How Are Mortgage Rates Determined

There are seven primary factors that determine your mortgage rate, including:

What is a mortgage?

A mortgage is a loan from a bank or another lending institution that helps you refinance or buy a home. The lender provides funds on your behalf secured by a lien on your home, and you agree to repay the loan plus interest. If you stop making monthly payments, your lender can repossess your home through the foreclosure process and sell it to recover their money.

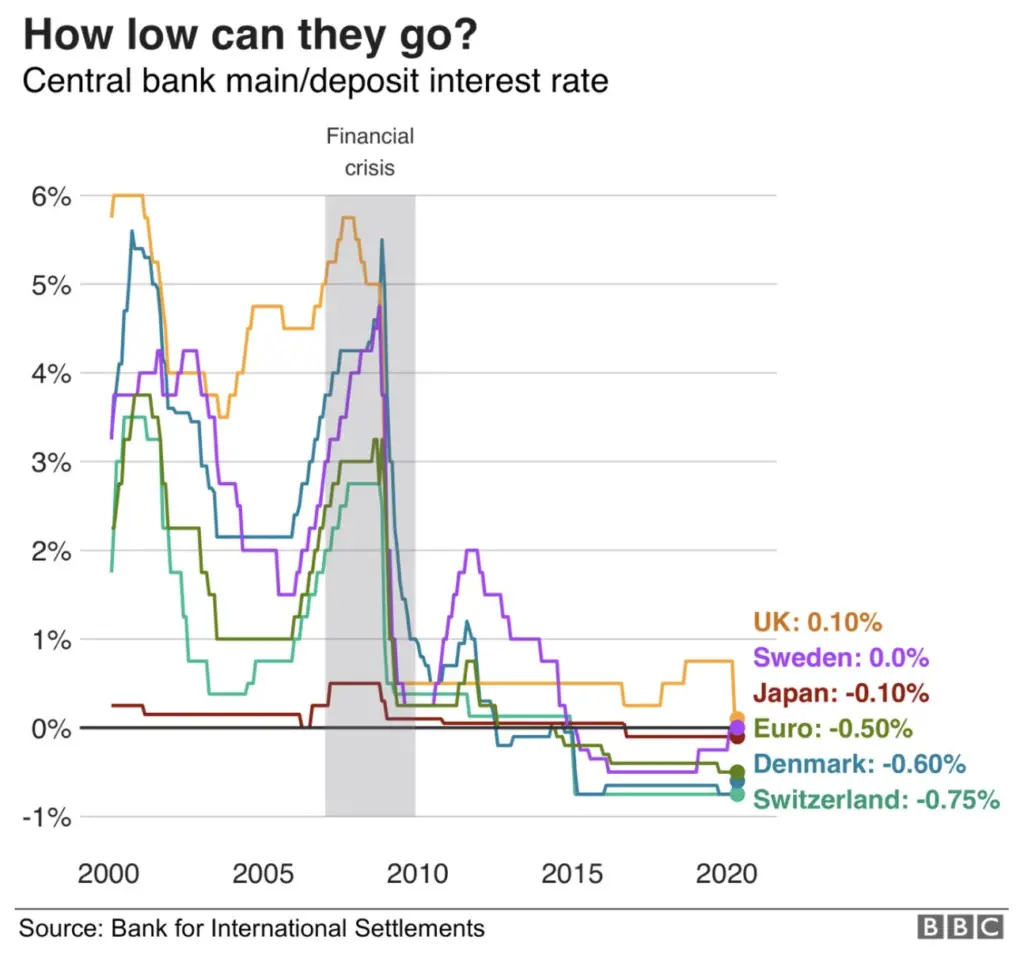

How does the Federal Reserve impact mortgage rates?

The Federal Reserves monetary policy directly affects adjustable-rate mortgages, as they are tied to an index that moves up and down with the broader economy. The Feds policy indirectly impacts fixed-rate mortgages, which typically correlate with the 10-year U.S. Treasury bond yield.

What are the different types of mortgages?

What Are Closing Costs

Youll likely owe more when you close on the house than just the down payment on the mortgage. There are other expenses that have to be paid to make this big transaction go through. Closing costs often entail taxes and fees associated with the purchase that arent included in the sale price.

Expect closing costs to total around 3% to 6% of the purchase price, so youre looking at between $8,250 and $16,500. They might include fees charged by the lender like loan origination fees, points paid to get a lower mortgage rate, fees associated with the property such as an appraisal or inspection, or prepaid costs such as property taxes or homeowners association dues.

Lower Mortgage Rates Are Already Being Offered

Finally, were already seeing certain mortgage lenders offer the 30-year fixed below 2%. So its not just a question of if, its already a reality.

This week, wholesale mortgage lender UWM announced the availability of a 1.999% 30-year fixed mortgage rate via its Conquest program.

In order to get that rate, you need to work with a mortgage broker since UWM doesnt work directly with the public.

You also need to qualify for that rate by being a solid borrower with a vanilla loan scenario, e.g. excellent credit score, low LTV, conforming loan amount, etc.

And theres a good chance youll need to pay mortgage discount points to obtain that rate.

That brings up another important point it may not be wise to pay points right now given the trend of lower and lower mortgage rates.

If youre just going to refinance your mortgage a second time a couple months later, you certainly dont want to pay lots of money upfront for a home loan youll barely keep, and thus not actually benefit from.

Now in terms of how low mortgage rates will go, thats anybodys guess, but at this point I wouldnt rule anything out.

Were already seeing mortgage rates in the 1% range, and weve got the potential for a very wild second half of the year with a contentious U.S. presidential election and a stock market that refuses to read the writing on the wall.

Want a fast, free rate quote? Quickly get matched with a top mortgage lender today!

Read Also: What Does Points Mean On A Mortgage Loan

How To Make The Most Of Low Interest Rates

- Publish date: Nov 8, 2010 8:00 AM EST

The Feds decision to keep interest rates low will affect how you spend, invest and borrow.

The Federal Reserves plan to keep interest rates low for longer than expected has thrilled stock investors, encouraged borrowers and put fixed-income savers into a funk.

How can ordinary people make the most of the situation?

On Nov. 3, the Fed announced plans to spend $600 billion to buy government securities to stimulate the economy. That increased demand should push bond prices up, causing yields to fall. It means mortgage rates will stay low or go lower while leaving savings yields in the basement.

Action in the futures markets indicates traders now think the Fed wont reverse course and start raising interest rates until June 2012. However, earlier this year, many experts thought rates would be rising by now.

Low rates, of course, are great for borrowers. The average rate on the standard 30-year fixed-rate mortgage is a mere 4.476%, according to the BankingMyWay.com survey.

Would it now make sense for a mortgage shopper to hold off on getting a lower rate? Theres no guarantee the rates will fall further, but now there seems to be less reason to worry that they will rise.

Instead of focusing on the rate, take a close look at other expenses like points and fees, as higher costs can easily wipe out the savings from a slightly lower rate.

Can Mortgage Rates Get Even Better From Here

- Fixed mortgage rates are already at all-time record lows

- There have been eight record lows this year, including three record lows in three weeks recently

- Is it possible that mortgage rates could move even lower in the second half of 2020?

- The trend certainly seems to point to even lower rates, especially with wide spreads relative to Treasuries

As noted, mortgage rates are hitting record lows so often its becoming a bit of a non-event. Heck, I dont even write about it anymore.

And its hard to know if homeowners are even excited about it at this point. When something happens on a weekly basis, its difficult to garner any sort of novelty.

Theres also an expectation at this point that mortgage rates will simply get better and better and better.

Oddly, you cant blame folks for thinking that way because theyre probably right.

If you asked me right now if I thought mortgage rates would move even lower from their current levels, Id say YES with no hesitation.

Thats not just a gut feeling its based on math and data and events going on in the industry and the world.

Recommended Reading: What Does It Mean To Close On A Mortgage

Mortgage Interest Rates Forecast Next 90 Days

The Federal Reserve made an aggressive policy plan to bring inflation down. While that would normally lead to mortgage rate growth, the lending market may have already accounted for the Feds rate hikes.

Because of this, many experts currently believe mortgage interest rates will move within a tighter range in the fall compared to the big weekly swings we saw throughout the year.

Of course, the Russian-Ukrainian war or a new wave of Covid-19 could create economic uncertainty and cause more rate volatility in the coming months.

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process, the lender will look at your overall financial profile to determine how much it will lend to you. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI is typically 43%. So if you make $5,000 a month, your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

Recommended Reading: How Much Does A Mortgage Payment Increase For Every 100000

What Happens If My Loan Requires A Longer Than Average Rate Lock Period

Longer rate lock periods may be required for things like new construction or a condo that needs board approval. An extended rate lock fee may apply.

- Rate lock fees will vary based on the length of your rate lock period and interest rate chosen.

- We will refund the rate lock fee if your application is denied.

- If you withdraw your loan application or it is cancelled, the upfront extended rate lock fee may not be refunded unless the application is for a VA loan.

We’ll let you know if your situation requires a longer than normal rate lock period and if any rate lock fees apply. If you choose a longer rate lock period option, you will receive a separate disclosure with detailed information.

One More Thing To Consider: The Trade

As you shop for a mortgage, youll see that lenders also offer different interest rates on loans with different points.

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs.

- Points, also known as discount points, lower your interest rate in exchange for an upfront fee. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

- Lender credits might lower your closing costs in exchange for a higher interest rate. You pay a higher interest rate and the lender gives you money to offset your closing costs. When you receive lender credits, you pay less upfront, but you pay more over time with the higher interest rate. Keep in mind that some lenders may also offer lender credits that are unconnected to the interest rate you payfor example, a temporary offer, or to compensate for a problem.

There are three main choices you can make about points and lender credits:

Learn more about evaluating these options to see if points or credits are the right choice based on your goals and financial situation.

You May Like: How Much Does A Mortgage Go Up For Every $1000

Are Current Mortgage Rates Good For Buying A Home Right Now

The big increase in mortgage rates this year has taken a lot of potential homebuyers out of the market. That could present opportunities for you if you can afford the higher cost of borrowing money.

Homebuyers are facing less competition and prices are down compared to their all-time highs earlier this year, but theyre still high. If you can find a deal you can afford, it can still be a good opportunity. After all, nobody knows what mortgage rates and prices will be like next year, and buying a home is a lifestyle decision, not just a financial one.

Its always a good time to buy a home, if thats what is important to you. Its just about doing your research and making good informed decisions, says Eileen Derks, head of mortgage at Laurel Road, an online lender owned by KeyBank that specializes in serving health care professionals.

Money’s Average Mortgage Rates For September 9 2022

Mortgage rate moved lower across all loan categories today. The average rate for a 30-year fixed-rate loan was down for the second day in a row, decreasing by 0.136 percentage points to 6.731%.

- The latest rate on a 30-year fixed-rate mortgage is 6.731%.

- The latest rate on a 15-year fixed-rate mortgage is 5.601%.

- The latest rate on a 5/6 ARM is 6.395%.

- The latest rate on a 7/6 ARM is 6.422%.

- The latest rate on a 10/6 ARM is 6.393%.

Money’s daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each day’s rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

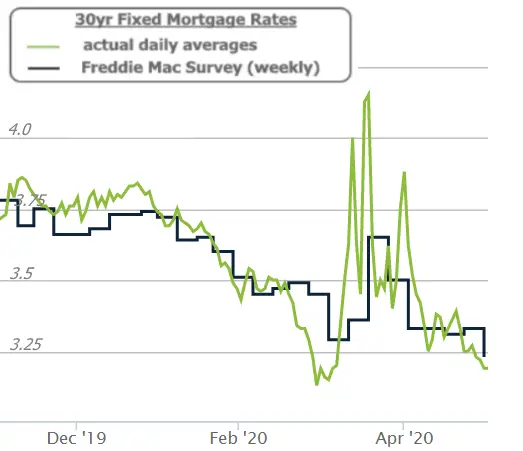

These rates are different from Freddie Macs rates, which represent a weekly average based on a survey of quoted rates offered to borrowers with strong credit, a 20% down payment and discounts for points paid.

Also Check: Does Getting Pre Approved For Mortgage Hurt Credit

Work For A Lower Interest Rate

One of the biggest parts of home buying is the mortgage rate youre able to lock into. Everyone wants the lowest possible interest rate they can get but thats mostly determined by what the lending market offers on a given day. Unfortunately, timing isnt always in every borrowers favor.

Thats where mortgage discount points come in. Its a lever borrowers can pull to decrease their monthly mortgage costs and paying down your rate could save thousands of dollars over the life of your home loan.

Rather than asking the seller to drop their price, a buyer can leverage a seller concession to buy down their mortgage rate via points, said Taylor Marr, deputy chief economist at Redfin. This will have a much greater impact on lowering their monthly mortgage payment than a lower price would.

Although, paying for mortgage points adds more upfront costs at closing, which could be a barrier to entry for some borrowers. Shopping your rate around by contacting multiple lenders to see if they can offer a lower one only requires time and effort. Given how lenders differ and how volatile interest rates tend to be, taking your first offer could be a mistake.

How Are Mortgage Rates Set

Lenders use a number of factors to set rates each day. Every lender’s formula will be a little different but will factor in the current federal funds rate , competitor rates and even how much staff they have available to underwrite loans. Your individual qualifications will also impact the rate you are offered.

In general, rates track the yields on the 10-year Treasury note. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note.

Yields matter because lenders don’t keep the mortgage they originate on their books for long. Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes.

Also Check: How To Calculate Principal And Interest For Mortgage

Mortgage Rate Strategies For September 2022

Mortgage rates grew fast and furiously to open 2022. The pace slowed in the second quarter, then interest rates shot up after the Feds 0.75% federal funds rate hike in mid-June. The central bank said it anticipates multiple similar hikes in 2022. Mortgage rates could climb throughout the rest of the year as a means to offset inflation. However, opportunities to lock in a low interest rate do still exist for home buyers and refinancing homeowners.

Here are just a few strategies to keep in mind if youre mortgage shopping in the coming months.

Apply For A Mortgage With Us

Applying for a mortgage can be a complicated process, since there are several things lenders will review. Knowing what lenders are looking for and making that as attractive as possible is one of the best steps you can take in getting a great mortgage rate. Luckily, you have us.

At Assurance Financial, well work with you, assessing your situation and doing all the heavy lifting for you. Contact one of our experts today and let us help you get the perfect mortgage rate!

Recommended Reading: How Long Does A Mortgage Approval Last

Choose Your Loan Term Carefully

Short-term loans are less risky and, as a result, have lower mortgage rates. The trade-off for these kinds of loans are larger monthly payments since you’re paying off the principal in a shorter time. With a longer-term loan, you spread the payments over a longer period of time, leading to lower monthly payments with a higher interest rate.

Short-term loans will generally save you more money in the long run, but long-term loans may leave you with more disposable income every month. If you’re looking specifically for low mortgage interest rates and savings over the life of the loan, a short-term loan is your best bet.

What Are Today’s Mortgage Rates

Although mortgage rates fluctuate daily, 2020 and 2021 were years of record lows for mortgage and refinance rates across the US.

While low average mortgage and refinance rates are a promising sign for a more affordable loan, remember that they’re never a guarantee of the rate a lender will offer you. Mortgage rates vary by borrower, based on factors like your credit, loan type, and down payment. To get the best rate for you, you’ll want to gather rates from multiple lenders.

| Mortgage type |

Read Also: How Do You Figure Out Mortgage Interest

What Happened To Rates In August

After dipping in the first week of August, the 30-year fixed-rate mortgage climbed each week thereafter. It rose above 5.8% at the end of August, up from below 5.2% at the end of July.

In my August forecast, I predicted that mortgage rates would rise “as the Federal Reserve continues to yank interest rates higher.” That’s what happened in the run-up to Powell’s Aug. 26 speech, when investors speculated that he would reinforce a message that the Fed will continue to confront inflation.