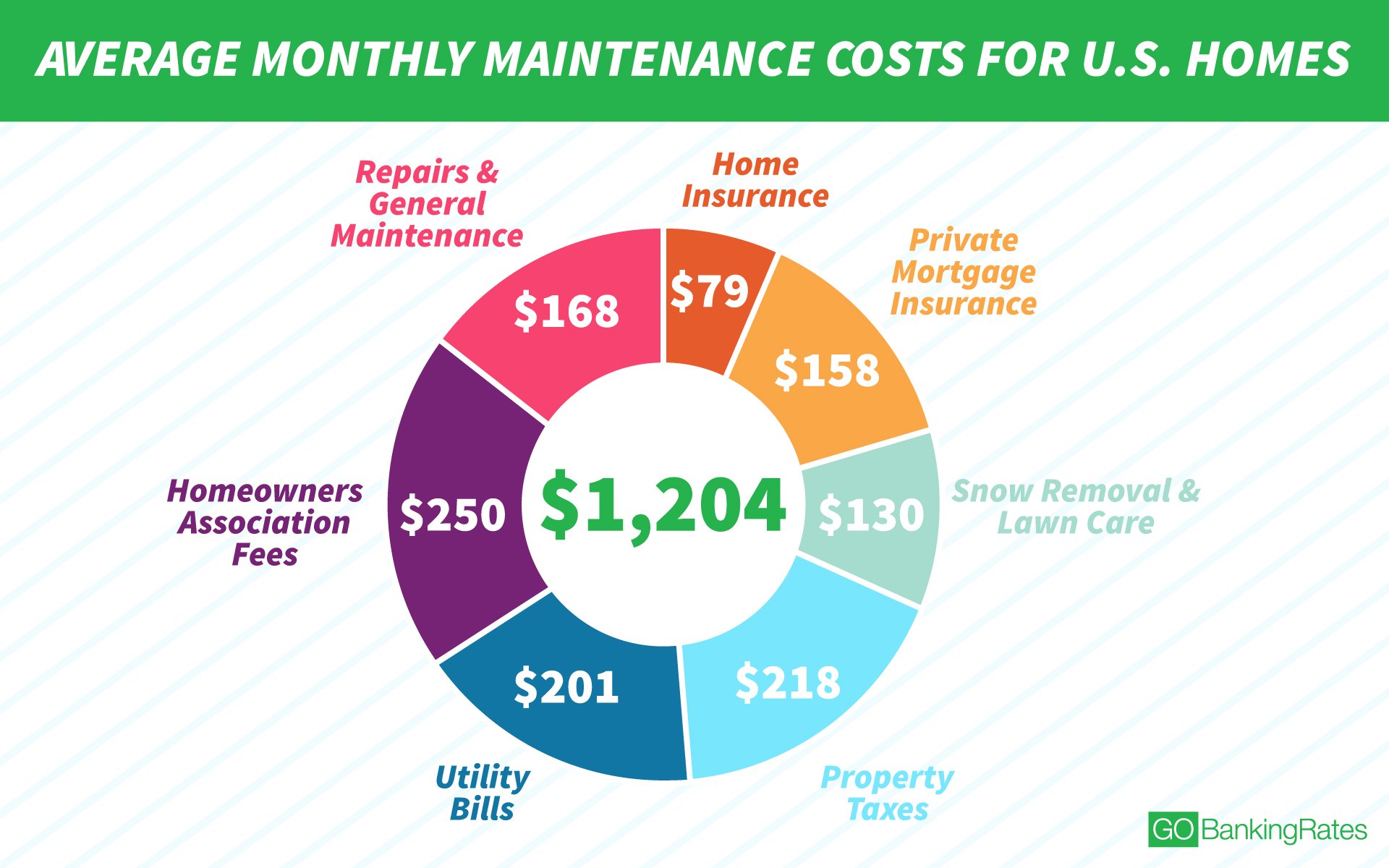

How About Property Taxes

You cant escape taxesperiod. From the moment you buy a house, until, well, forever, your local government makes you pay property taxes. How do they calculate these taxes? Theyll send a property assessor to find out how much your house is worth, then theyll use that number to figure out how much you owe them.

You May Like: Chase Recast

How Do I Get A Buy

Itâs normally a bit harder to get a buy-to-let mortgage than it is to get a residential one.

Your lender will do all the normal checks that they would for a residential mortgage, like checking your income and . But theyâll also check how much rent youâre planning on charging.

Theyâll normally need your rental income to be at least 125% of your monthly mortgage repayments . Confused? Donât worry. Say your monthly repayments are going to be £500 per month. It just means youâd need to charge your tenants at least £625 per month as your lender will want to be sure your rental income will easily cover the repayments.

That said, your lender will also be wondering whatâs going to happen if you donât have any rental income for a while â so, theyâll want to make sure your income is high enough to cover all eventualities!

If youâre looking to switch to a buy-to-let mortgage, weâd recommend using an independent mortgage broker . Your current lender might be happy to swap you over, but a mortgage broker will be able to tell you if you could get a better deal elsewhere. Hereâs a tip for you: you usually can!

Total Interest Paid On A $200000 Mortgage

The longer your loan term, the more youll pay in interest over the life of the loan.

For example, on a 30-year $200,000 mortgage with a 4% fixed rate, youll end up paying $143,739.01 in interest over the full term.

On a 15-year mortgage with the same balance and rate, youd pay just $66,287.65 saving you more than $77,000 in interest charges. But keep in mind your monthly payment would be higher with the 15-year mortgage.

See what your total interest paid and estimated monthly payment will be using our mortgage payment calculator below.

Enter your loan information to calculate how much you could pay

Find Out: 15- vs. 30-Year Mortgage: Which Ones Right for You?

Don’t Miss: Reverse Mortgage Manufactured Home

Whats The Difference Between Variable And Fixed Rates

Variable rates can change over the course of your mortgage term . On the other hand, fixed rates remain constant throughout your mortgage term, even if the prime rate changes.

The advantage of variable rates is that if rates fall across the market, then your rate will also drop. The downsides are that rates can go up. This would also cause your rate to rise, which means paying more on your regular mortgage payment.

The advantage of fixed rates is that your regular mortgage payments will stay the same for your entire term. However, if prime rates were to drop, youâd be missing out on the savings that a lower rate would offer.

Learn more about fixed and variable rates here.

What Is Mortgage Loan Insurance

Mortgage loan insurance protects the mortgage lender in case you cant make your mortgage payments. It doesnt protect you. Mortgage loan insurance is also sometimes called mortgage default insurance.

If your down payment is less than 20% of the price of your home, you must buy mortgage loan insurance.

Your lender may require that you get mortgage loan insurance, even if you have a 20% down payment. Thats usually the case if youre self-employed or have a poor credit history.

Mortgage loan insurance isnt available if:

- the purchase price of the home is $1 million or more

- the loan doesnt meet the mortgage insurance companys standards

Your lender coordinates getting mortgage loan insurance on your behalf if you need it.

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

What To Do With Your Home Equity

Once you’ve figured out how much home equity you have, the big question becomes what to do with it. And to be clear, “nothing” is a perfectly acceptable answer.

Just because you have a nice amount of equity in your home does not mean you have to put it to work. If you don’t tap that equity, you may end up looking at a larger profit when the time comes to sell your home.

But if you do have a need for money, then there are several options you can exercise for tapping your home equity. For one thing, you can borrow against it via a home equity loan or line of credit . Both options allow you to borrow money for any purpose — it doesn’t have to be home-related.

For example, if you have a large amount of credit card debt hanging over your head that you’re paying 18% interest on, you might manage to take out a home equity loan with an interest rate in the 5% to 7% range. That could make your debt much easier to repay.

You can also look into a cash-out refinance, which allows you to swap your existing mortgage for a larger one and use that excess money as you choose. Going back to our example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you might decide to do a $240,000 cash-out refinance. Of that, $200,000 would go toward paying off your initial mortgage, and you’d get the remaining $40,000 in cash to use as you please.

How Much Do Mortgage Brokers Make

How much money a mortgage broker is likely to earn over the course of a year will vary according to where they work and how much business they do. Since they’re often paid a percentage based on the amount of the mortgage, areas where home prices are high, and homebuyers need larger loans to afford them, will be more lucrative for mortgage brokers than areas where home prices and mortgages are more modest. A well-connected and enterprising mortgage broker who does a lot of deals will make more than one who is just starting out or working at it part-time.

Online job sites and other resources list a range of average earnings for salaried mortgage brokers:

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Is Mortgage Life Insurance A Good Idea

While some folks may be attracted to mortgage life insurance because you dont need to take a life insurance medical exam, there are very few advantages to mortgage life insurance over term life insurance.

For many, the biggest deal breaker is the lack of flexibility. With mortgage life insurance, the death payout goes directly to your mortgage lender. With term life insurance, the death benefit goes to your beneficiary who can use the money as they see fit .

You May Like: Can You Refinance Mortgage With Poor Credit

You May Like: Rocket Mortgage Conventional Loan

Today’s Mortgage Rates In New York

| Product |

|---|

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Total Monthly Payment

Based on a $350,000 mortgage

Based on a $350,000 mortgage

| Remaining Mortgage Balance |

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Average Mortgage Payments In The Us

Monthly mortgage payments are largely determined by the size of a loan. In general, high-income consumers who take out bigger mortgages will pay more in lifetime interest than lower-income consumers. Still, smaller loans generally have the higher interest rates, as do loans drawn by borrowers with poor credit scores. As expected, higher interest rates also lead to larger monthly payments as a whole.

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

How Are Mortgage Brokers Paid

Mortgage brokers typically receive an amount equal to 1% to 2% of each loan they arrange. In some cases, they are paid by the borrower and in other cases, the lender. Under current law, they are not allowed to be paid by both the borrower and the lender.

So, for every $100,000 of the loan amount, the broker can expect to receive $1,000 to $2,000. With home loans averaging $414,114 in November 2021, for example, a broker could earn $4,141 to $8,282 on an average deal.

A mortgage broker might be a solo practitioner or work for a firm with multiple brokers. Brokers who are employees may be paid a salary and split their commissions with their parent firm.

If I Pay Back My Mortgage Early Can I Cancel My Mortgage Protection Policy

Yes but youll have to let your insurer know you want to cancel the policy early as it usually wont be done automatically.

However you can also choose to continue with your mortgage protection policy, meaning if you were to die before the end of the original term, any remaining benefit would be paid out to your estate, instead of being used to pay off your mortgage.

Recommended Reading: Rocket Mortgage Loan Types

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 3.6% right now.

Whats The Average Monthly Mortgage Payment In San Diego

For example, Zillow reports that the median home price in San Diego, California is $586,000, which is far more than the national median. Even with a 20 percent down payment, the monthly payment on a 30-year loan at 4.1 percent would be $2,265. Meanwhile, the median home price in Omaha, Nebraska is $156,600.

Don’t Miss: Recasting Mortgage Chase

Average Mortgage Rates Today

We present the average 30- year, 15- year, and 5/1 ARM rates for all 50 states and the District of Columbia. These current rates update on a weekly basis and vary according to your state of residence.

Our current mortgage rates reflect several assumptions: The most important of these include the loan amount and loan-to-value ratio .

If your mortgage balance is greater than the $200,000 baseline used to find these averages, then your rate will likely be higher as well. For LTV, our mortgage rate averages assume a value of 80%equal to a down payment of 20%.

A lower down payment means a higher LTV, resulting in a rate estimate that’s higher than average.

| Loan Type | |

|---|---|

| 3.76% | 2.38%7.75% |

Rates assume a loan amount of $200,000 and a loan-to-value ratio of 80%. ARM rates apply to the initial fixed-rate period, after which rates can change based on market conditions.

On the other hand, having a lower mortgage balance or larger down payment means that your quoted rates might fall below the average rates of the loan types you request.

Mortgage lenders may also offer lower rates to applicants based on credit scores and debt-to-income ratios .

A higher credit score leads to more favorable loan terms, including a lower interest rate.

DTI is calculated as your total monthly debt payments divided by monthly gross income, so a lower DTI:

- Indicates better financial health

- Reduces the mortgage rates you’ll be offered.