Who Oversees The Credit Reporting Agencies

Since 2012, the Consumer Financial Protection Bureau has been tasked with supervising the largest agencies at a federal level. The CFPB conducts exams to monitor how the credit reporting agencies screen for accuracy, investigate consumer complaints, and other procedures.

If you have a complaint with one of them, you can contact the CFPB, the FTC, and your state attorney general. It may seem like many steps, but its best to cover your bases and get as many regulators involved as possible if theres any potential wrongdoing.

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

Minimum Credit Scores By Mortgageprogram

The credit score needed to buy ahouse depends on the type of loan you apply for.

Minimum credit requirements forthe five major loan options range from 580 to 680.

- Conventional loan : 620 minimum FICO score

- FHA loan: 580 minimum FICO score

- VA loan: 620 minimum score is typical

- USDA rural housing loan: 640 minimum FICO score

- Jumbo loan : 680 minimum FICO score

Note that FHA loansactually allow credit scores as low as 500. But if your score is below 580, youneed a 10% down payment to qualify. Borrowers with credit scores above 580 onlyneed 3.5% down for an FHA mortgage.

Other requirements to buy a house

Theres more to know than just credit minimums, of course .

In addition to credit scores, lenders evaluate borrowers based on:

- Down payment: Most loan programs require at least 3% down

- Income and employment history: Most lender want to see at least 2 years of steady income and employment

- Savings: Youll need cash to cover the down payment, closing costs, and often cash reserves

- Existing debts: Your debt-to-income ratio compares pre-existing debts like student loans, auto loans, and credit card minimum payments against your monthly gross income. The lower your DTI, the better

- Loan amount: If you have lower credit, your loan amount will likely need to be within FHA loan limits or conforming loan limits

If your credit scoreis weak but you have stable income, a large amount ofsavings, and a manageable debtload, youre more likely to get mortgage-approved.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

What Else Do Mortgage Lenders Look At To Determine Mortgage Terms

Your credit scores can be an important factor in getting approved for a mortgage and the rates you’re offered. However, mortgage lenders also go beyond your credit scores when evaluating a potential borrower’s application.

They’ll also take a close look at the information within your credit reportsnot just your scores. For example, even if you have a good credit score, the lender might deny your application if you recently filed for bankruptcy or had a home foreclosed on. Or if you owe too much money to collection agencies.

Mortgage lenders may also request various financial records, including recent bank statements, investment account statements, tax returns and pay stubs. They can use these to determine your income, debts and debt-to-income ratio, which can be an important factor.

Other factors, such as the loan amount, the home’s location, your down payment and loan type can all play into whether you’ll be approved and your mortgage’s terms. Lenders may also have unique assessments, which is one reason shopping for a mortgage can be important.

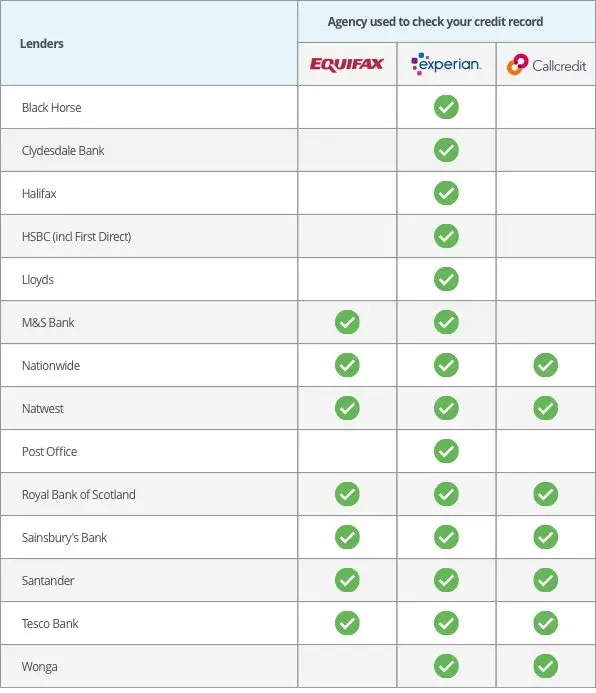

Which Credit Reference Agency Is Used By Which Lender

Major high-street lenders are likely to share your account data with all three credit reference agencies. However, smaller lenders may only share your data with one.

Lenders are not required to update the credit reference agencies, so lenders may choose which credit reference agencies they want to share their data with.

If you feel theres credit data missing from your TotallyMoney free credit report, you can speak with your lender directly and ask them to share your account information with all three of the credit reference agencies in the UK.

It can take around six weeks for lenders to update new information with the credit reference agencies, so dont worry if you notice accounts on your credit report that arent completely up to date. This is normal and your credit score is live, so this is always updated based on the latest information that TransUnion hold.

Incorrect information in your credit report?If there is incorrect information that you can see in your credit report, you can notify TransUnion by raising a dispute.

TransUnion will then contact your lender to investigate the dispute and, if the lender agrees with the dispute, TransUnion will amend your credit report.

It can take TransUnion around 28 days to complete the disputes process as this is the amount of time they need to allow for the lender to respond. Once this has been completed, TransUnion will email you directly with the outcome.

Also Check: How Does Rocket Mortgage Work

How Your Credit Score Affects Your Mortgage Eligibility

When it comes to getting a mortgage, your credit score is incredibly important. It determines:

- What loan options you qualify for

- Your interest rate

- Your loan amount and home price range

- Your monthly payment throughout the life of the loan

For example, having a credit score of excellent versus poor could save you over $200 per month on a $200,000 mortgage.

And if your credit score is on the lower end, a few points could make the difference in your ability to buy a house at all.

So, it makes sense to check and monitor your credit scores regularly especially before getting a mortgage or other big loan.

The challenge, however, is that theres conflicting information when it comes to credit scores.

There are three different credit agencies and two credit scoring models. As a result, your credit score can vary a lot depending on whos looking and where they find it.

Get A Credit Strong Credit Builder Loan

One of the best ways to build payment history is to get a Credit Strong credit builder account. Credit Strong is part of an FDIC insured bank and offers credit builder loans. Credit builder loans are special types of loan accounts that build credit easily.

When you apply for a loan from Credit Strong, you can select the term of the loan and the amount of the monthly payment. Credit Strong does not immediately release the funds to you. Instead, the company places the money in a savings account for you.

As you make your monthly payments, it improves your credit by building your payment history. Credit Strong will report your payments to each credit bureau.

When you finish paying off the loan, Credit Strong will give you access to the savings account it established for you, making the program a sort of forced savings plan that also helps you build credit.

Ultimately, with interest and fees, youll pay a bit more for the loan than youll get back at the end, but this can still be a solid option for a borrower who wants to improve their credit while building savings.

Unlike some other credit builder loan providers, Credit Strong is highly flexible, letting you choose from a variety of payment plans. You can also cancel your plan at any time so you wont damage your credit by missing payments if you fall on hard times.

See the credit builder loan pricing and plans here.

Don’t Miss: Monthly Mortgage On 1 Million

What Credit Score Is Used To Buy A House

When buying a house, the most important credit score is the one your mortgage company uses to make an underwriting decision. These points-based equations provide holistic evaluations.

However, it is not always easy to pinpoint the score lenders will use because they often pick the middle rating for an industry-specific overlay equation.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

You May Like: Rocket Mortgage Conventional Loan

What Are The Differences Between The Credit Agencies

Each of the credit agencies offers slightly different services. For example, TransUnion is the only credit agency that offers Identity Lock, a service that helps you protect yourself against identity theft. Also, not all venders report to all three credit agencies. This means that the information on your credit report can vary from agency to agency, resulting in different scores.

How Do You Find Your Tri

You cant order a copy of your tri-merge credit report. This report is only offered to lenders. However, you can order copies of your individual reports maintained by ExperianTM, Equifax® and TransUnion®.

You can even do this for free at www.AnnualCreditReport.com. Under federal law, you are allowed one free copy of each of your reports every year. This means you can order your reports from TransUnion®, Equifax® and ExperianTM at no cost every year.

Doing this is a smart move. Studying your credit reports will give you a better idea of what types of mortgages you might qualify for. If your report lists low account balances and no negative information such as missed payments, foreclosures or bankruptcies, youre more likely to qualify for mortgages with low interest rates.

You might also want to order your FICO® credit score before you apply for a mortgage. Unfortunately, you cant get this for free. You can order it for $19.95 from FICO. Your credit card provider or bank might also provide you with free credit scores. Just be aware that these free scores are rarely the same ones that lenders use when making lending decisions. Free scores, though, can give you a general idea of how strong your credit is as they usually dont vary too much from your official FICO® Score.

Recommended Reading: Rocket Mortgage Requirements

What Credit Agency Does Chase Use

The credit report that Chase is most likely to pull for your credit card application is your Experian credit report. We reviewed 293 consumer-reported credit inquiries from the past 24 months and found that Chase pulls credit reports from all three major U.S. credit bureaus, but it seems to favor Experian.

How To Check Your Credit Score

To find out your credit score, contact Canadas two credit-reporting agencies: Equifax Canada at www.equifax.ca and TransUnion Canada at www.transunion.ca.

For a fee, these agencies will provide you with an online copy of your credit score as well as a a detailed summary of your credit history, employment history and personal financial information on file. You can also obtain a free copy of your credit report by mail. If you find any errors in your report, notify the credit-reporting agency and the organization responsible for the inaccuracy immediately.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

Excellent Credit: What Actually Goes Into It

Credit reports and scores will inevitably vary from person to person, but there are some steps everyone can take to improve their credit health. Both FICO and VantageScore consider the same factors when scoring you. Learning what these factors are, and how to manage them, can help almost anyone build a good credit history or raise their score.

In addition to making a habit out of checking your credit reports regularly, you have to really understand what it includes, and how that information can make or break your credit score. Following, we outline some simple steps to take to raise your score.

Pay your bills on time

This one might seem obvious, but its crucial. After all, credit scores are meant to determine how trustworthy you are in paying back what you owe. If you have a lot of missed payments, creditors will see you as a risk. Period. Consistently paying your debts on time is a must.

If you do miss a payment, not to worry! Pay it off as soon as possible and try not to miss another one again. Creditors wont usually hold a single missed payment against you, and your credit score will rise again once you get back to your healthy credit habits.

The 30% or less rule

There are financial experts that believe using 10% or less of your available credit is even better. In fact, research from FICO found that Americans with credit scores between 800 and 850the exceptional score rangeused around 4% to 10% of their credit.

Mix it up

Oldies are definite goodies

How Do Credit Reporting Agencies Work

Every month, banks and other creditors send millions of records to the credit reporting agencies, updating them about their borrowers. These reports include whether the borrowers paid the money they owed that month, if they were late making a payment, or if they defaulted on their balance.

They accumulate all the data given to them by the banks and list it on each individuals credit report.

While most information is updated monthly, they usually have a processing time of several weeks before everything is completely up-to-date.

Read Also: Rocket Mortgage Qualifications

Why Is Equifax Score Higher Than Transunion

The credit bureaus may have different information. And a lender may report updates to different bureaus at different times. So, it’s possible that Equifax and TransUnion could have different credit information on your reports, which could lead to your TransUnion score differing from your Equifax score.

If Youve Ever Checked Your Credit Scores Its Likely You Got Them Separately From The Three Major Consumer Credit

A mortgage lender trying to figure out if youre creditworthy wants a complete picture of how you use credit. But it can be challenging to put that picture together by looking at a single credit report from one of the three major consumer credit bureaus. Thats because lenders and other creditors may not report to each of the big three, resulting in each bureau having different information for you.

To help solve this, lenders can obtain special compiled credit reports that merge multiple reports into one, giving a more-complete picture of your credit history.

There are two types of compiled credit reports a mortgage lender might pull to evaluate your finances. Theres the so-called tri-merge report: a single, easy-to-read credit report compiled from the individual reports issued by the three major consumer credit bureaus. And then theres the residential mortgage credit report, which compiles at least two reports from the three bureaus and typically offers additional information to help lenders assess how risky a borrower you are.

Also Check: 10 Year Treasury Yield And Mortgage Rates

Which Credit Scores Do Mortgage Lenders Use

When you apply for a mortgage, lenders will generally request all three of your credit reports and a FICO® Score based on each report. However, the type of FICO® Scores they request are often older versions, due to guidelines set by government-backed mortgage companies Fannie Mae or Freddie Mac. It can be important to know about these different FICO® Score versions when you’re planning to buy a home.

Types Of Credit Bureau

There are three main types of credit bureaus. They are:

TransUnion is one of the three reliable credit bureaus. It is an American credit reporting agency that deals in collecting credit reports and offering credit protection. Trans Union is a large agency for credit analysis and predictions for their consumers to make good financial decisions. They offer services in over 200 countries worldwide with a large number of trusted employees. You can check your credit score and other services on the TransUnion official website.

Equifax is a large credit reporting agency. It allows its users to access credit scores, protect credit information from frauds. However, Equifax does not determine a persons eligibility for loans. It is used to estimate the credit position. Equifax credit scores can be calculated on all three credit bureaus available. Equifax is absolutely free for the first month of use. After which, a designated amount is paid for subscription.

Experian offers credit monitoring services that help the borrowers track and repair their credit scores. Credit reports on Experian are updated on a monthly basis.

Another service of Experian is to sell marketing strategies for decision-making to companies and establishments.

Experian services are both paid and free depending on the users choice.

Also Check: Mortgage Rates Based On 10 Year Treasury

When Are Credit Reports Used In The Mortgage Process

A lender will typically pull and review your credit reports once youve completed your mortgage application. Morse advises against having your reports pulled by the lender when youre just starting the home-buying process, because its considered a hard credit inquiry, which can hurt your credit scores.

Instead, he recommends using a lender whos willing to first talk about your budget and ensure youre financially ready to move forward. That way you can be certain a hard inquiry will be worth it.