How Does It Differ From A Gfe

For those whove been through the mortgage process before, an LE may sound awfully similar to a Good Faith Estimate. As part of the Know Before You Owe mortgage disclosure rule, the LE replaced the GFE. Industry experts acknowledge LEs are better than GFEs because theyre easier to comprehend. LEs arent usually full of financial jargon, and they encourage borrowers to weigh all their options and compare loan costs and fees against those offered by other banks or mortgage entities.

No one likes to be surprised by hidden expenses, especially when it comes to mortgage payments. LEs aim to prevent this from happening. Loan origination expert Jonathan Dyer told MagnifyMoney that, under the changes implemented by Know Before You Owe, whatever fees loan originators originally discuss with borrowers often remain as they are, something that wasnt necessarily true under the GFE system.

Regulatory agencies have now prohibited any increase of disclosed fees without a significant change in the loan purpose or loan amount, Dyer said.

How Does Trid Affect Sellers

As a seller, youre not responsible for the practices of your buyers mortgage lender. However, you may see delays or last-minute closing cancellations if the buyers lender attempts to sign a loan against TRID regulations.

Due to new regulations, many lenders now say a home loan takes an average of 45 60 days to close due to mandatory waiting periods and disclosure timelines. If youre selling your home, keep TRID regulations in mind while you plan your move and remember to stay patient throughout the process.

A Quick Guide To Your Loan Estimate

The Loan Estimate is intended to provide a clear and concise summary of the terms and costs associated with any loan. Heres how to read it with confidence.

The Loan Estimate provides a clear and concise summary of the terms of your loan to help you understand the features, costs and risks associated with your mortgage as required by the Consumer Finance Protection Bureau . Before moving forward with any lender, you should be sure to compare and understand your Loan Estimate.

Read Also: What To Look Out For With Mortgage Lenders

The Bottom Line: Theres A Lot To Learn When You Decide You Want To Own A Home

Becoming a homeowner isnt easy and its certainly not cheap but its worth the effort. Its important to take the time to familiarize yourself with what a mortgage is before you plunge into the market. Ready to take the first step in your home buying journey? Get started on your mortgage approval today! You can also give us a call at 326-6018.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

The Bottom Line: Trid Is Helpful To Understand When Shopping For A Loan

TRID is a series of guidelines that dictate what information mortgage lenders need to provide to borrowers and when they must provide it. TRID rules also regulate what fees lenders can charge and how these fees can change as the mortgage matures.

If you know and understand TRID regulations, you can use them to find the best possible mortgage for you and your familys needs. Thanks to TRID, you can secure a number of Loan Estimates from competing lenders so you can decide on the best home loan option for you.

If youre ready to purchase a home, start the mortgage process today.

Take the first step toward buying a house.

Get approved to see what you qualify for.

Also Check: What Is A Second Mortgage And How Does It Work

A Refresher On Triggering Events Impacting The Revised Loan Estimate

Published in BankingExchange.com, November 2021

- Changed circumstances that cause an increase to settlement charges

- Changed circumstances that affect the consumers eligibility for the loan or affect the value of the property securing the loan

- Consumer-requested changes

- Expiration of the original loan estimate

- Construction loan settlement delays

How To Choose Which Lenders To Get Loan Estimates From

You shouldnt get Loan Estimates from every lender you talk to. Youll want to narrow down your list and get Loan Estimates from just three lenders, Beeston says.

When youre shopping for a lender look at online reviews for specific loan officers, not just the lender they work for. Otherwise, you may end up working with an inexperienced mortgage professional who just happens to work for a reputable lender. You have to feel the loan officer is competent and knows the guidelines, its not just about rate, Beeston says.

To weed out lenders, call a bunch to get a feel for who you connect with, and be sure to touch on the following topics:

Also Check: How Long Will I Pay Off My Mortgage

What Is A Mortgage Loan Estimate

A Loan Estimate is a three-page document detailing your prospective mortgage costs. This form outlines the fees, interest rate, and all other expenses associated with your mortgage. The lender must provide you with a Loan Estimate within three business days of receiving your application.

To get an official Loan Estimate youll need to have a home under contractmeaning the home seller has accepted your offerunless youre refinancing an existing mortgage. A lot of people think theyll get a Loan Estimate with a prequalification or a preapproval, but you wont get the official estimate without a property address, Beeston says.

All lenders are required to use the same Loan Estimate form. This makes it easier to compare offers, but you still need to know what youre looking at. Also keep in mind the Loan Estimate is just that an estimate. Fees vary between lenders and some can change by the time of closing. The good news is you dont have to be an expert to understand whats on a Loan Estimate. You just need to know what to focus on.

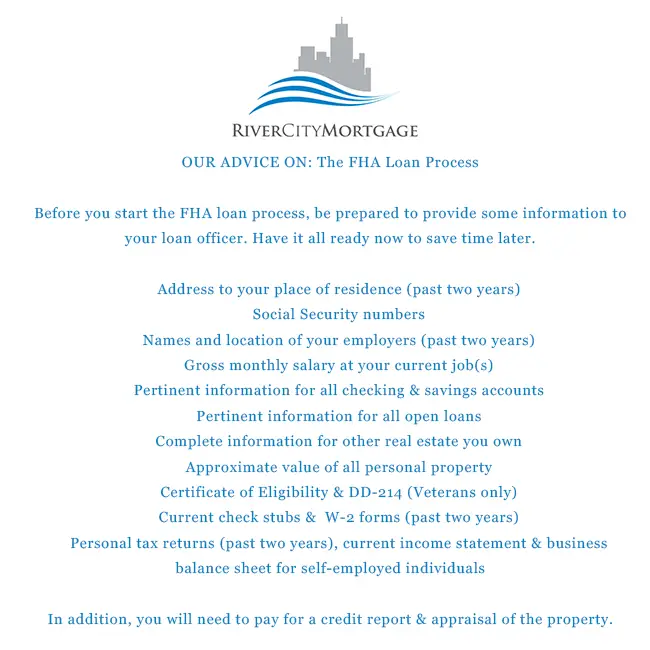

Your Credit Score Income And Assets

As weve noted, you cant control current market rates, but you can have some control over how the lender views you as a borrower. Be attentive to your credit score and your DTI, and understand that having fewer red flags on your credit report makes you look like a responsible borrower.

To qualify for the loan, you must meet certain eligibility requirements. Therefore, a person who gets a mortgage will most likely be someone with a stable and reliable income, a debt-to-income ratio of less than 50% and a decent .

You May Like: How To Remove A Cosigner From A Mortgage

Shop For Your Home And Make An Offer

Connect with a real estate agent to start seeing homes in your area. You may find that because of high demand and COVID-19 restrictions, many homes can be viewed online only. In fact, the number of sales completed online during the pandemic has skyrocketed.

In other words, your buyers agent today will likely be your eyes and ears like never before. Real estate professionals can help you find the right home, negotiate the price and handle all the paperwork and details.

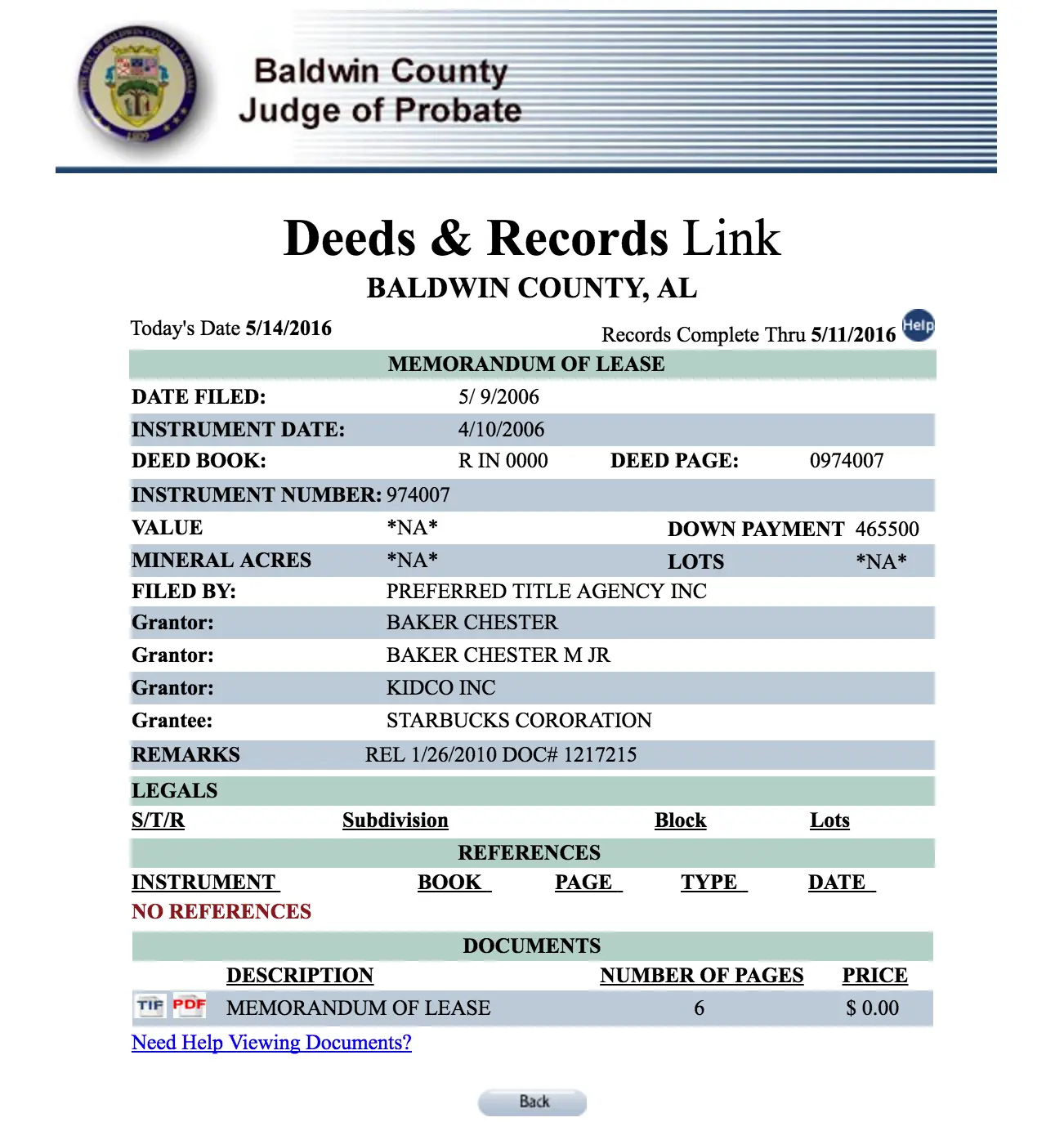

What Does Le Mean On Tax Records

Life estateCommon Abbreviations/Acronyms On Property Tax Bills

| Abbreviation |

|---|

| Life estate |

What happens if remainderman dies?

If the only remainderman on a life estate deed dies before the person with the life estate, the property interest remaining after the life estate passes to the remaindermans legal heirs. If the remaindermen were joint tenants, the dead remaindermans interest automatically belongs to the surviving remainderman.

What does H E mean on property records?

homestead exemptionhomestead exemption freedom of part or all of the value of a homestead from property taxation a reduction in the property tax base abbreviated as H/E or sometimes H/S SEE Homestead Exemption.

What does Le mean after someones name?

AV Rated Estate Planning, Best Lawyers A life estate deed is a transfer of the ownership of the real property that is the subject of the deed to one or more persons , while retaining ownership of a life estate in the property by the person transferring the property .

What does Le mean after a persons name?

Life EstateIf it appears after a name on a deed it generally stands for Life Estate.

What is Le mortgage?

According to the Consumer Financial Protection Bureau, a mortgage LE is a document thats usually about three pages in length. This includes the loan amount, the interest rate, closing costs and a ballpark figure of their monthly mortgage payment.

Also Check: How Much Money Can I Be Approved For A Mortgage

How Many Mortgages Can I Have On My Home

Lenders generally issue a first or primary mortgage before they allow for a second mortgage. This additional mortgage is commonly known as a home equity loan. Most lenders dont provide for a subsequent mortgage backed by the same property. Theres technically no limit to how many junior loans you can have on your home as long as you have the equity, debt-to-income ratio, and credit score to get approved for them.

What Is A Mortgage Le

For most Americans, the third of October in 2015 was just another ordinary day, no different than any other. But for lenders, as well as people applying for a mortgage loan, that October day fundamentally changed the way mortgage requests are handled to increase transparency.

As you may know, lawmakers passed a number of regulatory measures to reduce the likelihood of another Great Recession. One of them was what is formally known as a Loan Estimate . So what exactly is a mortgage LE, and why are they so important to the borrowers and lenders alike?

Read Also: Can You Get Pre Approved Mortgage Online

Tips For Comparing Les From Different Lenders

Here are a few things to look out for:

1. Third-party fees appearing on one lenders LE and not anothers

You should raise this with your Mortgage Expert. While the fee amount can vary, the types of third-party fees associated with a loan are fairly constant. One lender may be missing something.

2. Differences in loan amount for a refinance

A lender may increase your loan amount slightly to create a no closing cost loan. Borrowing a little more than the payoff on your current loan is one way to offset fees at the closing table, but this is increasing your debt to pay for your closing costs it does not make them go away. For an apples-to-apples comparison across lenders, you should get LEs with identical loan amounts.

3. Promises of credits after close that do not appear on the LE

This is a major red flag. The purpose of the LE is to create transparency and accountability. You lose both by transacting outside of the standard disclosure.

4. Increasing costs during a change in circumstance

Some lenders may advertise attractive rates and fees for one product, then switch into something less competitive . You should ask about any additional fee and look at the relative competitiveness of the new product by continuing to shop before locking.

How To Compare Mortgages

Banks, savings and loan associations, and credit unions were virtually the only sources of mortgages at one time. Today, a burgeoning share of the mortgage market includes nonbank lenders, such as Better, loanDepot, Rocket Mortgage, and SoFi.

If youre shopping for a mortgage, an online mortgage calculator can help you compare estimated monthly payments, based on the type of mortgage, the interest rate, and how large a down payment you plan to make. It also can help you determine how expensive a property you can reasonably afford.

In addition to the principal and interest that youll be paying on the mortgage, the lender or mortgage servicer may set up an escrow account to pay local property taxes, homeowners insurance premiums, and certain other expenses. Those costs will add to your monthly mortgage payment.

Also, note that if you make less than a 20% down payment when you take out your mortgage, your lender may require that you purchase private mortgage insurance , which becomes another added monthly cost.

If you have a mortgage, you still own your home . Your bank may have loaned you money to purchase the house, but rather than owning the property, they impose a lien on it . If you default and foreclose on your mortgage, however, the bank may become the new owner of your home.

You May Like: When Should I Refinance My Mortgage Dave Ramsey

What Borrowers Need To Know About New Mortgage Disclosure Rules

01.29.2016

The Consumer Financial Protection Bureau recently issued a new mortgage disclosure rule that combines mortgage disclosures established by the Truth-in-Lending Act and the Real Estate Settlement Procedures Act into a single rule known as TILA-RESPA Integrated Disclosure rule. The TRID rule has been in effect since October 3, 2015.

The goal of the TRID rule is to promote clarity during the loan process by providing borrowers with accurate and consistent information in connection with different loan and settlement cost options offered by their lenders.

The TRID rule applies to most closed-end consumer credit transactions secured by real property , but does not apply to chattel-dwelling loans .

The TRID rule has replaced the four disclosure forms previously used under TILA and RESPA with two new integrated forms: a Loan Estimate and a Closing Disclosure . Here are details on the new forms:

The TRID rule provides that the borrower can waive the seven-business-day waiting period after receiving the LE and the three-day waiting period after receiving the CD if the borrower has a bona fide personal financial emergency, which requires closing the transaction before the end of these waiting periods. While this term is not defined, the CFPBs example sets a high bar, as it involves a borrower facing an imminent foreclosure sale of his or her home unless loan proceeds are available to the borrower during the respective waiting periods.

The Truth In Lending Act

The government introduced TILA regulations in 1968 to discourage dishonest credit lending practices. TILA, and its subsequent Truth-in-Lending disclosures, protects you from unfair credit and credit card billing practices by requiring lenders to offer written documentation on your loan well before you must sign to lock the rate.

For most types of loans, TILA requires lenders to provide upfront information about interest rates and payments before you sign on. This act also gives you a grace period of at least 3 days in which you can back out of the loan without losing money also known as the right of rescission. TILA doesnt tell lenders how much they may charge in interest, but it does give borrowers the opportunity to compare lenders before making a decision.

Don’t Miss: Do Hard Inquiries Affect Getting A Mortgage

What Does Trid Mean For Home Buyers

As the borrower, TRID regulations protect you against high-pressure or unfair sales tactics, and they ensure you know exactly what youre signing on for when you agree to a loan. However, TRID also introduces a new layer of responsibilities that you need to uphold when buying a house, just like your lender must remain fair and transparent. When you decide on a lender, you need to contact your mortgage provider of choice and sign an Intent to Proceed document.

If you dont sign this document, your lender legally cant continue with the mortgage process. You also need to contact your lender and acknowledge when you receive your Closing Disclosure, so they can start the 3-day timer before you close on your loan.

If you wait to inform your lender that you have the document, you might prolong finalizing the sale. Staying in contact with your mortgage lender will speed up your borrowing process and help your lender stay within the bounds of TRID regulations.

General And Specific Liens

A lien can either be general or specific. These two different labels can tell you how a lien will impact you specifically, the scope of your property it will affect.

A general lien is a claim on all your property assets, including real estate and personal property . When you owe the IRS taxes, they can apply a claim on all of your property, not just your house, with a general lien.

In contrast, a specific lien is a claim on a particular piece of property or asset. For instance, a specific lien might be incurred when a property owner owes homeowners association fees or late mortgage payments on a specific property. A mortgage on a home is an example of a specific lien.

You May Like: When Was The Lowest Mortgage Rate

Keys To Comparing Lenders With Loan Estimates

All the most important things for a borrower to look at are on the first two pages of the Loan Estimate, Beeston says: the loan type, rate lock information, rate, and fees.

For example, the , which includes the interest rate plus fees, is a better measure of the overall cost of a mortgage than the interest rate. But it does include some costs such as prepaid taxes that can adjust between the Loan Estimate and closing. So the APR on the Loan Estimate might change, thats why its important to focus on comparing lenders fees and the interest rate.

How Does A Mortgage Loan Work

When you get a mortgage, your lender gives you a set amount of money to buy the home. You agree to pay back your loan with interest over a period of several years. The lender’s rights to the home continue until the mortgage is fully paid off. Fully amortized loans have a set payment schedule so that the loan is paid off at the end of your term.

The difference between a mortgage and other loans is that if you fail to repay the loan, your lender can sell your home to recoup its losses. Contrast that to what happens if you fail to make credit card payments: You dont have to return the things you bought with the credit card, though you may have to pay late fees to bring your account current in addition to dealing with negative impacts on your credit score.

Don’t Miss: Who Is The Mortgage Holder