Example Of How Mortgage Points Can Cut Interest Costs

If you can afford to buy discount points on top of the down payment and closing costs, you will lower your monthly mortgage payments and could save lots of money. The key is staying in the home long enough to recoup the prepaid interest. If you sell the home after only a few years, or refinance the mortgage or pay it off, buying discount points could be a money-loser.

Here is an example of how discount points can reduce costs on a $200,000, 30-year, fixed-rate mortgage:

| Loan principal | |

|---|---|

| None | $20,680 |

In this example, the borrower bought two discount points, with each costing 1 percent of the loan principal, or $2,000. By buying two points for $4,000 upfront, the borrowers interest rate shrank to 3.5 percent, lowering their monthly payment by $56, and saving them $20,680 in interest over the life of the loan.

How To Use Basis Points

Basis points evaluate small changes to interest rates or yields. The Federal Reserve sets the federal funds rate, which is a benchmark interest rate that influences how much you pay to borrow money.

Here are some financial instruments that use basis points to measure percentages:

- Corporate bonds

Dont Miss: How Many Payments Left On Mortgage

When Is It Worth It To Buy Points

Typically, most financial advisors would say that if you cant break even in 36 months or less then it wont make sense.

If you’re planning to move or refinance in a couple of years, paying points is probably not a good move.

Think of it as if youre putting money in a bank to make interest. The longer you have to wait to get the return is also a factor. Waiting longer than 36 months in most cases means that you may have been able to put those same funds in a different investment vehicle and make more money than what the cost wouldve saved you.

Don’t Miss: What Should Your Credit Score Be For A Mortgage

Mortgage Loan Points: What Are They And Should You Buy Them

Purchasing mortgage points from your lender can lower your interest rate and make your monthly mortgage payments more affordable. If youre considering a home purchase or refinance, mortgage points could save you tens of thousands of dollars over the life of the loan.

In this article, well explain what mortgage points are and present the pros and cons of buying mortgage points

Are Mortgage Discount Points Worth It

Discount points can save you money if you stay in the home loan long enough to make them worthwhile.

The following example will show the impact of discount points on the monthly payments for a $300,000 home loan financed over 30 years:

| Discount Points | |

| $1,225 | $122 |

Payment estimates do not include real estate property taxes or homeowners insurance. They include mortgage principal and interest only.

In the above example, the mortgage applicant saves $42 a month by spending $3,000 on discount points upfront.

To reclaim the full $3,000 cost of the point, the homebuyer would need to make 72 regular monthly payments. That would take six years of making the loans regularly scheduled payments.

Don’t Miss: When Is The Best Time To Pay Off Your Mortgage

Calculating Points On Arm Loans

While a point typically lowers the rate on FRMs by 0.25% it typically lowers the rate on ARMs by 0.375%, however the rate discount on ARMs is only applied to the introductory period of the loan.

ARM loans eventually shift from charging the initial teaser rate to a referenced indexed rate at some margin above it. When that shift happens, points are no longer applied for the duration of the loan.

When using the above calculator for ARM loans, keep in mind that if the break even point on your points purchase exceeds the initial duration of the fixed-period of the loan then you will lose money buying points.

| Loan Type |

|---|

| 120 months, or whenever you think you would likely refinance |

Pros Of Buying Mortgage Points

The biggest benefit of buying mortgage points is lowering the interest rate on your loan, no matter your . This saves you money not only on your monthly mortgage payments but also on total interest payments.

Buying down your rate also reduces the total cost of the home. Paying an extra $3,000 upfront could save you thousands more over the life of the mortgage loan.

Mortgage points are also tax-deductible. The IRS considers mortgage points to be prepaid interest, which may be deductible as home mortgage interest if you itemize deductions. If you deduct all interest on your mortgage, you may be able to deduct all of the points.

Calculate how much you can save on your mortgage payments with Total Mortgage.

Recommended Reading: How To Determine Mortgage Approval Amount

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score of both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

What Are Points When Refinancing

Mortgage points are upfront fees paid directly to your lender at closing in exchange for a lower interest rate.

A lower interest rate reduces your total monthly payment and can save you a significant amount of money over the life of your loan.

When you refinance a loan, youre basically swapping out your original mortgage for a new one. In the process, the old loan gets paid off and you agree to the terms of the new one. Just like with a regular mortgage, you might want to consider purchasing points at closing as a way to buy down the interest rate of your new refinance mortgage. You can also use points to secure various types of more favorable loan terms.

Don’t Miss: Can I Refinance My Parents Mortgage

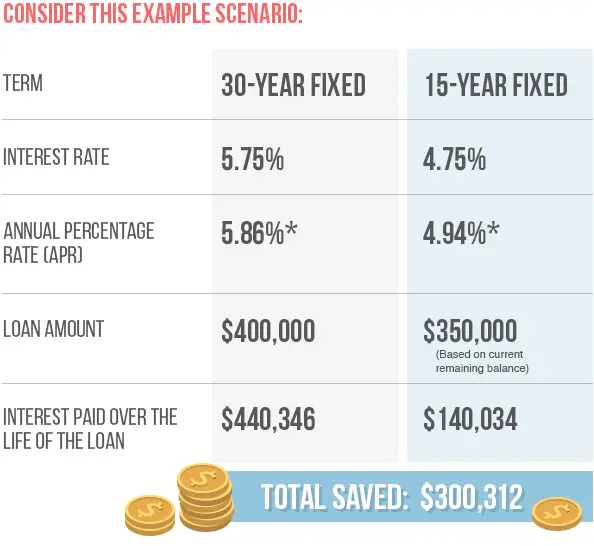

Mortgage Discount Points Vs Apr

Buying discount points on your mortgage is effectively a way of prepaying some of your interest, and looking at the annual percentage rate can help you compare loans with different rate and point combinations. The APR incorporates not just the interest rate, but also the points you pay and any fees the lender will charge. Check out a quick explanation from Greg McBride, CFA, Bankrate chief financial analyst:

What Are Todays Interest Rates

Current mortgage rates depend, in part, on what home buyers are willing to pay for a home loan. In general, higher interest rates go to those who pay less.

And remember, the lowest rate isnt always the best deal. A good loan officer should be able to help you sort through your home-purchase options and choose the lowest-cost program for your needs.

Don’t Miss: What Makes Mortgage Rates Change

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan and reduce its monthly payment. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

Of course, if you dont plan to stay in a home for a long time, paying points is likely to lose you money overall.

Another consideration is whether you should put money toward points or a larger down payment. A larger down payment can often help you secure a lower interest rate anyway. Additionally, hitting the 20% down payment mark can also let you avoid the additional cost of PMI.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

What Are Origination Fees

Why do so many lenders quote an origination fee? To get a true no point loan, lenders must disclose a 1% fee and then give a corresponding 1% rebate. Wouldnt it make more sense to quote a loan at par and let the borrower buy down the rate?

The reason lenders do it this way is because of the disclosure laws in the Dodd-Frank Act. If the lender does not disclose a certain fee in the beginning, it cannot add that fee on later. If a lender discloses a loan estimate before locking in the loan terms, failure to disclose an origination fee will bind the lender to those terms.

This may sound like a good thing. If rates rise during the loan process, it can force you to take a higher rate. Suppose you applied for a loan when the rate was 3.5%. When you are ready to lock in, the rate is worse. Your loan officer says you can get 3.625% or 3.5% with the cost of a quarter of a point . If no points or origination charges show up on your loan estimate, the lender wouldnt be able to offer you this second option. You would be forced to take the higher rate.

You May Like: How Do You Figure Out Mortgage Interest

What Are Todays Mortgage Rates

Todays mortgage rates are at historic lows. Mortgage points allow borrowers to buy down their interest rate even further, which can generate huge savings.

However, mortgage points arent always worth it. And if you opt not to pay for them, youre still likely to get a great deal in todays ultra-low rate environment.

How Much Do Mortgage Discount Points Cost

Typically, one point is equal to 1% of the loans principal, and it usually buys the rate down by 0.25%. So, you might have to pay four points to reduce your rate by a full percent.

Example. Say you buy one point on a mortgage loan of $300,000, which costs $3,000 . The initial interest rate was 3%. Because each point lowers the interest rate by 0.25%, buying one point lowers your mortgage interest rate from 3% to 2.75%.

But one point might reduce the rate by more or less than 0.25%, depending on the loan and lender.

Also Check: How Do Mortgage Brokers Get Leads

Read Also: How Much Is Monthly Payment On 200 000 Mortgage

Comparing Monthly Mortgage Principal & Interest Payments With Discount Points

A home-buyer can pay an upfront fee on their loan to obtain a lower rate. The following chart compares the point costs and monthly payments for a loan without points with loans using points on a $200,000 mortgage.

| Points | |

|---|---|

| $9,072.22 | $17,997.21 |

Some lenders advertise low rates without emphasizing the low rate comes with the associated fee of paying for multiple points.

A good rule of thumb when shopping for a mortgage is to compare like with like. Shop based on

- annual percentage rate of the loan, or

- a set number of points

Then compare what other lenders offer at that level.

For example you can compare the best rate offered by each lender at 1 point.

Find the most competitive offer at that rate or point level & then see what other lenders offer at the same rate or point level.

Recommended Reading: When Do You Pay Pmi On A Mortgage

How Much Money Can You Save Buying Mortgage Points

Is purchasing points beneficial if you keep your new home for five years? You can figure it out by using a mortgage calculator.

Suppose it costs two points to reduce the interest rate on a $400,000 30-year fixed-rate loan from 4.5% to 4.0%. Your monthly mortgage payment for principal and interest would drop by $117 with the lower rate .

After five years, with the 4.0% home loan, youll have paid $76,370 in interest payments, plus $8,000 in mortgage points, for a total of $84,370. Youll have reduced your principal balance by $38,210.

With the 4.5% loan, youll have paid $86,236 in interest. Youll have reduced your principal balance by just $35,368.

In this case, then, it will cost you $1,888 less over five years if you pay the discount points. But thats not all. Youll have reduced your balance by an extra $2,842. So your total savings in five years is $4,730.

One more advantage of paying mortgage points is that, since they represent prepaid interest, they are typically tax-deductible

Recommended Reading: What Would My Mortgage Payment Be On $90000

How Do Mortgage Refinance Points Work

In short, points are fees. Each point costs about 1% of the corresponding loans total amountthe more expensive the loan, the higher the cost of each individual point.

Typically, for each point purchased, you would receive a 0.25% reduction in your interest rate. If you dont want to purchase an entire point, you can purchase fractions of a point to buy down your rate. Keep in mind that most lenders have a cap on the number of points you can buy.

Lets look at an example of how mortgage refinance points work in action:

Meet Jamie. Jamie is refinancing his home and taking out a new loan of $300,000. Based on his new loan amount, Jamie will have to pay $3,000 per refinance point. Purchasing 2 points will raise his closing costs by $6,000 and lower his rate by 0.5%. In this scenario, his original interest rate of 4% would come down to 3.5%, and his mortgage payments would go from $1,432 to $1,347 per month, saving him $1,020 over the course of the year.

Lets say Jamie decides to pay for 2.5 points. The extra .5 point adds $1,500 to his closing costs and decreases his interest rate by a total of 0.625% . By purchasing an additional half-point, he can save an extra $240 a year in interest. But is that extra savings worth the additional upfront cost?

You Pay The Points Out Of Your Own Funds

This is a common outcome in strong real estate markets and among higher-priced properties. Sellers rarely pay any closing costs under either condition. If so, youll need to budget additional funds for closing.

Lenders will generally accept funds coming from any source, with the lone exception of borrowing. For example, lenders generally wont permit you to take an advance on your credit card to pay the points.

You May Like: How Much Do You Pay On A 30 Year Mortgage

How To Shop For A Mortgage With Points

When youre looking at a rate quote that includes points, youd have to pay extra money upfront to actually get the rate shown.

For example, imagine youre taking out a $300,000 mortgage loan. Heres how your interest rate might look with and without mortgage points:

| Mortgage Points | Upfront Cost To Buy Points | Interest Rate | Total Interest Paid Over 30 Years |

| 0 | |||

| 3.0% | $155,300 |

Interest rates shown are for sample purposes only. Your own mortgage rate and fees will vary. Get a custom rate estimate here.

The cost of buying mortgage points adds up quickly. But as you can see in the example above, the long-term savings built into your monthly mortgage payment can be substantial.

Are Mortgage Rates Going Up

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-palmetto-mortgage.jpeg)

Mortgage rates started ticking up from historic lows in the second half of 2021 and have increased significantly so far in 2022.

In the last 12 months, the Consumer Price Index rose by 8.3%. The Federal Reserve has been working to get inflation under control, and is expected to increase the federal funds target rate two more times this year, following increases at its last five meetings.

Though not directly tied to the federal funds rate, mortgage rates are sometimes pushed up as a result of Fed rate hikes and investor expectations of how those hikes will impact the economy.

Inflation remains elevated, but has started to slow, which is a good sign for mortgage rates and the broader economy.

Recommended Reading: Who Offers 10 Year Mortgages

Mortgage Refinance Points Up Front

Determine how much extra cost you can handle for the closing of your refinanced mortgage loan. Every extra point equals one percent of the loan amount adding points can be expensive when you’re about to sign on the dotted line.

One option is to borrow extra funds to cover the cost of your points. If you go down this road, you’ll pay interest on the points that were rolled into the loan balance. It’s a bit counterproductive, so you may not save much over the option in which you don’t take extra points.

How Much Money Do You Have To Put Down At Closing

If your down payment on a conventional loan is under 20%, you may be required to pay private mortgage insurance , which can cost about 1% of the loan amount annually. In the case of a conventional loan for $150,000, the PMI will cost $1,500 a year or $125 a month.

This is important for clients who are on the fence between paying for mortgage discount points or a larger down payment. If its between discount points and boosting your down payment to 20% or over, youll want to choose the down payment most of the time. Always do the math and consider if your discount points are costing you more or less than your monthly PMI fees.

PMI rates do vary from lender to lender, so this is a question worth asking if youre shopping for a conventional loan. Its also important to know that mortgage insurance guidelines will depend on the type of loan you have .

Read Also: What Is Loan Servicing In Mortgage