Your Loan Balance Grows Each Month

With a reverse mortgage, your loan balance increases each month as your lender makes payments to you. It works in the reverse of a regular, forward mortgage, which shrinks as you make monthly payments to your lender. That means the ongoing fees associated with HECM loans, such as the annual mortgage insurance premium will increase as well.

+ Are There Tax Consequences What About My Social Security And Medicare Benefits

Because reverse mortgages are considered loan advances and not income, the IRS considers the proceeds received by them to be non-taxable. Similarly, having a reverse mortgage should not affect your Social Security or Medicare benefits. Please contact your tax advisor to assess your particular situation. If you receive SSI, Medicaid, or other public assistance, your reverse mortgage loan advances are only counted as “liquid assets” if you keep them in an account past the end of the calendar month in which you receive them. You must be careful not to let your total liquid assets become greater than these programs allow. You should discuss the impact of a reverse mortgage on federal, state or local assistance programs with a professional advisor, such as your local Area Agency on Aging, your accountant or tax attorney. Finally, another tax fact to bear in mind is that the interest on reverse mortgages is not deductible on your income tax returns until the loan is paid off entirelyin other words until the interest is actually paid.

How Do You Get Out Of A Reverse Mortgage

There are a few ways to get out of a reverse mortgage. Initially, you have a “right of rescission,” which means you can cancel the loan and have your loan costs refunded if you notify your lender in writing within three days of closing on the loan. After that, you’ll need to either pay off the loan or refinance it if you no longer want a reverse mortgage.

Read Also: Can I Refinance My Mortgage With The Same Bank

Senior Housing Bubble Held Together By Glue And Tax Dollars

Executive Summary

Reverse mortgages are loans that allow seniors to take equity out of their homes to help pay for living expenses or other costs. As the equity in their home decreases, the amount of the loan increases. Unlike a traditional mortgage, seniors do not make monthly payments. The loan becomes due when the borrower dies, moves out of the house, or fails to maintain the property and pay homeowners insurance and property taxes. This type of loan is almost always insured by the Federal Housing Administration.

As financial pressures on seniors have increased, the numbers of reverse mortgages have grown, and so have the opportunities for unscrupulous lenders to take advantage of seniors. These loans are complex, expensive, and drain equity from the property, leaving seniors with very few options later in life.

I. BackgroundWhat is a reverse Mortgage?

Payment OptionsThe Role of the Federal Government.Why Seniors Take Out Reverse Mortgages Reverse Mortgages Are Bad for SeniorsReverse Mortgages are Expensive Reverse Mortgages Strip Equity from Homes and Leave Seniors without OptionsCelebrity Spokespeople

- Fred Thompson for American Advisors Group :A government insured reverse mortgage allows seniors to stay in their own home and to turn their equity into tax-free cash.

Misleading Marketing

+ What Kinds Of Reverse Mortgages Are Available Are All Reverse Mortgages The Same

No, actually there are two basic types of reverse mortgages:

- Federally-insured reverse mortgages. Known as Home Equity Conversion Mortgages , they are insured by the U.S. Department of Housing and Urban Development . They are widely available, have no income requirements, and can be used for any purpose.

- Proprietary reverse mortgages. These mortgages are held by the companies that offer them and are typically used to facilitate higher loan amounts than offered through FHA HECM’s

Don’t Miss: Which Way Are Mortgage Rates Headed

Reverse Mortgage Vs Refinance: Which Is Better

Reverse mortgages can be a good idea for seniors who need more retirement income but still want to live in their homes. However, this might not be the best choice for you if you want to pass your home down to your children, or if you plan on vacating the home soon.

If you’re not sure a reverse mortgage is right for you, there are other refinancing options for seniors. For a homeowner in the right situation, one of these types of mortgages could provide a very viable or even better alternative as it accomplishes one of the major goals of a reverse mortgage accessing equity but allows more flexibility for you and your heirs.

Rocket Mortgage offers cash-out refinances. Read our guide to refinancing to see if this option makes sense for you.

Find a match.

For Reverse Mortgage Loans With Case Numbers Assigned Before August 4 2014

As explained in more detail below, after you, the borrower, die or move into a healthcare facility for more than more than 12 consecutive months, your lender or servicer can choose to either:

- Foreclose on the home, or

- Enter a process called Mortgage Optional Election Assignment that allows an Eligible Non-Borrowing Spouse to stay in the home.

Recommended Reading: Does Wells Fargo Do Reverse Mortgages

Mortgagee Optional Election Assignment

If your lender or servicer decides not to foreclose and instead enters the MOE Assignment process, to qualify as an Eligible Non-Borrowing Spouse, your spouse must:

- Have been married to you at the time the loan documents were signed and remain married to you in situations in which you move into a healthcare facility for more than 12 consecutive months, or remain married up until your death. If you and your spouse were unable to be legally married at the time the reverse mortgage loan was made, your spouse must show that you were legally married to each other at the time of your death.

- Have lived in the home since the beginning of the loan and continue to live in the home as their principal residence ever after you die or move into a healthcare facility for more than 12 consecutive months.

- Provide their Social Security number or Tax Identification Number.

- Agree that they will no longer receive any payments from the reverse mortgage loan.

- Continue to meet all loan obligations, including paying property taxes and homeowners insurance.

You Can Still Lose Your Home To Foreclosure

Finally, even if you dont have to make mortgage payments, youre still responsible for the applicable property taxes, homeowner insurance, and maintenance.

When you dont meet these requirements, your home can be foreclosed. Its important to make sure you have money available to make these payments or risk losing your home. Some lenders will create a set aside account to help you deal with these costs, funneling a portion of your loan into the account. However, a set-aside account isnt a guarantee that youll always have the money for these costs. Pay attention, and be sure youre up to date.

In the end, a reverse mortgage is like any other financial tool. You need to understand how it works and how it might fit into your finances to decide whether its right for you.

Recommended Reading: What Do I Need For A Mortgage Pre Qualification

Term Reverse Mortgage Payment Plan

Term payment plans provide equal monthly payments with a predetermined stop date. If the end of your term is up before you pass away, then you have outlived your reverse mortgage proceeds.

With a term payment plan, you reach your loans principal limitthe maximum that you can borrowat the end of the term. After that, you wont be able to receive additional proceeds from your reverse mortgage.

Tenure Reverse Mortgage Payment Plan

Tenure payment plans have an adjustable interest rate and provide equal monthly payments for life, as long as at least one borrower still lives in the home as their primary residence. If youre concerned about outliving your reverse mortgage proceeds, consider the tenure plan, which works like an annuity.

The lifetime income guarantee means that the younger you are when you get your reverse mortgage, the smaller your monthly payments will be. Those payments may be too small to provide the financial boost you need.

You May Like: How Much Would Mortgage Be On A Million Dollar House

How To Avoid Outliving Your Reverse Mortgage

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Reverse mortgages are sometimes advertised as a source of income for the rest of your life. And they can be, under the right conditions.

However, running out of reverse mortgage proceeds sooner than expected is a major risk for consumers who dont understand this loan product well.

Heres a look at how you could run out of reverse mortgage proceeds too early under each choiceand how to avoid that scenario.

Benefits Of Reverse Mortgage Payment Plans

To further understand the benefits of reverse mortgage payment plans, take the following example of Sandy.

Sandy has a forward mortgage with a remaining balance of $175,717. At her current rate of 4.25%, it will take her 10 years to pay off this balance with monthly payments of $1,800. Sandy is eligible for a reverse mortgage that will lower her interest rate to 2.5%.

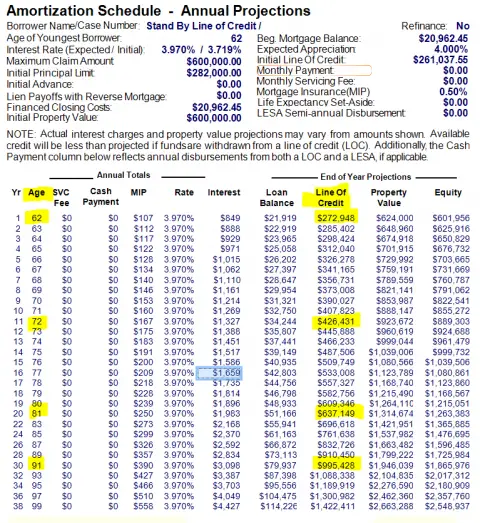

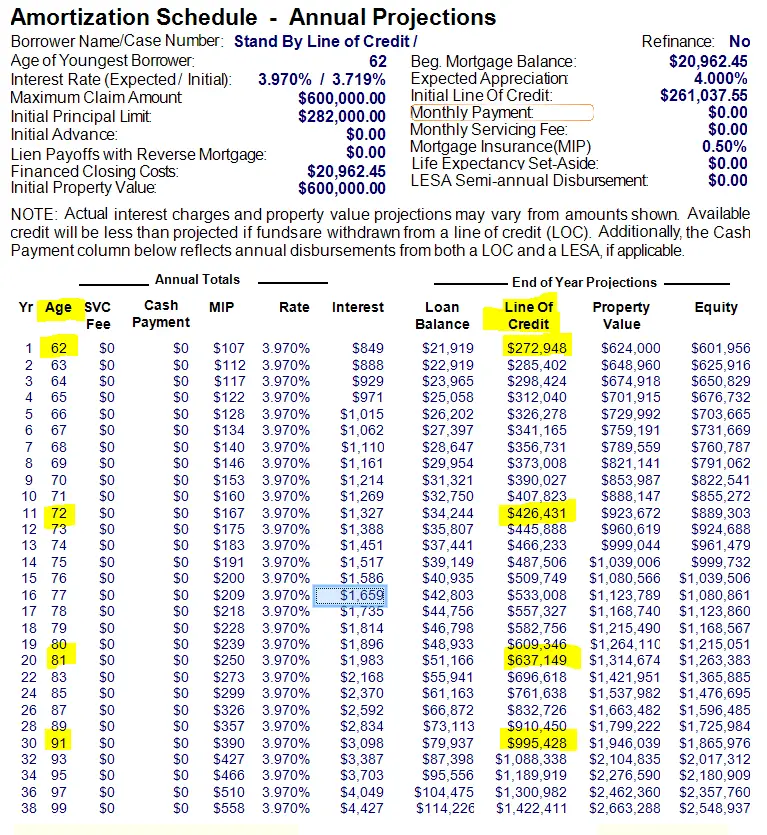

Because reverse mortgage payments are much more lenient than forward mortgages, Sandy can pay off the remainder of her forward mortgage through a number of flexible options. She can simply continue making monthly payments of $1,800 over the next 10 years and receive $15,224 cushion in cash or put that money away for later use. Sandy may also choose to put this extra cash towards paying off her forward mortgage early. She also has the option to make reduced monthly payments of $1,656.48 and still pay her balance off in 10 years. Finally, because the terms of a reverse mortgage protect the Sandy from incurring the late payment penalties, she has the flexibility to make payments at the frequency and amounts of her choosing.

Read Also: How 10 Year Treasury Affect Mortgage Rates

+ When Must A Reverse Mortgage Loan Be Repaid

Your reverse mortgage loan becomes due and must be paid in full when one or more of the following conditions occurs:

- the last surviving borrower passes away or sells the home

- all borrowers permanently move out of the home

- the last surviving borrower fails to live in the home for greater than 12 consecutive months

- you fail to bring current property taxes or insurance

- you let the property deteriorate beyond what is considered reasonable wear and tear and do not correct the problems.

How Does A Reverse Mortgage Differ From A Home Equity Loan

Q. How is a reverse mortgage like a home equity loan? How is it different?A. Both a reverse mortgage and a home equity loan use the equity you have built up in your home to provide you with readily available cash. They differ in that with a home equity loan you must make regular monthly payments of principal and interest. However, with a reverse mortgage you do not make any monthly mortgage payments for as long as you stay in the home.

Q. Can my current income influence my ability to get a reverse mortgage?A. No. Since reverse mortgage borrowers need not make monthly repayments, there are no income qualifications.

Don’t Miss: How To Pay A Mortgage In 10 Years

+ How Much Cash Will I Have To Come Up With Upfront To Cover Origination Fees And Other Closing Costs

One of the major benefits of a reverse mortgage is that you can use the money you obtain from your home’s equity to pay for the various fees . The costs are simply added to your loan balance. You pay them back, plus interest, when the loan becomes due – that is, when the last surviving borrower permanently moves out of the home or passes away.

Could A Reverse Mortgage Mitigate The Risk Of Economic Uncertainty

Mutual of Omaha- Reverse Mortgage Specialist- David Edel

Coulda Reverse Mortgage Mitigate the Risks of Economic Uncertainty?

Risks thatcould impact your retirement. And coulda reverse mortgage be a perfect risk mitigant for these hazards?

There are manyrisks that could impact retirement. Forexample, the risk of outliving ones assets, the inflation risk that erodesbuying power, market risk where nest egg values decrease, and liquidity riskwhere there is an excess ratio of wealth concentrated in an illiquid,indivisible asset such as real estate just to name a few.

So, whatexactly is a reverse mortgage? It is anFHA mortgage that doesnt have any payment schedule except for the sale of thehome or the death of the borrowers. Itis a way to convert a portion of the homes value into tax-free cash withoutany obligation on the part of the homeowners to ever make a mortgage payment.

There are mythsabout reverse mortgages that still abound like the myth that the bank owns ortakes your home or the myth that the wisest strategy is to wait to take out areverse mortgage as a last resort. Retirement research confirms waiting until portfolio depletion toinitiate a reverse mortgage is a dangerous way to rely on home equity. In doing so, you would lose the compoundinggrowth in the line of credit and/or use too much of your portfolio on fixedexpenses in market downturns.

Whoqualifies?

How muchmoney could I receive?

What are mypayment options?

Don’t Miss: How To Get Mortgage Statement Online

What Is The Advantage Of A Reverse Mortgage

The biggest advantage of a reverse mortgage are the payments to you! You can receive a lump sum, monthly installments, a line of credit, or a combination of payment types.

Another advantage of a reverse mortgage loan is that you are not required to pay the loan back until the home is no longer your primary residence or you fail to maintain the home, or fail to pay property taxes and/or homeowner’s insurance or do not otherwise comply with the terms of the loan.

If youre aged 62 or older and own your home you might be eligible for a reverse mortgage loan. Contact us to find out more about reverse mortgage loans and ways to make it work for you.

+ Is It Possible To Purchase A Home With A Reverse Mortgage

Yes, most definitely, however it must be your primary residence. Eligible property types include: single family homes, 1-4 Unit properties, some manufactured homes, condominiums and townhouses. Newly constructed properties must have a certificate of occupancy before a loan application can be taken. For more specific information, please contact your local All California Reverse Mortgage Specialist.

Read Also: How To Find Monthly Payment For Mortgage

You Could Outlive Your Reverse Mortgage

With some homeowners living into their 90s, its possible that youll outlive your reverse mortgage. This could result in a reverse mortgage balance thats higher than your homes value. One built-in protection allows you to sell the home at 95% of its value, and let the mortgage insurance pay the difference.

Reverse Mortgage Rates Fees And Regulations

Is there an age requirement to qualify for a reverse mortgage?

How can I use my reverse mortgage funds?

What fees do I have to pay with a reverse mortgage from Equitable Bank?

How can I reduce how much interest I pay on my reverse mortgage?

Are reverse mortgage rates higher than standard mortgages?

Is there a setup fee for a reverse mortgage?

You May Like: Why Do You Need Mortgage Insurance

What Is A Reverse Mortgage

A reverse mortgage loan is different than a traditional mortgage. With a traditional mortgage loan you make monthly mortgage payments, but with a reverse mortgage loan the lender pays you money through monthly installments, a one-time lump sum payment, a line of credit or a combination of a line of credit and monthly installments. The money that you receive is dependent on your age, the value of your home and the current interest rate.

You keep the title to your home. Your home is part of your estate. You are simply using the reverse mortgage to pull equity from your home.

How Much Money Can I Get

Q. How do you determine the amount of cash I am eligible for?A. The amount you can borrow depends on several factors, including your age, the type of reverse mortgage you select, current interest rates, the location of your home, and the appraised value of your home and FHA’s lending limits for your area. In most cases, the older you are, the more valuable your home, and the less you owe on it, the more money you can get.

Also Check: How Much Do You Pay On A 30 Year Mortgage

Your Heirs Might Not Be Able To Keep The Home

If you want to pass your home on to your children or other heirs, it might not be possible if your estate doesnt have enough in assets to pay off the loan.

Once you die, the loan becomes due. If your heirs cant figure out a way to pay off the loan using other resources, theyll have to sell it instead of keeping it. Before getting a reverse mortgage, double-check that you have a way for your estate or life insurance to pay off the debt if keeping the home in the family is an important priority.

Can I Outlive My Reverse Mortgage

Can I outlive my reverse mortgage?

One of a retirees chief concerns is that their savings wont last, that they will outlive their retirement assets and run out of money.

This concern carries over to those who obtain a reverse mortgage to help them supplement their retirement income. Due to a lack of knowledge or misinformation, many seniors believe its possible to outlive a reverse mortgage and be kicked out of their homes before theyre ready.

The reality is that you cant outlive the loan. What can happen is that you default on the loan because you fail to pay your property taxes and/or insurance. Its also possible to borrow the limit on your reverse mortgage and not be able to borrow additional funds later. This depends on the homes equity/value and your ability to keep your obligations.

What can cause the loan to become due

Regardless of how much you borrow from the reverse mortgage or how much equity you have available, you cannot be forced out of your house unless you fall behind on taxes, insurance, utilities or property maintenance.

If any of those situations occur, the loan defaults and the balance becomes due. The loan also becomes due if the borrower pass away or permanently move out of the residence.

Until a default occurs or the loan becomes due because of death or relocation, the borrower does not have to repay any part of the loan.

Borrowing too much, too soon

Tenure payment option

Don’t Miss: Should You Roll Closing Costs Into Mortgage