Where To Get A Reverse Mortgage

Two financial institutions offer reverse mortgages in Canada. HomeEquity Bank offers the Canadian Home Income Plan , which is available across Canada. You can get a reverse mortgage directly from HomeEquity Bank or through mortgage brokers. Equitable Bank offers a reverse mortgage in some major urban centres.

Shop around and explore your options before you get a reverse mortgage. Your financial institution may offer other products that might meet your needs.

Compare the costs of the following potential alternatives to a reverse mortgage:

- getting another type of loan, such as a personal loan, line of credit or credit card

- selling your home

- renting another home or apartment

- moving into assisted living, or other alternative housing

You may want to speak with a financial advisor and your family before getting a reverse mortgage. Make sure you understand how a reverse mortgage works and how it can affect your home equity over time.

Can You Lose Your House With A Reverse Mortgage

As with any mortgage, there are conditions for keeping your reverse mortgage in good standing, and if you fail to meet them, you could lose your home. The ways you could violate the terms of a reverse mortgage include:

- The home is no longer your primary residence.As part of the reverse mortgage agreement, the home must be your primary residence. This means that you cannot leave the home for more than 12 consecutive months, explains Michael Micheletti, spokesperson for Unlock Technologies, a company that helps homeowners access their equity. This rule doesnt bar you from leaving your home to travel or to come and go as you please, but if you vacate the property for 12 consecutive months, the reverse mortgage loan becomes eligible to be called due and payable.

- You decided to move or sell your home.If you have to move and put your home up for sale as part of the move, youre still bound by the requirement to live in the house for 12 consecutive months. If selling your home becomes a challenge and you dont find a buyer within that 12-month window, the reverse mortgage can be called due, Micheletti says.

- You dont pay your property taxes or homeowners insurance. Even with a reverse mortgage, youre still responsible for paying property taxes, and failure to do so could violate the terms of your loan. In addition, you must maintain current homeowners insurance.

What Is A Single Purpose Reverse Mortgage

A single-purpose reverse mortgage is an arrangement whereby lenders make payments to borrowers in exchange for some of the borrowers equity. Borrowers must use these payments for a specific purpose approved by the lender.

These can be contrasted with proprietary reverse mortgages and home conversion mortgages .

Also Check: How Much Do Mortgage Underwriters Make

Qualifying For A Reverse Mortgage

To apply for a reverse mortgage, you must be at least 62 years old, live in the home and have paid off all or most of your mortgage.

Most reverse mortgages today are insured by the Federal Housing Administration , as part of its Home Equity Conversion Mortgage program.

If you are eligible, you must first meet with a housing counselor approved by the U.S. Department of Housing and Urban Development . Under Minnesota law, a lender must provide a prospective borrower with a list of at least three independent housing counseling agencies. The lender must also receive certification that the applicant actually received the counseling.

When meeting with the counselor, talk through your concerns and make sure to provide your counselor with an accurate and full picture of your finances. The counselor cant give you the best possible advice without all the relevant information

A good counselor will make sure that you fully understand the reverse mortgage and will help you make a decision.

Cons Of Reverse Mortgages

- Must be at least 62 years old

- You lose equity in your home

- Loan amount is limited to $726,525

- It may be possible to outlive your funds

- More complicated than a normal mortgage

- May lose your home if you cant meet ongoing requirements

- May make it difficult or impossible for your heirs to keep your home

- In some cases, your surviving spouse or roommates may have to move out after you pass away

Don’t Miss: Can I Rent An Apartment If I Have A Mortgage

How Does Reverse Mortgage Work

To be eligible for a reverse mortgage, you must be at least 62 years or older. If you live with a younger spouse, you may still become the primary borrower, though it can be very risky for your spouse. If you die, your spouse may have to sell the house or would have to pay off the entire loan to avoid selling the house.

The amount of loan you get depends on your age, home value, and current interest rate. The amount can become available to you as a lump sum payment, as monthly payments, or as a line of credit. The loan is written in such a way that the value of the house does not fall below the actual loan value. This is done to avoid burdening the estate or the heirs of the borrower from covering the difference between the loan and the house value.

The repayment of the loan becomes due when the last surviving borrower dies. Any amount remaining from the selling of the house and after repaying the loan becomes available to your heirs. However, if the borrowers wish to make a prepayment on the loan, there is no penalty. The loan can be paid off at any time after it was taken.

You Decided To Move Or Sell Your Home:

Another rule associated with reverse mortgages is that a reverse mortgage loan becomes payable upon the sale or relocation of the parties involved in the loan.

So, if you decide to put up your home for sale as part of your relocation process, youre still required to live in the property for 12 consecutive months. But if you vacate the house for this period or sell the property, the loan becomes payable.

Recommended Reading: How To Transfer A Mortgage To Someone Else

What Happens If The Reverse Mortgage Borrower Stops Using The Mortgaged Property As His Principal Residence

Generally speaking, when a reverse mortgage borrower stops using the mortgaged property as his principal residence, the loan becomes due. However, if a co-borrower continues to reside in the mortgaged property, then the latter can continue to enjoy the benefits of the reverse mortgage loan if he also continues to comply with its ongoing requirements.

What Is The Downside Of A Reverse Mortgage

There are a few downsides of a reverse mortgage. When you take out a reverse mortgage it lowers the value of your home equity since youre borrowing against what you already own. For example, if you own $100K of your home and you use $50K in a reverse mortgage, you now only own $50K of your home.

A reverse mortgage could also affect the ownership of your home down the line. If you live with someone and take out a reverse mortgage that you or they cant pay back, they may lose their living arrangements in the event of a foreclosure.

Dont forget that although a reverse mortgage can provide you with a line of credit, you are still in charge of other living expenses like taxes and insurance.

Finally, be wary of who you are borrowing money from. There are private companies or even less legitimate lenders who could take advantage of your situation or lend you something beyond your means.

You May Like: How To Calculate What Mortgage You Can Qualify For

The Downside Of The Texas Reverse Mortgage

While a reverse mortgage may sound like a good idea for everyone over 62, there are serious risks that must be considered before you take out a reverse mortgage loan.

If you pass away before you sell your house, your children or heirs could wind up with a financial mess on their hands.

They will have to pay off the full reverse mortgage loan amount or allow the bank to seize your home.

Reverse mortgages are financially risky, but they do offer a few benefits for some homeowners.

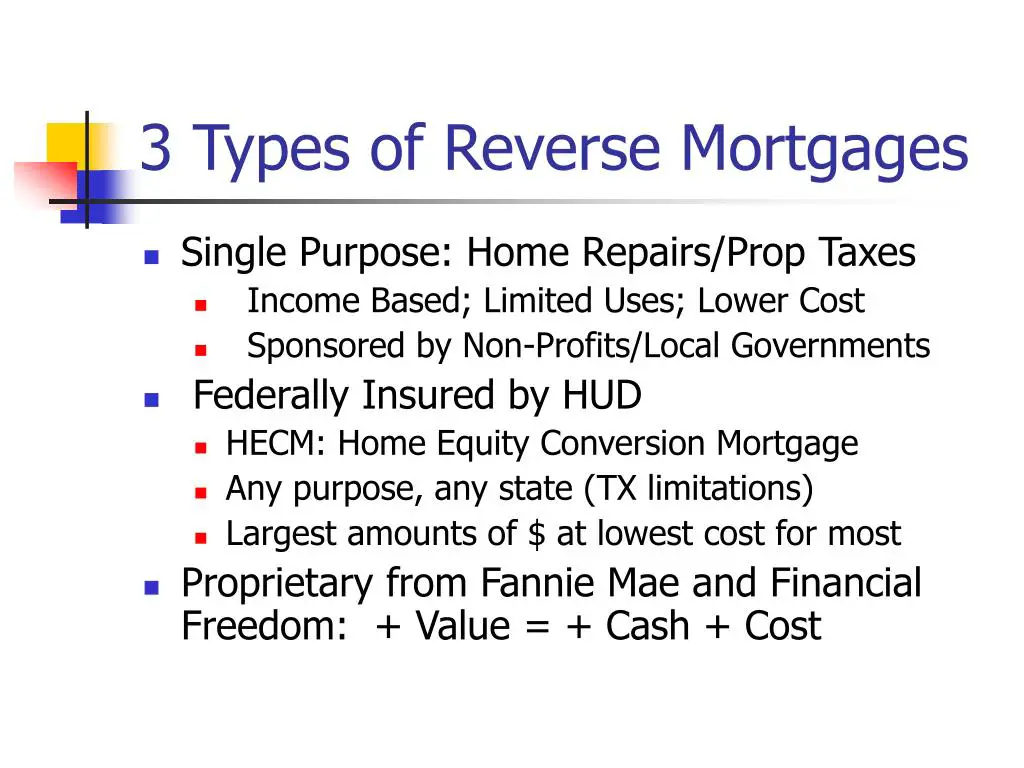

There are three main types of reverse mortgages you can apply for.

1. Single-Purpose Reverse Mortgage State and local government agencies may offer reverse mortgages, but there are restrictions on how you can spend your loan money when you take out a single-purpose reverse mortgage.

You may need to make home repairs or pay property taxes. These essential expenditures can be paid for with the help of a single-purpose reverse mortgage loan.

Travel, entertainment, and personal expenses are out of the question. This type of loan can be a life-saver for seniors who are short on cash.

2. HECM Reverse Mortgage Home Equity Conversion Mortgages are the most common reverse mortgages. These mortgages are offered by the Federal Housing Administration.

HECM reverse mortgages were first offered in 1988 to help seniors pay their bills.

HECM loans can be used for anything. Vacations, expensive dinners, and extravagant purchases are fair game if you take out this type of loan

Home Equity Conversion Mortgage

A home equity conversion mortgage is the most popular type of reverse mortgage. It does not require a medical examination or income requirements and can be used for virtually any purpose. Given the flexibility of these mortgages, and the fact they are backed by the US Department of Housing and Urban Development, the fees and upfront costs for a HECM is also higher.

The main requirement before obtaining a HECM loan is to attend a counseling meeting with a HUD representative. The HUD representative apprises the borrower of the cost of the loan, its benefits, any pitfalls, the responsibilities of the borrower, and the payment options. The borrower also learns about the other types of reverse mortgages available that they may be eligible for. The counseling session is paid for by the borrower or through the loan proceeds.

After the counseling session, the borrower is in a better position to understand which type of reverse mortgage they would like to go for and how much would they can borrow. The amount of the loan is dependant on the persons age, the value of the house, and the current interest rate. However, the loan amount is within $765,500, the amount set by HUD in 2020.

Don’t Miss: How Does A Heloc Work To Pay Off Mortgage

How Much Money Do You Get From A Reverse Mortgage

The amount of money you can receive from a reverse mortgage will depend on several factors. Some of these factors may include:

- Your age

- The current market value of your home

- Type of reverse mortgage

- Your chosen reverse mortgage and its related costs

Also, the amount you receive will be impacted if your current home is linked to an existing mortgage or liens.

If your home is serving as collateral for an existing home equity loan or home equity line of credit , they will have to be paid with the proceeds of the reverse mortgage before any of your personal needs.

More importantly, youll only receive a portion of your home equity and not the entire equity of your home.

Questions To Ask Before During And After

Questions to ask before getting a reverse mortgage

If you are thinking about a reverse mortgage, the following are some important questions you should ask. Talk about them with your family. Meet with a HUD-certified housing counselor. Consult a trusted, independent financial adviser or attorney.

What questions should I ask AFTER I have decided to get a reverse mortgage but BEFORE I start the process?

What questions should I ask DURING the reverse mortgage process?

You May Like: When It Makes Sense To Refinance Mortgage

Choosing A Reverse Mortgage Lender

If youre considering a reverse mortgage, shop around to find a lender who will give you the best rates.

Reverse mortgages have received a bad reputation in the past because of dishonest lenders. Its important to do your research to avoid scam operations.

These tips will help you find the best lender for your particular needs.

Is There A Time Limit On Reverse Mortgages

No, there is no fixed time limit for reverse mortgages. The loan only becomes due upon the happening of one of these events:

Recommended Reading: Do Any Mortgage Lenders Use Fico 8

What Is A Reverse Mortgage Alternative To Consider

This article is for educational purposes only. JPMorgan Chase Bank N.A. does not offer this type of loan. Any information described in this article may vary by lender.

A reverse mortgage is a loan for homeowners 62 and up with large home equity looking for more cash flow. There are a few types of reverse mortgages, but there are also alternatives that might work better for your needs. For example, if youre approaching retirement age but would like to explore mortgage options, some alternatives including refinancing or a home equity loan may work best.

What Should I Remember When Thinking About A Reverse Mortgage

Also Check: Can You Pay Back A Reverse Mortgage Early

What Is A Reverse Mortgage

A reverse mortgage is a loan that allows you to get money from your home equity without having to sell your home. This is sometimes called equity release. You can borrow up to 55% of the current value of your home.

The maximum amount youre able to borrow will depends on:

- your age

- your homes appraised value

- your lender

You pay back your loan when you move out of your home, sell it or the last borrower dies. This means you dont need to make any payments on a reverse mortgage until the loan is due. You will owe more interest on a reverse mortgage the longer you go without making payments. At the end of your loan term, you may have less equity in your home.

How Do Reverse Mortgages Work

When you have a regular mortgage, you pay the lender every month to buy your home over time. In a reverse mortgage, you get a loan in which the lender pays you. Reverse mortgages take part of the equity in your home and convert it into payments to you a kind of advance payment on your home equity. The money you get usually is tax-free. Generally, you dont have to pay back the money for as long as you live in your home. When you die, sell your home, or move out, you, your spouse, or your estate would repay the loan. Sometimes that means selling the home to get money to repay the loan.

There are three kinds of reverse mortgages: single purpose reverse mortgages offered by some state and local government agencies, as well as non-profits proprietary reverse mortgages private loans and federally-insured reverse mortgages, also known as Home Equity Conversion Mortgages .

You May Like: How To Get A Mortgage At 21

How Do I Pay Back A Reverse Mortgage

One of the most enticing things about a reverse mortgage is that youll never need to make monthly payments on it ever. In fact, its possible that your reverse mortgage will outlive you, in which case the balance will be settled by your estate.

Reverse mortgages are generally paid back in one lump sum, usually from the sale of the home. Its possible that this may come sooner than you wish, though. If you cant meet the ongoing requirements of the reverse mortgage, you may be forced to sell your home to pay off the loan. For many people, this happens when they move to a nursing home or fall behind on property taxes or home upkeep.

So while the big advantage of a reverse mortgage is that you wont have to make monthly payments, remember: that balance will continue getting larger over time, and as it does itll steadily erode any equity in your home for your heirs.

This is an important point to consider. If leaving your home to your heirs is important to you, youll want to think twice about taking out a reverse mortgage. In addition, if you have a spouse who isnt listed on the reverse mortgage, youll need to make sure you know how theyll be treated after you pass away. Its possible theyll still be allowed to live in the home, but according to the rules of some reverse mortgages, they may be kicked out so that the home can be sold to pay off the reverse mortgage.